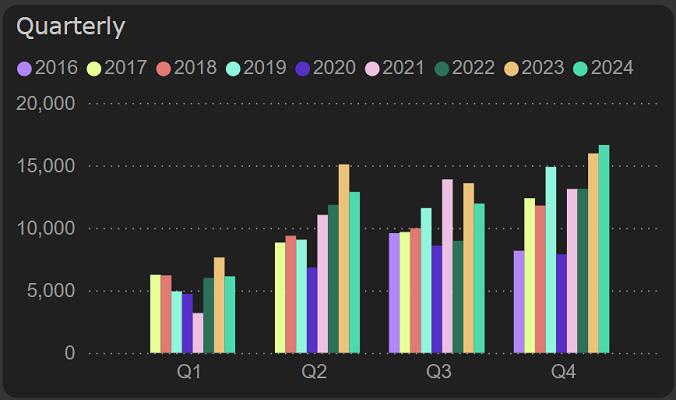

TKM Grupp 2024 Q4 financial review

Financials show continued weakness

The financial results of TKM Grupp for the fourth quarter do not show significant changes – the downward trend continues. Although revenues have been fairly stable this year, but the main issue remains profitability.

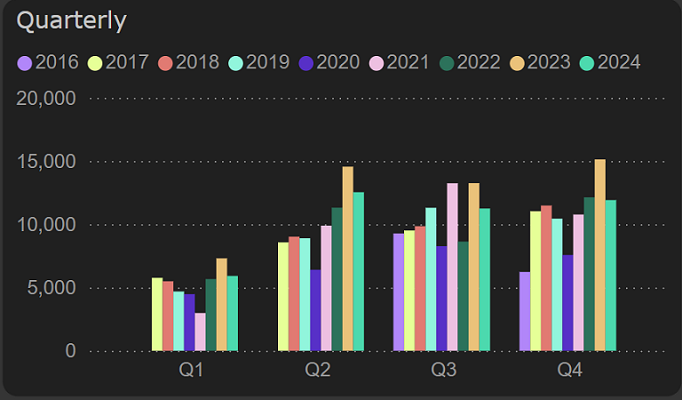

Investment property boosts results

At first glance, the fourth-quarter operating profit signals a rebound – after a decline in the first three quarters of the year, it has surged by 4% compared to last year.

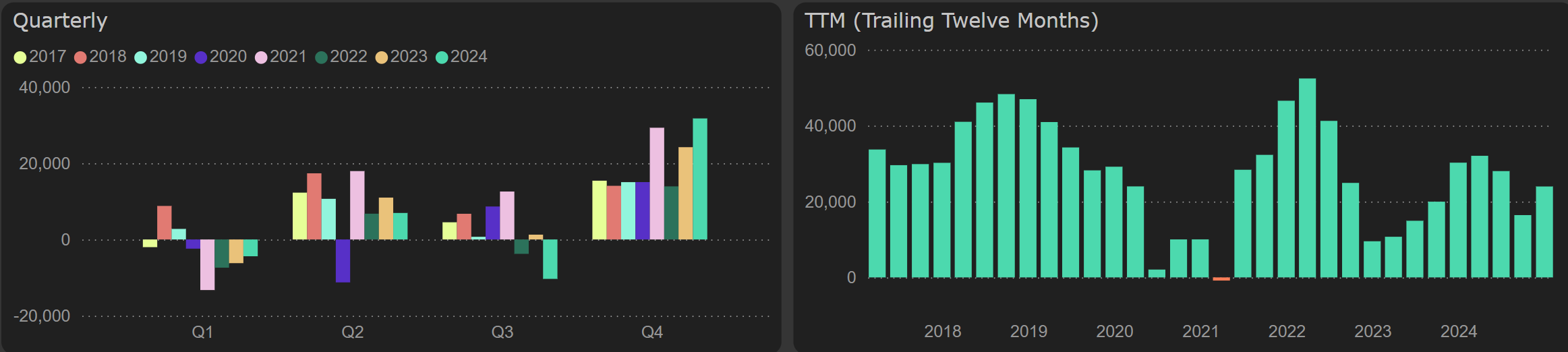

Operating profit

However, this growth was not driven by the company’s core operations, but by the fair value adjustment of investment property and profits from its sale. When excluding the other operating income line, which includes these gains, a further decline in operating profit becomes apparent.

