DelfinGroup 2025 Q1 financial review

Sustains growth trend

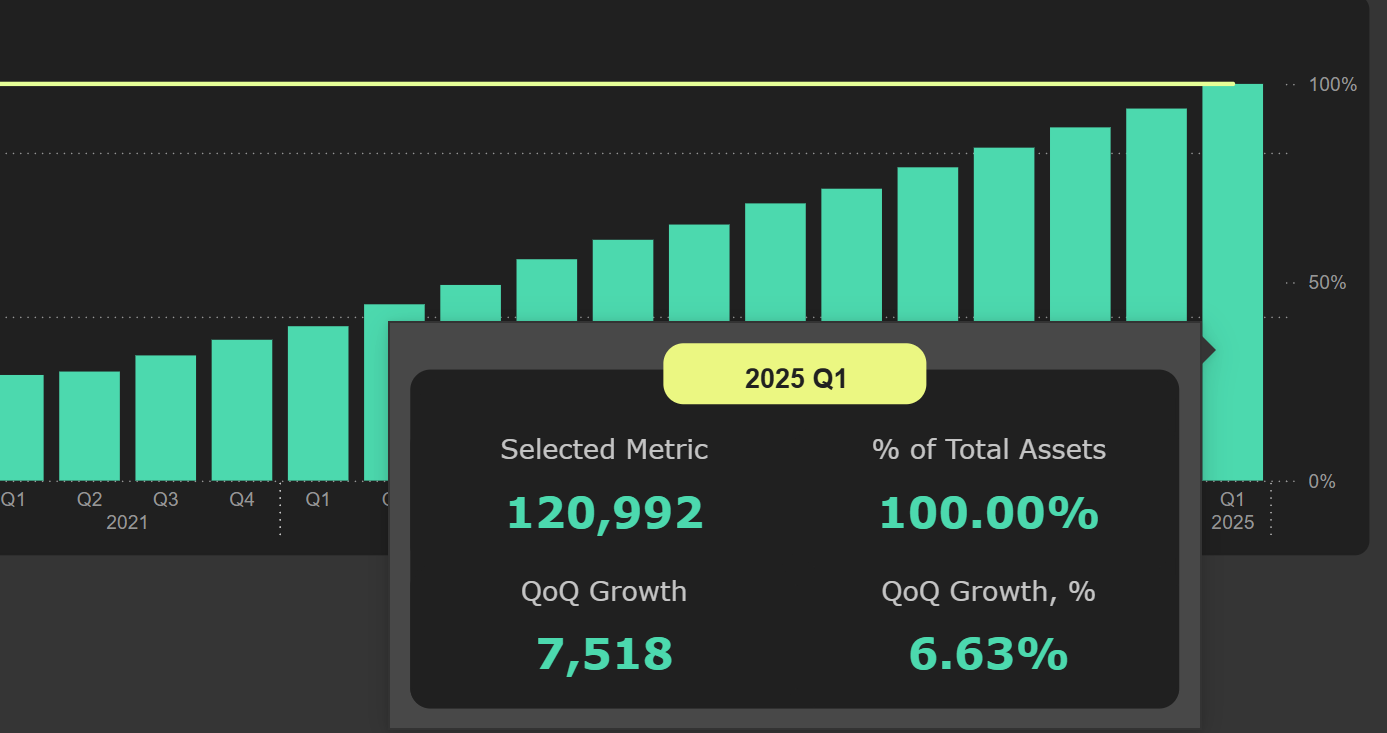

DelfinGroup continued strong loan portfolio growth in the first quarter of 2025 – increasing by nearly 7% compared to the end of last year. Accordingly, a solid rise in interest income was recorded: up 22% compared to Q1 2024, and 5% compared to Q4 2024.

