Merko Ehitus 2025 Q3 financial review

A steep drop – but is it really that bad?

Last year, Merko Ehitus delivered impressive Q3 results, which makes this year’s decline seem more dramatic, although, in the context of the company, this quarter is quite typical.

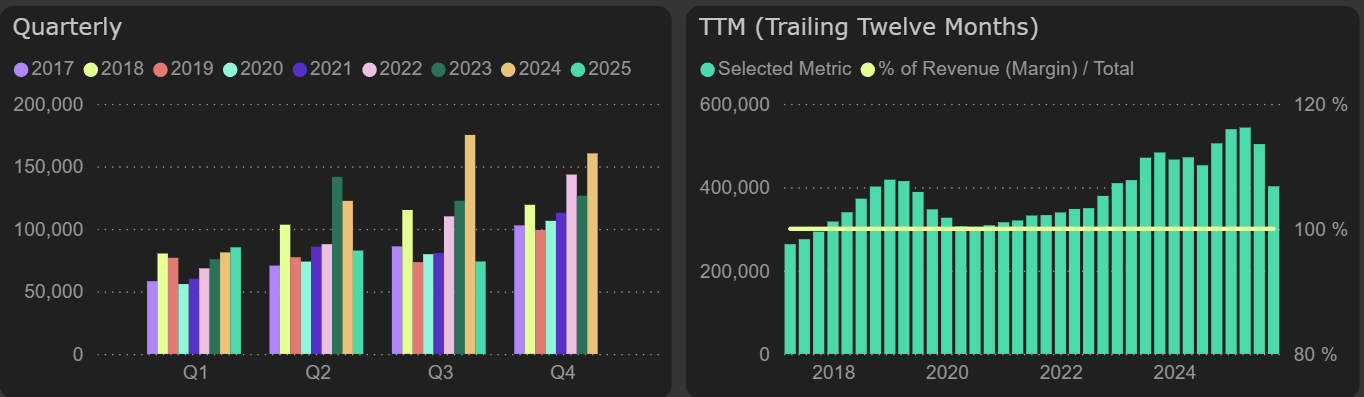

Revenue for the third quarter of this year reached €74M, which is 58% lower than in the same period last year. The main reason is significantly lower revenue in the construction segment, especially in Lithuania. Over the 9 month period, revenue totaled €242M, which is the lowest level since 2021 (€227M).

Revenue

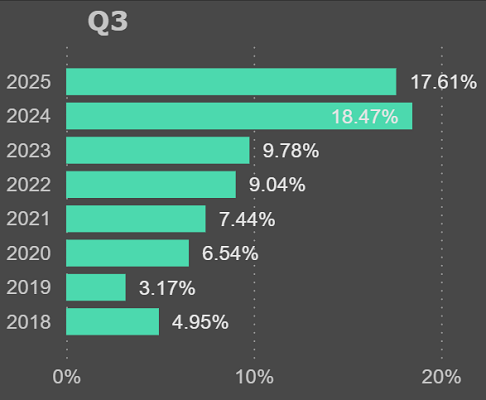

On the positive side, profitability remained strong due to effective cost and goods sold management – the gross margin for Q3 was 24.3%. Operating expenses in the third quarter decreased more slowly than sales – by 28% compared to last year, but the operating margin still remained high.

Operating margin

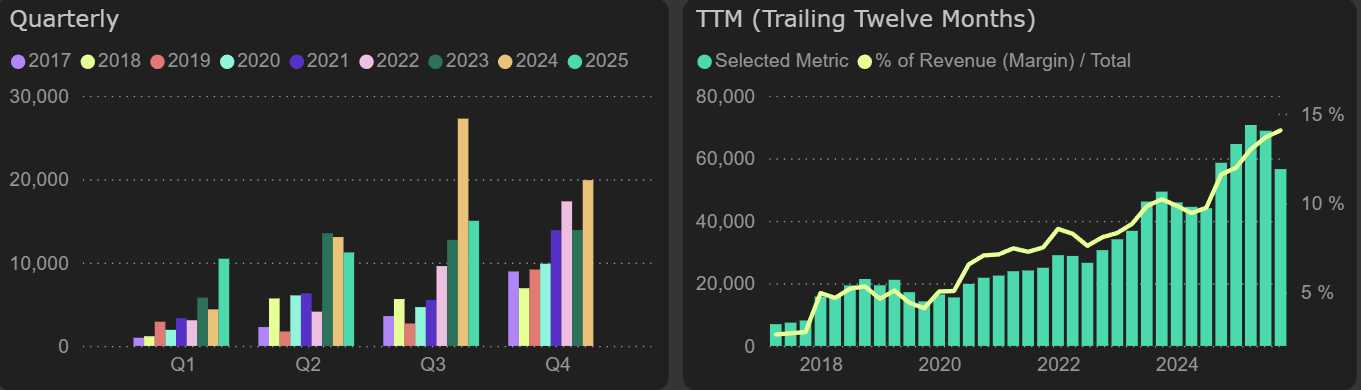

The net profit for the third quarter was €15M, which is 45% lower than last year. However, in a broader context, this is still a solid performance, with net profit up 18% compared to Q3 2023, driven by higher margins.

Net profit

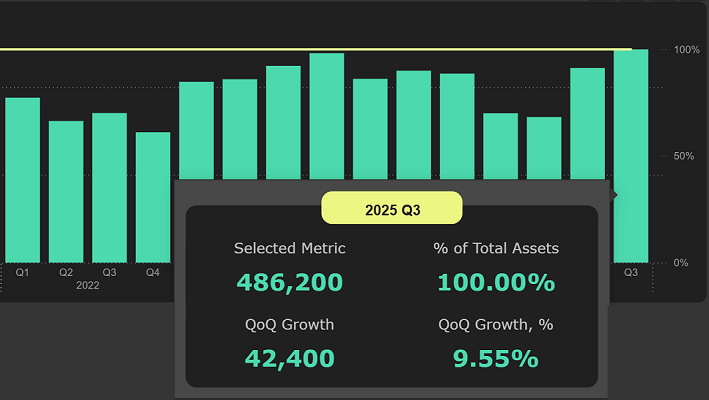

Looking ahead, the order book grew and reached €486M at the end of the third quarter. Although fewer new contracts were signed in the third quarter compared to last year, contracts worth €322.8M were signed over the 9 months of this year, which is €30.7M more than last year (+10.5%).

Order book

Funds from operations were weaker than in Q3 last year, leading to a decline in annual free cash flow to €31M.