Akola Group 2024 Q3 financial review

Challenges in the core business segment

The first quarter of Akola Group’s 2024/2025 financial year has had a slower start compared to the previous year, with revenue declining alongside a decrease in sales volumes. Profits, however, saw a more significant drop, falling even more sharply than the reduction in revenue.

Contrasting fortunes: partners for farmers struggle while food production thrives

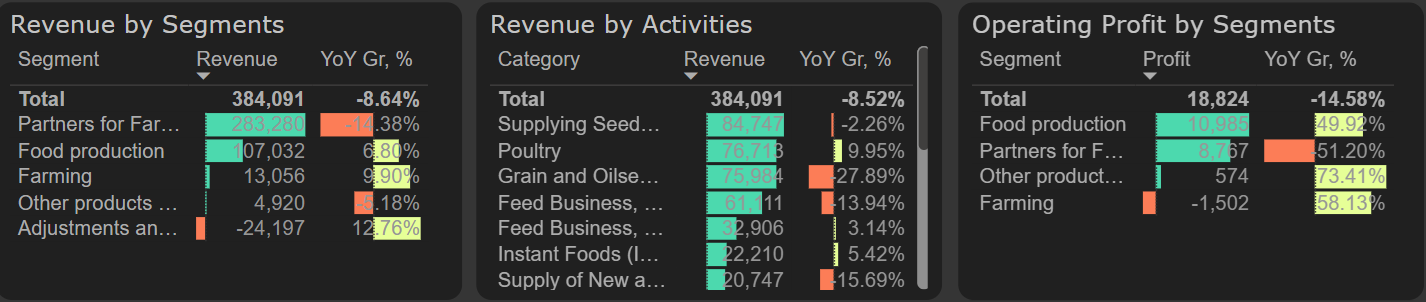

Revenue experienced a 9% YoY decline, mainly influenced by challenges in the partners for farmers segment. This segment saw a significant negative impact from a €29 million (28% YoY) drop in revenue from grains and oilseeds. The decline was driven by a 13% YoY reduction in grains and oilseeds sales volume and lower wheat prices compared to the previous year.

Results by segments, 2024/2025 Q1 (2024 Q3)

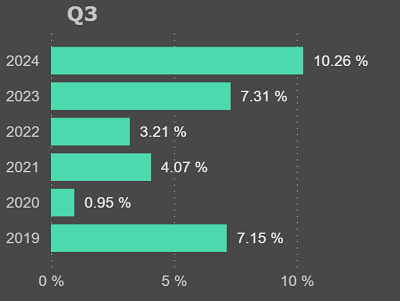

On the brighter side, the food production segment was a standout performer. This segment outperformed the company's main partners for farmers segment in operating profit, earning €11 million compared to €9 million, despite the latter generating approximately 74% of the total revenue. Notably, the food production segment achieved one of its historically highest operating profitability levels at 10% in third quarter. The segment’s success was driven by a combination of robust revenue growth and significant profitability improvements.

Operating profitability of food production segment, Q1 according to the company's financial year

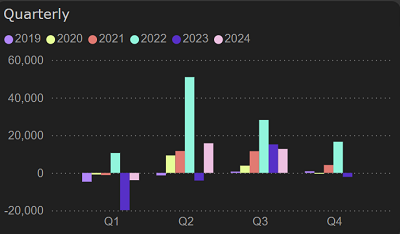

Net profit for the first quarter of FY 2024/2025 stands at €12.7 million, reflecting a 16% decline compared to the previous year. After accounting for adjustments made for the prior year, the decrease is even more significant, reaching 27%. Despite the gross margin holding steady, rising selling and stable administrative costs, alongside lower revenues, have impacted profitability. As a result, the operating profit margin deteriorated, with the decline in operating profit outpacing the decrease in revenue.

