Grigeo Group 2025 Q2 financial review

Profit decline, but there’s no need to panic

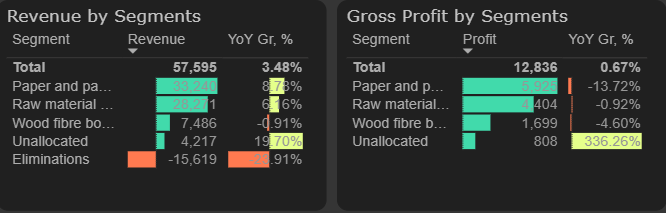

Grigeo Group’s revenue grew moderately by 3.5% YoY in Q2 2025, as the consolidation effect following the factory acquisition ended after a full calendar year. Revenue growth was further supported by the company’s core segments – paper and corrugated cardboard – which increased by 9% and 6% YoY, respectively. However, these segments continued to face challenges in managing gross margins, particularly the paper segment, whose gross profit fell by 14% YoY. Despite this, the decline in the company’s overall gross margin stabilized during the quarter, keeping gross profit close to last year’s level.

Results by segments, Q2 2025

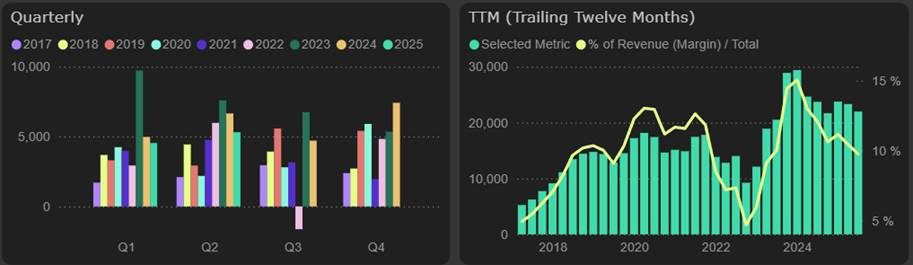

A stronger decline was observed at the operating profit level – it fell by 20% YoY in Q2. However, this was largely due to non-core activities, mainly a higher asset disposal result in the previous year, which amounted to €884K compared to €30K this year.

In Q2 2025, selling & distribution expenses were 11% higher than in the same period last year. However, continued reductions in administrative expenses helped keep overall operating costs in line with revenue growth.

Operating profit

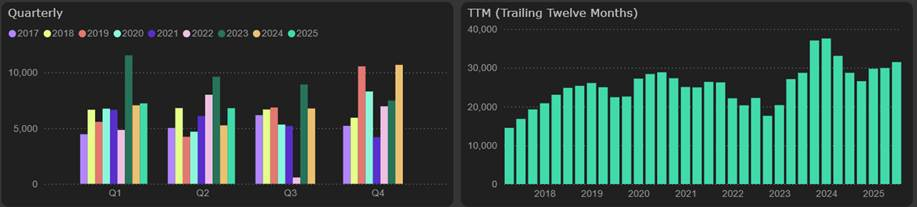

Funds from operations in Q2 2025 increased by 29%, mainly due to lower paid income tax compared to last year. Free cash flow was minimal this quarter, as in the previous year, since the majority of FFO was allocated to intensive long-term asset investments. Additionally, nearly €2M was used for working capital. The annual free cash flow remained unchanged from the previous quarter, standing at €7.5M.

Funds from operations

Valuation multiples, such as P/E and EV/EBITDA, rose slightly to 7.5x and 4.1x, yet they remain at a solid level, and PLY score stays strong at 8.75 compared to other Baltic companies.

Valuation metrics