Operating profit, excluding other operating income

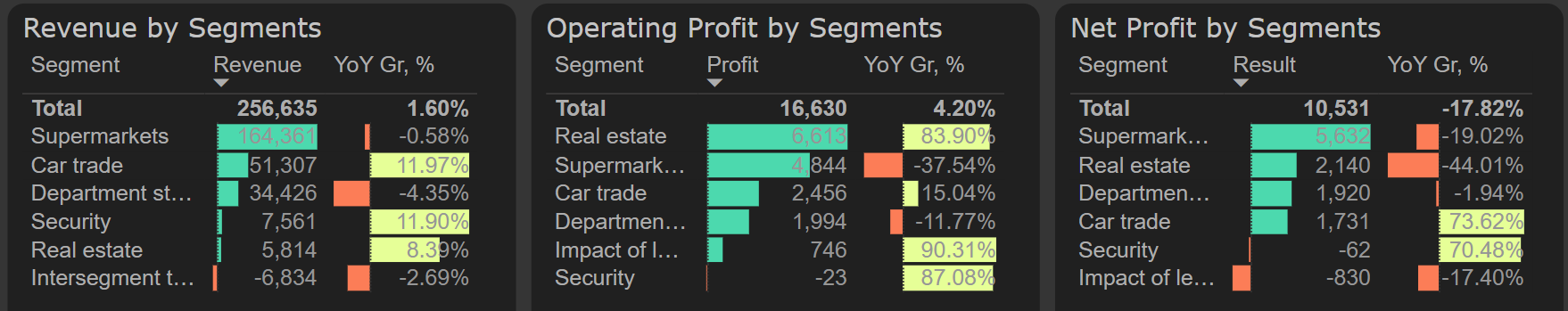

Profitability challenges in supermarkets

Segment analysis reveals that the company’s primary revenue source – the supermarkets segment – continues to negatively affect the overall results due to decreased profitability. While this quarter, the supermarkets generated nearly the same revenue as last year, net profit dropped by 19%.

The real estate segment showed a notable improvement in operating profit for Q4. However, this growth potential was largely eroded by the income tax expenses, leading to a decline in net profit.

The car trade segment outperformed last year's results this quarter with a 74% increase in net profit. Nevertheless, it’s worth noting that the comparative period was exceptionally weak, so such impressive growth should be viewed with some caution.

Results by segments, 2024 Q4

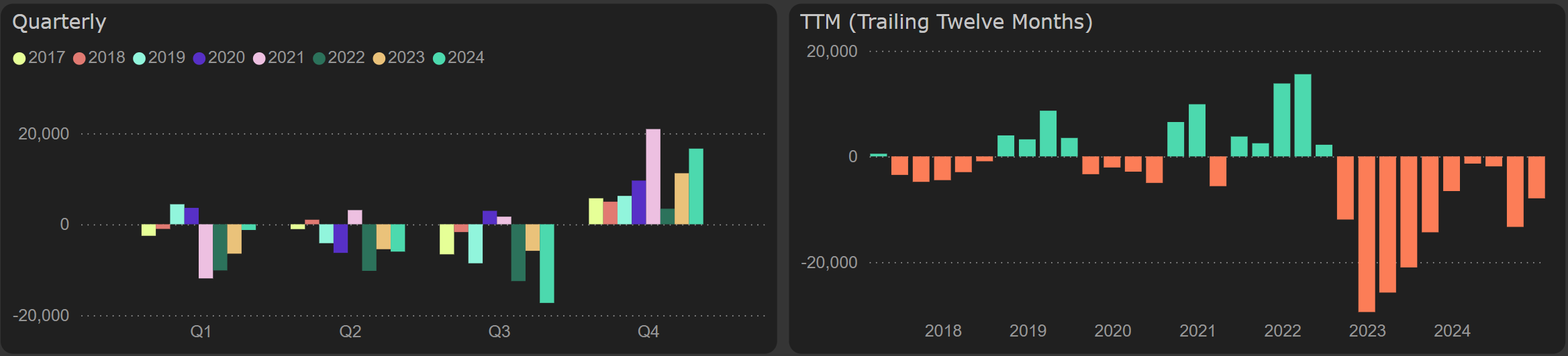

Improved FCF, but FFO isn’t the driver

In the fourth quarter, cash flow from operations (FFO) decreased by 16%, but total cash flow from operating activities increased due to changes in working capital. After a substantial rise in working capital requirements in the third quarter, the situation stabilized in the fourth quarter, releasing €16.6 million.

Working capital

The largest positive impact on the dynamics of free cash flow in the fourth quarter was due to changes in working capital, which accounted for half of this amount. The annual free cash flow amounted to €24 million. However, a significant part of this cash flow arises from one-off transactions - €10.5 million is related to the sale of investment property.

Free cash flow

TKM Grupp holds a PLY value score of 6.11, with key valuation ratios – EV/EBITDA at 7.51x and P/E at 14.67x – not standing out in the Baltic stock exchange context.