Ignitis Group 2025 Q1 financial review

Green capacities fueling results

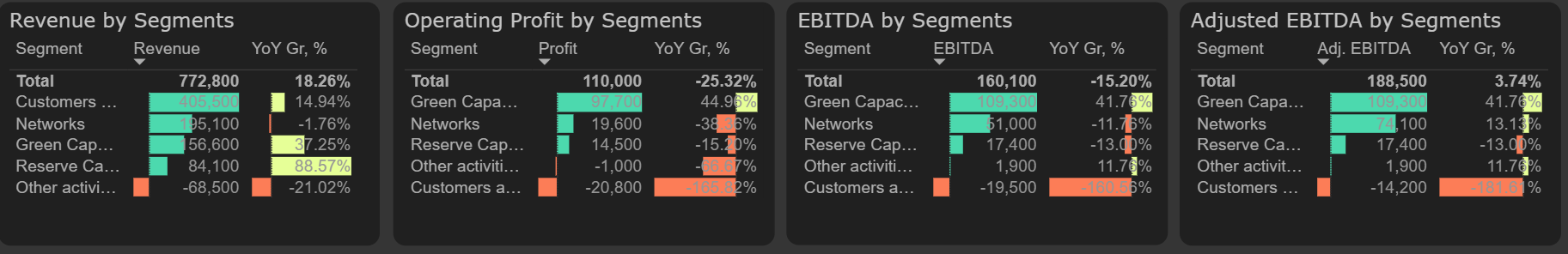

Ignitis Group’s operating profit decreased by 25% in the first quarter of 2025 compared to the same period last year, despite an 18% increase in revenue. The profit decline was driven by a reduced margin due to higher costs: purchases of electricity, natural gas, and other services rose by 35%, other operating expenses increased by 24%, and employee-related costs grew by 20%. The negative impact was further compounded by increased depreciation, resulting in a more moderate EBITDA decline of 15%.

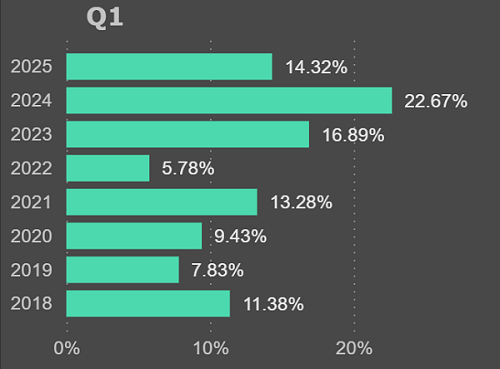

Operating margin, Q1

In the first quarter of 2025, according to adjusted results, €23M was returned in the networks segment from previous periods, including the elimination of this year’s profit. As a result, the segment’s adjusted EBITDA grew by 13%, while actual P&L statement results showed a decline.

The green capacities segment continues to show the strongest growth – its adjusted EBITDA increased by 42%, primarily due to higher revenue, although the profit margin was also slightly better than last year.

Revenues in the other segments – reserve capacities and customers solutions – increased, but adjusted EBITDA declined.

Results by segments, 2025 Q1

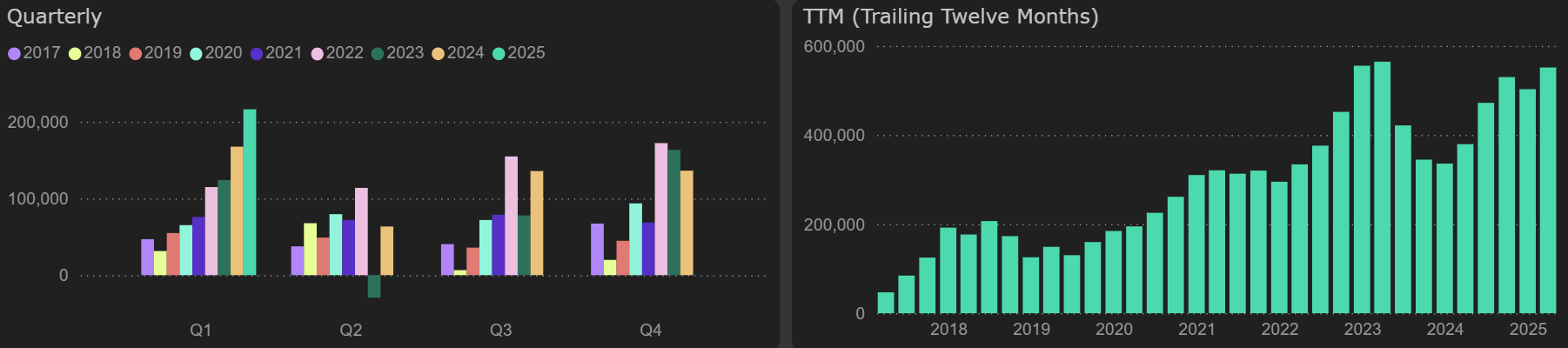

Funds from operations (FFO) increased by 29% in Q1 2025, bringing the annualized level to €551.5M. Investments during the quarter were lower than a year ago, and together with the FFO growth, this resulted in a positive free cash flow (FCF) of €45M – €10M higher than in the first quarter of 2024. However, on an annual basis, the level of investments still exceeds operating cash flow, so the annual FCF remains negative.

Funds from operations