Telia Lietuva 2024 Q4 financial review

Picking up speed again after hitting the brakes in Q3

Telia Lietuva Q4 2024 and full-year results show stable growth. Despite a slight slowdown in Q3, the fourth quarter once again demonstrated consistent and steady rise.

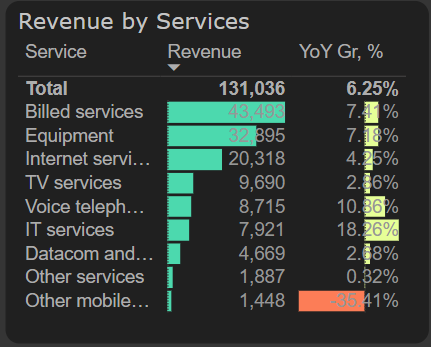

Revenue increased by 6% in Q4 compared to the same period last year. Growth was recorded in almost all service categories, with IT and voice telephony services standing out in particular. Overall annual revenue growth remained steady at 3% YoY, driven primarily by billed services – one of the company’s core business areas.

Revenue by services, 2024 Q4

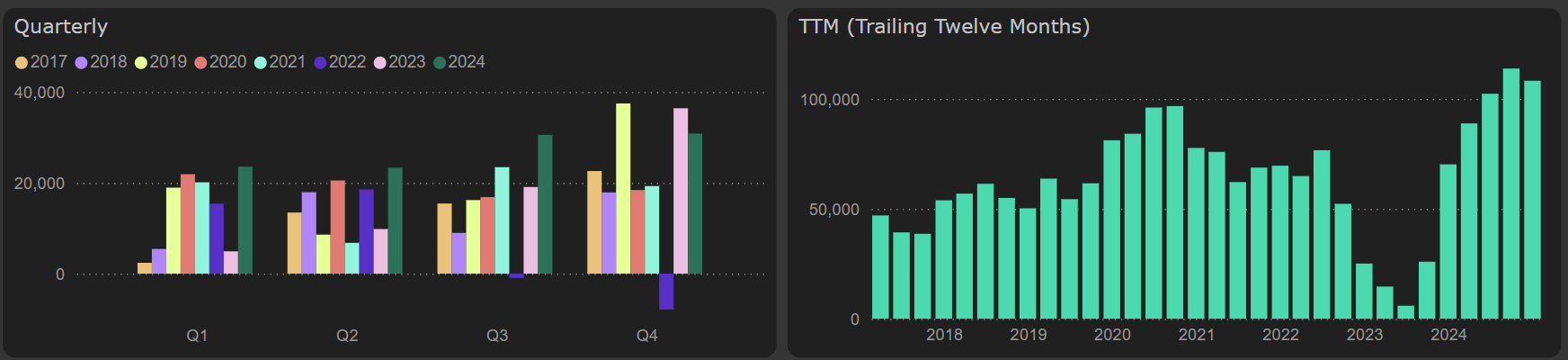

Operating profit saw a remarkable 27% YoY surge in Q4. However, this increase was largely driven by lower depreciation, making EBITDA growth more moderate at 6% YoY – closely mirroring revenue trends.

Operating profit

The cost of goods and services in Q4 increased slightly more than revenue – by 9% compared to the previous year. Despite this increase, structural personnel cost management changes allowed the company to maintain stable EBITDA margin from the previous year. Employee expenses rose by just 2% this quarter, whereas they had increased by 12% over the first nine months of 2024.

