Ignitis Group 2025 Q2 financial review

Power generation jumps – but where’s the profit growth?

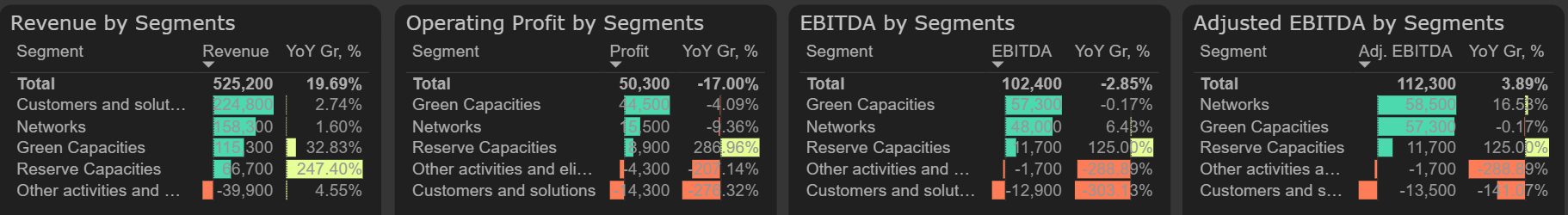

In Q2 2025, Ignitis Group’s revenue grew by 20% YoY, with H1 revenue up by a similar 19%. The strongest growth was seen in revenue from reserve capacities (+136% YoY H1 and +247% YoY Q2) and green capacities (+35% YoY H1 and +33% YoY Q2).

Results by segments, Q2 2025

Profit growth lagged behind – EBITDA was broadly flat in Q2: reported -3% YoY, adjusted +4% YoY. Profitability was hit by a +69% rise in other operating expenses and more than doubled gas-related costs due to higher prices and volumes for electricity generation.

