Telia Lietuva 2025 Q3 financial review

No slowing down

Telia Lietuva entered the second half of 2025 as successfully as it started the year.

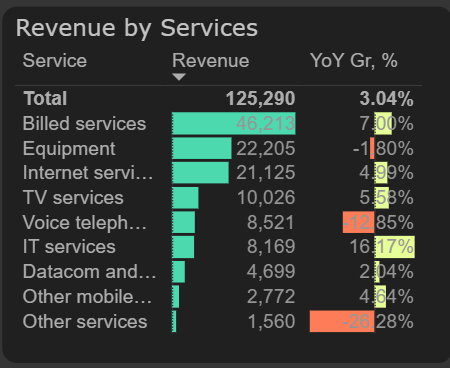

Telia Lietuva's revenue reached €125.3M in Q3, reflecting a 3% increase compared to the previous year. The main sources of revenue growth remained the same as throughout this year. Compared to Q3 of the previous year, revenue from mobile services increased by €3M (+7% YoY), while revenue from IT services (+16% YoY) and internet services (+5% YoY) grew by €1M each.

Revenue by services, 2025 Q3

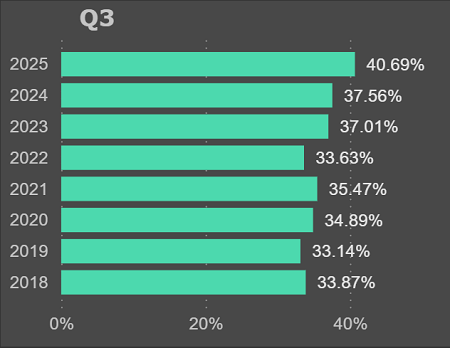

Profitability remained at their highest level – the third quarter EBITDA margin was 40.7%, similar to the overall margin for this year. In the context of growing revenues, third quarter employee costs remained quite stable, while the cost of goods and services together with other operating expenses were €2M lower than last year (-3.3% YoY). For these reasons, third quarter EBITDA was 12% higher than a year ago, outpacing revenue growth.

Q3 EBITDA margin

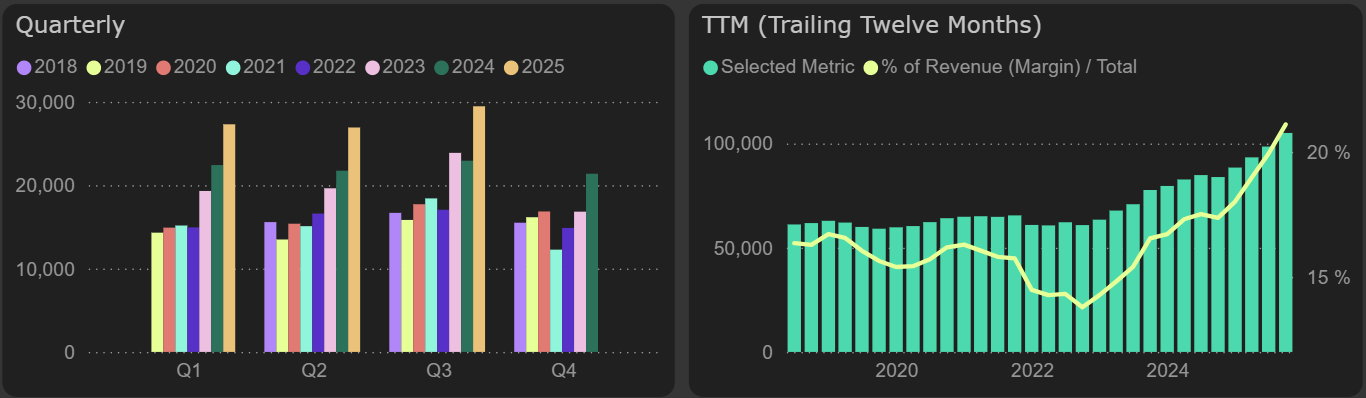

An even more intense growth is evident at the operating profit level due to lower depreciation – this quarter, it was 28.5% higher than in Q3 2024. The 9 month operating profit rose by 24.8%, reaching €83.7M.

Operating profit

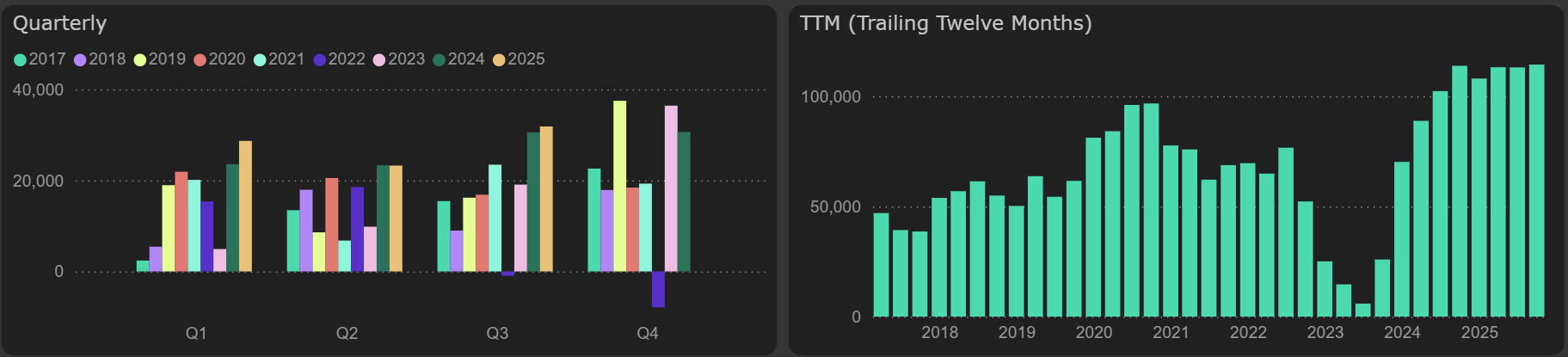

Conditions were favorable for cash flows in the third quarter. Funds from operations increased, there was no additional need for working capital and CAPEX remained below depreciation levels. As a result, free cash flow stands solid at €114.4M over the last 12 months.

Free cash flow