Coop Pank 2025 Q4 financial review

Shift in trajectory

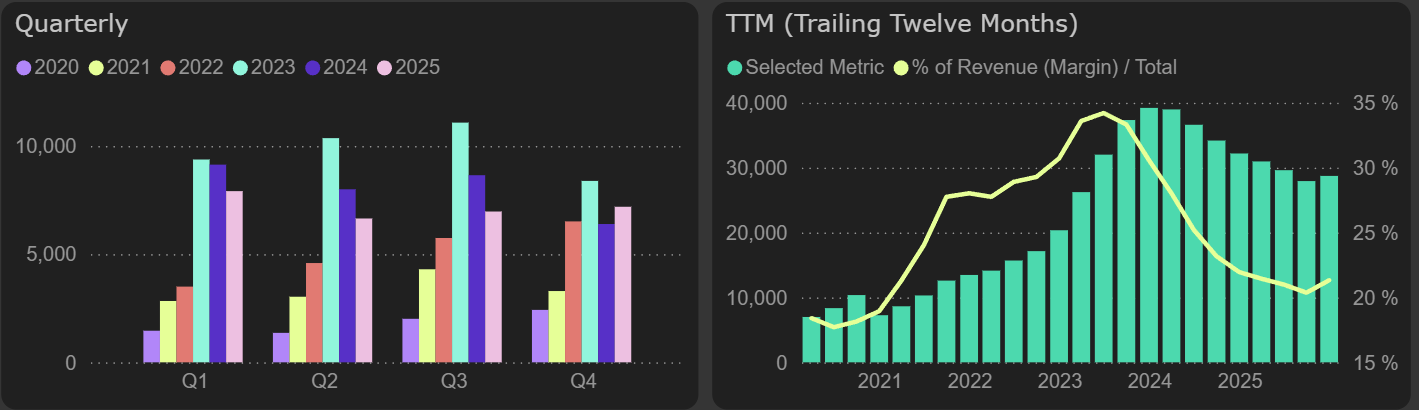

Coop Pank's net profit for the last quarter of 2025 showed a change in trajectory that had been ongoing since the beginning of 2024. In the fourth quarter of 2025, net profit increased by 12% compared to 2024, but remained lower than the record levels of 2023. The growth in the fourth quarter of 2025 was mainly driven by €579K higher other operating income and €779K lower impairment costs compared to the same quarter of 2024.

Overall, €28.7M of net profit was earned in 2025, which is 11% lower than in 2024. Profit was pressured by lower net interest income due to decreased interest income, together with higher expenses for staff (+4% YoY), depreciation (+15% YoY) and income tax (+30% YoY).

Net profit

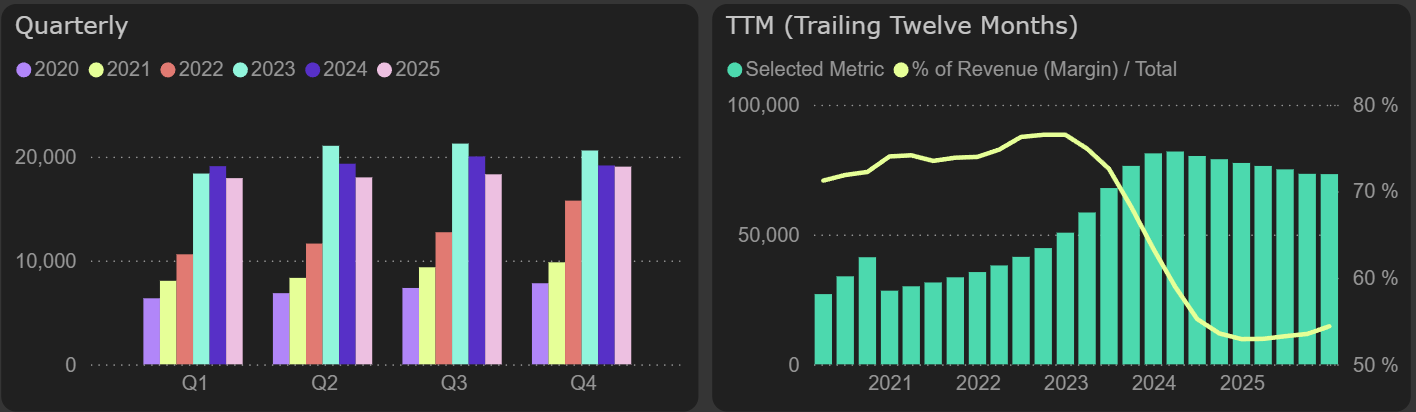

In 2025, Coop Pank's annual net interest income was 5.5% lower than in 2024, but this decline was smaller than LHV Group’s – 14% YoY.