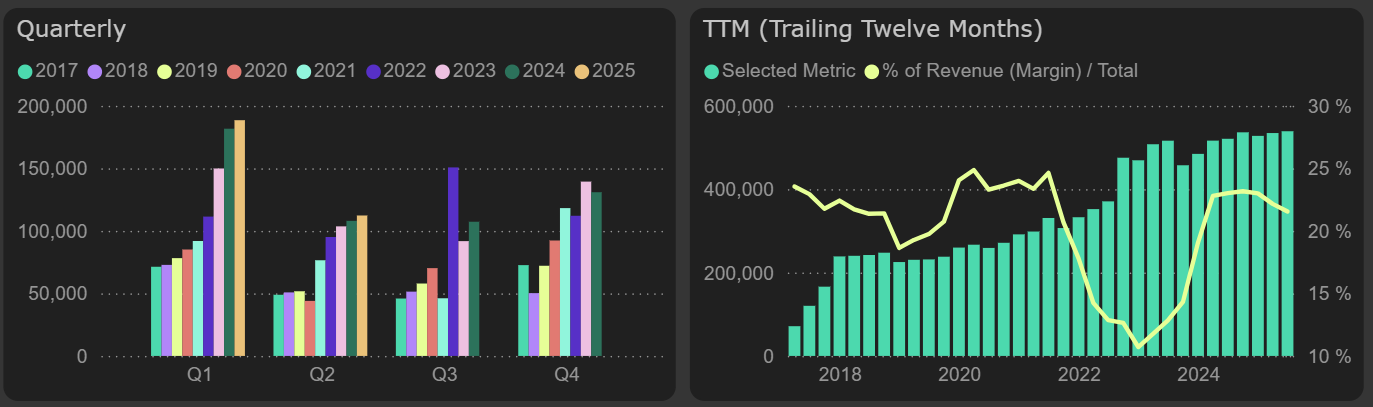

Adjusted EBITDA

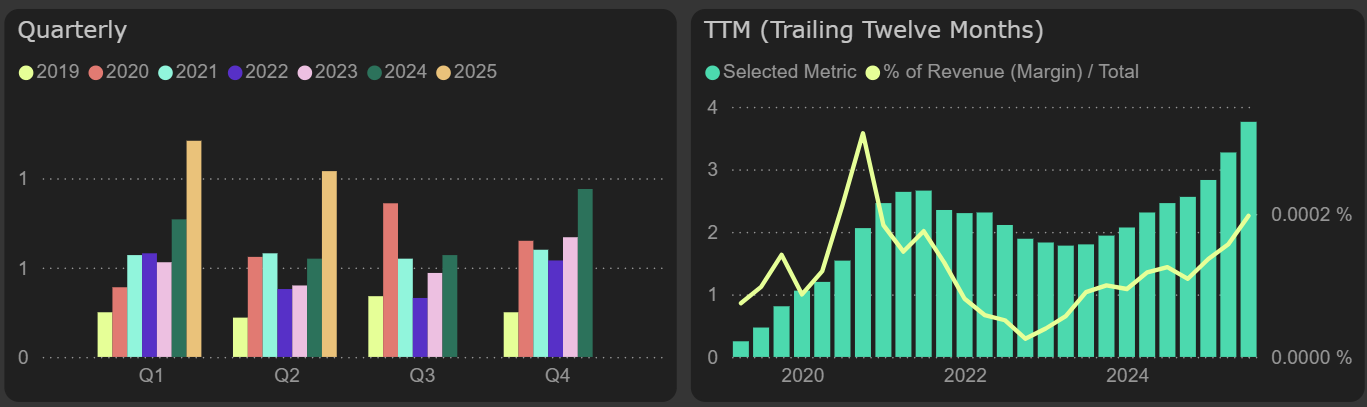

Electricity generation in H1 2025 increased by 71% – from 1.32 TWh in H1 2024 to 2.25 TWh – largely due to higher output at the Elektrėnai complex. This drove a sharp increase in revenue in the reserve capacities segment and lifted profit, but profitability declined sharply in both quarters: adjusted EBITDA margin dropped from 39.5% in H1 2024 to 19.3% in H1 2025. The green capacities segment also faced profitability challenges in Q2 – adjusted EBITDA remained at last year’s level despite revenue growth.

Electricity generated

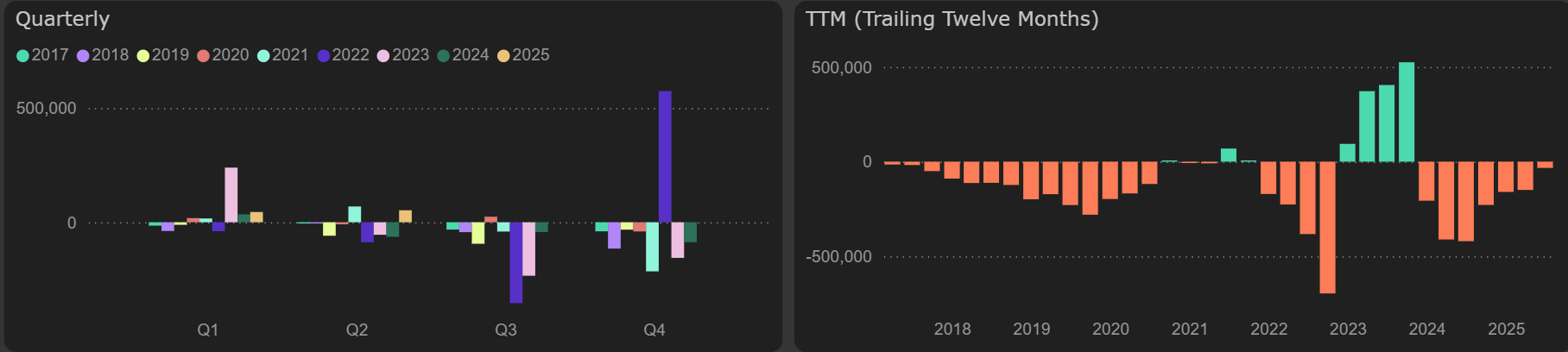

Free cash flow in Q2 2025 was positive at €52.5M, supported by stronger funds from operations, a release of working capital due to lower receivables, and lower investments in fixed assets. On a TTM basis, free cash flow remained negative but moved closer to positive territory.

Free cash flow