TKM Grupp 2025 Q4 financial review

Challenges lasting until the year end

The financial results of TKM Grupp for the last quarter of 2025 continued downward trajectory. In the fourth quarter of last year, revenue were 6.8% lower compared to the same quarter in 2024. The previous three quarters showed more stable sales, so the total revenue for 2025 was only 2.6% below the 2024 level, amounting to nearly €920M. The car trade segment faced the biggest sales challenges both in the fourth quarter of last year (-18% YoY) and throughout 2025 (-12% YoY).

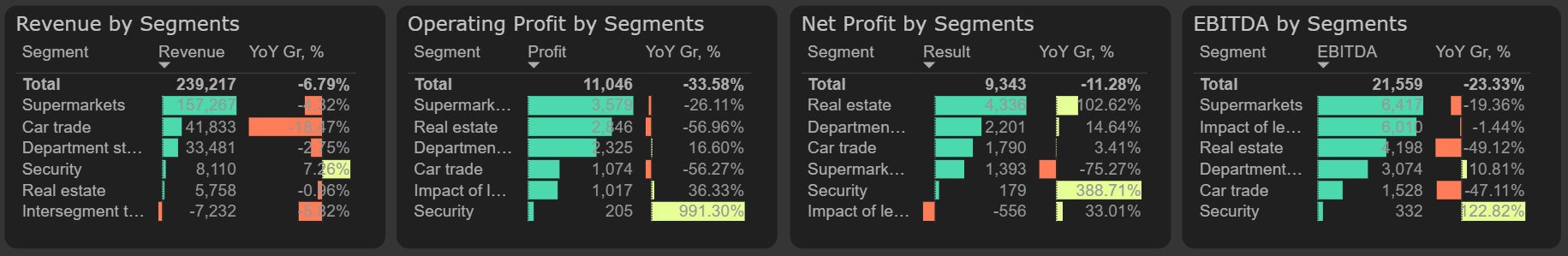

Results by segments, 2025 Q4

At the end of 2025, there is a noticeable decline in operating profit – 34% compared to the fourth quarter of 2024. However, most of the decline is due to the net fair value adjustment from investment property in 2024, which led to a spike in other operating income. When calculating operating profit excluding other operating income, the decline in the fourth quarter of last year decreases to 14% YoY.

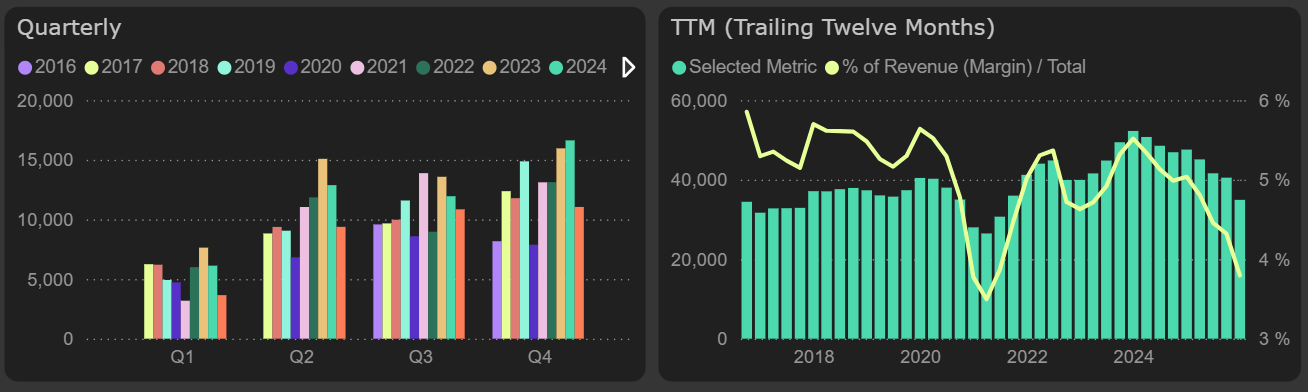

Operating profit

Profitability – another aspect that posed challenges for the company in 2025. Although the cost of merchandise followed the revenue decline, employee expenses in 2025 were 3.7% higher than the year before. Service costs remained stable, but in the context of lower revenues, this also had a negative impact.

