Grigeo Group 2024 Q3 financial review

Gross margin under pressure

While optimism about revenue growth in the third quarter shines, it is tempered by declining profits and negative free cash flow. Despite these challenges, the company’s valuation metrics remain compelling.

Robust revenue expansion

Grigeo Group has achieved solid revenue growth over the past two quarters, with a 17% YoY increase during the third quarter.

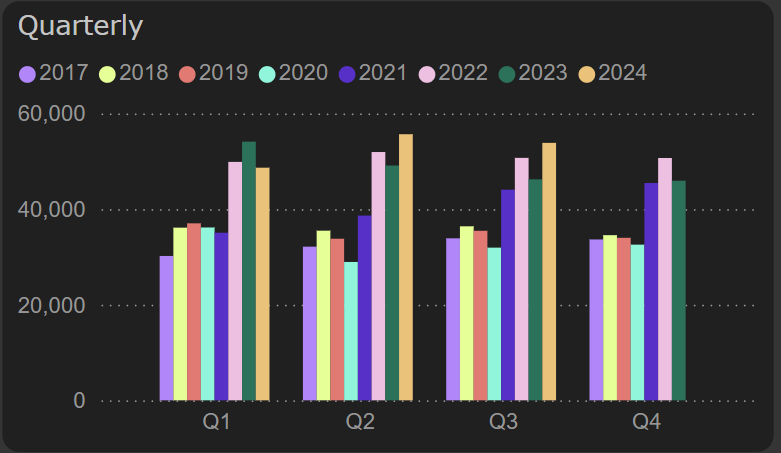

Quarterly revenue

Revenue growth was primarily driven by the core segments: paper and raw materials for corrugated cardboard.

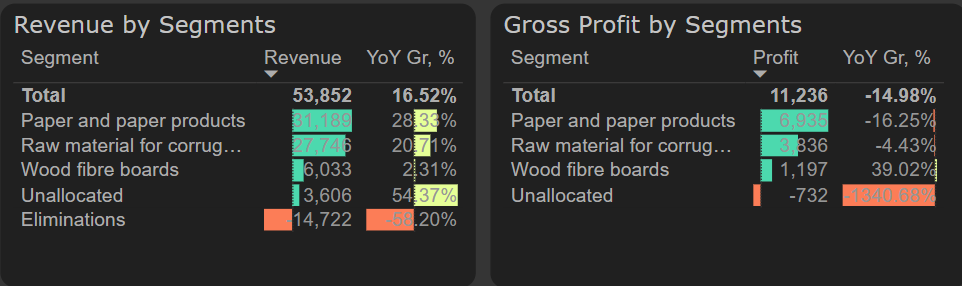

Results by segments, 2024 Q3

Nevertheless, issues in managing the cost of goods sold, particularly in the paper and paper products segment, played a significant role in the decline of gross profit.

Gross margin challenges

Operating expenses were managed efficiently in the third quarter: selling expenses increased at a much slower pace than revenue (6% YoY), while administrative expenses saw a 7% decrease compared to last year.

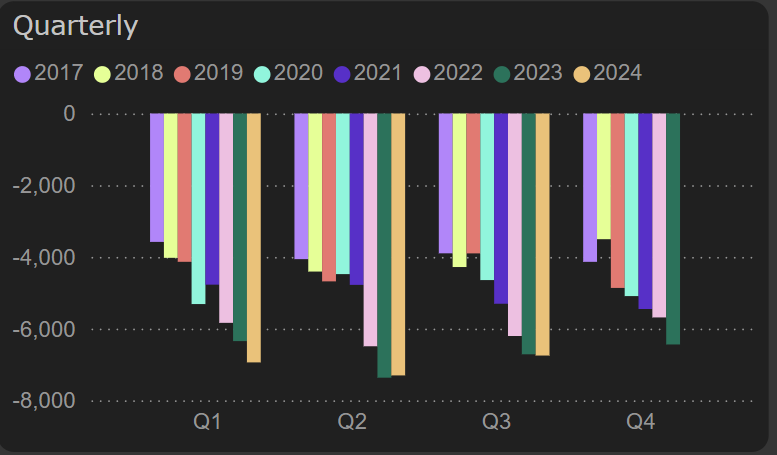

Quarterly operating expenses (selling and administrative)

