Vilniaus baldai 2024 Q3 financial review

A small step back, but results stay solid

The first quarter of the 2024/2025 financial year (2024 Q3) demonstrated slightly weaker results compared to the previous year. However, the company maintains a strong position, close to one of its highest historical levels, with an annual net profit of €9.3 million.

Progress fueled by margins has reached a standstill

During the first quarter of the 2024/2025 financial year (2024 Q3), the company’s net profit decreased by 16% to €3.5 million, compared to €4.2 million in the previous year (2023/2024 Q1, or 2023 Q3). The key factors driving this change were a decline in revenue and rising costs during the same period.

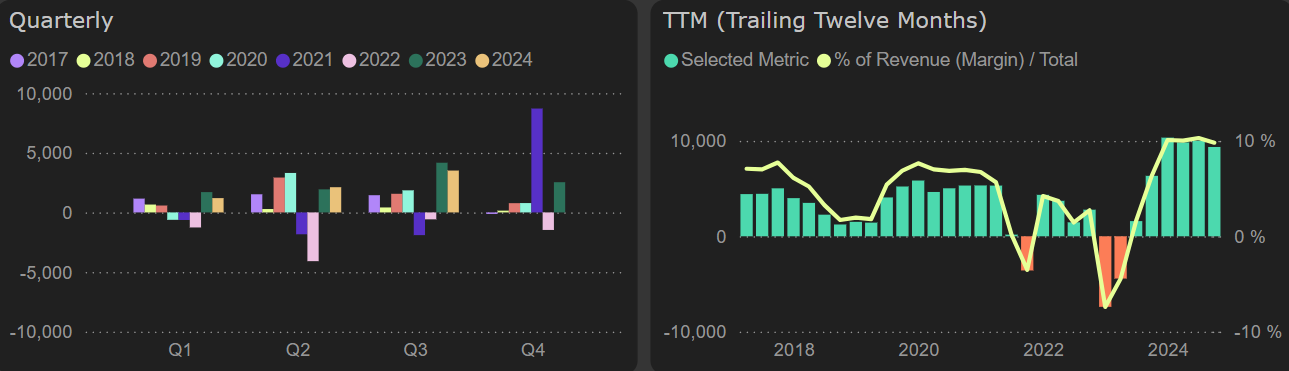

Net profit

Last year’s growth was largely fueled by a significant expansion in gross margins. As profit margins have reached their peak, future growth will depend more on revenue dynamics.

In Q1 of the 2024/2025 financial year (2024 Q3), revenue decreased by 6% compared to the same period last year. However, there’s a positive takeaway: the company maintained a record-high gross margin of 20.9%, ensuring that the drop in gross profit remained in line with the decline in revenue. Unfortunately, additional pressure on profitability arose from the growth in administrative and financial expenses, amplifying the negative impact of the revenue decline on net profit.

Gross margin

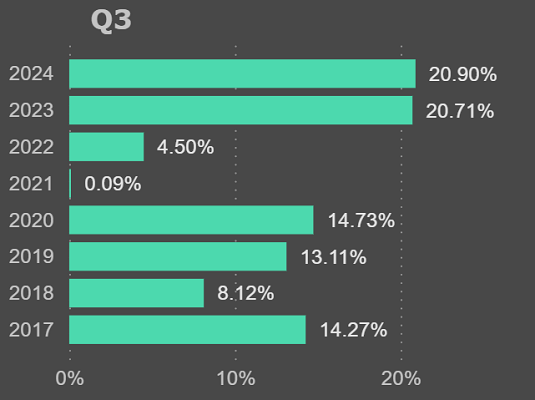

Free cash flow strengthened during the first quarter of the 2024/2025 financial year, due to a reduced need for working capital compared to the corresponding period of the previous year. Annual free cash flow reached €9.9 million, marking the best result in the company’s history, with the yield surging to an impressive 24%.

Free cash flow

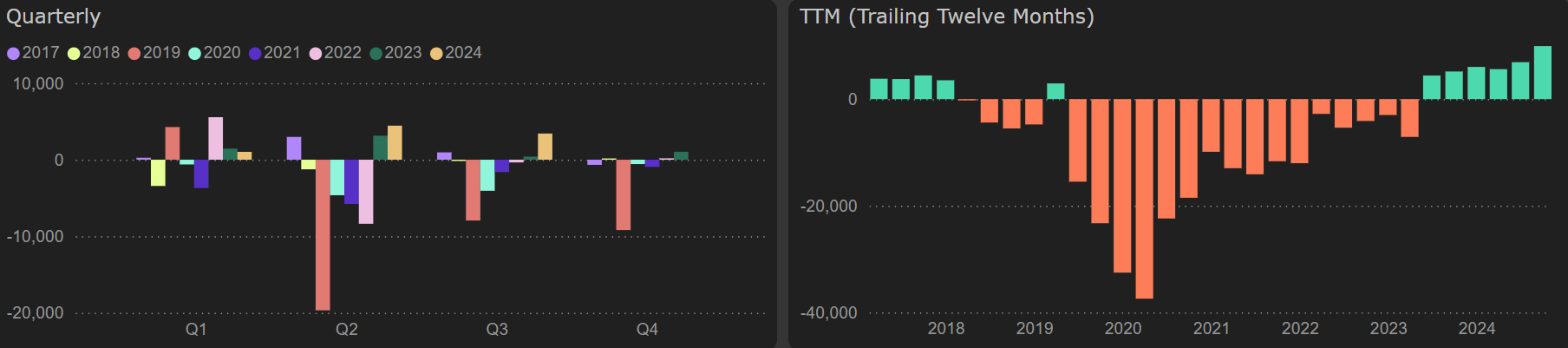

The improvement in free cash flow allowed the company to reduce its financial debt, which fell by 21% compared to the previous quarter (Q2 2024).

Total debt

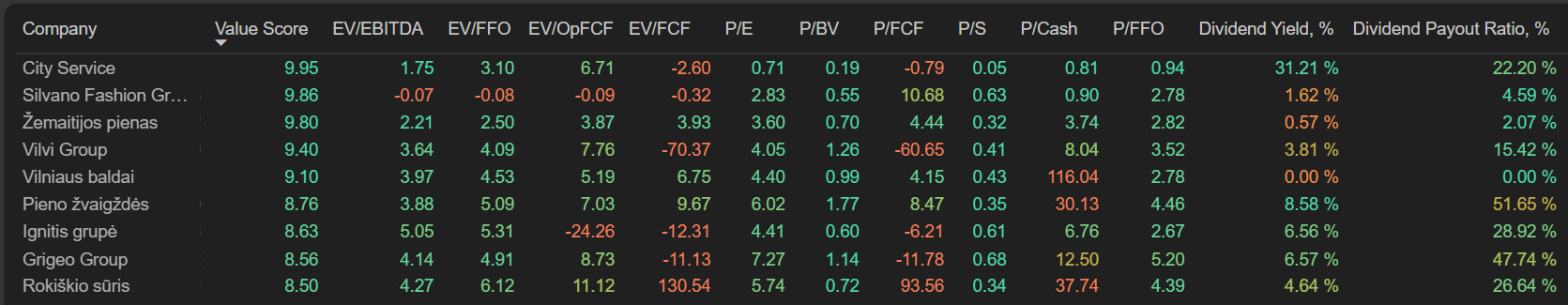

Valuation metrics have remained largely unchanged, yet the company continues to be one of the most attractively priced in the Baltic market, with a P/E of 4.40x and an EV/EBITDA of 3.97x. Additionally, the company boasts a strong PLY value score of 9.10.

Valuation metrics