Telia Lietuva 2023 Q3 Financial review

The return of the free cash flow

Excellent operating results. Growing subscribers’ base, growing revenue across all main business lines, very good cost control and record high operating margin (and not only due to significantly lower energy costs). However, the main achievement was in the area, that caused the most questions and pain for investors during last several quarters. The healthy free cash flows have finally return.

Operating excellence

Telia Lietuva (TEL1L) managed to improve its operating results across all fronts.

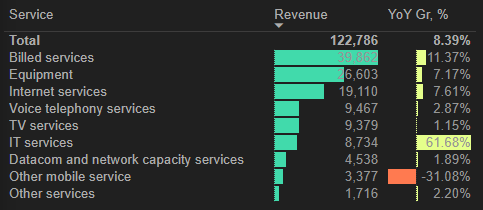

2023 Q3 revenue grew by 8,4% YoY to 122,8M Eur, driven mostly by mobile billed services, equipment, internet services and IT services:

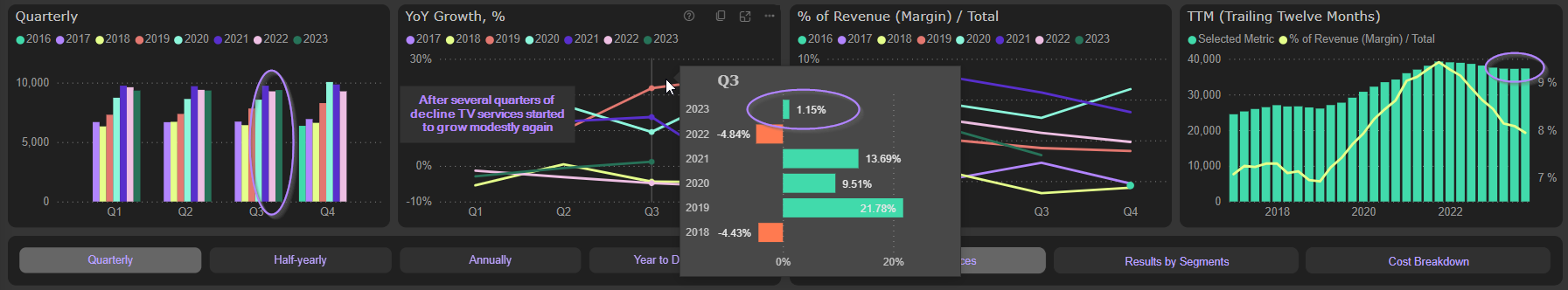

Even voice telephony services and TV services, two most “growth-resistant” business lines, started to grow modestly again:

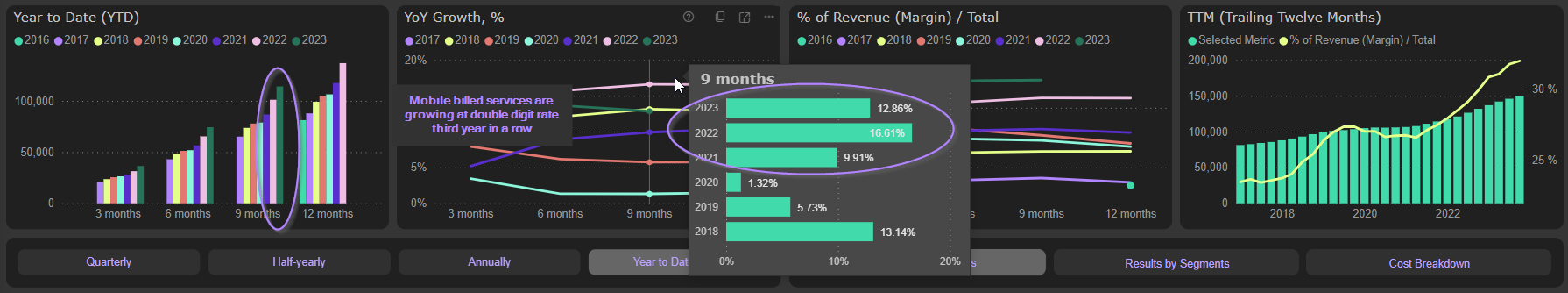

Mobile billed services are growing at double digit rate third year in a row ant its weight in the revenue structure is continuously increasing:

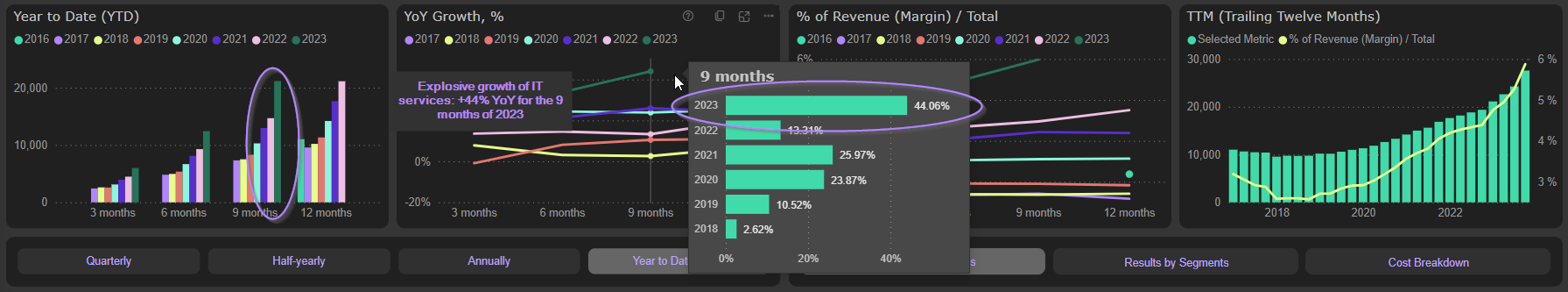

IT services “exploded” by +62% YoY in 2023 Q3 and +44% YoY for the 9 months, reaching almost 6% of total revenue:

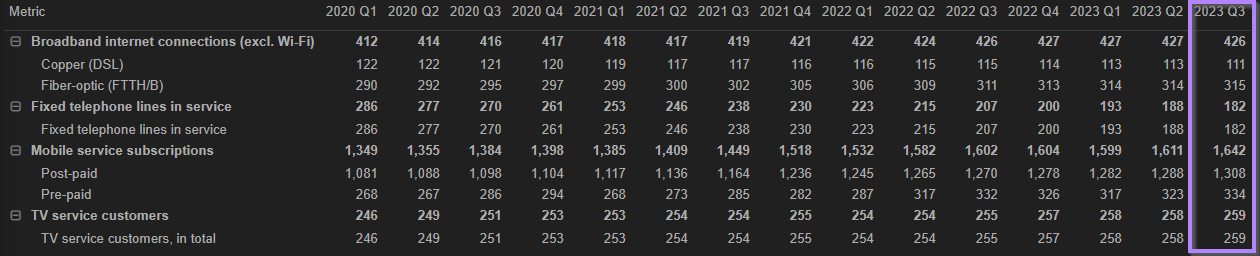

Revenue growth in mobile ant TV services was driven by healthy mix of higher subscribers’ base and higher ARPU, while lower number of customers in voice telephony and internet services was offset by higher ARPU:

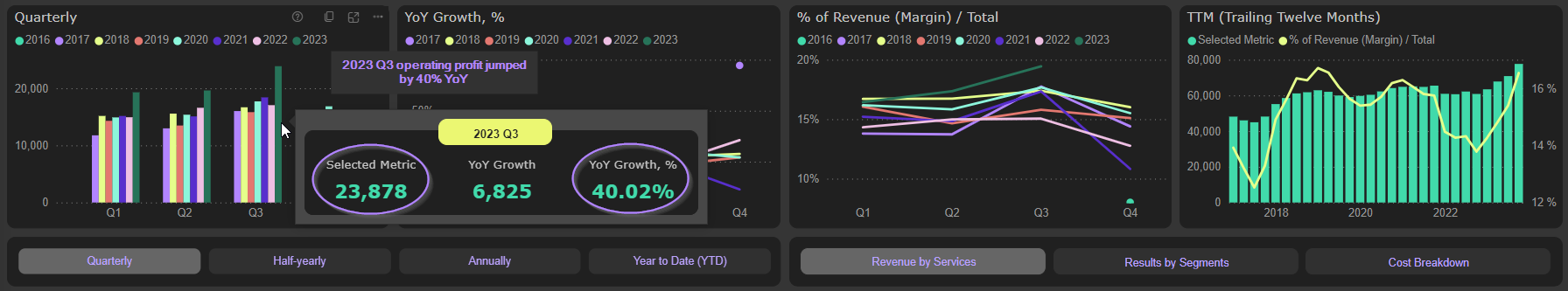

2023 Q3 operating profit shoot up by 40% YoY to 23,9M Eur (TTM operating profit reached 77,7M Eur):

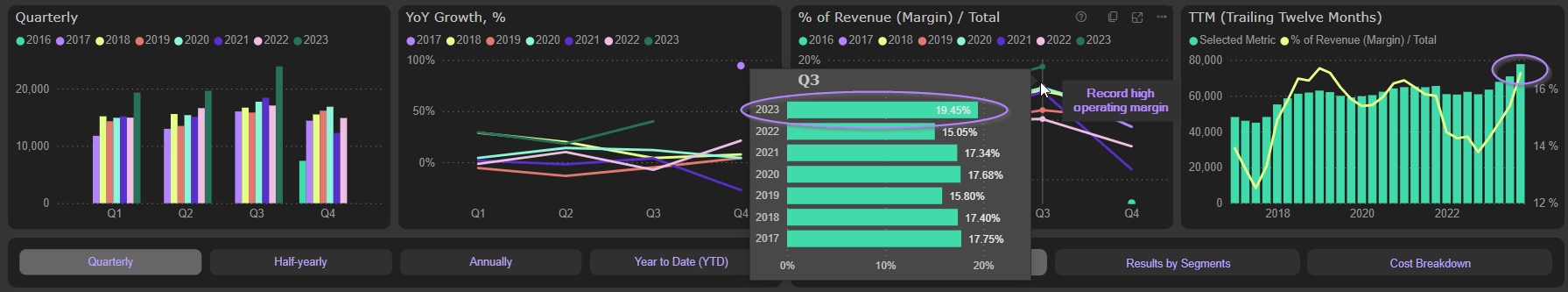

Operating margin reached record highs: 19,45% for 2023 Q3 and 16,5% for TTM:

Adjusted EBITDA margin also jumped to new record highs: 37,6% for 2023 Q3 and 35,3% for TTM.

It’s worth to note also, that Telia Lietuva this year’s recovery in operating margins was significantly stronger, compared to the whole Telia Company Group. Telia Lietuva TTM adjusted EBITDA margin improved to 35,3% in 2023 Q3 from 33,3% in 2022 Q4 and 34,4% in (in EUR terms), while Telia Company Group’s 2023 Q3 TTM adjusted EBITDA margin was 33,6% compared to 33,8% in 2022 Q4 (in SEK terms). Contrast in adjusted operating margin’s improvement is even stronger.

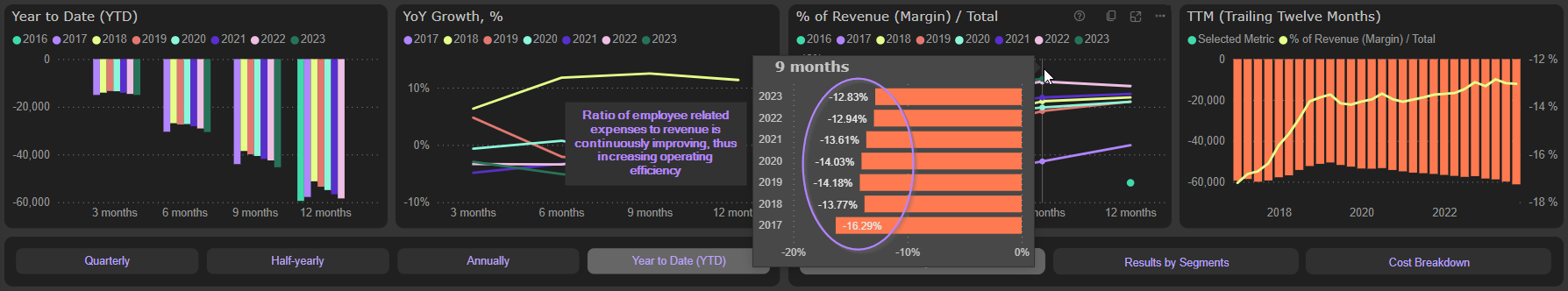

Operating profit and margin’s improvement was driven mostly by revenue growth and significantly lower other operating expenses (impacted by substantially lower energy prices, compared to last year). However, operating efficiency was increased also by lower ratio of employee related expenses to the revenue:

