Tallink Group (TAL1T) 2023 Q2 Financial review

Business model's flexibility

Extraordinarily strong results. That would be probably the best description of the first impression made by this blockbuster quarter. Record highs in earnings, margins and cash flows. But as usual, the devil is in the details.

Operating excellence

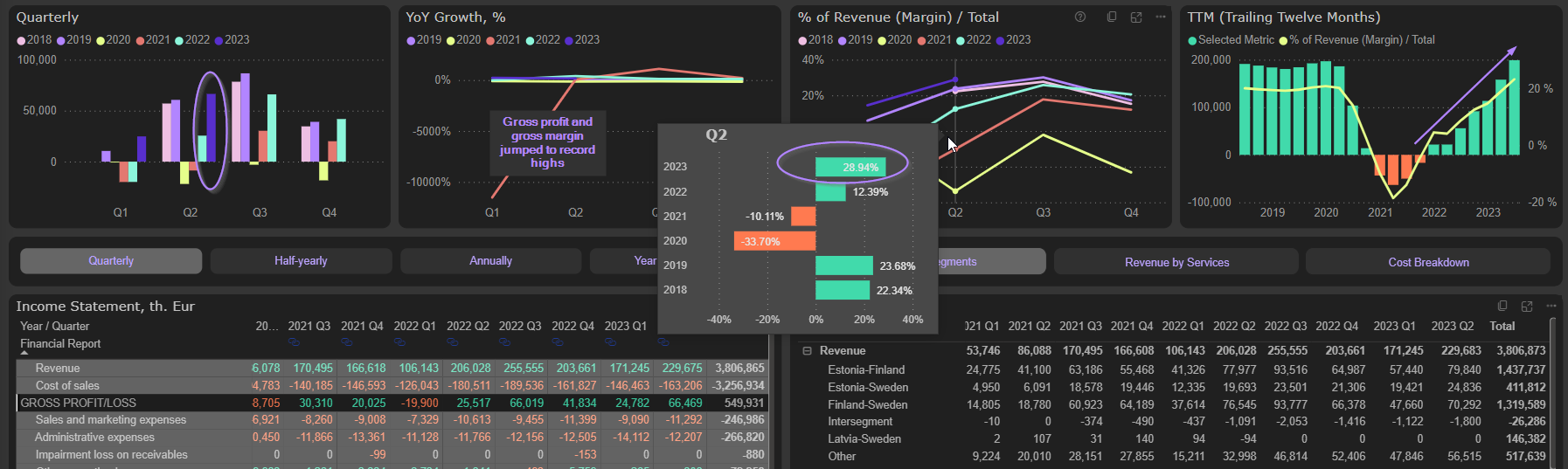

The headline numbers are really impressive. Gross profit jumped by 160% YoY, exceeding pre-COVID level and driving gross margin to record highs (29%):

Extremely strong gross margin was supported by lower fuel costs and different revenue composition (more on that later). Therefore, despite the fact that TTM Revenue are about 15% below its pre-COVID level, TTM Gross profit already is exceeding it.

