Telia Lietuva 2025 Q4 financial review

Journey to the top

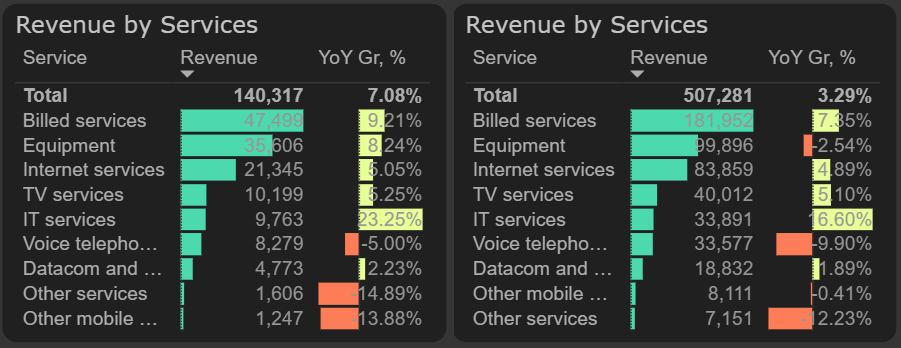

Telia Lietuva completed 2025 on a strong note. During the year, the company generated €507M in revenue, which is 3% more than in 2024. Revenue in the fourth quarter grew slightly faster than the overall annual result – 7% YoY. Both in Q4 and throughout 2025, IT services (Q4 2025 – 23% YoY; 2025 – 17% YoY) and billed mobile services (Q4 2025 – 9% YoY; 2025 – 7% YoY) saw the strongest growth. While equipment sales were weaker in the first three quarters of 2025 compared to 2024, they increased by 8% YoY in the last quarter.

Revenue by services, 2025 Q4 and 2025

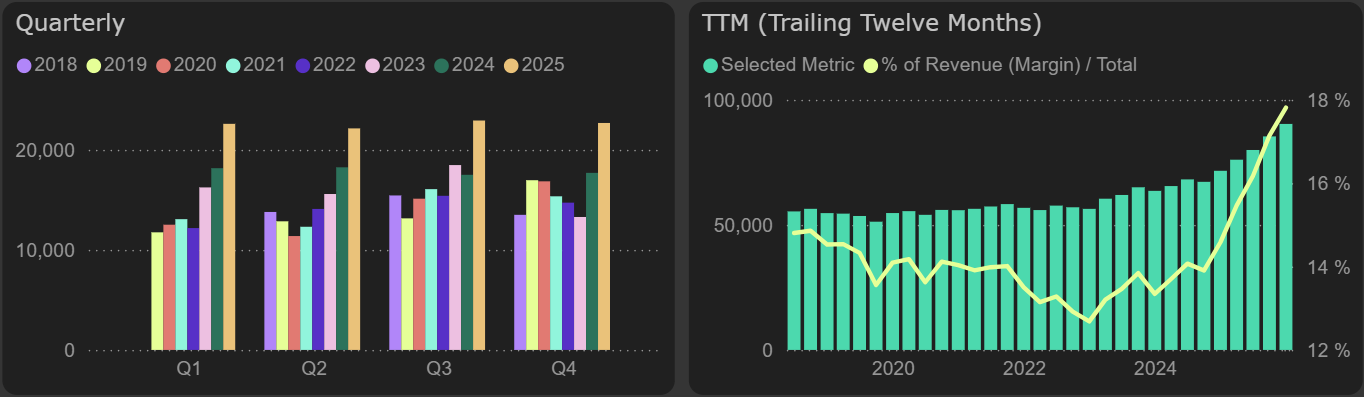

In the fourth quarter of 2025, operating profit was 29% higher than the previous year. The growth in operating profit for 2025 is similar – 26%, compared to 2024.

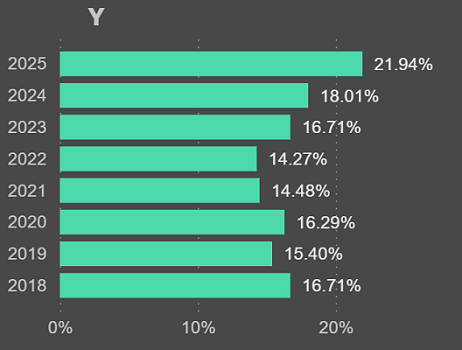

All four quarters in 2025 were marked by an increase in operating margin, which became the key factor driving the company's strong performance. Telia Lietuva's operating margin grew by 4% over year, from 18% in 2024 to 22% in 2025. The growth in operating margin has been ongoing since 2022, but 2025 saw the biggest jump.

