Enterprise Value (EV) vs Market Capitalization (MC): what’s the difference and why it is important?

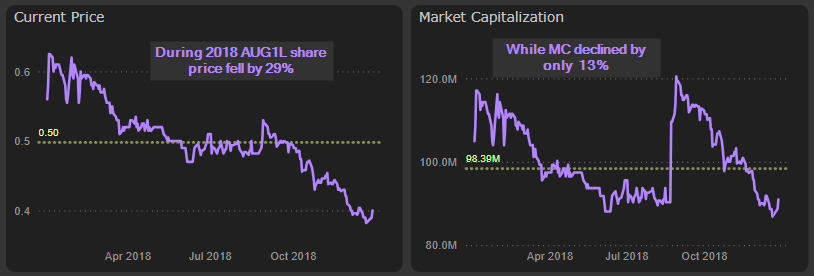

Since the beginning of 2018 Auga Group (AUG1L) share price fell over 30%. Market capitalization declined slightly less – by 15%, due to additional share issues. Average annual EBITDA remains essentially the same. Does it mean the company became cheaper? Not necessarily. And that is why.

Market capitalization

Market capitalization, also known as market cap (MC), is mostly and commonly used metric of company’s market value (and, accordingly, its size). This metric is the basis for widely used classification to the large-cap, medium-cap and small-cap stocks. It is calculated simply by multiplying the number of shares outstanding by the share price:

MARKET CAPITALIZATION = SHARES OUTSTANDING x SHARE PRICE

This simplicity is complicating sometimes trying to define the number of shares outstanding, bet let’s leave that for another post.

This simple formula shows already, why falling share price doesn’t necessarily mean lower company’s value. If company is issuing new shares, MC, or company’s market value, can remain the same or even increase, when share price is falling.

Let’s look on the Auga Group (AUG1L) in 2018. During this year share price declined by 28,6%, while MC fell only by 13,3%:

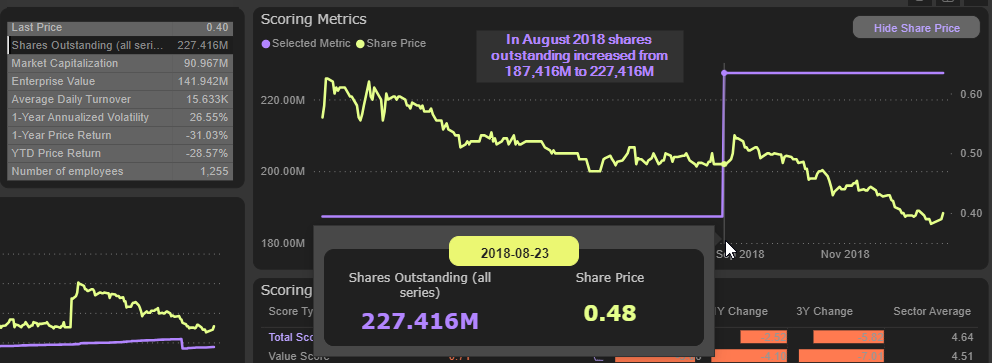

Because in August 2018 company issued 40M new shares and increased its shares outstanding from 187,416M to 227,416M:

Enterprise value

However, MC omits critically important facts in the overall valuation of a business. Most importantly, it doesn’t take into consideration company’s debt. That’s why Enterprise value (EV) is using as a more comprehensive and alternative approach to estimate a company’s total value. It includes various financial metrics such as MC, debt, minority interest, preferred shares and cash to derive company’s total value. In simple terms, EV is the total price of buying a company (theoretical takeover price).