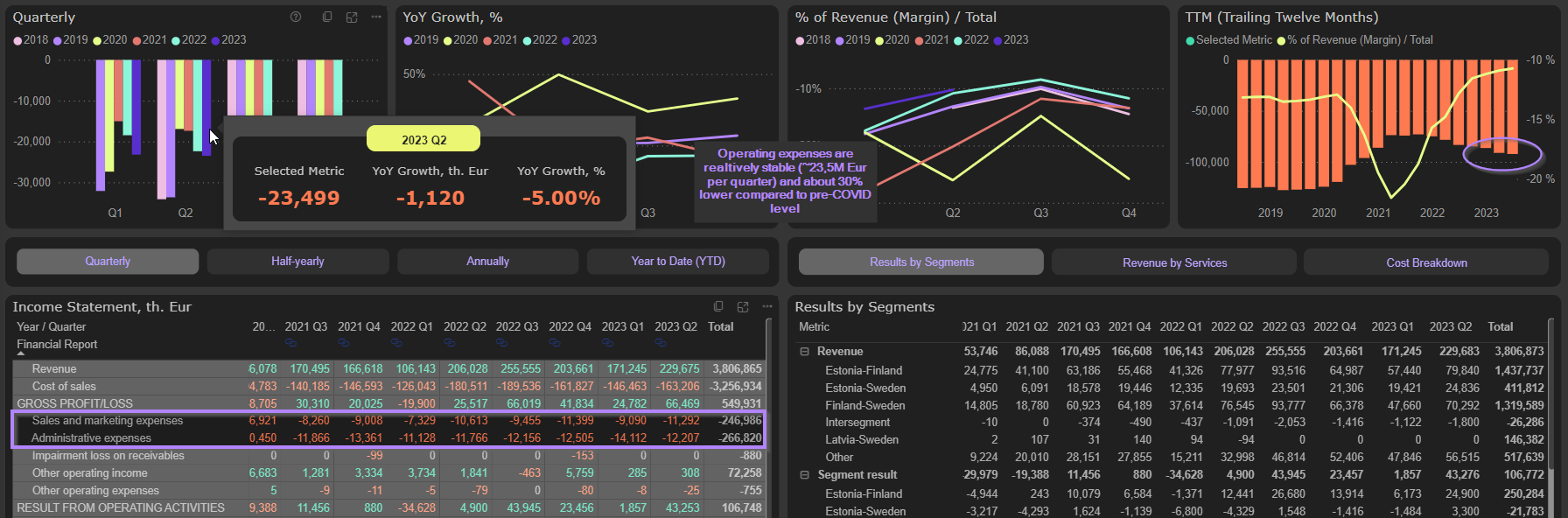

Even stronger performance is on the operating level. Operating expenses are relatively stable (~23,5M Eur in 2023 Q2) and 30% lower, compared to pre-COVID level (main contributor to lower OpEx is S&M expenses):

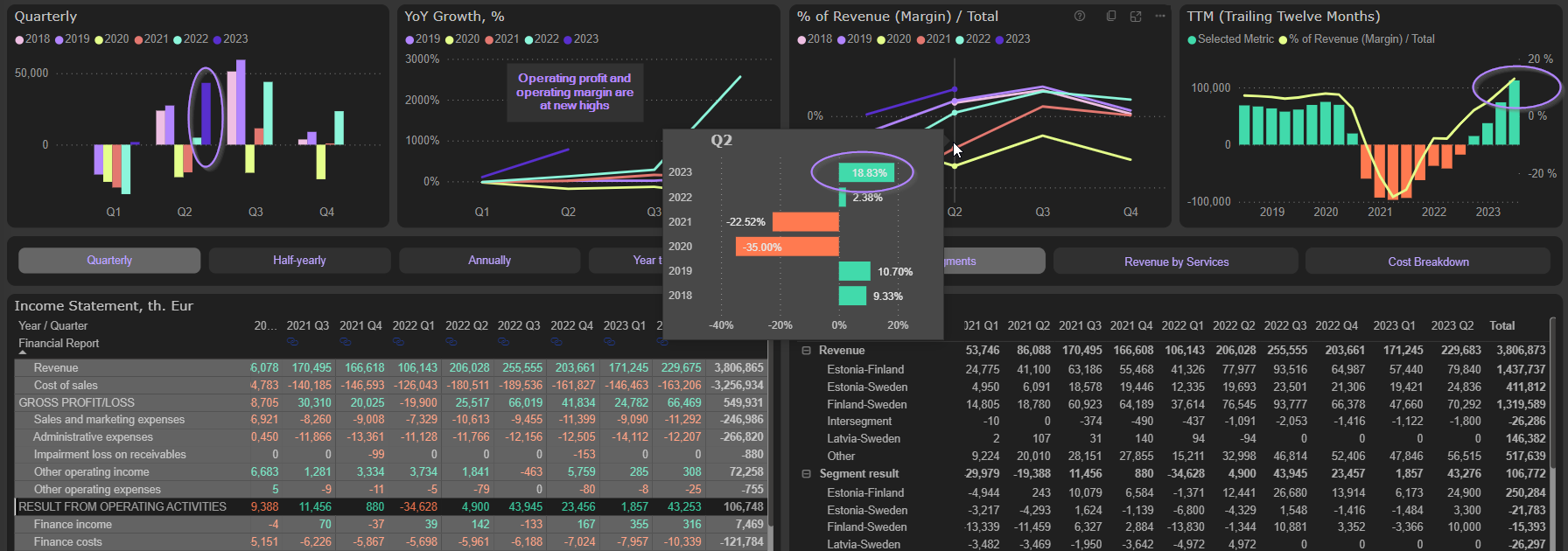

Strong gross margin and lower OpEx drove Operating profit and margin to new highs. 2023 Q2 Operating profit jumped to 43,3M Eur (58% above pre-COVID level), operating margin – to 18,8%. TTM operating margin improved to 13%:

Different Tallink

It should be admitted however, that these strong results were achieved by structurally different Tallink.