Free cash flow is finally back

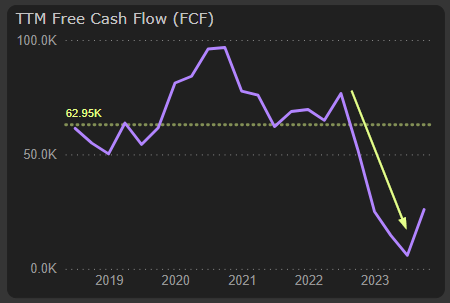

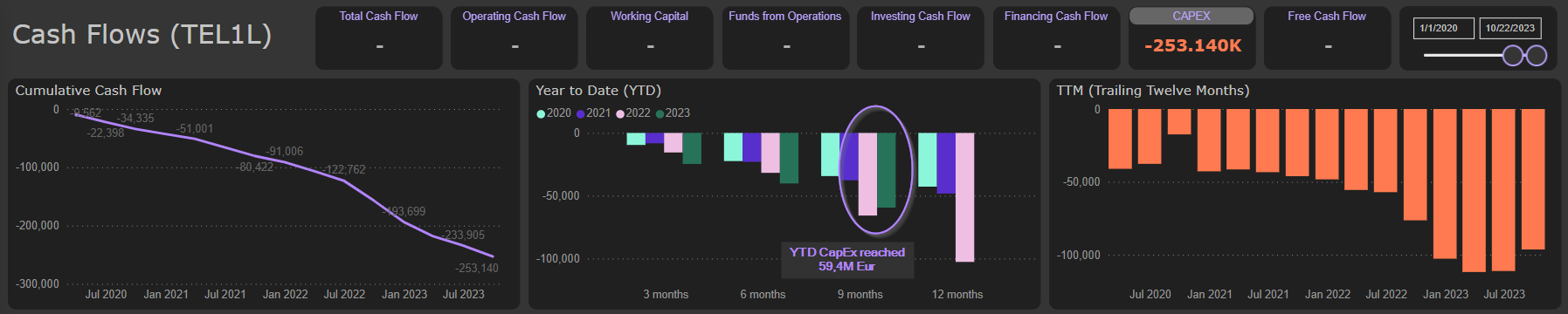

Certainly, the most welcomed 2023 Q3 numbers were related to capital expenditures (CapEx) and free cash flow (FCF). It’s quite obvious, that company’s huge investment program (5G and not only), substantially lower FCF and, as a consequence, reduced dividends, was one of the main reasons of investors’ nervousness:

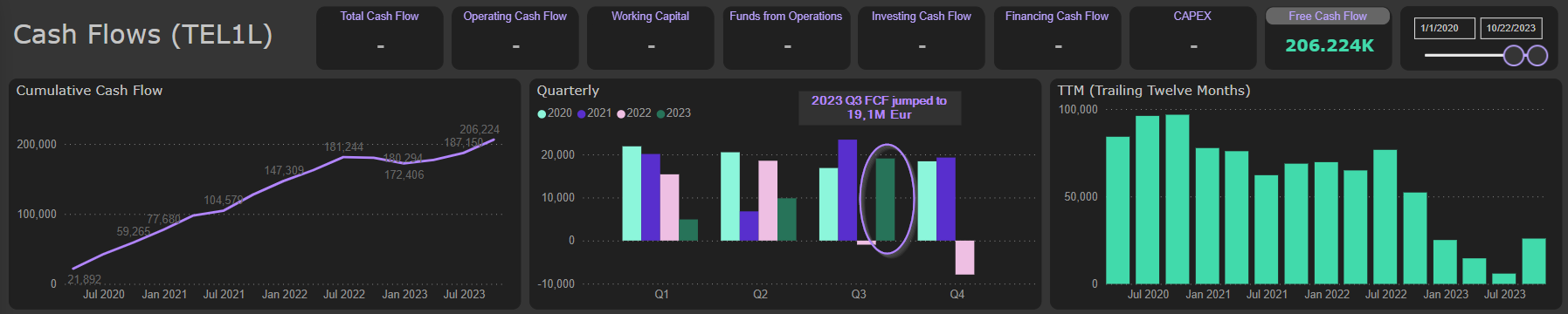

So, presumably, all eyes should be on this year’s free cash flow numbers. And the company didn’t disappoint.

