Tallinna Kaubamaja Group (TKM1T) | 2023 Q3

New highs for earnings, but probably not the dividends

Another strong quarter for Tallinna Kaubamaja Group. New records for sales revenue, continuing recovery in margins and heading for a record high earnings in FY 2023. However, there are some clouds on the horizon.

Strong sales, but growth is slowing

2023 Q3 sales revenue grew across all segments, however the growth is slowing down (except of Security segment, which is still very small in absolute terms).

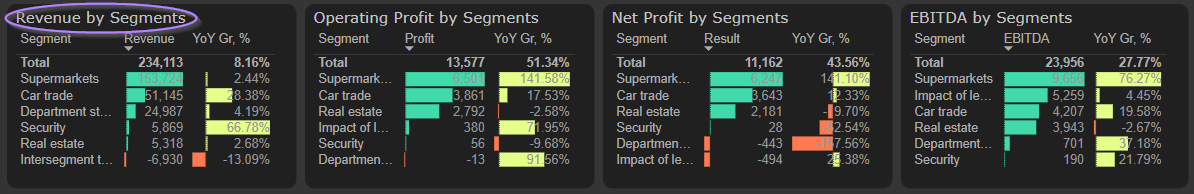

Sales revenue and YoY growth in 2023 Q3:

Sales revenue and YoY growth in 9 months of 2023:

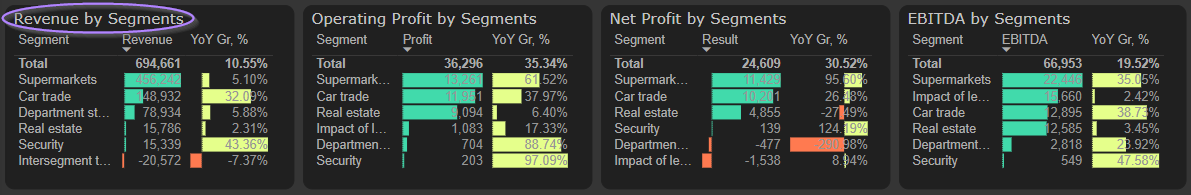

Main contributor to the revenue and, especially, operating profit growth is Car trade segment:

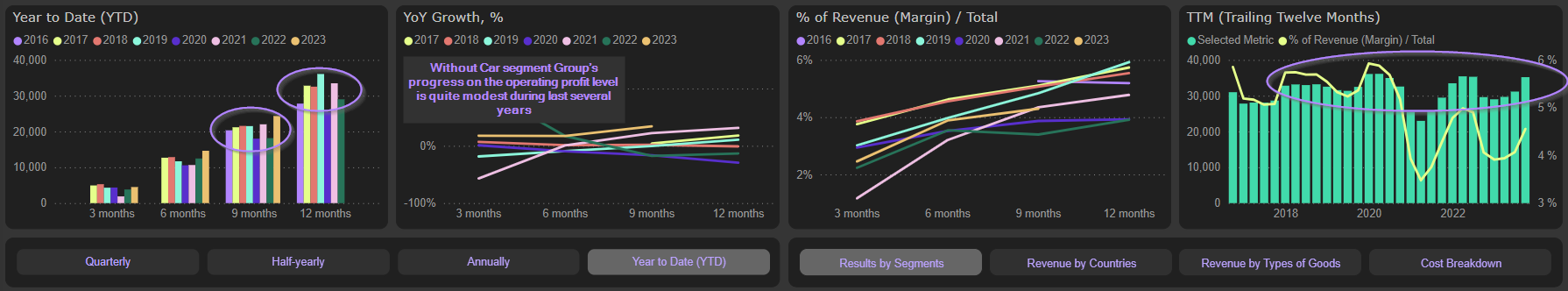

It’s quite interesting, that without Car segment Group’s progress on the operating profit level is quite modest during last several years:

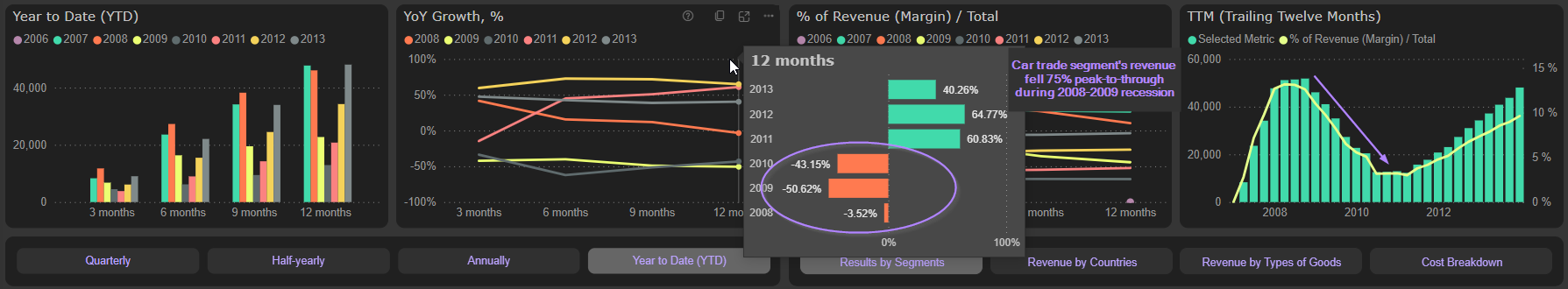

Moreover, don’t forget that Car trade segment is highly cyclical. Every day brings more and more evidences, that we are rather in the late cycle environment. Whether we will have soft or hard landing, it’s another question. However, any “landing” will be not very pretty for the cyclical sectors. Just for reminder, let’s look at Group’s Car trade segment’s revenue during 2008-2009 recession:

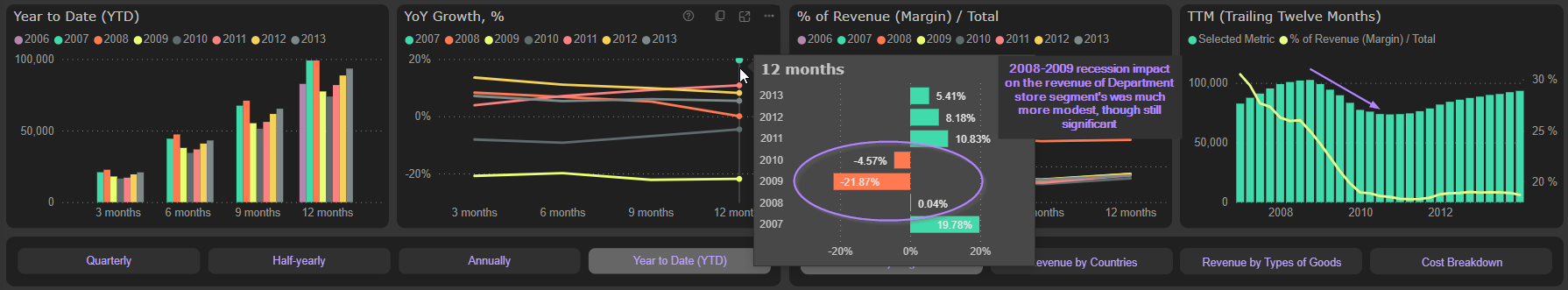

Compare that to Department store segment:

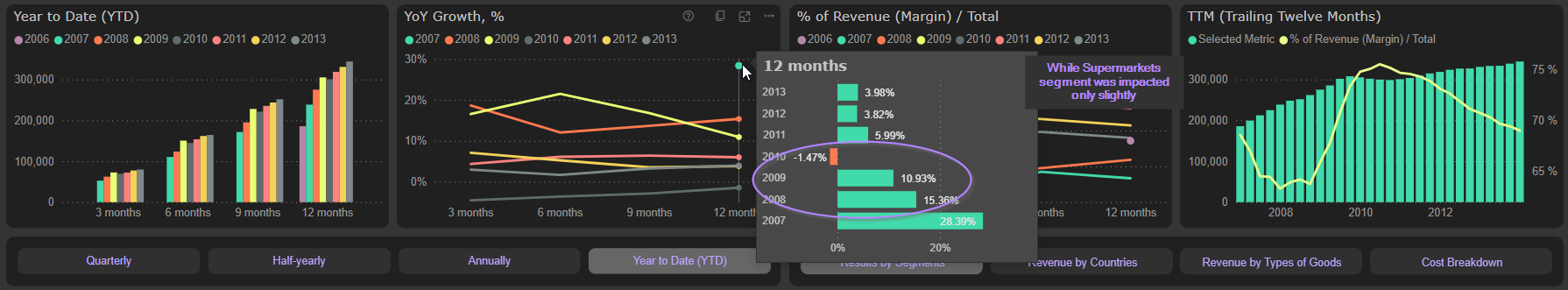

and Supermarkets segment:

With Car trade segment’s continuously growing weight in total revenue structure (from just 8% ten years ago to 20% currently), Tallinna Kaubamaja Group is becoming more and more pro-cyclical. Contribution to the operating profit is even higher. This year Car trade segment accounts for 33% of total operating profit. Just three years ago it was only 9%.

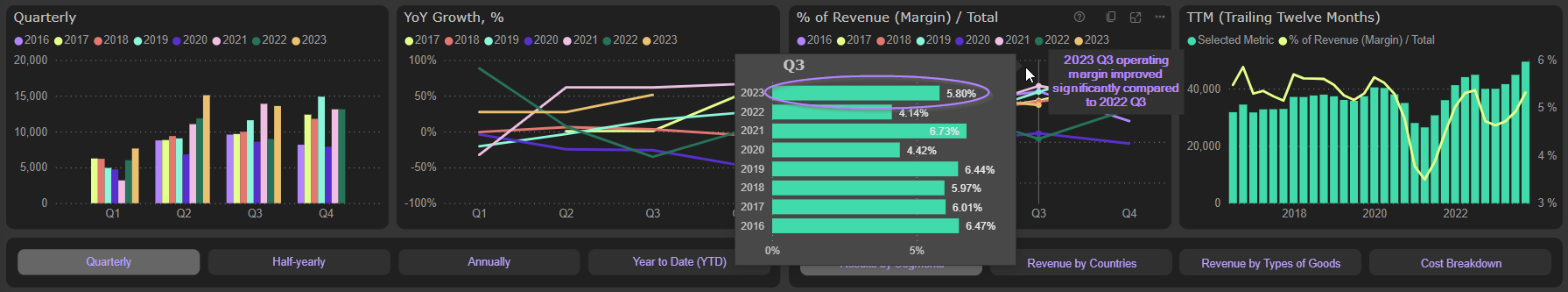

Recovery in margins continues

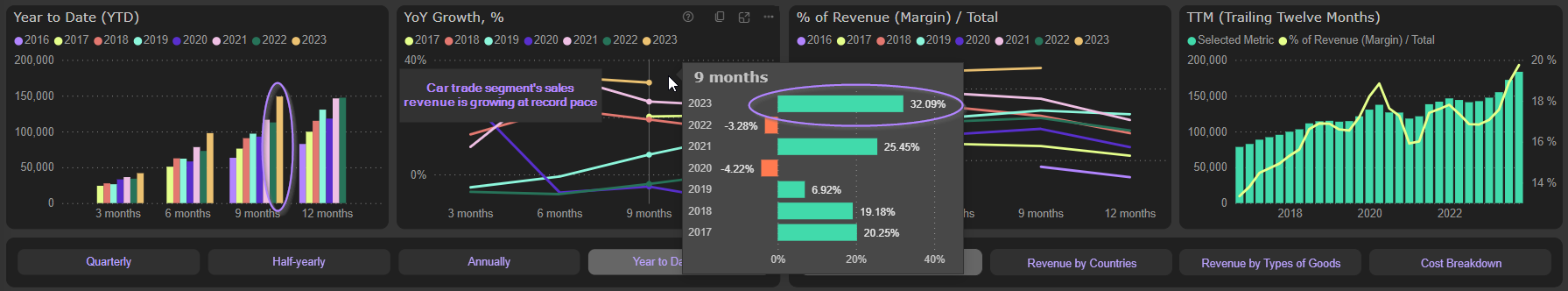

Operating margin is continuing to improve, mostly due to lower services expenses (dominated by electricity and heat costs). 2023 Q3 operating margin was 5,8%, significantly higher compared to 2022 Q2 (4,14%), however slightly lower compared to very strong 2023 Q2 (6,22%):