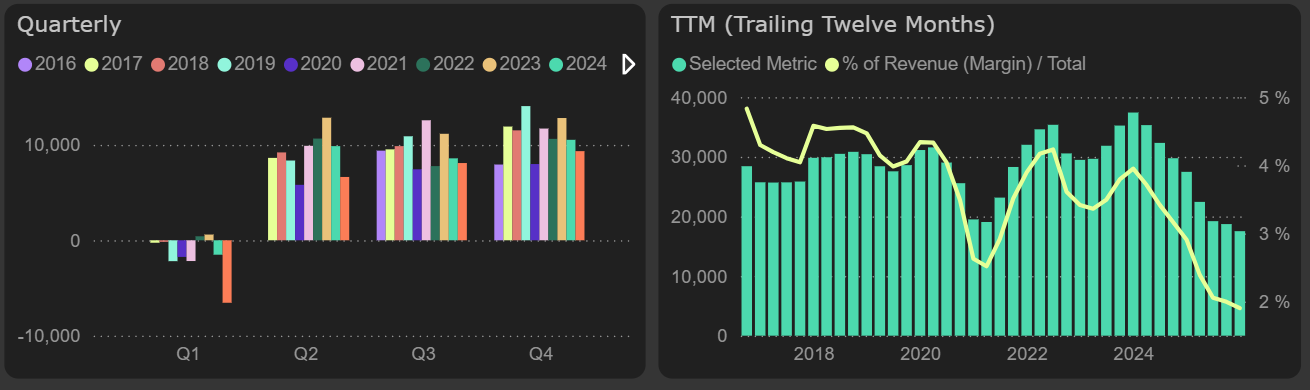

The net profit for the fourth quarter of 2025 was 11% lower compared to the same period in 2024. On an annual basis, the decline was even more pronounced – the net profit for 2025 was nearly €10M lower (-36% YoY) than in 2024, amounting to €17.5M. As the company operates with a relatively low net profit margin, its decline by 1% – from 2.9% in 2024 to 1.9% in 2025 – had a significant impact.

Net profit

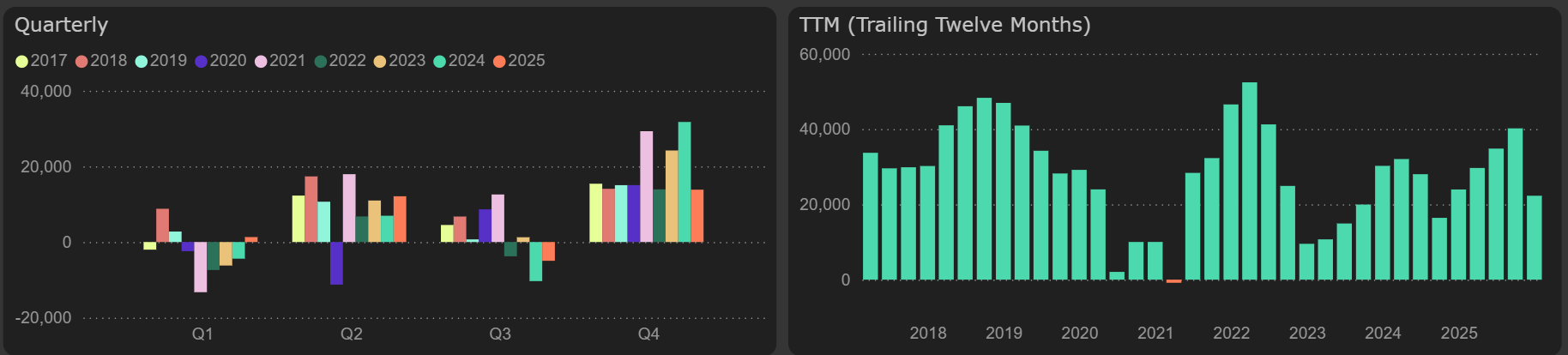

The free cash flow for 2025 amounted to €22.3M (5.7% yield). Compared to 2024, the decline in free cash flow was smaller – 7% compared to the 15% drop in funds from operations, as slightly less was invested in fixed assets and working capital in 2025. Nevertheless, the generated free cash flow falls short of the level of the last paid-out dividends (€34M including taxes).

Free cash flow

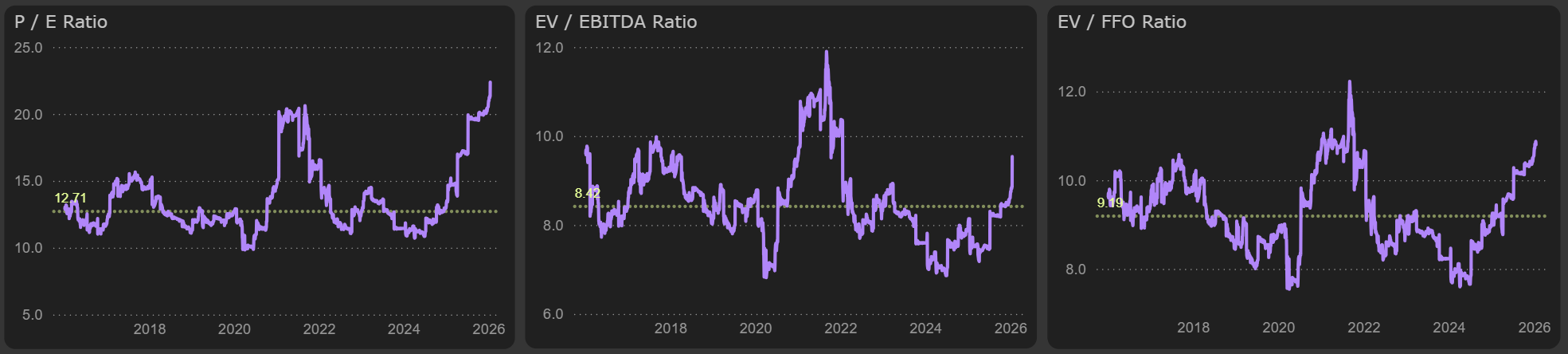

After the results of the last quarter of 2025, the company’s valuation metrics increased slightly to P/E – 22.4x, EV/EBITDA – 9.5x and still don’t look too attractive.

Valuation metrics