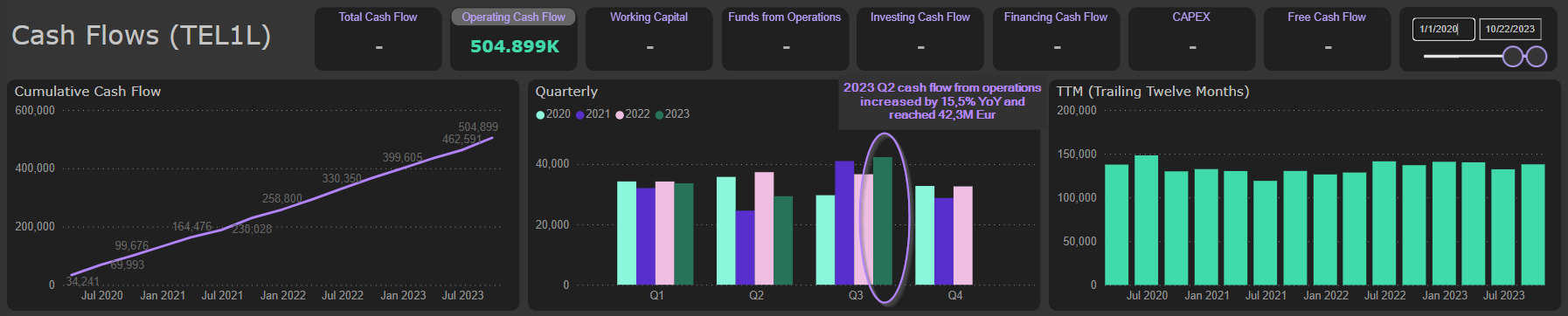

First of all, 2023 Q2 cash flow from operations increased by 15,5% YoY and reached 42,3M Eur:

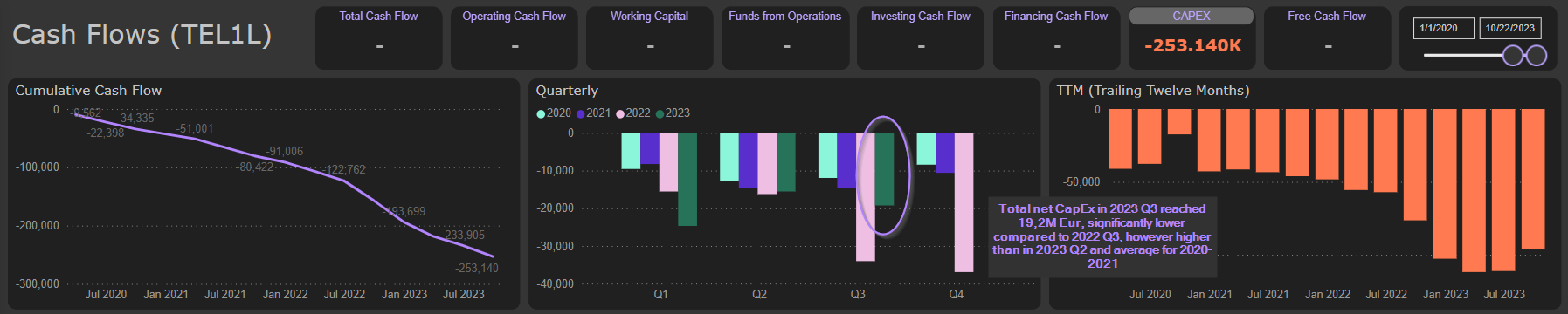

On the CapEx front also is significant progress, though not so excellent, compared to operating activities. Total net CapEx in 2023 Q3 reached 19,2M Eur, significantly lower compared to 2022 Q3, however higher than in 2023 Q2 and average for 2020-2021:

YTD CapEx reached 59,4M Eur. For the FY 2023 we expect total net CapEx around 75-80M Eur. That will be significantly lower compared to 2022 (102,7M Eur), however substantially higher compared to 2020 and 2021 (42,7M Eur and 48,3M Eur, respectively):

We expect, that new “normal” annual net CapEx level will be around 65-70M Eur, reflecting mostly cost inflation of recent couple of years.