The formula to calculate EV is:

ENTERPRISE VALUE = MC + DEBT + MINORITY INTEREST + PREFERRED SHARES – CASH

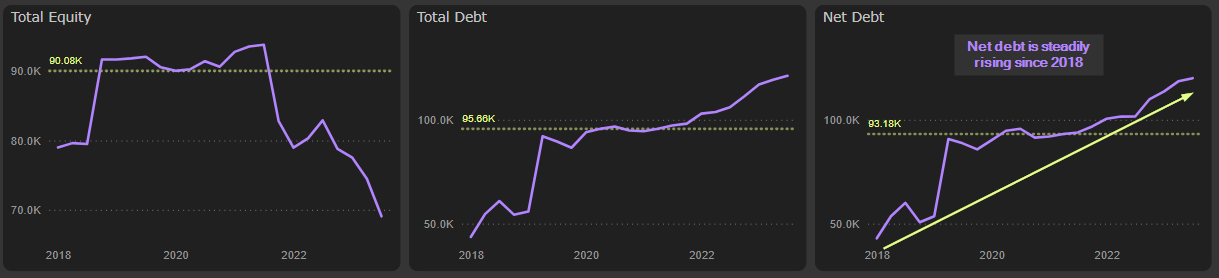

Although the minority interest and preferred shares are usually kept at zero effectively, this may not be the case for some companies. So, the main difference between the EV and MC is (DEBT – CASH), or in other words - NET DEBT. And this difference, as well as its implications on business valuation, can be huge.

Let’s go back to the Auga Group case and see the difference. Since the beginning of 2018 its share price fell over 30%, MC declined by 18%, while EV skyrocketed by 40%:

The reason is steadily growing net debt:

Average annual EBITDA during this period remained essentially the same. Accordingly, with the falling share price and relatively stable financial results (there are a lot of questions and nuances here, but we will leave them for another post also) the company is getting substantially more expensive, not cheaper.

Very similar situation is with Harju Electer (HAE1T). Share price, MC and annual EBITDA are essentially the same compared to the 2018, while EV is 70% higher, making company significantly more expensive on the relative basis:

Of course, there are also opportunities on the other side of valuation spectrum.

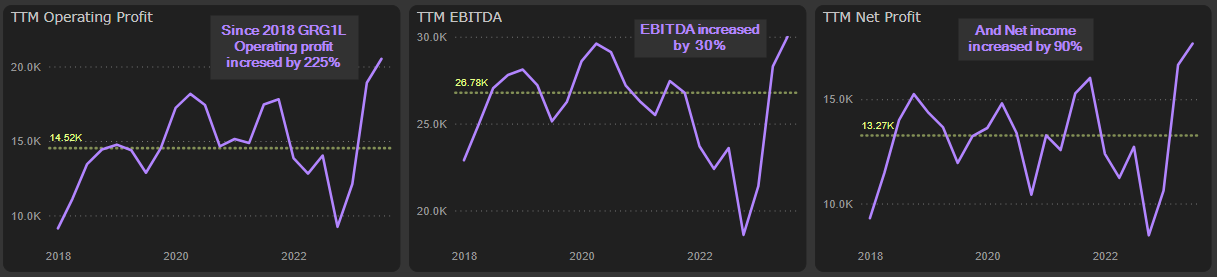

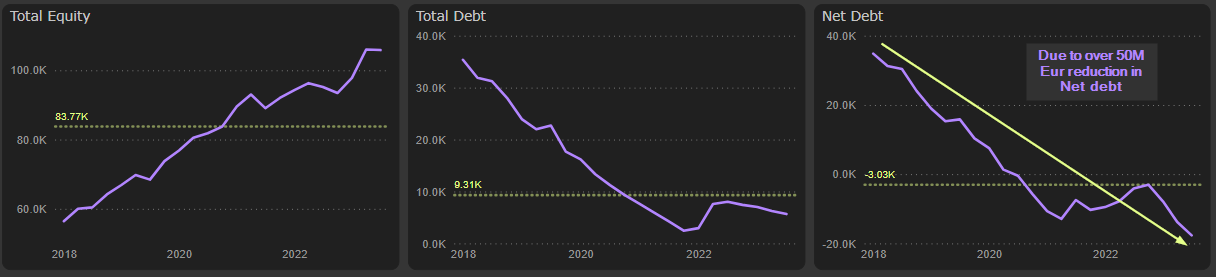

Since the 2018 Grigeo (GRG1L) increased its annual EBITDA by 30% and Net income by 90%:

During this period its share price and MC rose by 35%. However, due to significantly reduced net debt EV actually fell by 20%:

Therefore, paying attention to the significant differences between EV and MC could lead to the discovery of very interesting investment opportunities (or threats).