Šiaulių bankas 2025 Q1 financial review

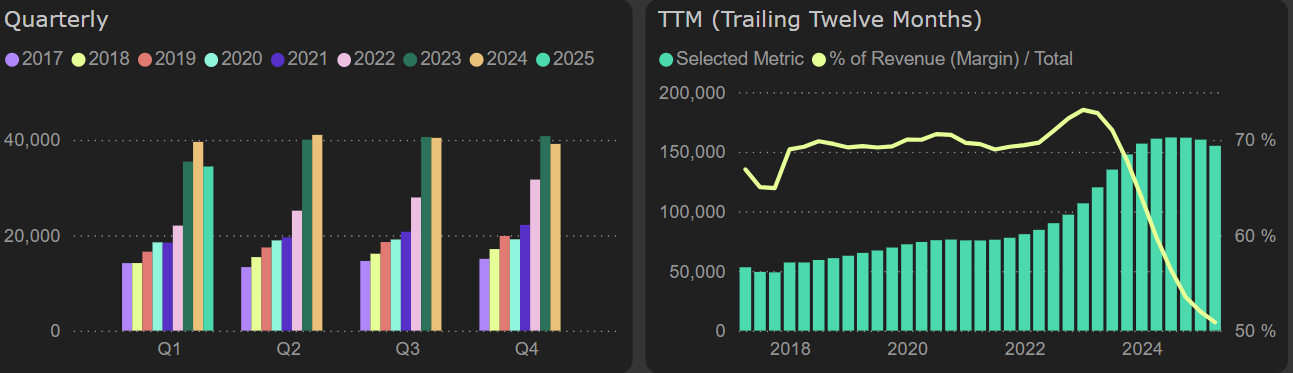

Shifting trajectory of interest income

In the first quarter of 2025, a shifting trajectory in Šiaulių bankas interest income is observed – a decline is recorded compared to both Q1 2024 (-7%) and Q4 2024 (-8%). While in 2024 the bank still managed to grow its interest income due to a faster-expanding loan portfolio despite the declining EURIBOR, the loan growth in Q1 2025 was more modest – just 2% compared to the end of the previous year. A similar trend is evident in LHV Group Q1 2025 results, while changes at Coop Pank became apparent earlier – already in Q4 2024, due to a more moderate loan growth last year.

Šiaulių bankas net interest income fell by €5M (13%) in Q1 2025 compared to the same period last year, driven by declining income and rising interest expenses (+2.6% YoY) – reflecting narrowing margins (56.4% vs. 60.5% in Q1 2024).

Net interest income

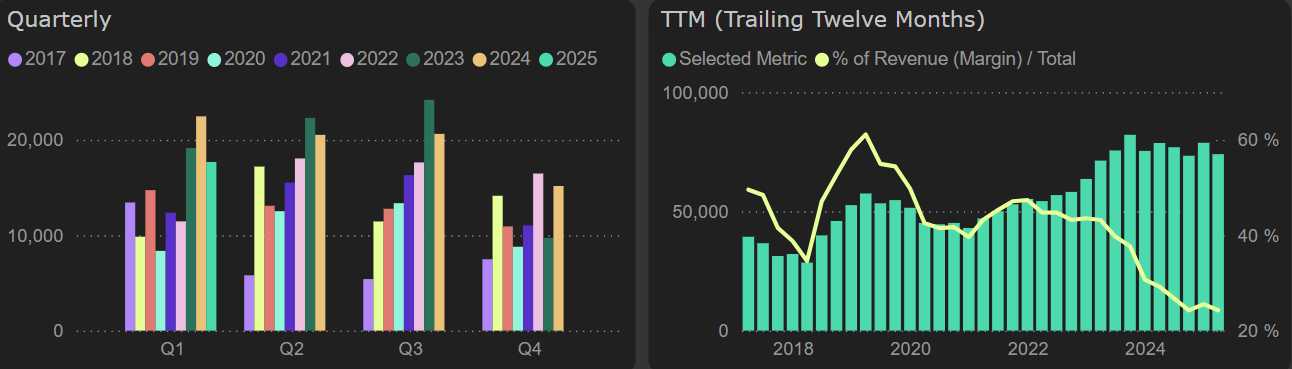

The growth in operating expenses continues to pressure the company’s results. Employee costs increased by 24% YoY, although the number of employees grew more slowly – by 9% YoY. Other operating expenses were 31% higher compared to the same period last year. On the other hand, positive contributions to Q1 2025 results came from the growth in net fee and commission income (+€1M) and gain from the derecognition of financial assets (+€3.8M), which could be considered as one-off factors.

Net profit for this quarter was €4.8M lower (similar to net interest income), representing a 21% decrease compared to Q1 2024. The annual net profit amounts to €74M.

Net profit

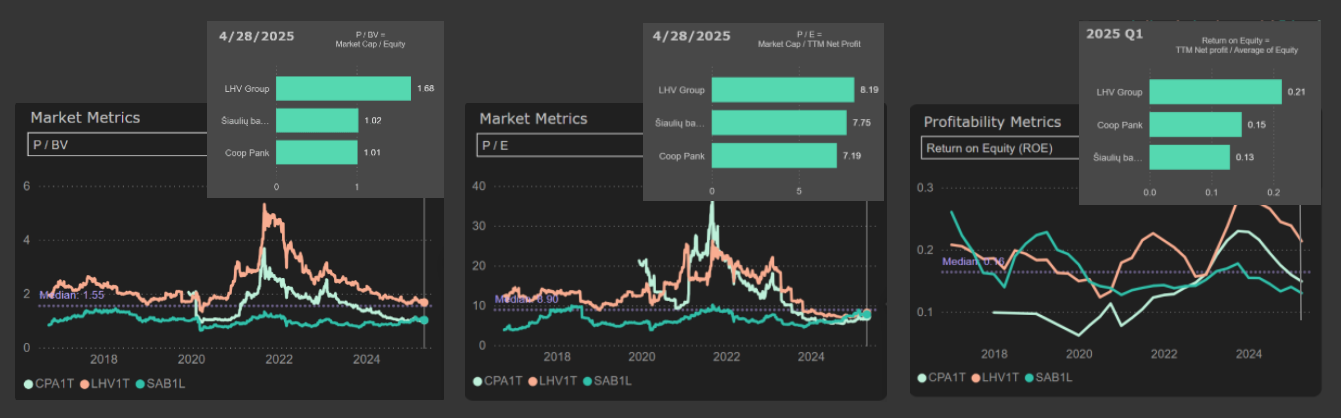

Compared to Estonian banks, Šiaulių bankas still does not stand out as exceptionally attractive. Coop Pank shows slightly lower valuation metrics (P/E, P/BV) and higher ROE. LHV Group continues to have a clear advantage over Šiaulių bankas in terms of ROE, which justifies its trading premium.

Comparision with other banks