Dividend growth potential

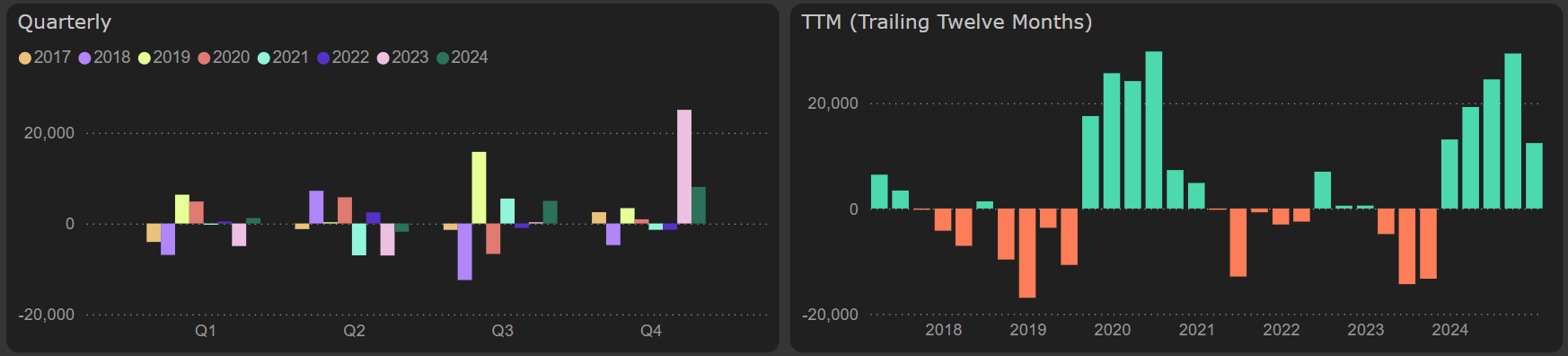

Net profit for 2024 reached €71.6 million, reflecting a solid 12.6% increase YoY. Annual free cash flow remained robust at €108 million, including lease payments. The current free cash flow and net profit, combined with a low debt level, create favorable conditions for dividend growth. Based on the 2024 dividend policy review by the board, dividends could be raised at least to the 2023 level of €58.3 million – or even higher.

Free cash flow

Q4 free cash flow was slightly weaker than in the same quarter last year, due to a significant release of working capital in the prior year. However, this quarter also saw a positive working capital inflow, with trade and other payables increasing by 22% and inventory levels decreasing by 21%.

Working capital

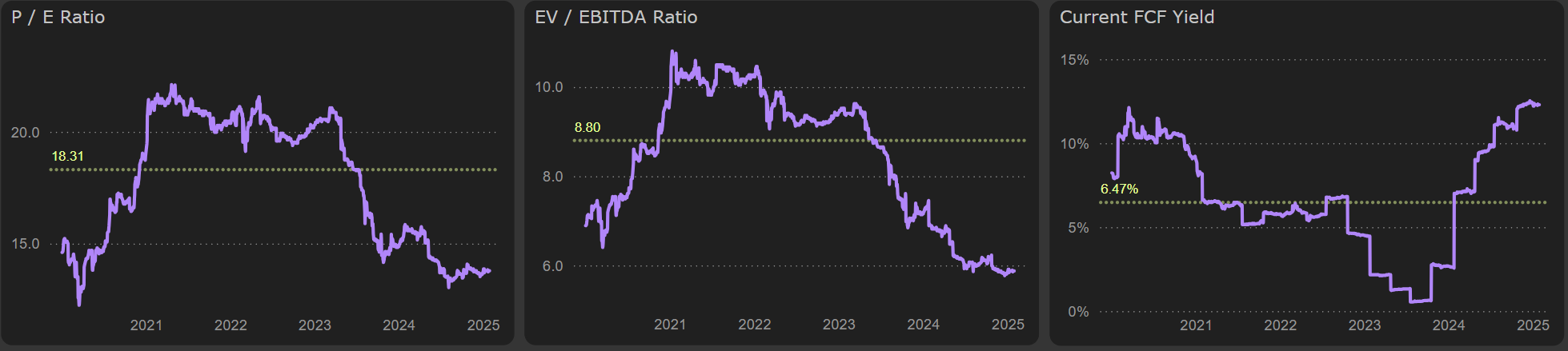

Valuation metrics, such as P/E, EV/EBITDA, and FCF Yield, are at some of the strongest levels in recent years. Coupled with consistent financial improvements and dividend growth potential, this reinforces Telia Lietuva position as an attractive investment opportunity.

Valuation metrics