Due to higher cash flow from operations and lower CapEx, 2023 Q3 FCF jumped to 19,1M Eur (In calculating FCF we subtract also lease payments to restore cash flow comparability after IFRS 16 changes in 2019. Without lease payment subtraction 2023 Q3 FCF reached 23,1M Eur):

That is very strong positive contrast with the last year and the first half of this year. FCF is firmly on its recovering path to the normal 70-75M Eur annual level. We expect about 17M Eur (21M Eur excluding lease liabilities payments) of FCF in 2023 Q4 and 51M Eur (67M Eur excluding lease liabilities payments) in FY 2023. In FY 2024 FCF will probably recover to 70-75M Eur (86-91M Eur excluding lease liabilities payments). With this level of FCF the company could address successfully one of the most important issues for investors – restore dividend payments to at least 2021-2022 level.

What about the dividends?

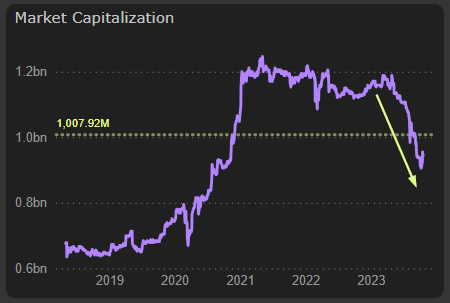

On 27 April 2023 the AGM of Telia Lietuva decided to cut its dividends by 40% (from 58,3M Eur to 35,0M Eur). That was understandable (higher necessary CapEx and significantly lower FCF), though very painful decision for investors. Dividend yield was cut instantly from 5% to 3%. It was even more painful given current interest rates environment. From this decision company’s market cap has lost almost 20% (or over 200M Eur). Investors’ voting is quite obvious.