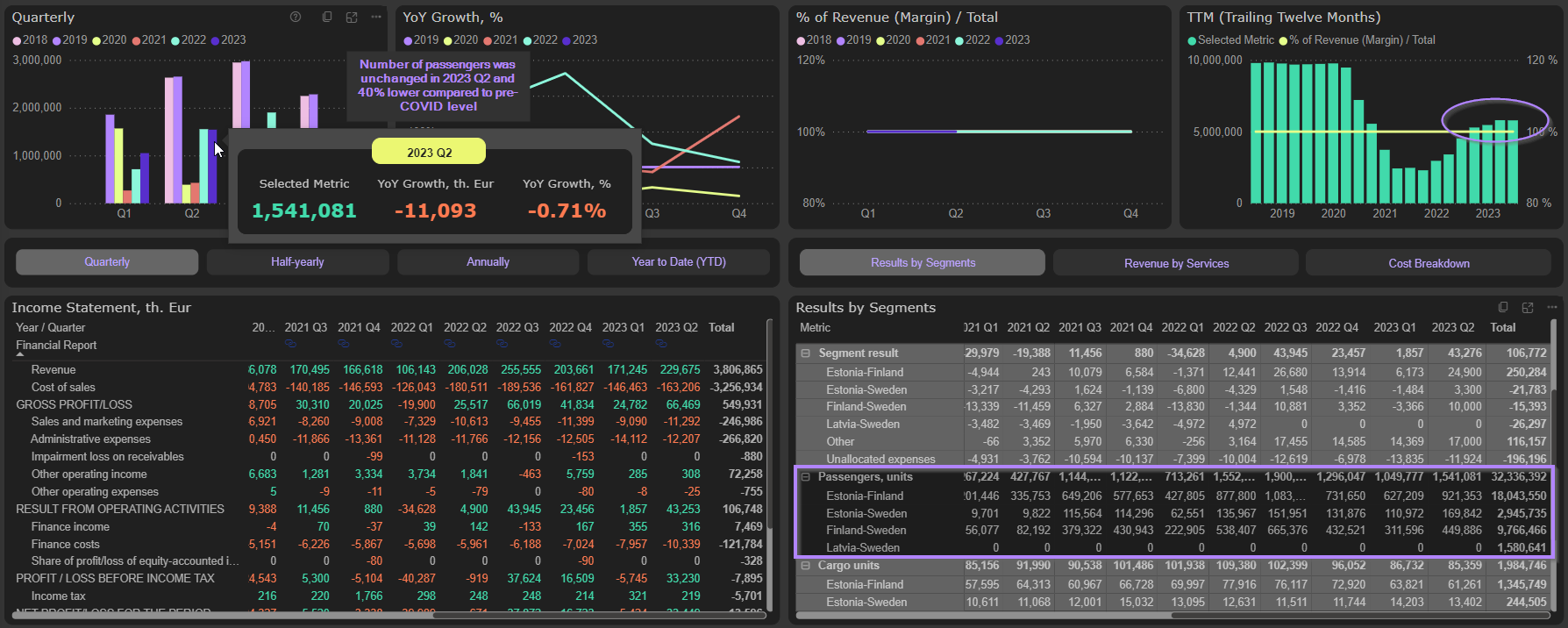

Company’s core business is recovering, however is far from pre-COVID levels. Number of passengers was essentially unchanged YoY in 2023 Q2 and 40% lower compared to pre-COVID level:

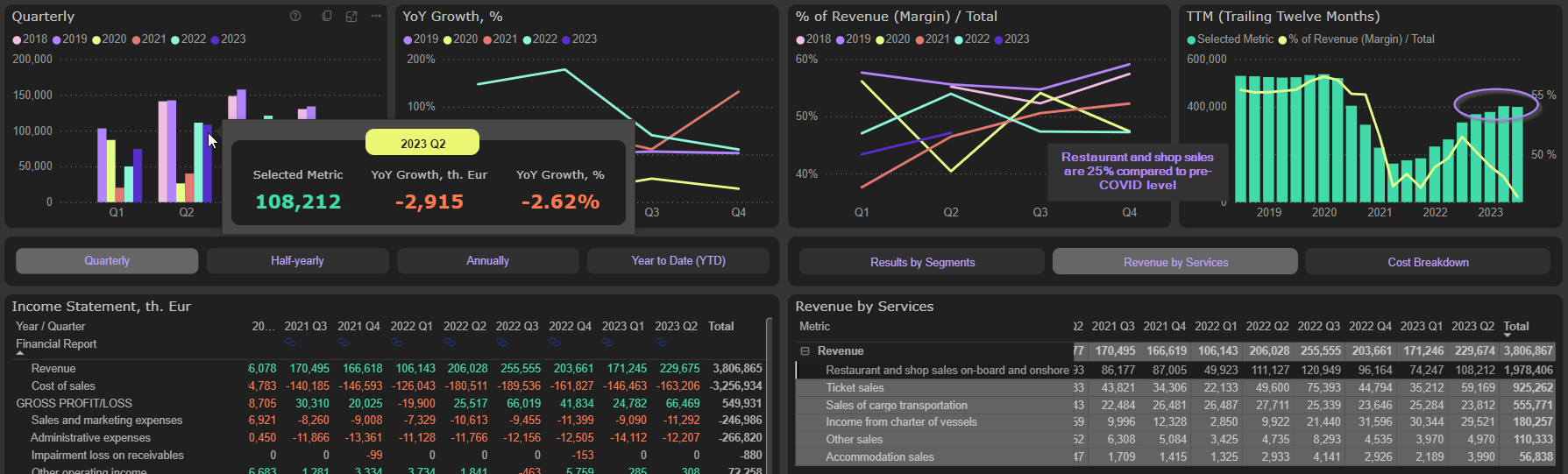

Restaurant and shop sales were 2,6% lower YoY in 2023 Q2 and 25% lower compared to pre-COVID level:

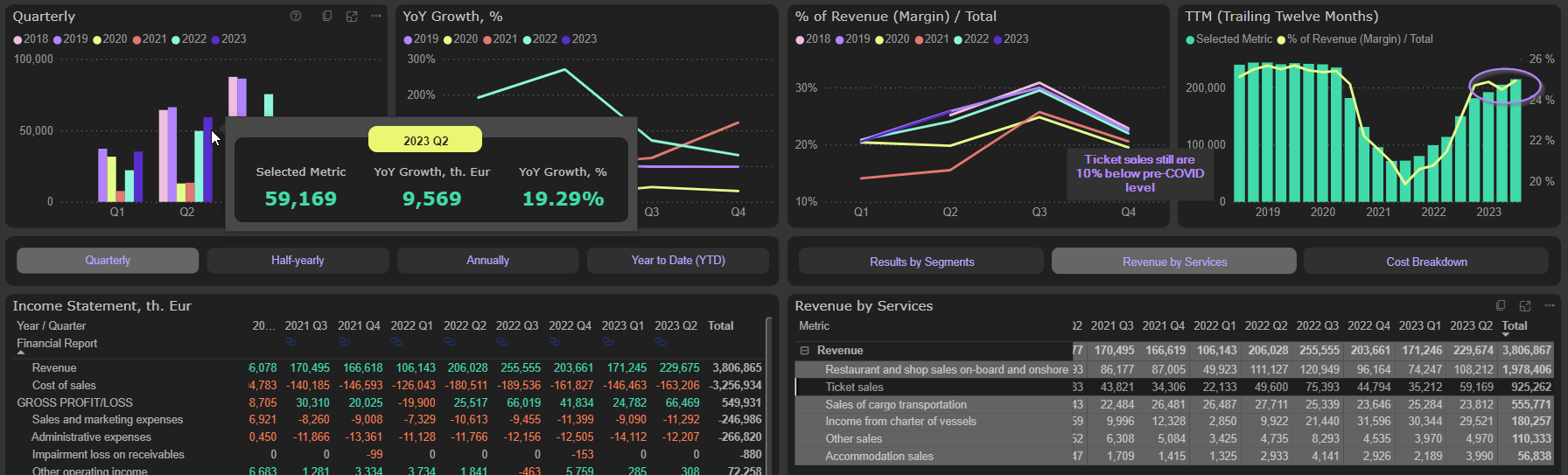

Ticket sales rose 19% YoY in 2023 Q2 but still were 10% lower compared to pre-COVID level:

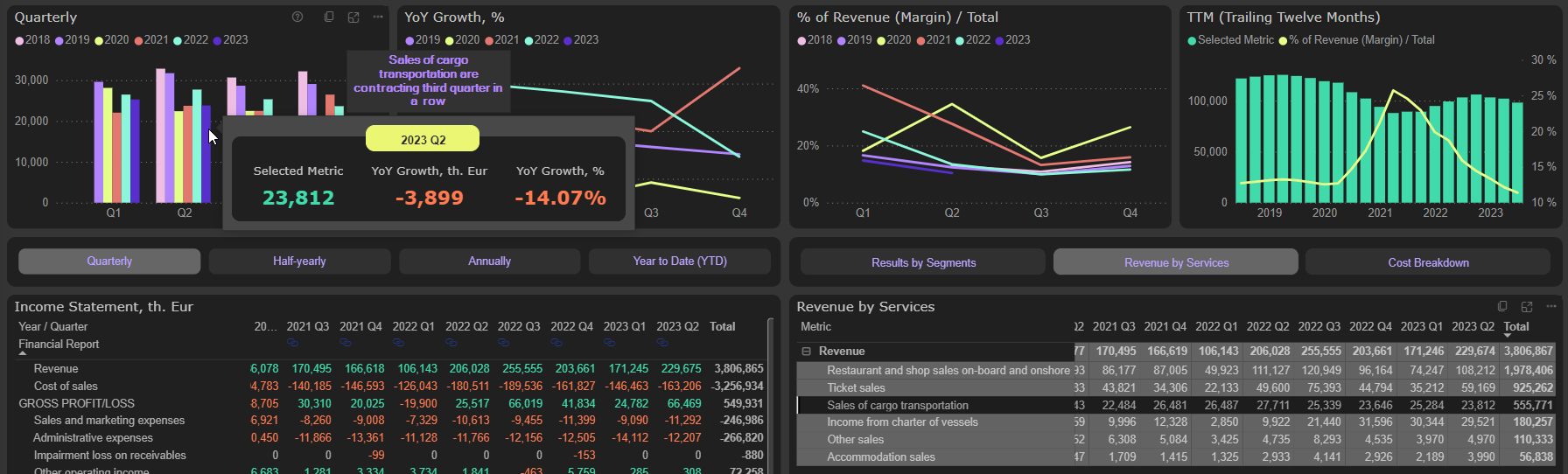

Sales of cargo transportation are contracting third quarter in a row. In 2023 Q2 sales dropped 14% YoY and were 25% lower compared to pre-COVID level:

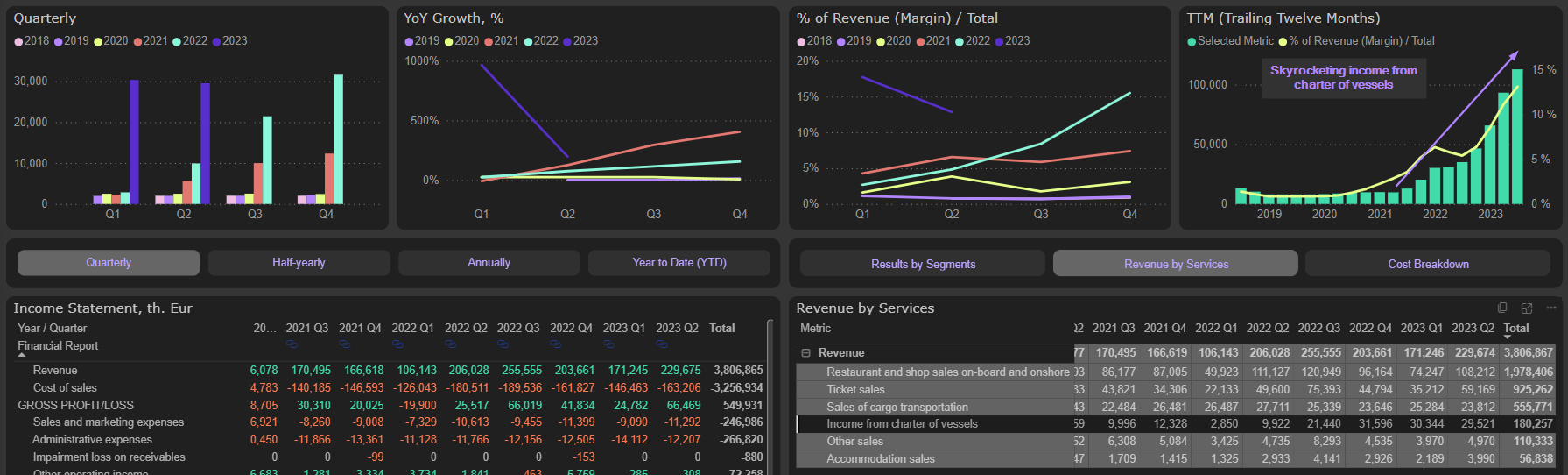

All of this lost core business was made up by skyrocketing income from charter of vessels:

Annual income from charter of vessels jumped to almost 120M Eur, or ~15% of revenue, from virtually non-existed level just couple of years ago. Of course, skyrocketing income from chartering and contracting revenue from core business are interrelated things. Vessels that are chartered can not be employed on the regular routs. On the one hand, as the management has emphasized, this flexible use of vessels adds valuable flexibility to the company’s business model. However, the main question is still unanswered: if the demand for charter of vessel falls, will the company be able to employ profitably these vessels in its regular routes?

At the end of 2023 Q2 Tallink operated 15 vessels and half of them was chartered: 4 on long-term and 3 on short-term charter. However, on September 1st company unexpectedly announced, that charter of vessel Romantika (long-term) was terminated before the charter agreement’s normal expiry date. What if we will have more such unexpected news?

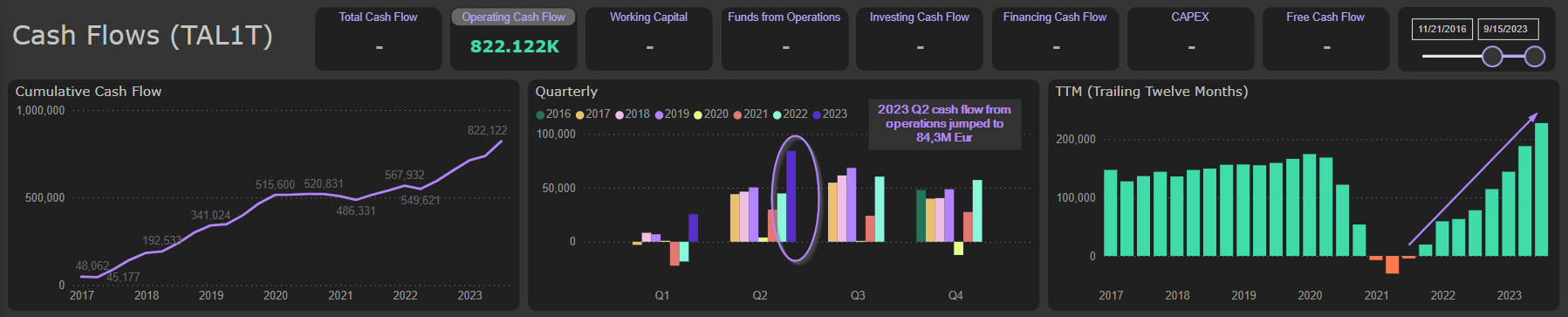

Huge cash flows

So far, flexibility added by chartering of vessels allows company to enjoy excellent operating results and huge cash flows. 2023 Q2 cash flow from operations jumped to eye-popping 84,3M Eur, supported by record FFO and inflows from decreased Working capital:

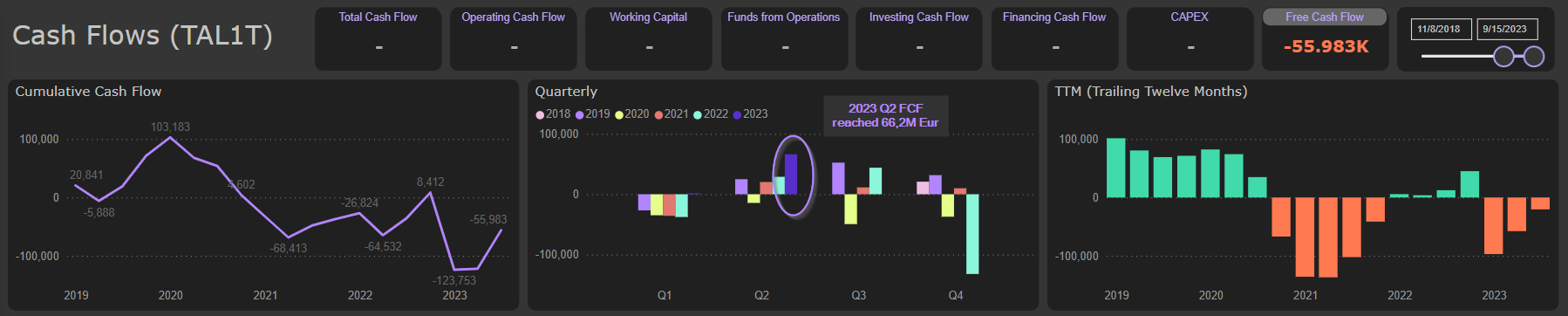

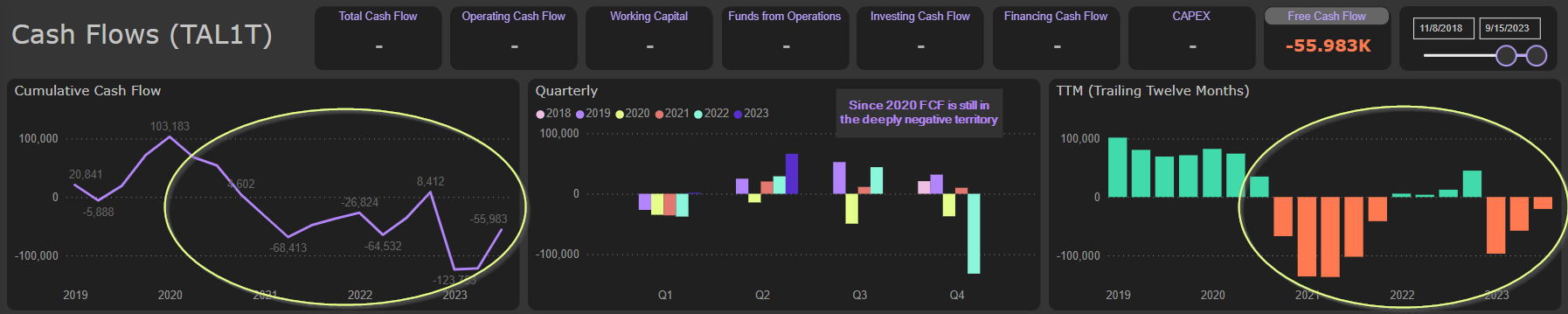

Quarterly CapEx was very modest (only 4,7M Eur) and combined with huge cash flow from operations that allowed to achieve very long seen free cash flow numbers – 66,2M Eur (in FCF calculation we include also Interest paid and Payment of lease liabilities):

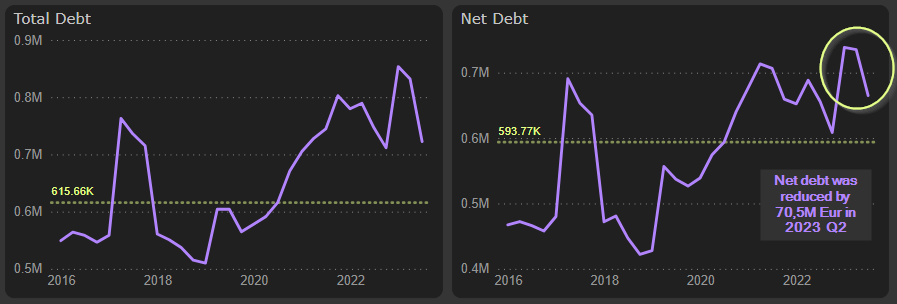

This huge FCF allowed to reduce net debt by 70,5M Eur in 2023 Q2:

However, it should be admitted that since 2020 FCF is still deeply in the negative territory, implying higher net debt levels to cover cash flow shortfalls:

Looks cheap, but…

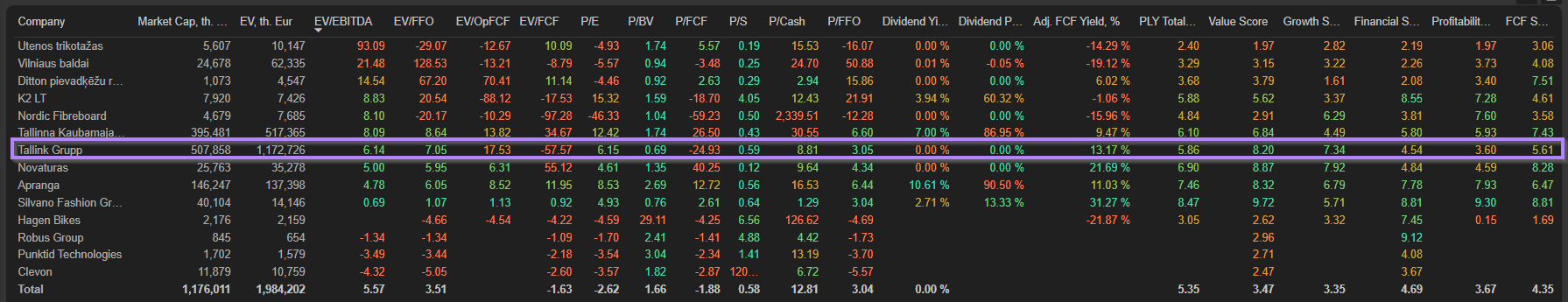

Of course, considering recent boost from the chartering, Tallink shares still look attractive from the relative valuation perspective. With current trailing EV/EBITDA at ~6,2x and P/E at ~6,3x Tallink is definitely in bottom quartile of Baltic Consumer cyclical sector:

These multiples also look cheap compared to historic Tallink valuation: from 2011 to 2019 EV/EBITDA averaged at ~8,0x, while P/E averaged at ~14,6x:

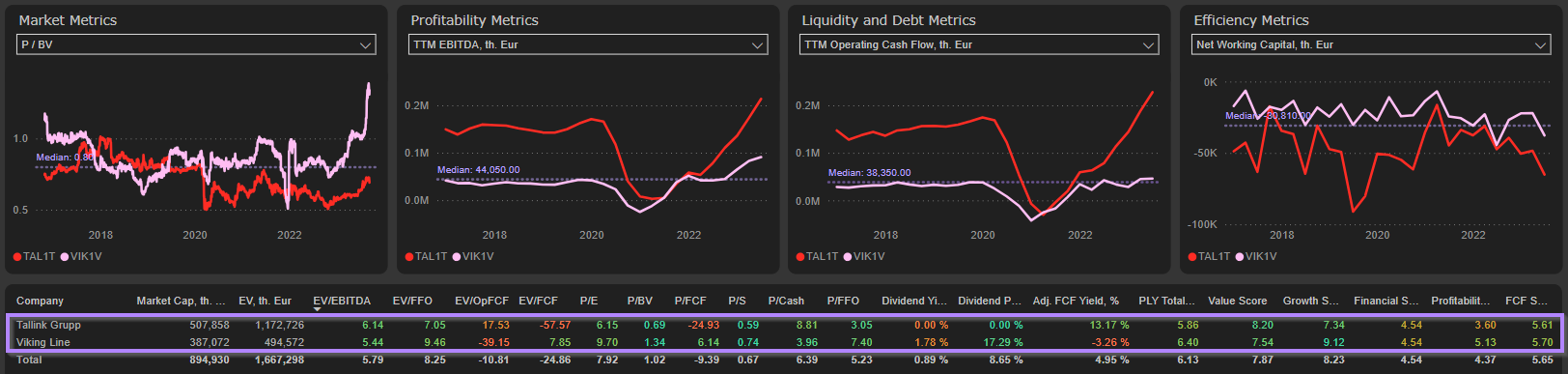

Also, Tallink is relatively better priced compared to its direct peer from Finland – Viking Line (especially after eliminating Viking Line’s capital gains):

However, let’s keep in mind, that if this new business model flexibility turns out to be really one-sided, that could change valuation arithmetic rather very quickly.