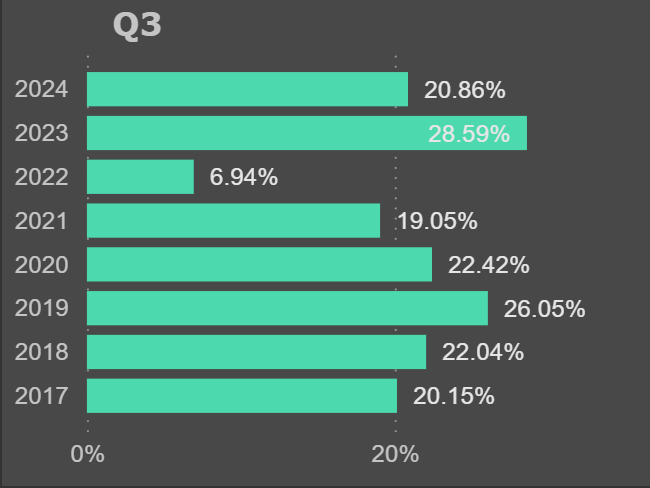

However, effective operating cost management was overshadowed by a notable decline in gross margin. Grigeo Group's gross margin contracted to 20.9% in the third quarter, marking a significant drop from 28.6% in Q3 2023.

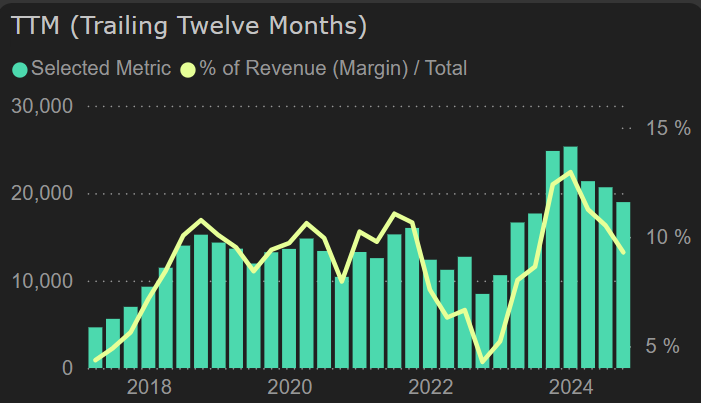

Gross margin

The decline in gross margin was the primary factor behind the €1.7 million drop in net profit for the third quarter, which fell from €5.8 million in 2023 Q3 to €4.1 million in 2024 Q3.