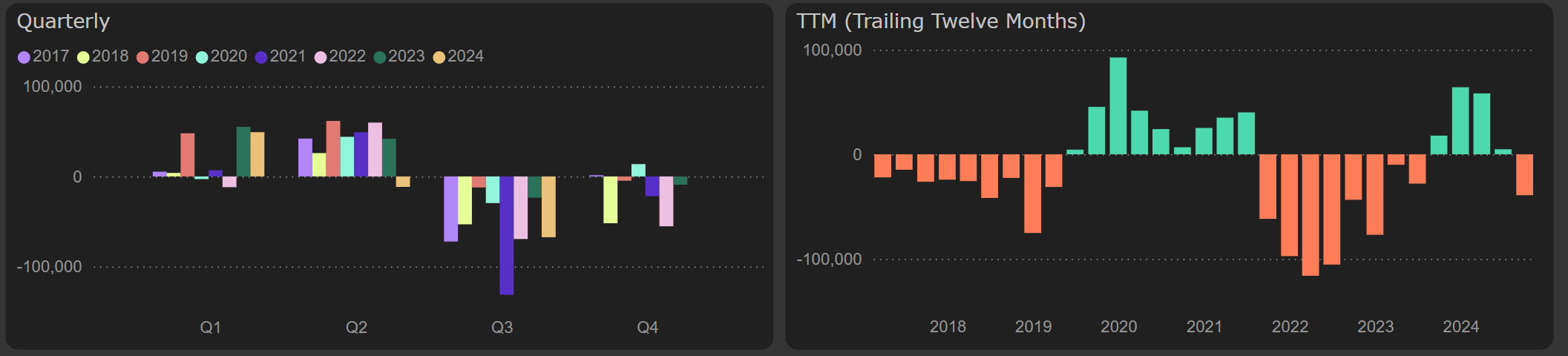

Quarterly net profit

Looking ahead, it’s unlikely that the Akola Group will see exceptional results in the next two quarters, as this period historically tends to produce weaker performance.

Negative free cash flow and unimpressive valuation

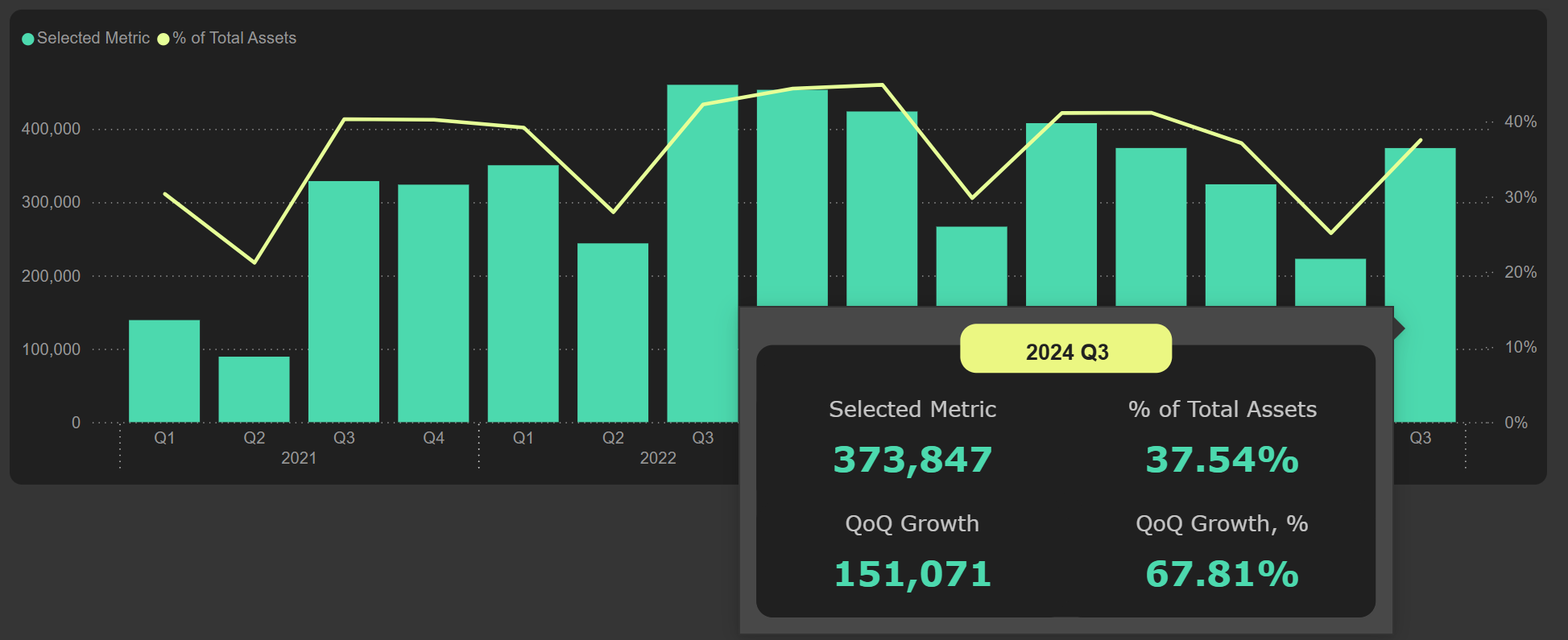

As is customary for this quarter, the company did not generate free cash flow, primarily due to seasonal inventory growth.

Inventories

The trailing 12-month free cash flow remains negative (due to increased CapEx), raising some concerns about dividend sustainability, especially in the context of increasing debt level.

Free cash flow

Overall, valuation multiples seems not very appealing: EV/EBITDA ~8.1 and P/E ~8.8 – particularly in the context of still struggling core business segment.