Ignitis Group 2025 Q3 financial review

Lags behind the first half of the year

Ignitis Group significantly grew its revenue in the first half of this year (19% YoY), but in the third quarter, they were 4% lower than the previous year, due to pressure from the customers and solutions segment, where revenue decreased by 22%. Additionally, in the reserve capacities segment, growth in the third quarter was much slower (22% YoY) compared to the first half of this year (136% YoY).

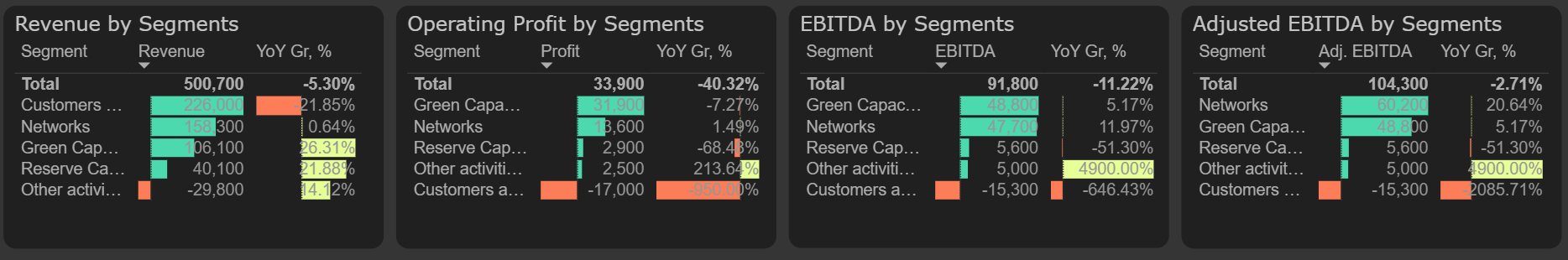

Results by segments, 2025 Q3

Actual EBITDA in the third quarter, as well as for the first 9 months, was 11% lower than last year, amounting to €92M. The reasons for this include lower revenue and profitability. Profitability was negatively affected by about 10% higher employee and other operating costs in the context of lower revenues. Due to a 22% increase in depreciation, operating profit in the third quarter decreased even more sharply – by 40% compared to last year. Overall, for the first 9 months of this year, operating profit was 27% lower than in 2024.

In the third quarter, €12.4M in adjustments were recognized, compared to €3.7M last year. Accordingly, the adjusted profit for the third quarter decreased less sharply than the actual profit: adjusted EBITDA was only 3% lower, while adjusted EBIT was 23% lower than a year ago.

Operating profit

The third quarter pushed the annual free cash flow further into negative territory. The third quarter funds from operations was more than half lower than last year – €61M, with the majority of it covering working capital needs – €52M. Additionally, this quarter saw higher CAPEX, but for the first 9 months, they remained below last year's level.

Funds from operations