Ignitis Group (IGN1L) 2023 Q2 Financial review

Strong results in tough market

Ignitis Group delivered strong 2023 Q2 results. Actually, 2023 H1 looks better than 2023 Q2, however considering tough market environment it still is quite impressive. Drastically lower electricity prices, rising interest rates, lagging regulatory WACC and continuing costs inflation were not especially supportive for Ignitis financial results. However, the Group managed to deliver outstanding results across all segments in such challenging environment.

Falling revenue

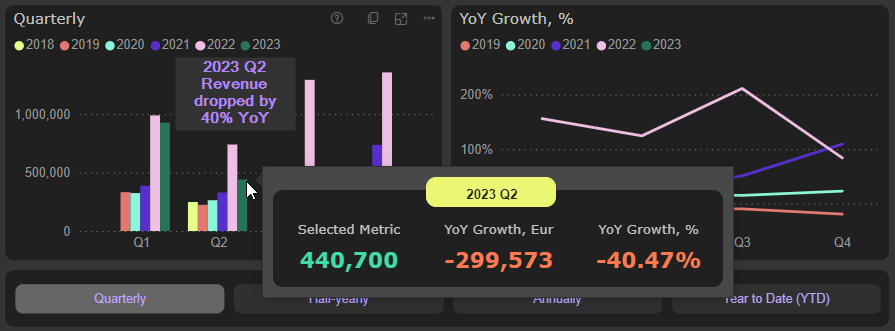

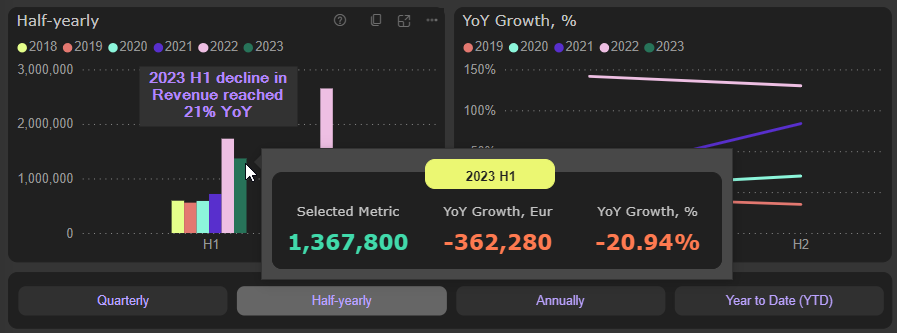

It’s not particularly surprising to see lower revenue in 2023 H1, though the magnitude of 2023 Q2 decline is quite eyebrow-rising:

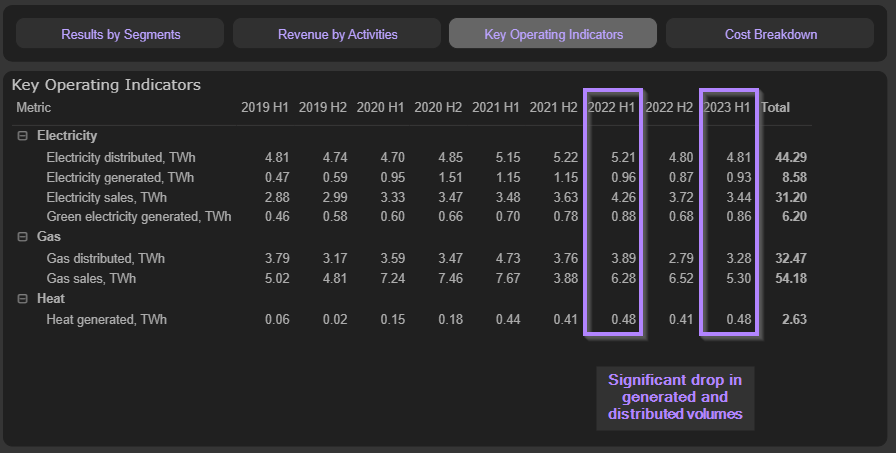

This decline in revenue is caused by significantly lower selling prices, as well as by declining volume of generated and distributed electricity and gas:

That naturally drove revenue lower across all segments and activities, except of transmission and distribution:

And growing profits

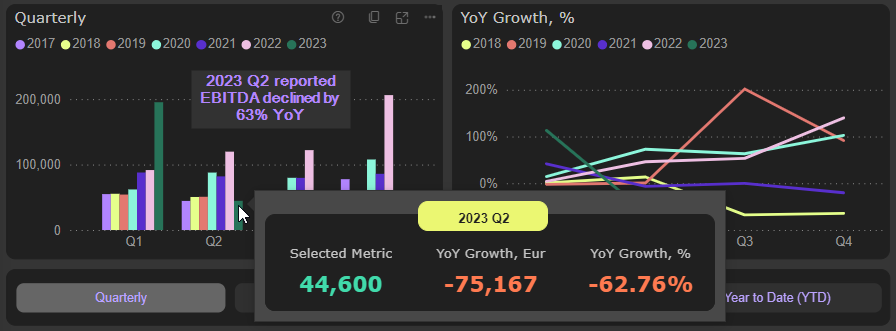

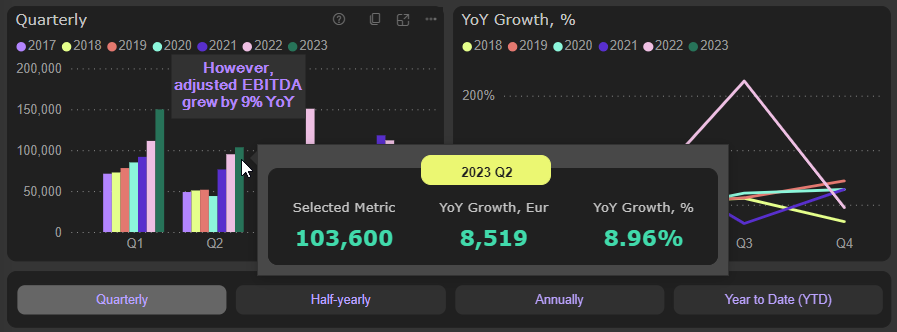

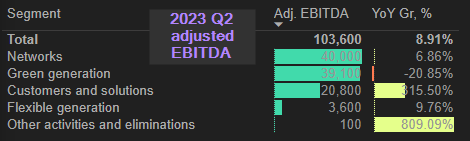

However, despite declining volumes and lower revenue, Ignitis Group managed to deliver very strong profit numbers. Actually, 2023 Q2 reported EBITDA was 63% lower compared to 2022 Q2. But adjusted EBITDA grew by healthy 9% (adjusted EBITDA margin reached record high in 2023 Q2 – 23,5%):

It should be mentioned also, that adjustments are related mostly to temporary regulatory differences in Networks and Customers & Solutions segments.

