Telia Lietuva 2025 Q2 financial review

Keeps the growth engine running

Telia Lietuva maintained the growth momentum demonstrated at the beginning of 2025 into the second quarter.

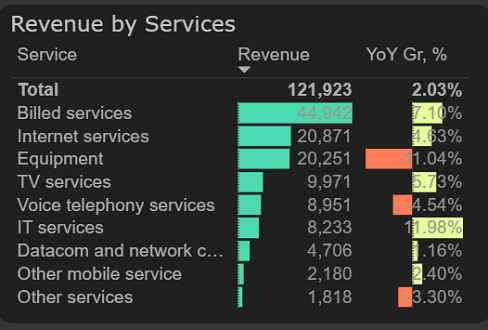

Sales grew modestly by around 2% YoY, with the main contributors being revenue growth in IT services (+12% YoY) and mobile services (+7% YoY). Meanwhile, equipment sales showed a declining trend – dropping by 11% in Q2 compared to 2024.

Revenue by services, 2025 Q2

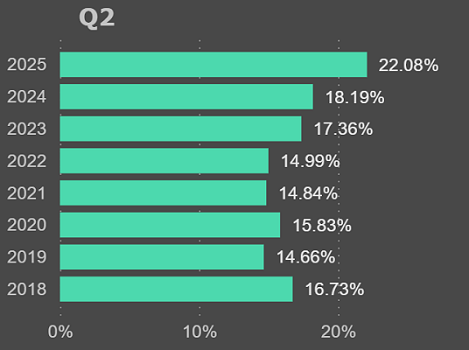

In the second quarter of 2025, operating profit increased by 24% compared to the same period last year. Improved profitability remained the main driver of this year’s performance growth. As in the first quarter, the operating margin rose significantly – from 18% in Q2 2024 to 22% in Q2 2025.

The impact of workforce reduction became more visible in Q2 – personnel expenses decreased by 4.6% YoY. Overall expenses declined by 3%, while revenue continued to grow.

Operating margin, Q2

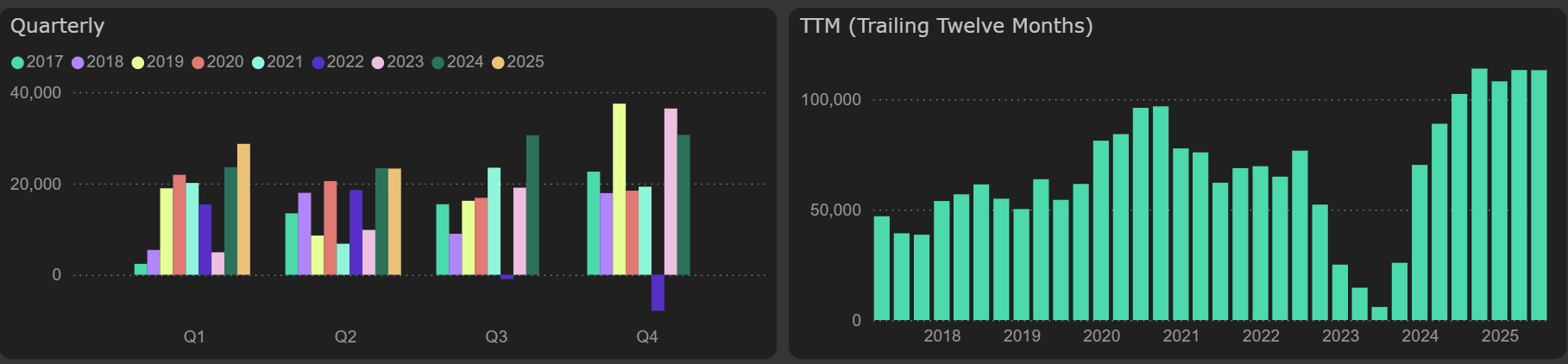

Cash flow dynamics remained stable in the second quarter. Fund from operations (FFO) followed a smooth upward path, increasing by 4% YoY, slightly behind profit growth. However, working capital requirements rose by a similar amount, resulting in free cash flow remaining roughly unchanged compared to the same period last year. The annual level of free cash flow remains at a record high of €113M, with a yield of 11%.

Free cash flow

Telia Lietuva’s valuation metrics are still among the lowest in the past decade – with a P/E of 12.5x and an EV/EBITDA of 6.1x.

Valuation metrics