Operating margin

In the last quarter of 2025, labor costs were 9% lower than the previous year. Overall, employee costs decreased by 3% in 2025 compared to 2024. Additionally, other operating costs dropped by 5% YoY, and the cost of goods and services decreased by 2% YoY in 2025. All of these cost reductions had a positive impact on the operating margin in the context of growing revenues.

The company achieved a record net profit of €90.4M in 2025, compared to €71.6M the previous year (+26% YoY). With this net profit, the company's ROE boosted to a high 23.5% level. However, this profit growth is limited, as it was driven by cost optimization, while the company's sales are growing at a relatively modest pace.

Net profit

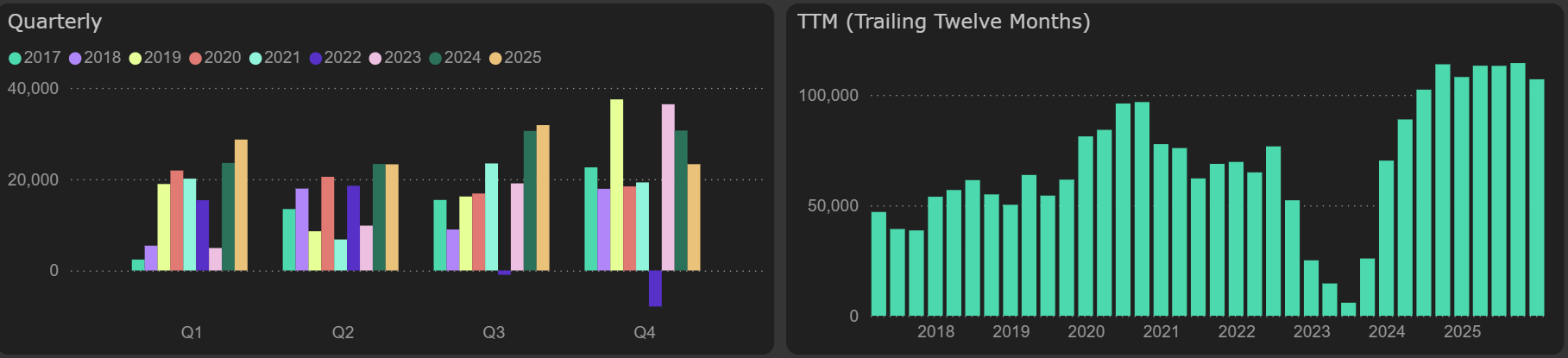

In 2025, the free cash flow reached €107M, providing a decent yield of 9%. However, last year, CAPEX was lower (€59M) than the depreciation replacement requirement (€72M).

With such strong free cash flow and net profit growth, the company has the potential to increase dividends above the last payout, which was €64M.

Free cash flow

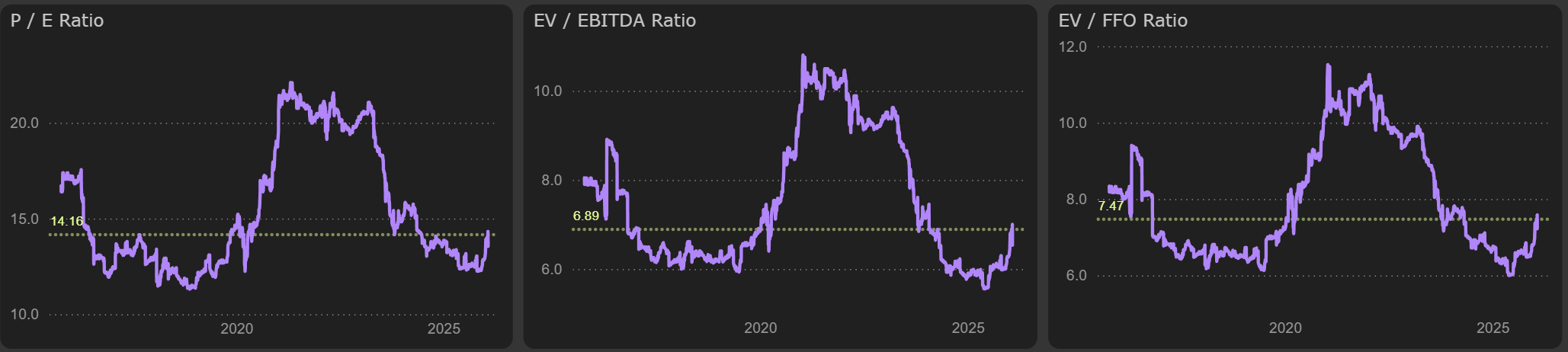

Valuation metrics grew, but still remain significantly below the 2021–2023 levels, with a P/E of 13.5x and EV/EBITDA of 6.5x.

Valuation metrics