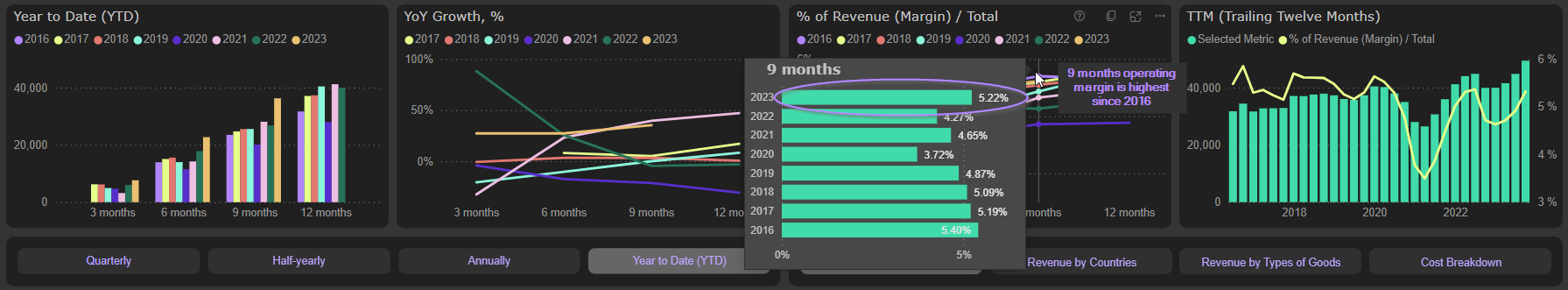

9 months operating margin reached 5,22% - highest level since 2016:

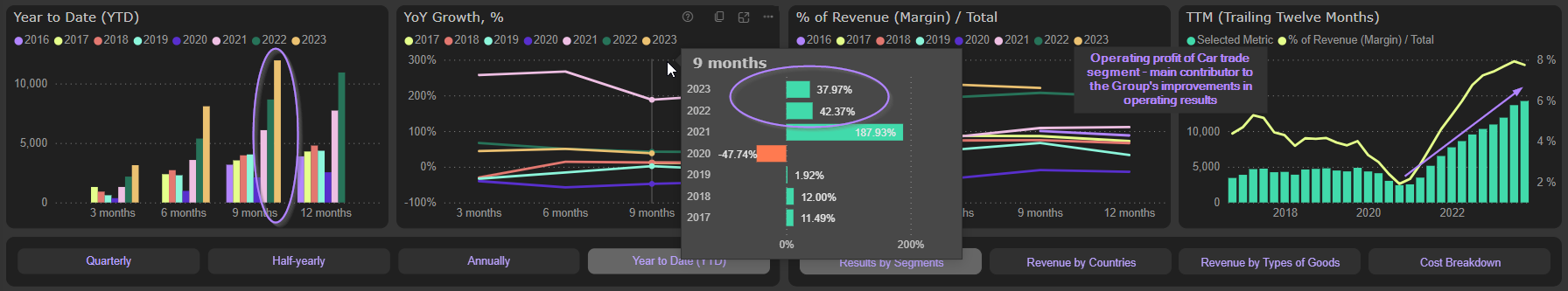

2023 Q3 net income reached 11,2M Eur, 44% higher compared to 2022 Q3. However, keep in mind, that 2022 Q3 was strongly affected by huge energy costs.

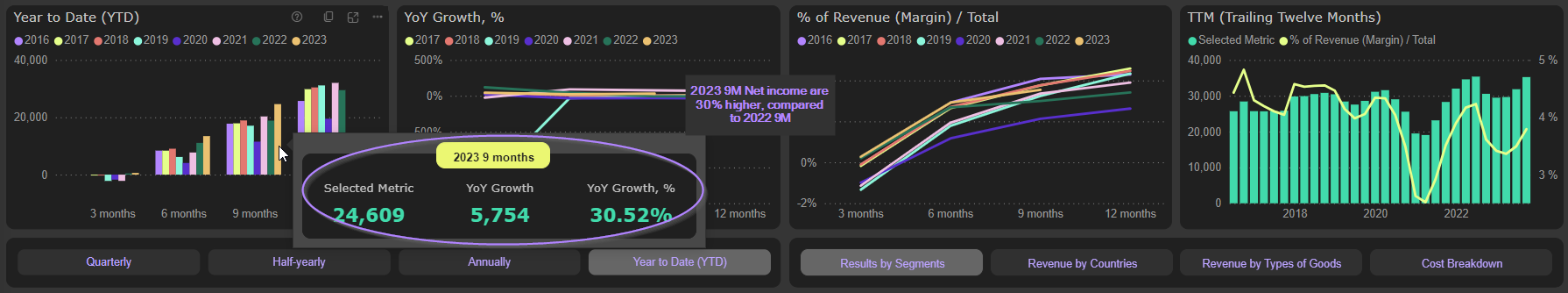

Net income for 9 months reached 24,6M Eur, 30,5% higer compared to 2022:

Company is heading confidently to its best year ever with our expectations for the FY 2023 net income around 36M Eur.

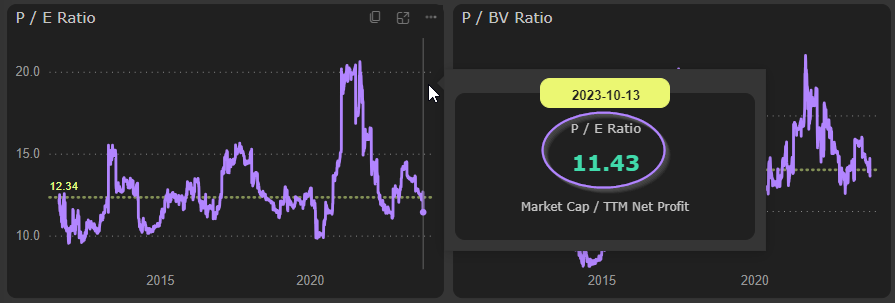

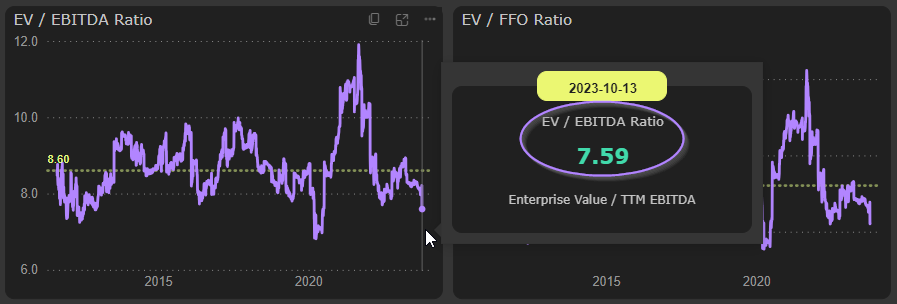

Attractive valuation

Due to continuously improving operating results and relatively stable share price, Group’s valuation multiples are moving gradually toward the bottom of their historical ranges:

However, let’s keep in mind the growing cyclicality of Group’s business. The more cyclical is the company, the more attractive valuation multiples are at the top of the cycle.