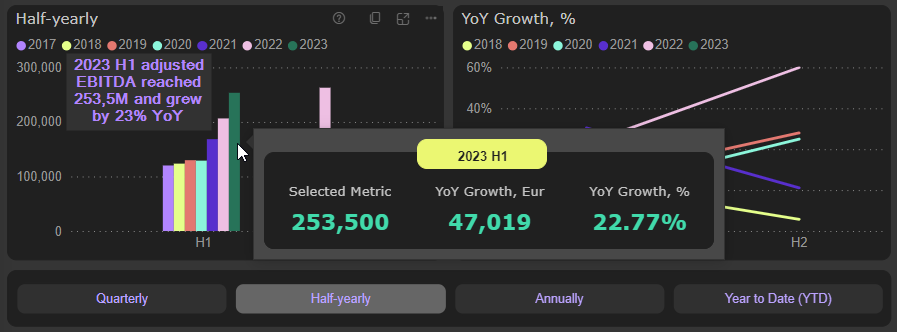

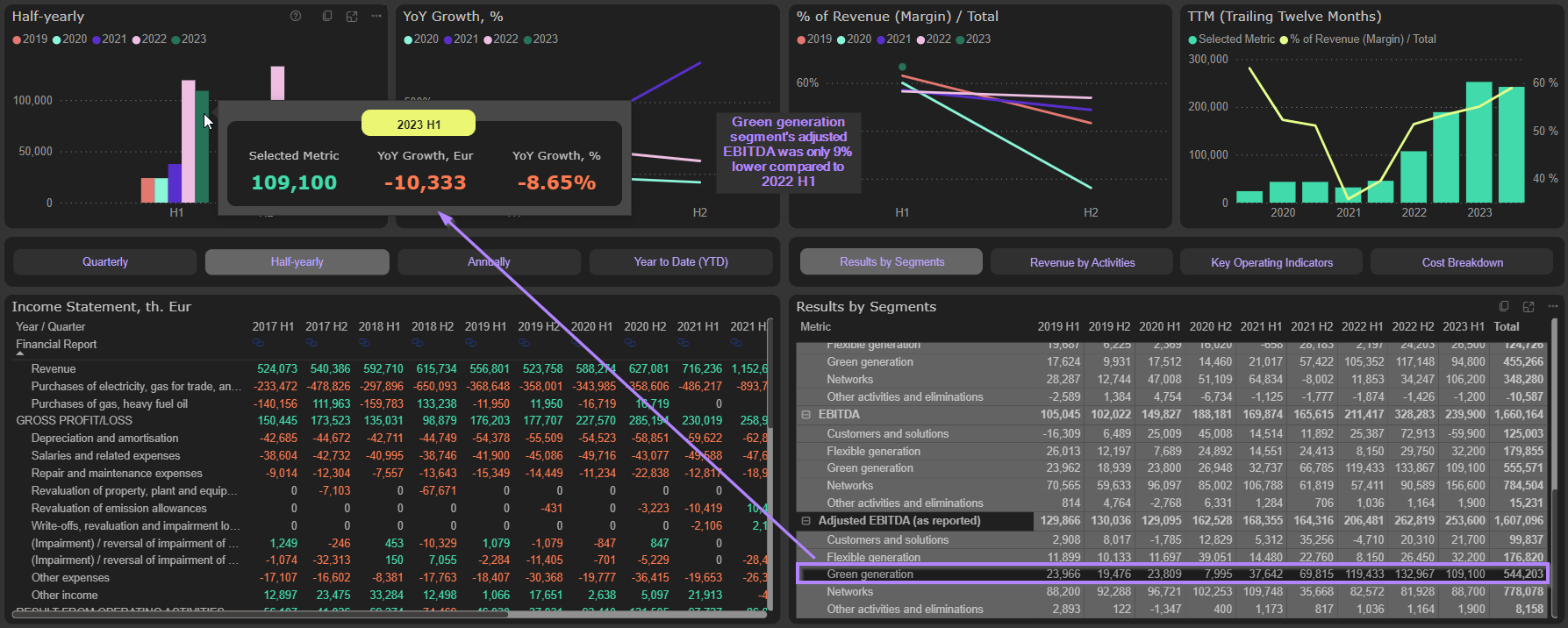

Despite significant differences between reported and adjusted income metrics in Q1 and Q2, 6 months numbers basically converged. 2023 H1 reported EBITDA reached 239,9M Eur (+13% YoY), while adjusted EBITDA amounted to 253,5M Eur (+23% YoY):

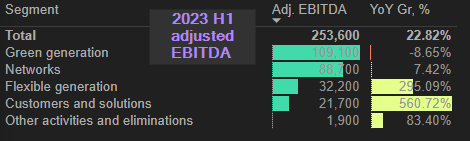

Strong EBITDA results were achieved across all segments both in 2023 Q2 as well as in 2023 H1:

Real positive surprise is Green generation segment. Despite lower generating volumes (-2% YoY), collapse in electricity market prices and plunging revenue (-23% YoY), this segment’s 2023 H1 adjusted EBITDA is only marginally lower (-9%) compared to 2022 H1:

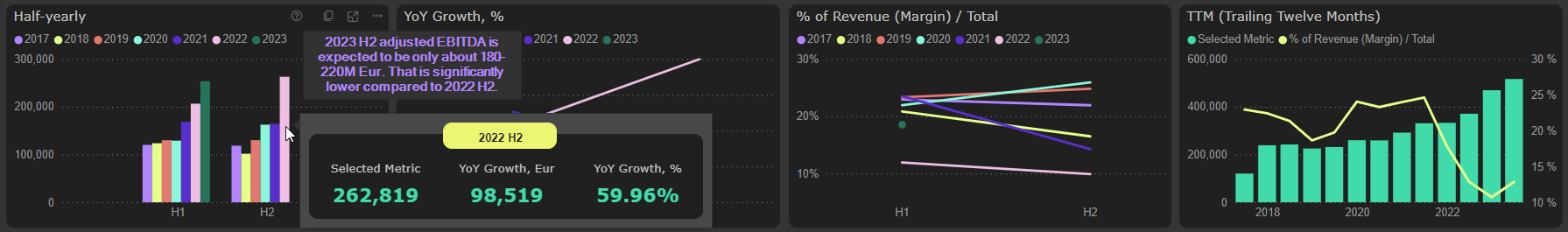

Cautious expectations

However, the picture for the second part of this year is not so rosy. The Group reiterated its forecasts for 2023 FY – adjusted EBITDA is expected in the range of 430 – 480M Eur. It means, that 2023 H2 adjusted EBITDA is expected in the range of 180 – 220M Eur. That is 16 – 31% lower compared to 2022 H2 and 13 – 29% lower compared to 2023 H1:

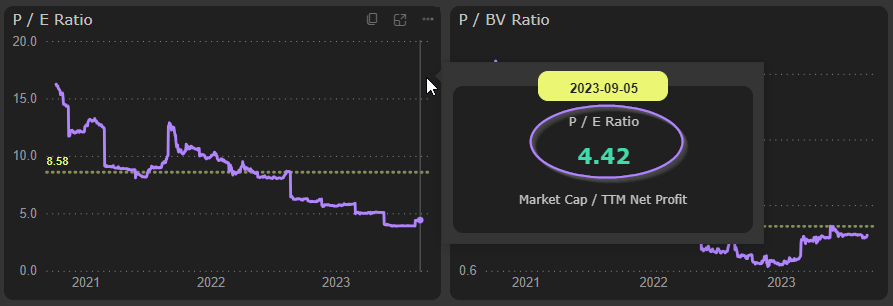

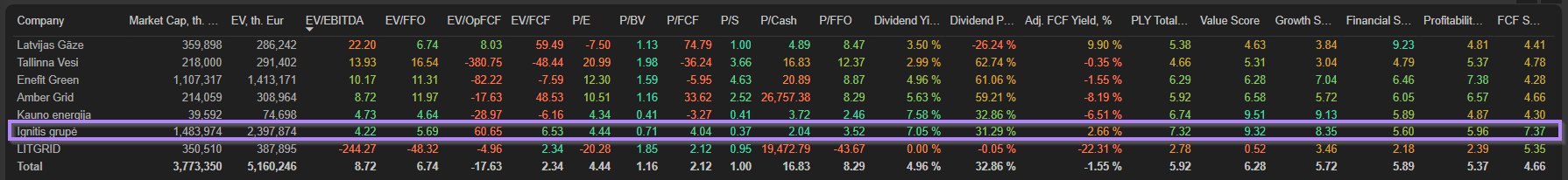

Cheap anyway

Looking in any way – on the basis of trailing or expected results – the Group’s shares are relatively cheap. On the basis of trailing financial results shares are looking even extremely cheap, both in the context of Group’s historical valuation multiples:

As well as in the context of peers’ valuation:

Group’s expected 2023 adjusted EBITDA of 430 – 480M Eur, gives us 5,0 – 5,5x EV/EBITDA 2023, which still looks very attractive.

Major concerns

As always, the devil is in the details. And in the Group’s case these details are about Capital expenditures (CapEx), Free cash flow (FCF), Net debt and Enterprise value (EV).

Probably, everybody knows already about huge Group’s investment program. It was really well publicized and even slightly politized (inevitably, considering shareholders structure). To expand installed generation capacity from current 1,2GW to 2,2-2,4GW in 2026 and to 4-5GW in 2030 is really ambitious (and necessary) goal. The problem is about financing and its implications on valuation in the short to medium term.

Group’s expected total CapEx budget until 2026 is 2,2-2,8B Eur. That is about 550 – 700M Eur per year. Assuming Group’s EBITDA forecast (470 – 550M Eur) and stable Working capital, average annual cash flow from operations is expected to be about 370M Eur. About 100M Eur per year are promised to shareholders as dividends. So, we have only about 270M Eur remaining operating cash flow to finance 550 – 700M Eur of annual CapEx.

Obviously, the remaining part of CapEx should be financed by additional debt. In total, 1,2-1,4B Eur of new debt will be added till 2026. That will bring Net debt from current 0,9B Eur to 2,1-2,3B Eur. With essentially the same EBITDA. That is really important structural change. Essentially, these simple calcs perfectly align with numbers provided in the Group’s Strategy – to bring Group’s Net debt / EBITDA multiple to ~5x.

It may have serious implications both on Group’s cash flows and (especially) valuation. First of all, with this trajectory of net debt and current interest rate environment, Group’s interest expenses can easily balloon from current ~35M per year to 90-100M Eur. That is very serious impact on the operating cash flow. Next, additional Net debt will significantly increase EV (even with stable Market Capitalization) and worsen EV/EBITDA multiple. With current Market Capitalization of 1,48B Eur and expected Net debt of 2,1-2,3B Eur, EV will reach 3,6-3,8B Eur. It will worsen expected EV/EBITDA multiple to 7,6-8,1x. That is not unthinkable and extremely expensive level, however is quite far from cheap.