Coop Pank 2025 Q3 financial review

Takes another step down in 2025

Coop Pank’s Q3 2025 results showed a softer decline compared to LHV Group.

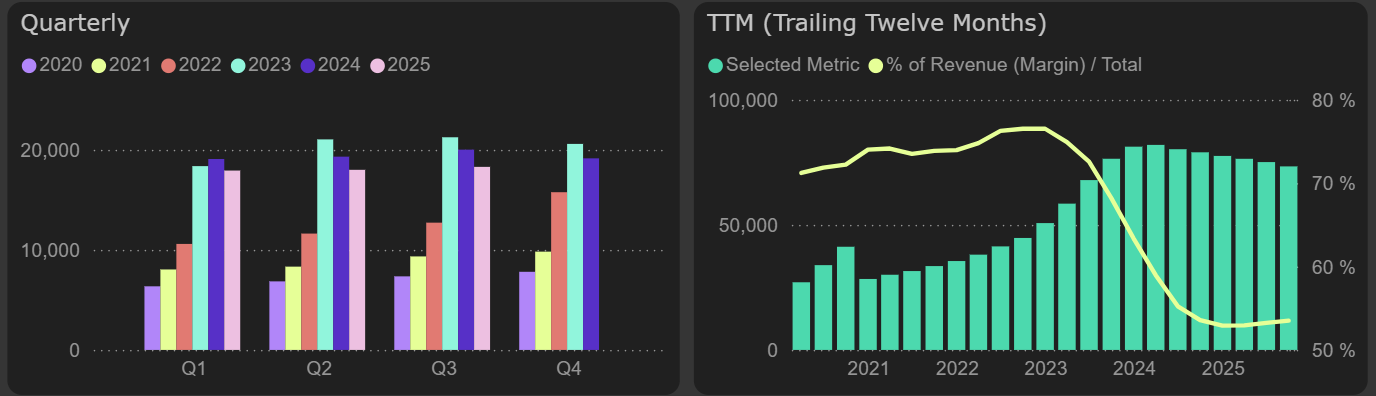

The net interest result for the third quarter was 9% lower than last year (LHV Group – 18% YoY). Despite this, stability is visible in the context of this year – net interest income has remained at a very similar level in all three quarters, around €18M per quarter. Although interest income fell by 11% in the third quarter compared to last year, margin showed signs of improvement as expenses decreased more rapidly – by 15% YoY. A similar trend is seen over the 9 months: interest income fell by 9% YoY, expenses decreased by 12% YoY, and the overall result dropped by 7% YoY.

Net interest income

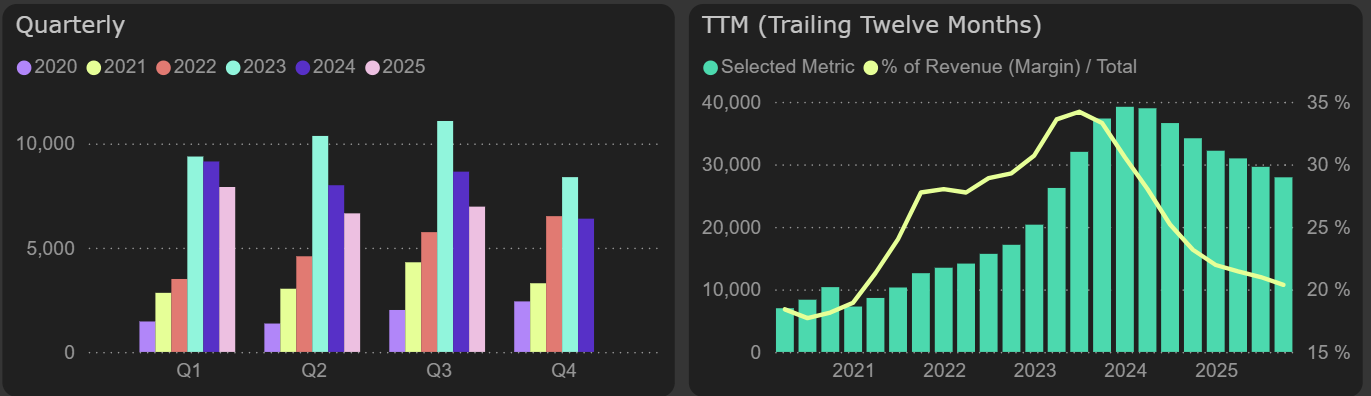

Coop Pank earned nearly €7M net profit in the third quarter of 2025, which is 19% less than last year (LHV Group – 24% YoY). Higher payroll costs (+5% YoY) and increased depreciation (+14% YoY) added additional pressure. However, the bank successfully reduced other operating costs by 10% YoY over the first 9 months of 2025 and by 12% in the third quarter compared to last year.

Net profit

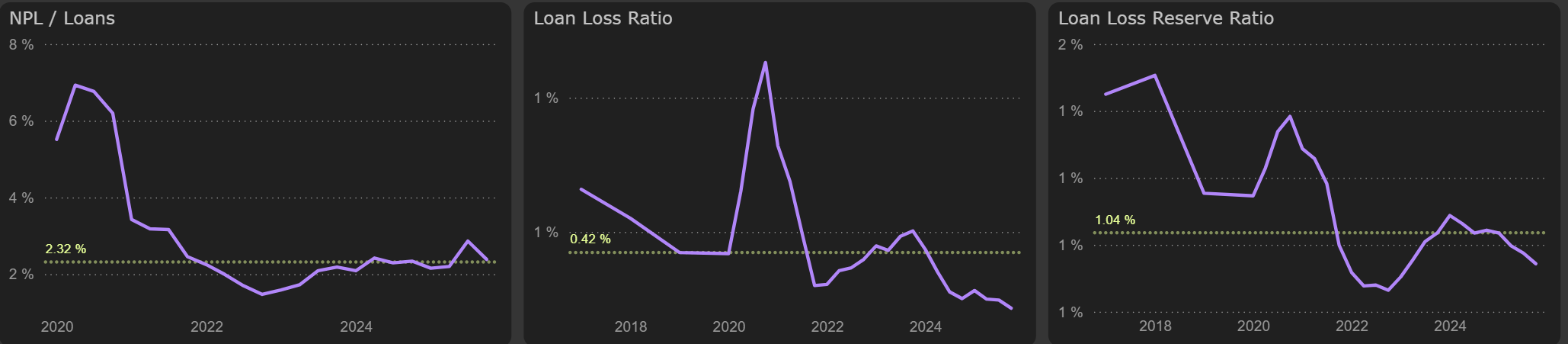

Credit quality remains strong in 2025, with the loan loss ratio at 0.22%. However, LHV Group regained the top position in credit quality (loan loss ratio 0.09%), surpassing Coop Pank.

Credit quality metrics