LHV Group 2025 Q3 financial review

Continued slowdown

The first published Q3 2025 Baltic banking sector results – from LHV Group – point to a continued slowdown.

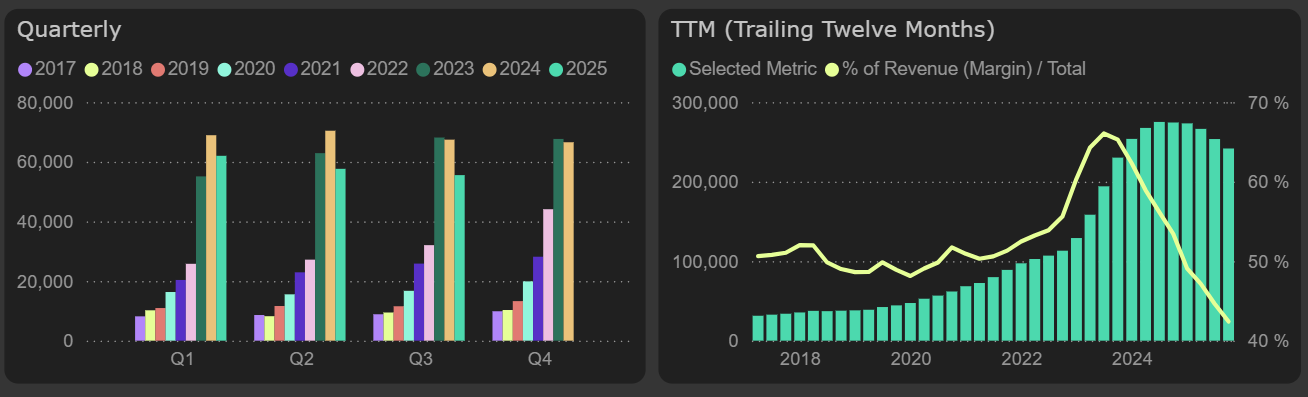

In the third quarter, as in the previous one, interest income declined faster – by 7% compared to the same period last year. At the same time, the growth of interest expenses has not yet stopped (+8% YoY), pushing net interest income down 18% compared to last year. Although the interest result weakened compared to Q2 2025 as well, the decline was less steep (-3.7% QoQ) than in the first two quarters of 2025, when it reached around -7% QoQ.

Net interest income

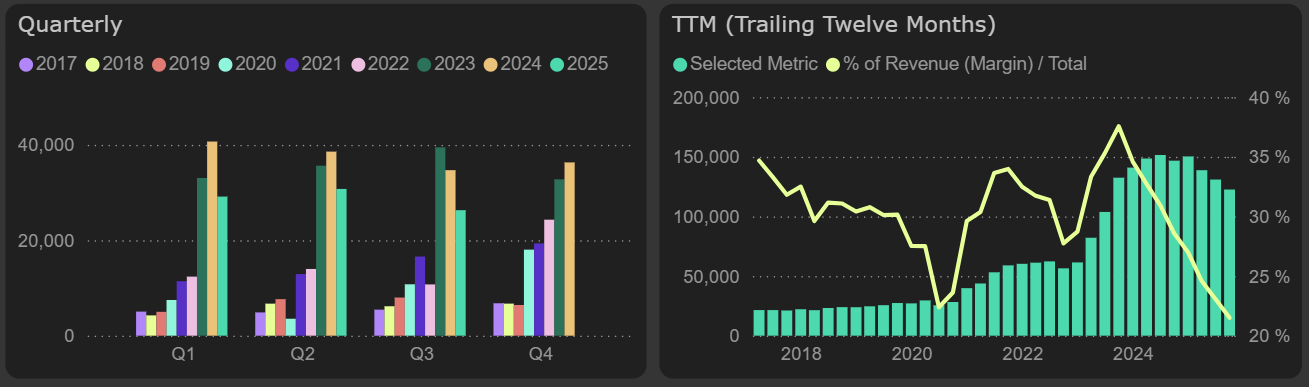

Net profit in the third quarter decreased by 24% – to €26.3M, compared to €34.7M earned in the same period last year. This was influenced by both a declining interest result and pressure from staff costs – which rose 11% YoY (15% on an adjusted basis) – roughly the same pace seen throughout 2025.

Net profit

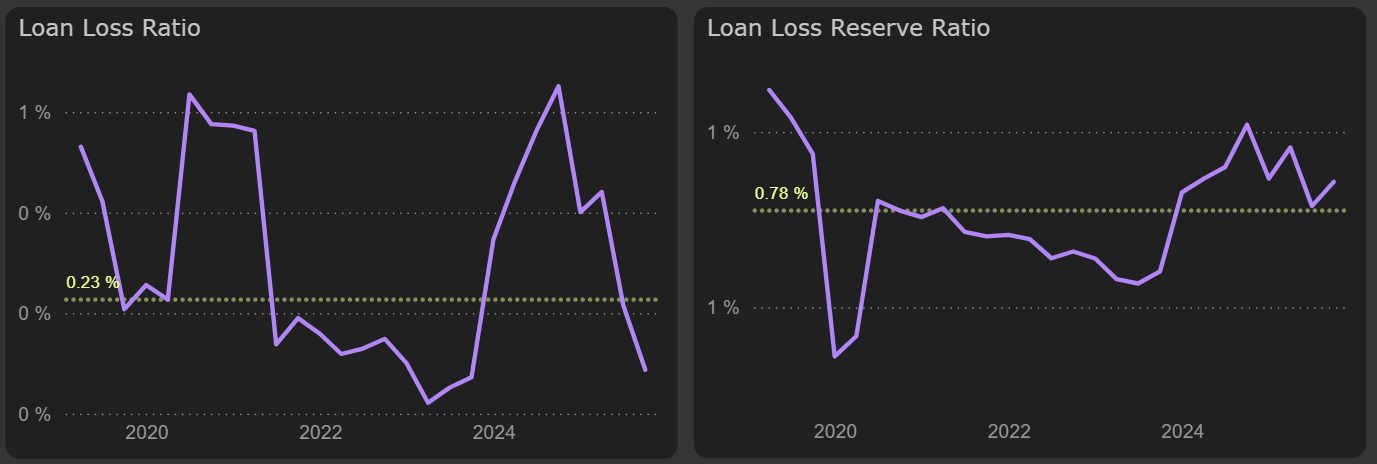

One positive: improved credit quality helped soften the hit, with Q3 impairment expenses €5.6M lower than a year ago. Excluding this effect, profit before impairment expenses declined 29% YoY.

Credit quality metrics