Grigeo Group 2025 Q1 financial review

Top line moves up – bottom line not in a hurry

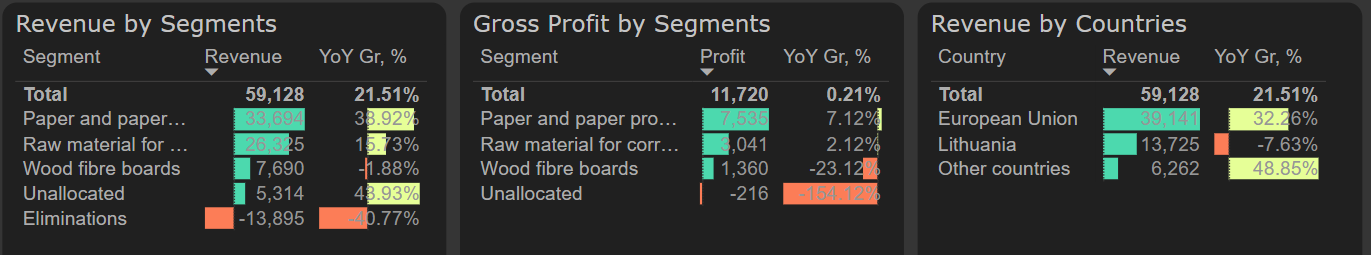

Grigeo Group's sales increased by 21.5% in Q1 2025, compared to the same period last year. Following the acquisition of a factory in Poland, sales in the paper segment continued to grow rapidly – rising by 39% YoY in the first quarter. The raw materials for corrugated cardboard segment also contributed to the overall revenue growth, with its sales increasing by 16% YoY.

Results by segments, 2025 Q1

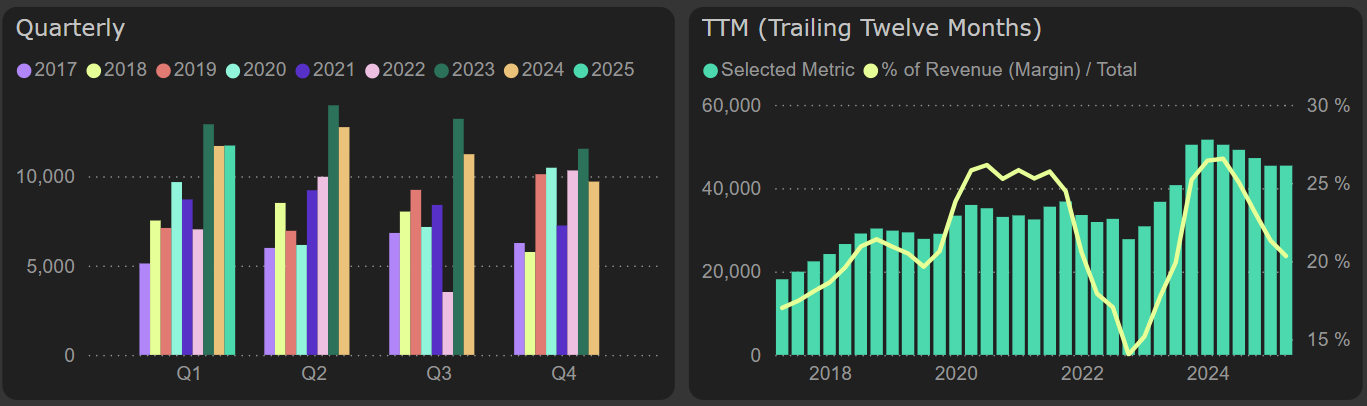

Despite strong revenue growth, profit trends were more moderate – gross profit remained at a similar level as last year, while operating profit decreased by 9%. Although operating expenses were managed quite efficiently – particularly administrative costs, which even declined by 9% – this was not enough to offset the drop in gross margin. The gross margin decline, which became more pronounced in the second half of last year, has continued: from 24% in Q1 2024, it fell to 20% in Q1 2025. Profitability has decreased across all segments.

Gross profit

In the first quarter of 2025, due to a lower income tax, net profit increased by 6%, maintaining an annual level of €21M. The company's return on equity (ROE) remains relatively high at 17%.

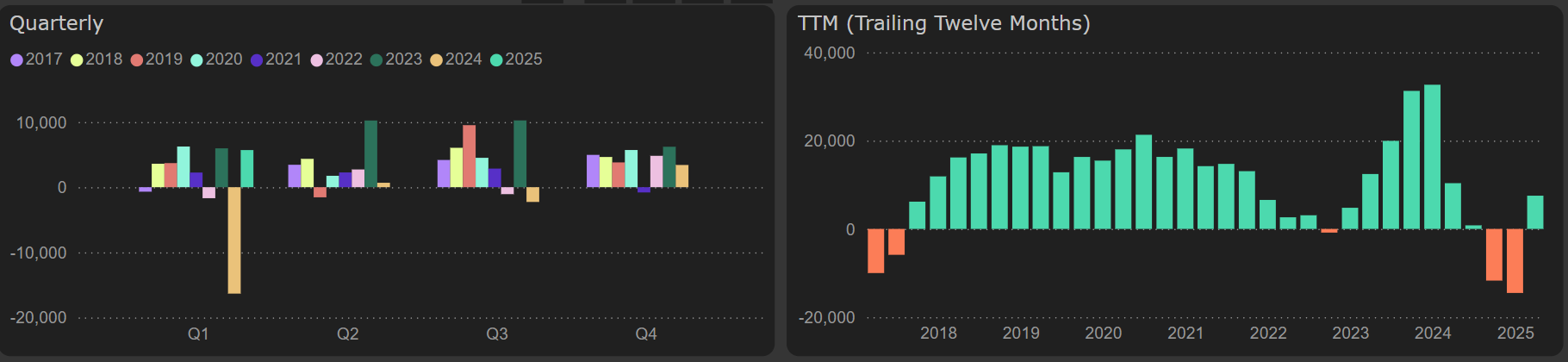

Last year’s negative annual free cash flow – due to the acquisition – turned positive following the results of the first quarter of 2025. Although investments in non-current assets have increased, €4M was released from working capital during the quarter, enabling the generation of €5.7M in free cash flow.

Free cash flow

The current annual level of investment in non-current assets has increased to €22M, while annual depreciation amounts to only around €12M. As a result, the free cash flow yield has decreased to just 5%. However, when adjusting for the cyclical nature of investments and calculating a 3-year average, the operating free cash flow yield stands at around 12%, which is an attractive level.

Valuation metrics – P/E (~6.8x) and EV/EBITDA (3.7x) – also appear favorable both in the company’s historical context and within the broader Baltic market.