Trailing twelve months of net profit

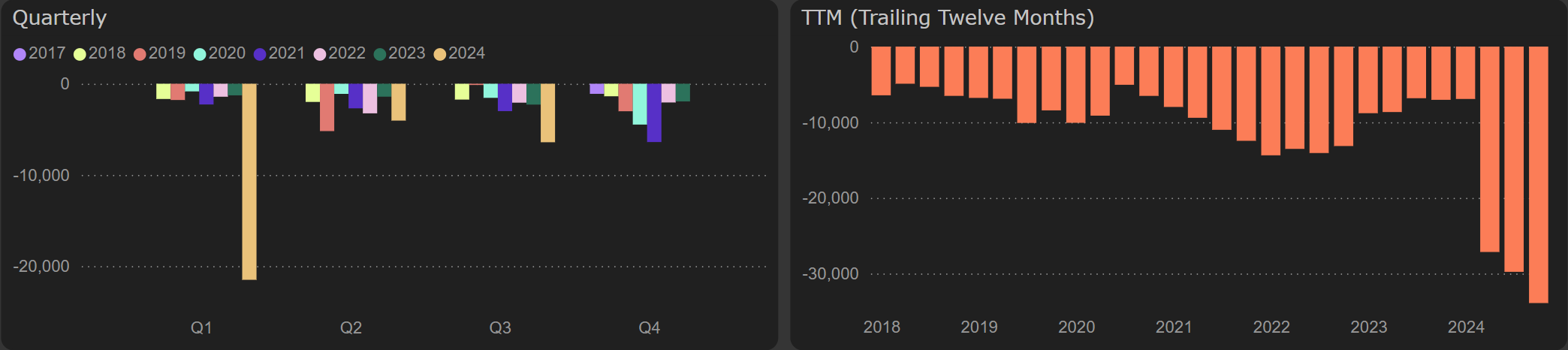

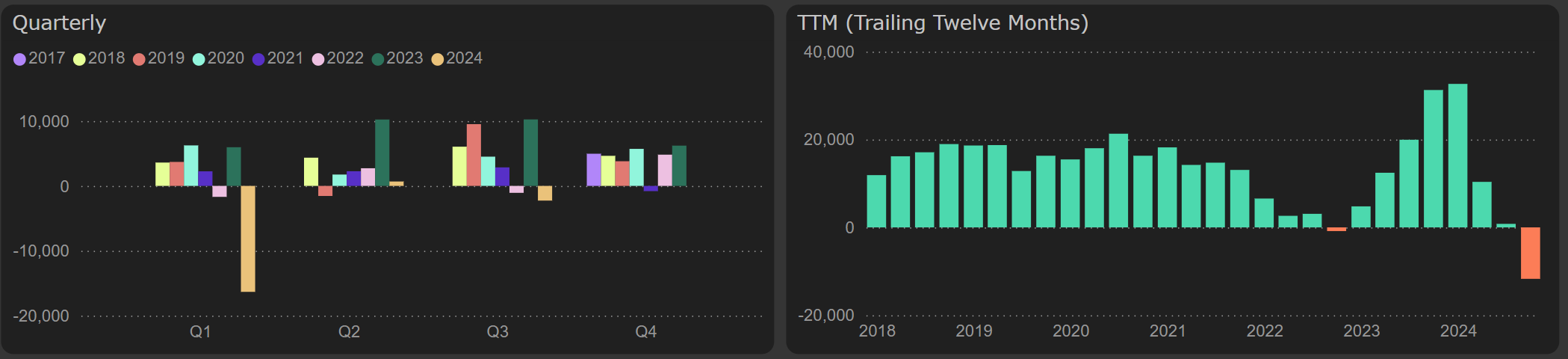

Free cash flow drops into negative territory

Grigeo Group continues to make substantial investments in fixed assets. In the third quarter, investments totaled €6.4 million, above depreciation recovery level (~€2-3 million). Over the past 12 months, the company invested €15.3 million in fixed assets and an additional €18.6 million for an acquisition in Poland (total CapEx amounted to ~€34 million).

Capital expenditures

Substantially increased CapEx, along with rising working capital, have been the primary drivers behind the shift to negative free cash flow. However, once CapEx return to more typical levels (~€10 million) and working capital stabilizes, free cash flow is expected to revert to its usual positive territory.

Free cash flow

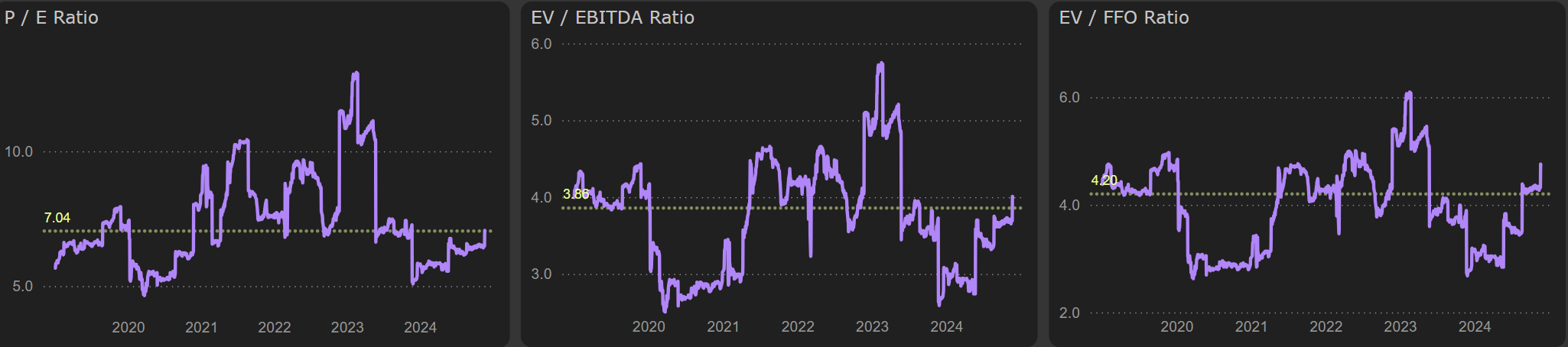

Valuation metrics remain attractive

Grigeo Group's weaker performance this year has impacted valuation multiples. Following the third quarter financial results, these indicators have shown a slight increase: EV/EBITDA ~3.99x, P/E ~7.03x, but remain at relatively attractive levels. On the PLY platform, Grigeo Group holds a strong Value Score of 8.55, ranking among the highest in the Baltic market.

Valuation multiples