TKM Grupp 2025 Q3 financial review

Car trade eases pressure

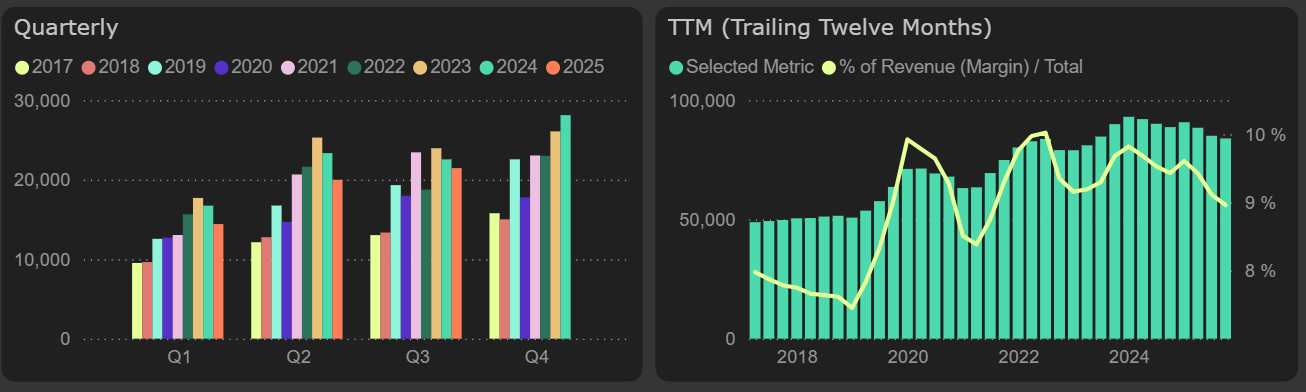

In the third quarter of 2025, TKM Grupp was weaker than last year, but the results were better than at the beginning of the this year. The company's EBITDA in the third quarter was 5% lower than in the same period last year, while at the beginning of the year the decline was 14%. In the first nine months of this year, the company generated €55.9M in EBITDA – 11% less than last year. Employee costs have had a negative impact on profitability throughout the year.

EBITDA

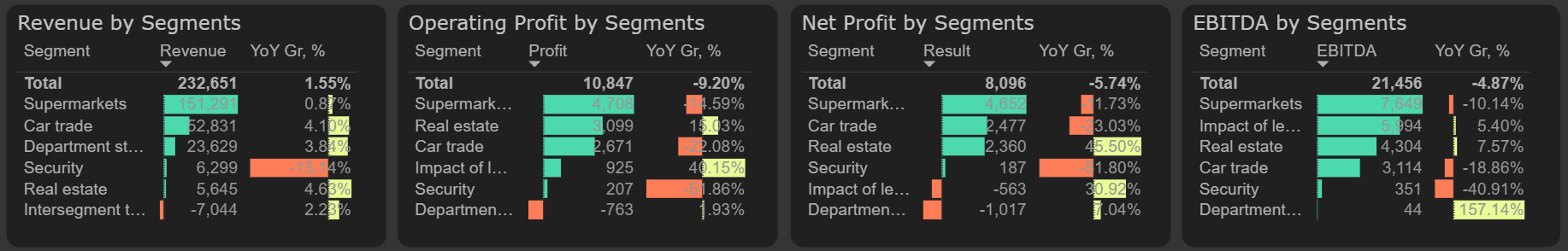

The car trade segment, which faced significant challenges in the first half of the year, showed signs of stabilization as it entered the second half. Sales in this segment even grew by 4% in the third quarter compared to last year. However, due to margin pressure, the car trade segment's EBITDA in the third quarter remained 19% lower than last year. Compared to the beginning of the year, the decline had eased – in the first half of 2025, it had reached 49%.

The supermarkets segment also remained below last year’s level – EBITDA in the third quarter was 10% lower, despite stable revenue.

Results by segments, Q3 2025

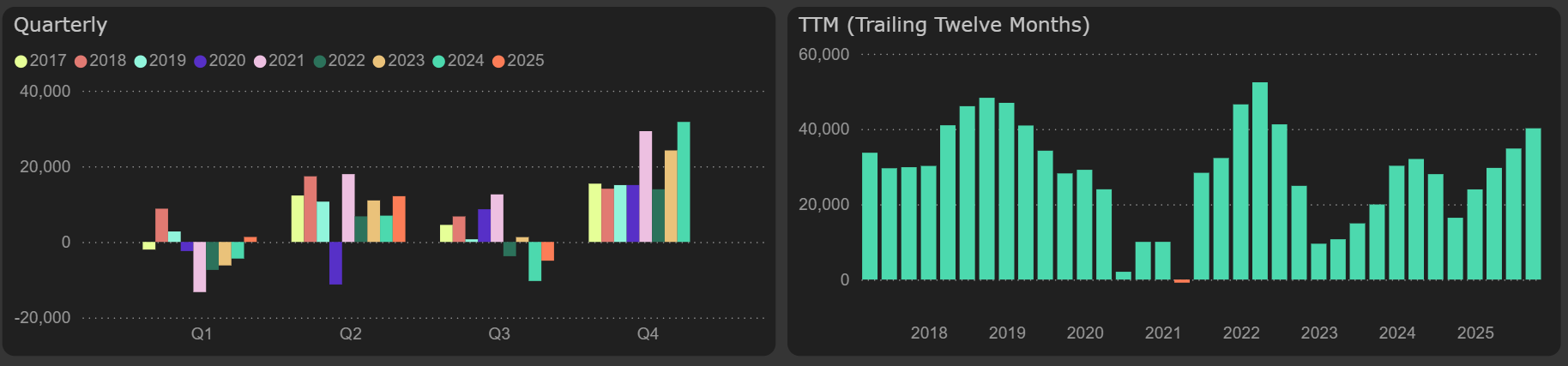

In the third quarter, funds from operations decreased by 4% compared to last year, but significantly less was invested in working capital. Together with lower CAPEX, the annual free cash flow remained on a growth trajectory, reaching €40M – corresponding to a yield of 10.7%.

Free cash flow

On a more conservative basis, with €49M FFO and €25M depreciation (excluding lease liabilities), FCF yield could stand around 6%, making it less attractive. On top of that, valuation metrics remain high – P/E 20.1x and EV/EBITDA 8.5x.