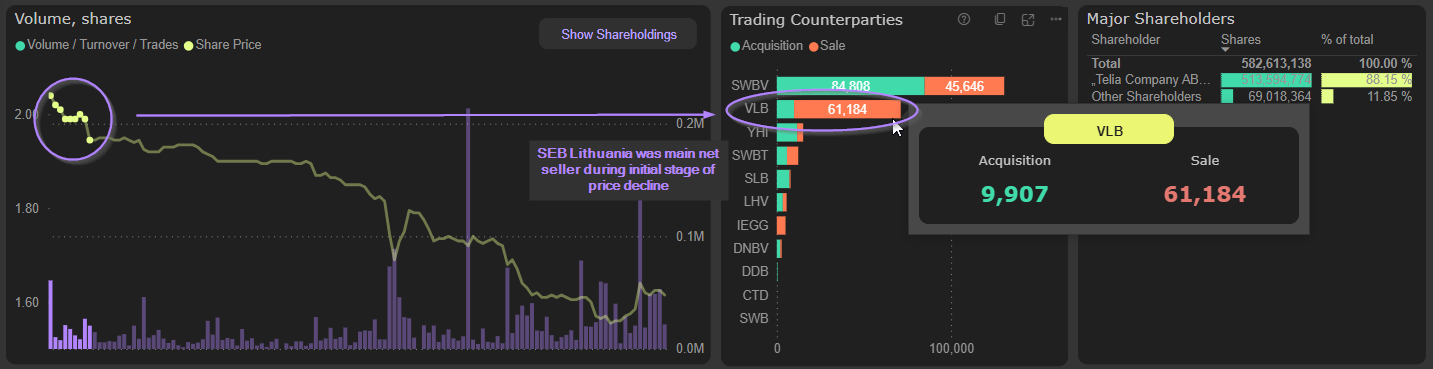

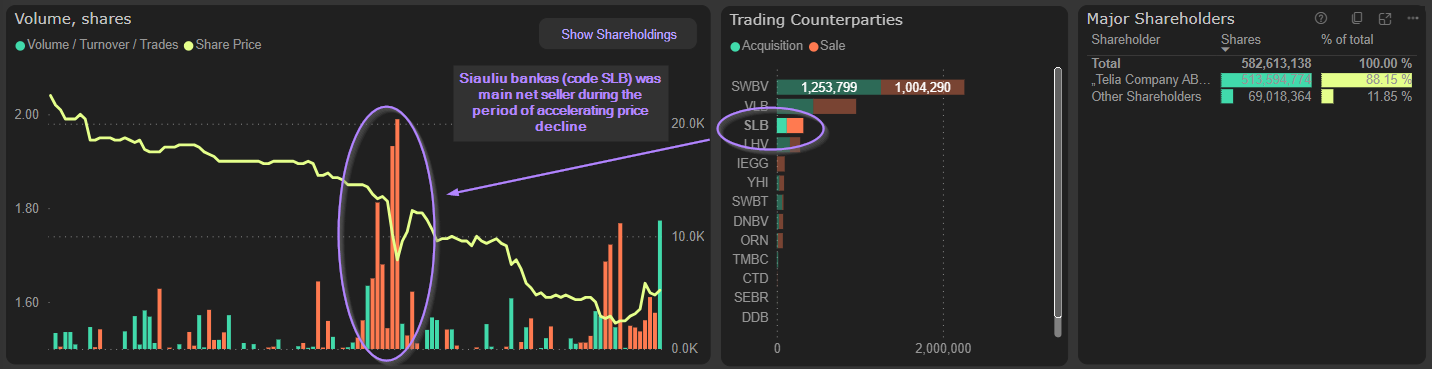

Analysis of the Nasdaq Vilnius brokers’ trading activity during this period may suggest increased selling pressure from the institutional investors’ side. E.g., during initial stage of the price decline SEB Lithuania (code VLB) was the main net seller with average trade size significantly above average. That may indicate increased selling activities of SEB Investment Management managed funds. Meanwhile, during the period of accelerated price decline (beginning of the August 2023) Siauliu bankas (code SLB) was the main net seller, which may indicate increased selling activities of INVL Asset Management managed funds:

The recovery in FCF creates necessary conditions to restore dividends payments (and investors’ confidence). Company’s dividend policy, approved in 2017, provides guidelines for dividend distribution: company may distribute as dividends up to 80% of FCF, if Net debt to EBITDA ratio is not exceeding 1,5 (company calculates FCF excluding lease liabilities payments). Given our projections of FCF for this and next year, company will be able to increase its dividends payments to at least 54M Eur next year (80% of expected FCF FY 2023). FY 2023 net income is expected at 67M Eur (20% YoY growth), so with 54M Eur dividend payment we will have 80% payout ratio, which is significantly below long-term average (about 97%). Current Net debt to EBITDA ratio is 0,55, significantly below restriction, set by dividend policy.

With 54M Eur dividends and current market cap (946M Eur), the dividend yield would return to 5,7%, only slightly below ten years average (5,9%). That would be very strong argument to restore investors’ confidence.

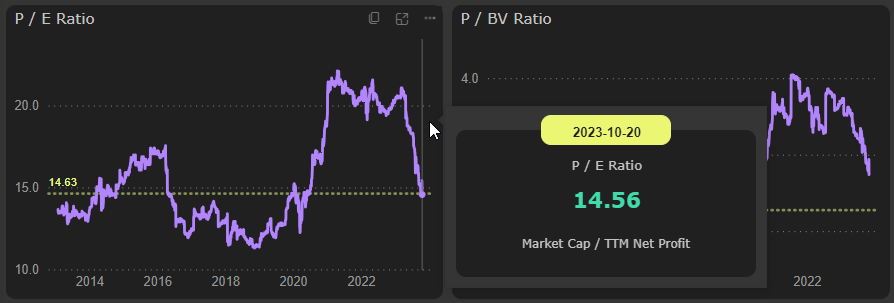

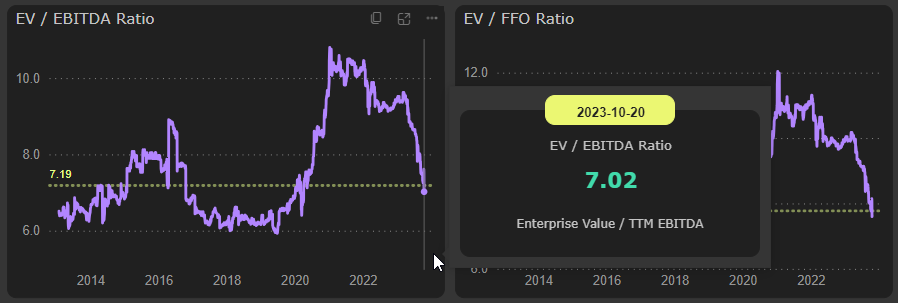

Moreover, recent excellent operating results and declined share price improved dramatically company’s valuation multiples. Trailing P/E multiple declined to 14,6x (14,1x FY 2023), while trailing EV/EBITDA multiple (EBITDA is calculating excluding lease liabilities payments) decreased to 7,0x (6,7x FY 2023):

This valuation levels, though slightly above 2018-2019 lows, combined with restored dividend yield, are certainly worth of investors’ attention.