Merko Ehitus 2025 Q1 financial review

A shift in segment dynamics

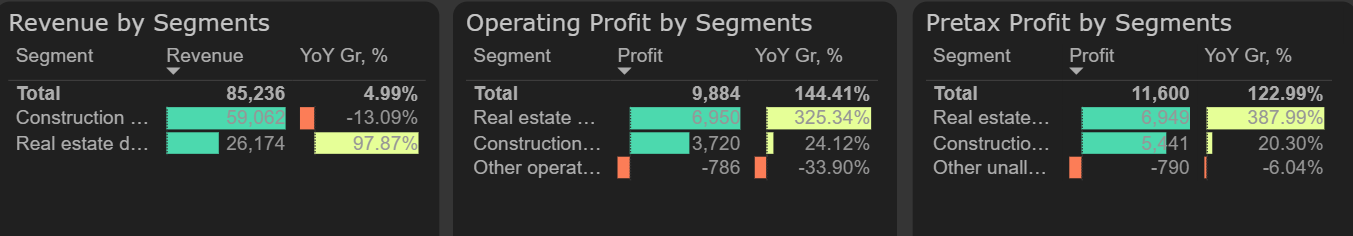

The beginning of 2025 revealed a change in trends – the real estate segment showed signs of recovery, while the construction segment lost growth momentum. In the first quarter, real estate segment's revenue doubled compared to the same period last year, while the construction segment recorded a 13% decline in revenue. Overall, revenue grew moderately – by 5% compared to the same quarter last year.

Results by segments, 2025 Q1

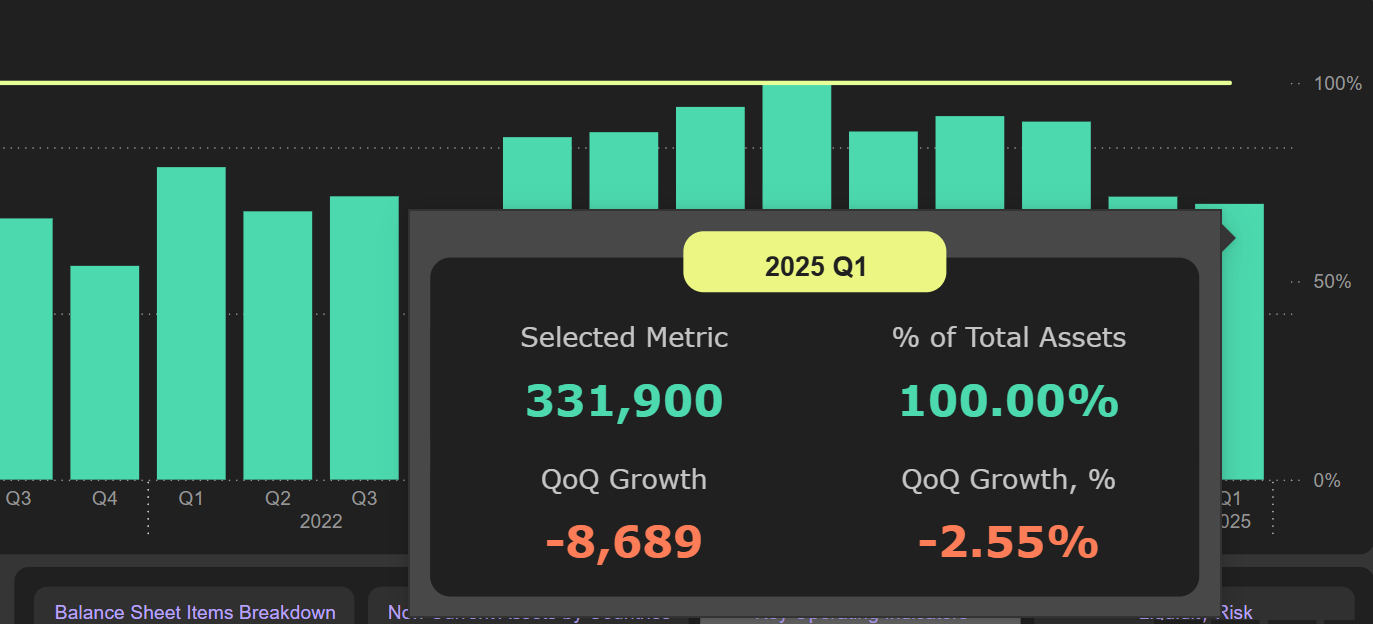

Although this quarter saw a significant increase in new contracts (due to an exceptionally low comparative base last year), the order book remained below the 2023–2024 levels and amounted to €332M at the end of the first quarter of 2025, which may make it more difficult to sustain sales in the construction segment.

Order book

The company’s profit recorded significantly stronger growth than revenue – operating profit increased 2.4 times compared to the first quarter of 2024. The main source of this growth was the real estate segment, which, in terms of absolute operating profit, even surpassed the construction segment.

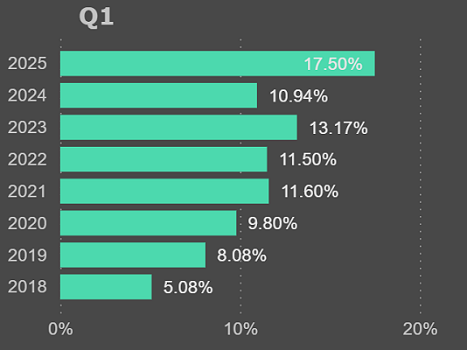

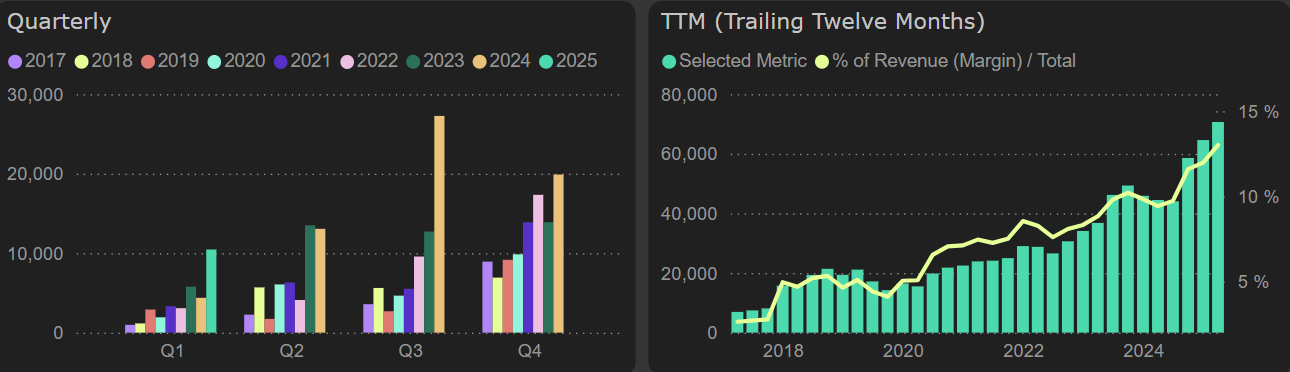

The profit growth trajectory was further supported by a high gross margin, which was 6.5% higher compared to the first quarter of 2024. However, in the first quarter of 2025, the gross margin (17.5%) was already lower than in the last two quarters of 2024 (Q3 2024 – 22.5%, Q4 2024 – 20.5%).

Gross margin

In the first quarter of 2025, operating expenses were managed quite efficiently – their total amount even decreased by 9% YoY. Although marketing expenses grew faster than revenues (19% YoY), other operating expenses returned to a minimal level this year after having increased significantly last year.

The annual net profit remained at a record level of €70.7M. Accordingly, the company's ROE rose to 29%, which is not only the highest level in the company’s history but also one of the highest among companies in the Baltic market. However, this was significantly influenced by a strong surge in the third quarter of 2024, which now shows signs of cooling – margins are gradually softening quarter by quarter, and the order book has declined

Net pofit

Due to the strong positive impact of working capital at the beginning of last year, free cash flow is still on a declining trajectory – the annual level stands at €42M, which represents a 7.5% yield.