LHV Group 2025 Q4 financial review

YoY down, but QoQ recovering

LHV Group ended 2025 with a weaker quarter compared to the previous year, but the result improved compared to the third quarter of 2025.

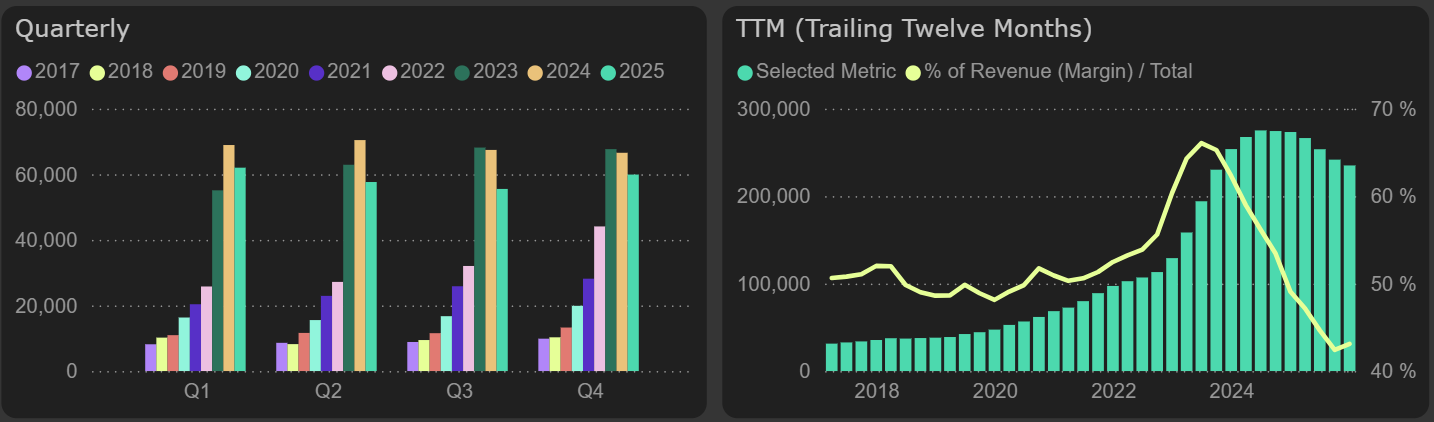

Net interest income showed a slight recovery in the fourth quarter of 2025, increasing by 8% compared to the third quarter. In the third quarter of the previous year, the net interest margin reached its lowest level at 53%, while in the fourth quarter it rose to 57%.

Compared to 2024, the trend remained unchanged: net interest income in the fourth quarter was 10% lower, while the full-year result was 14% lower.

Net interest income

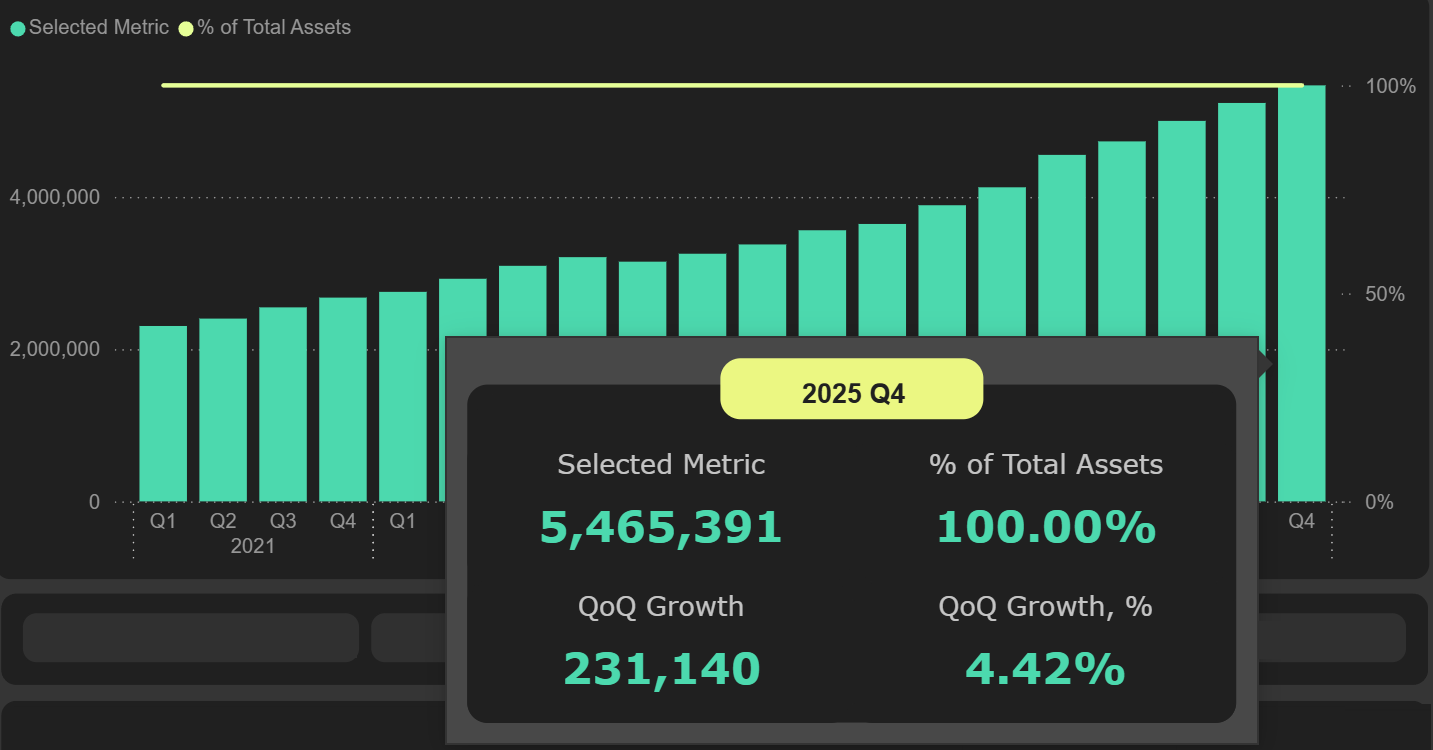

During 2025, the loan portfolio grew by €913M (+20% YoY), from €4.55bn to €5.47bn. In 2024, growth had been slightly stronger – €990M (+28% YoY). Despite the expansion of the loan portfolio, the decline in Euribor had a stronger impact, resulting in interest income being 6% lower in 2025 compared to 2024.

Loan portfolio

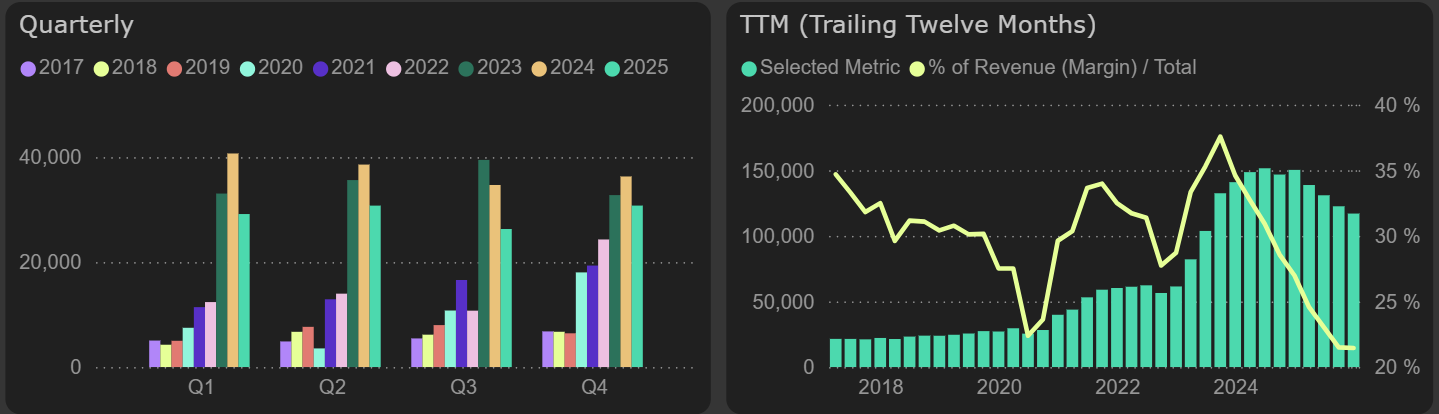

Last year, as net interest income declined, the increase in personnel expenses, which rose by 11% YoY, had a particularly negative impact. Other operating expenses also grew by 6% YoY. On the other hand, better credit quality had a significant positive effect on the results: in 2025, impairment losses amounted to just €1.5M, compared to €16.3M in 2024.

Net profit in the final quarter of 2025 declined more sharply than net interest income, falling by 15% compared to a year earlier. In total, net profit for 2025 amounted to €117M, which is 22% lower than in 2024.

Net profit