Artea Bank 2025 Q2 financial review

Struggles reflect wider sector challenges

The second quarter of 2025 was even weaker for Artea Bank than the first.

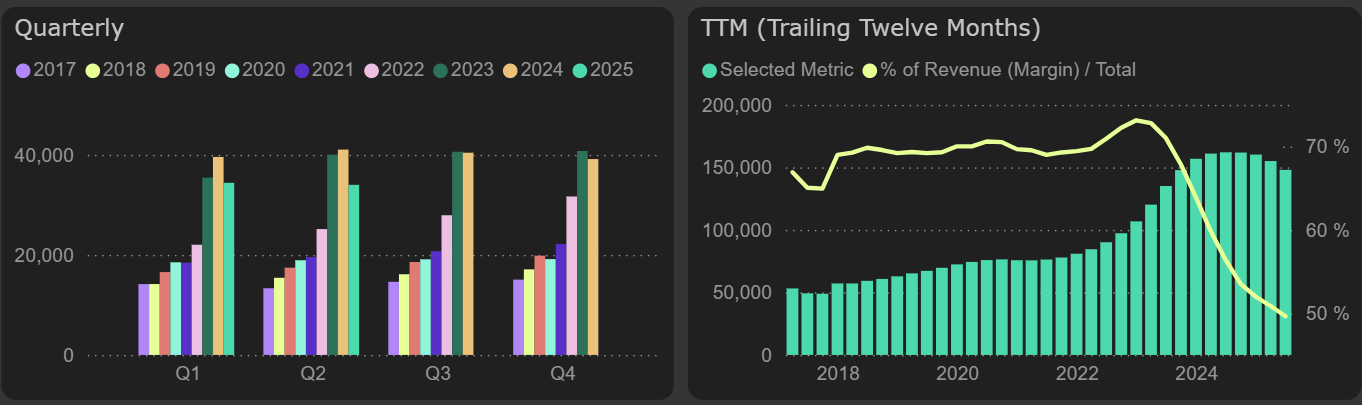

The loan portfolio grew faster during the second quarter compared to the previous two quarters (Q4 2024 and Q1 2025) — by 4.6%. However, interest income remained the same as in the first quarter of this year, resulting in an 11% decline compared to the second quarter of 2024.

At the same time, interest expenses remained at a similar level as a year ago, which further pressured profitability. As a result, net interest income fell by 17% YoY in the second quarter. A similar rate of decline (18%) was reported in the recently published results of LHV Group.

Net interest income

Managing personnel and other operating expenses remained challenging. Over the year, the number of employees increased by 7%, and related costs in the second quarter rose by 15% compared to the same period last year. A sharp increase in IT, communication, and marketing expenses drove a 16% growth in other operating costs.

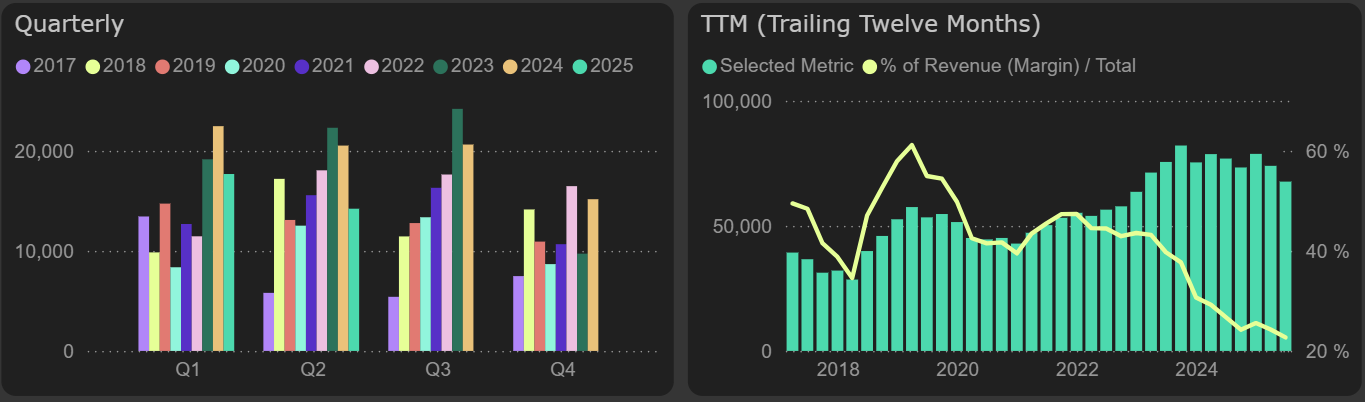

These expenses, together with the decreased net interest income, contributed to the decline in net profit — which amounted to over €6M in the second quarter, or a 31% decrease compared to the same period last year.

Net profit

Artea Banks's valuation metrics remain broadly unchanged compared to Estonian peers. Coop Pank maintains lower P/E and similar P/BV with higher ROE, while LHV Group trades at a premium justified by significantly stronger ROE.