Loans and receivables

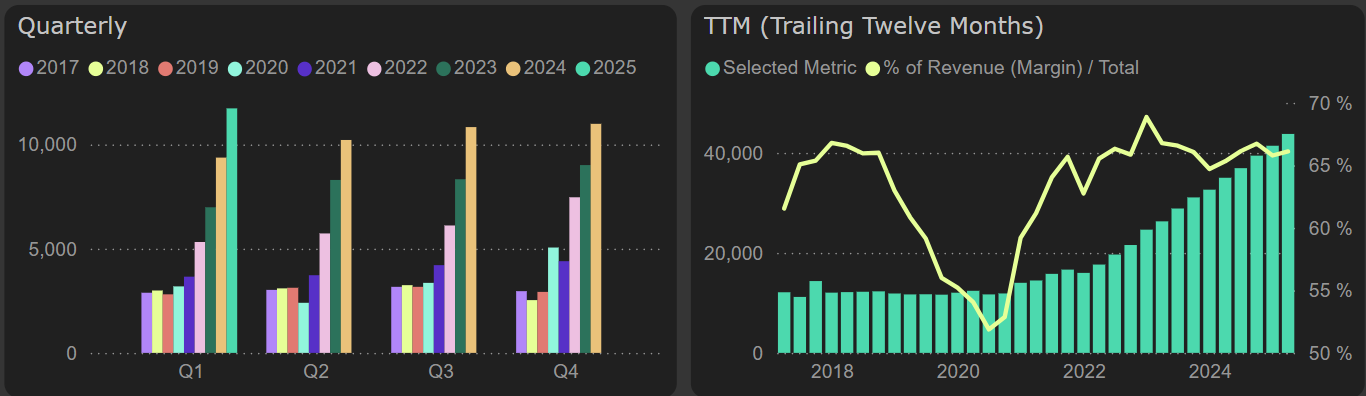

Interest expenses grew almost twice as slowly as income this quarter – up 12% YoY – resulting in an even stronger increase in net interest result, which rose by 25% compared to the same quarter last year.

