Infortar 2025 Q1 financial review

Tallink Grupp pushed Infortar’s bottom line into the red

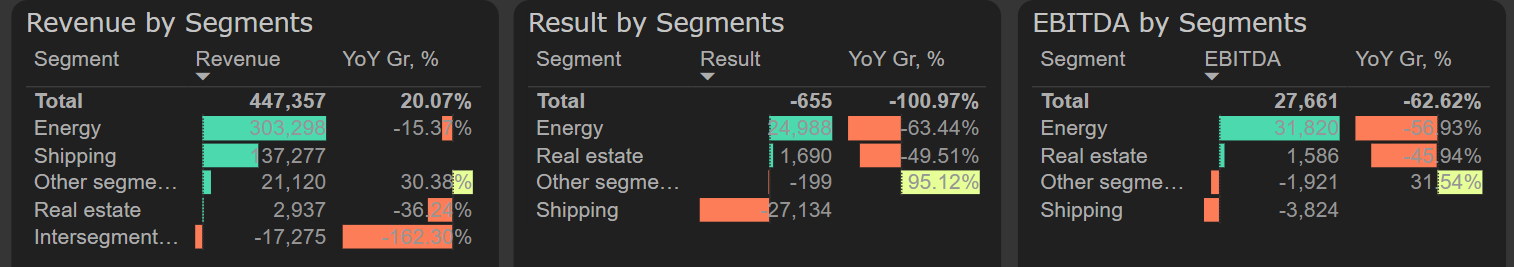

Infortar's performance in Q1 2025 remains weak. While one of the main segments managed to generate a positive profit, another offset this gain with a negative result, typical for the quarter.

Energy segment: In Q1 2025, Infortar's energy segment delivered stronger results compared to the last three, particularly weak, quarters of 2024. However, operating profit in this segment was still nearly three times lower than in Q1 2024, amounting to €25M — mainly due to a drop in margin, from 19% in Q1 2024 to 8% in Q1 2025.

Shipping segment: Tallink Grupp posted a €27M operating loss during this quarter, which was the main factor pulling Infortar’s overall results into negative territory.

Results by segments, 2025 Q1

As a result, Infortar reported a net loss of €14.6M in Q1 2025. However, it's worth highlighting that the majority of this loss is linked to Tallink Grupp's minority interest, meaning the net loss attributable to Infortar shareholders was a more modest €4.5M.

The company’s annual funds from operations (FFO) declined significantly — to just €4M. As a result, combined with intensive investments in acquisitions and fixed assets (€165M), the trailing twelve-month free cash flow turned negative, despite a positive figure in Q1 2025.

Free cash flow

Infortar’s EV/EBITDA remains relatively high. Tallink Grupp's annual EBITDA is €137M, while other segments contribute €48M, resulting in an EV/EBITDA of 11.4x, compared to 7.5x for Tallink Grupp alone.

Given Tallink Grupp’s typically stronger performance in Q2 and Q3 due to seasonality, any upswing in its results could positively affect Infortar’s overall performance.