Dividends

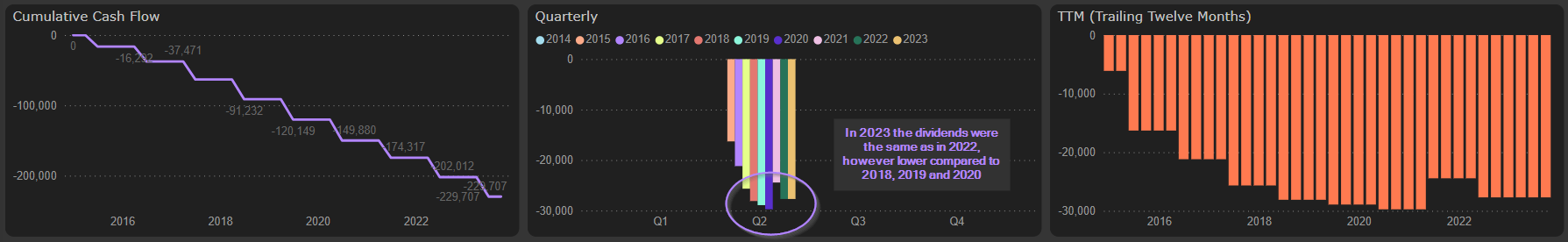

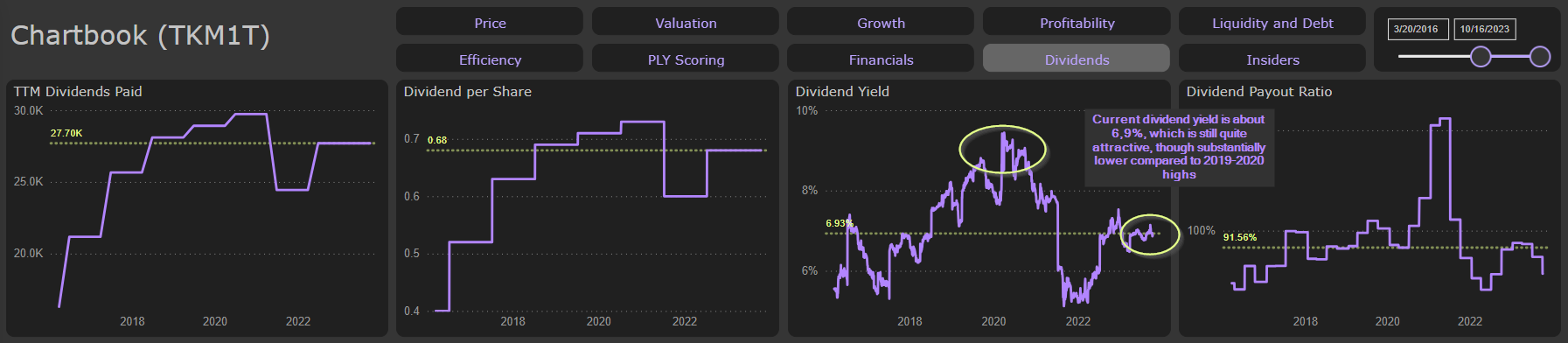

Group’s record high earnings, however, doesn’t necessarily imply future new highs in paid dividends.

In 2023 Tallinna Kaubamaja paid 27,7M eur of dividends, the same amount as in 2022. That was, however, still less than in 2018, 2019 and especially 2020:

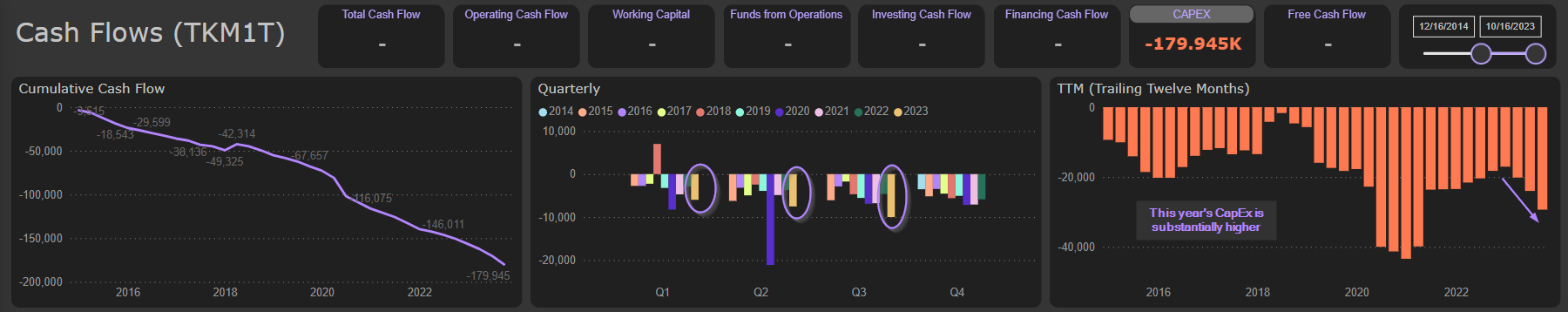

Main constrain to dividend increase next year could be weaker free cash flow, affected by higher CapEx and increase in working capital.

This year’s CapEx is substantially higher, compared to last year, driven by higher stores’ renovation costs and acquisitions in Security segment:

Moreover, in August the Group announced the plans to build a new logistics center with total cost of ~20M Eur. That will substantially increase this and next year’s CapEx and put additional pressure on free cash flow, which already is suffering from increase in working capital and higher CapEx:

However, if current dividend level will be remained in 2024 (likely scenario), Group’s shares still offer quite attractive dividend yield (about 6,9%), though substantially lower compared to 2019-2020 highs: