LHV Group 2025 Q2 financial review

Deeper into 2025, deeper into pressure

As 2025 progresses, LHV Group is facing mounting pressure on its performance. Although the loan portfolio grew by 5.7% during Q2, the shift in the interest income trajectory observed earlier this year became more pronounced — interest income declined by 7% compared to the same period in 2024. Meanwhile, interest expenses continued to rise, increasing by 13% YoY. As a result, net interest income in the second quarter was 18% lower than a year earlier.

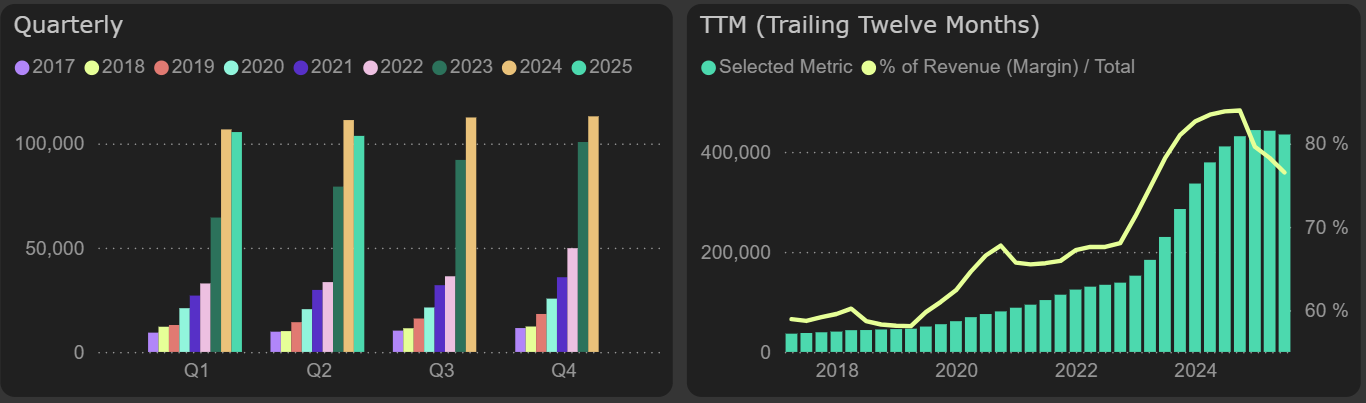

Interest income

Operating expenses (including personnel, administrative, and other costs) increased by 8% YoY in the second quarter (12% based on adjusted data). Combined with weaker net interest income performance, this had a significantly negative impact on the company’s profit. Profit before impairment expenses declined by 33% in the second quarter compared to the same period last year.

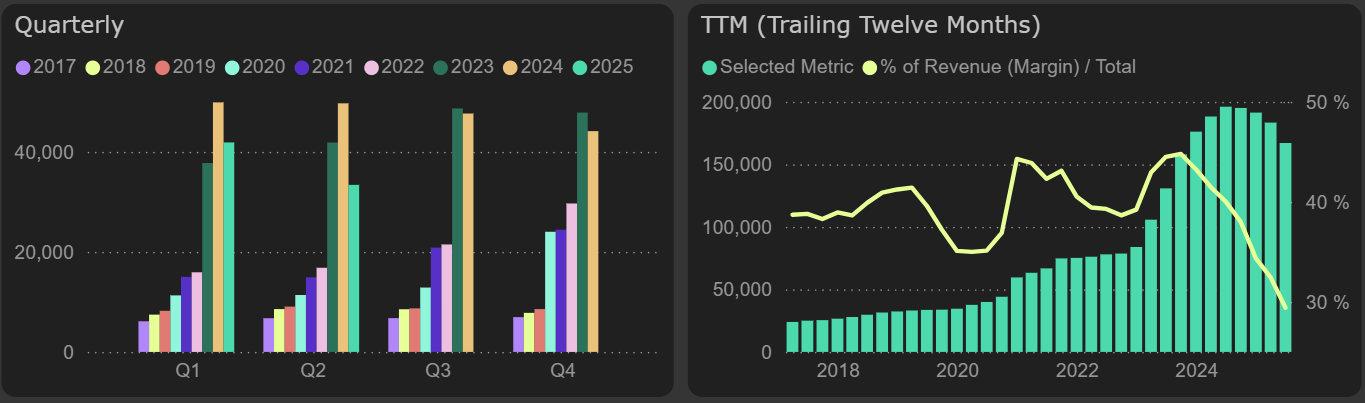

Profit before impairment expenses

On a positive note, €4M in loan impairment reversal were recorded in Q2, indicating improved credit quality. The loan loss ratio halved to 0.21%, providing some support against the bottom-line decline. Net profit decreased by 20% YoY, landing at €31M.

Credit quality indicators