Net interest income

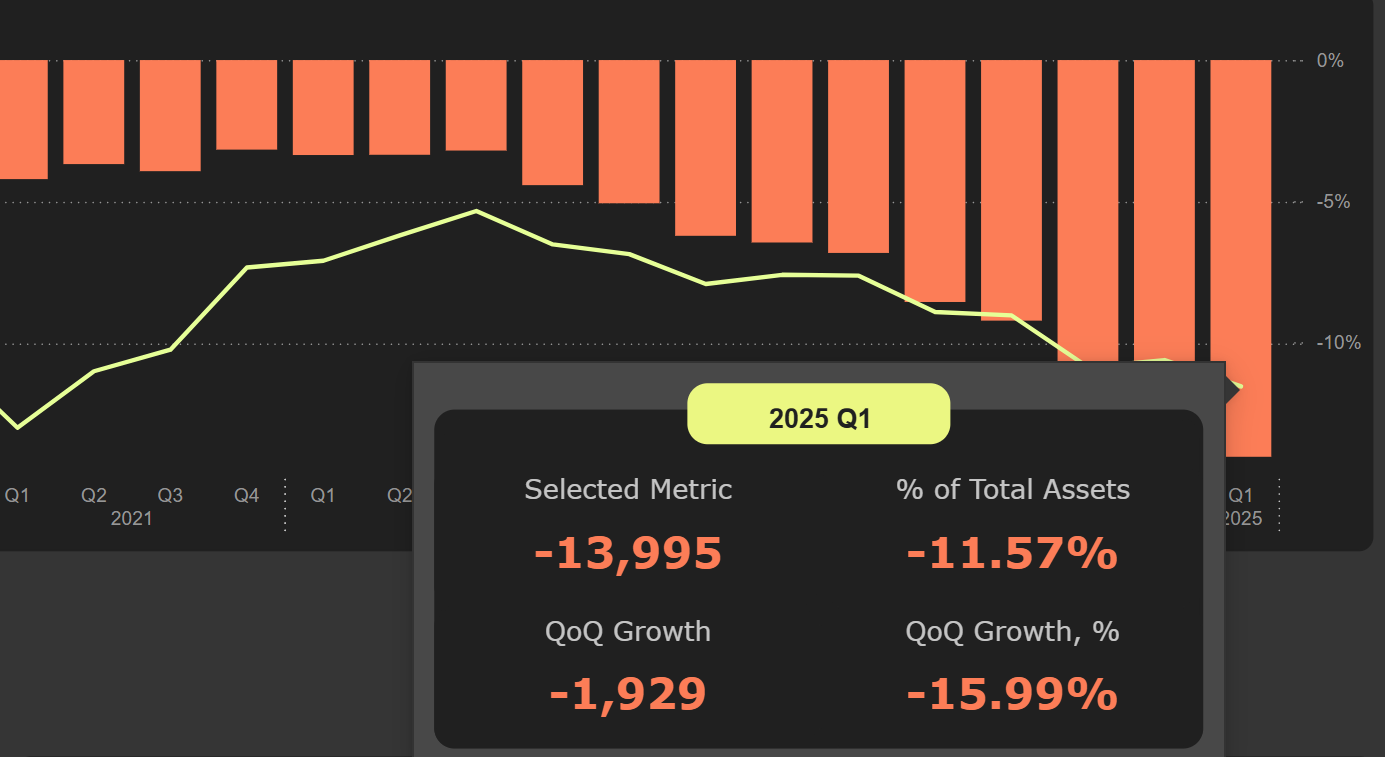

Credit quality continued to exert pressure on results, leading to a 36% increase in credit loss expenses compared to the first quarter of the previous year. The expected credit loss (ECL) allowance rose slightly further, reaching 11.6% of the loan portfolio, up from 8.9% in Q1 2024.

ECL allowance on loans to customers

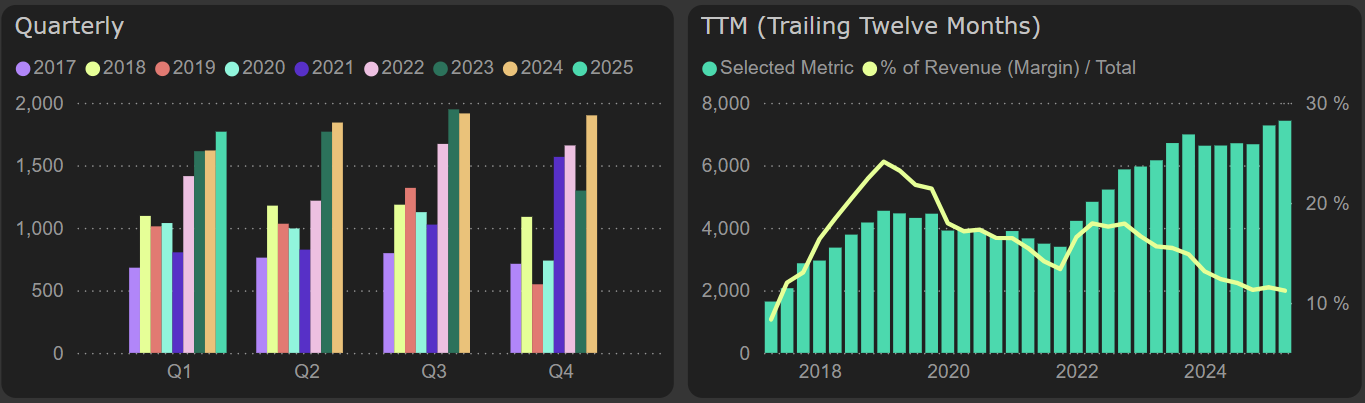

Nevertheless, gross profit still grew significantly – by 18.8% compared to the same quarter in 2024. However, operating expenses (sales and administrative) increased by 22% YoY, resulting in a more modest net profit growth of 9.3% YoY. The annual net profit remained at a record level of €7.4M.

Net profit

DelfinGroup's valuation multiples remain at historical lows, while return on equity (ROE) is one of the highest among Baltic financial services companies. Eleving Group slightly outperforms DelfinGroup in both ROE and market valuation metrics. Although DelfinGroup is more attractive on P/E and ROE basis compared to the banks, its business model carries more risk.

Comparison of Baltic financial services companies