A positive development is that in the fourth quarter of 2025, the decline in net interest income stabilized — it was almost the same as in 2024. Quarter-on-quarter growth in 2025 is also visible: in the fourth quarter, net interest income was 4% higher than in the third quarter. LHV Group showed a similar trend, although slightly more pronounced, with growth of 8% QoQ.

Net interest income

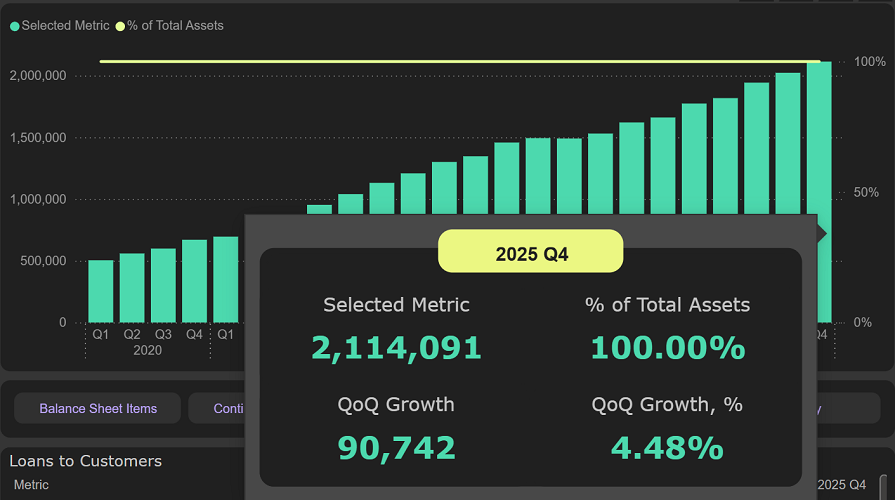

Coop Pank's loan portfolio growth rate in 2025 was very similar to LHV Group's, reaching 19%. During 2025, the loan portfolio increased by €340M, reaching €2.11bn at the end of the year.

Loan portfolio

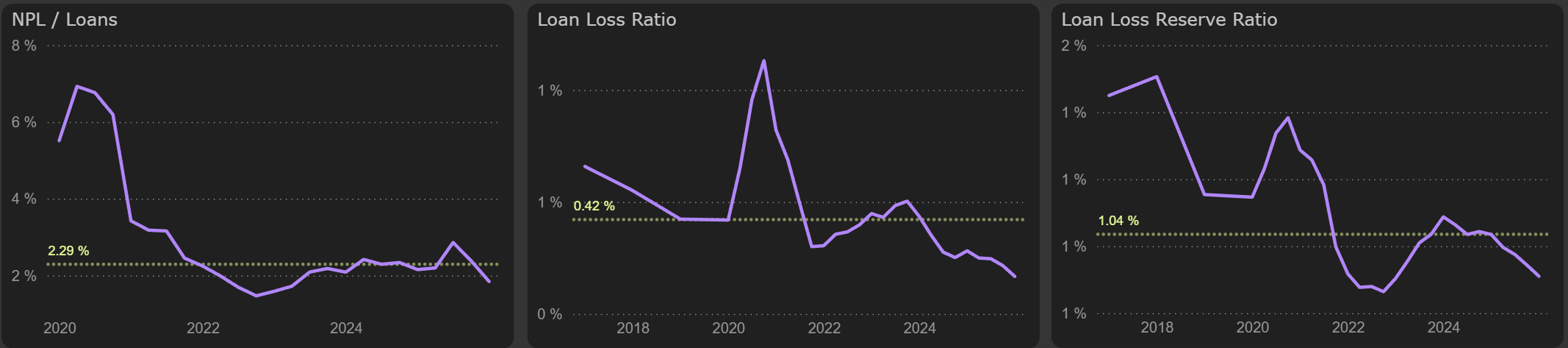

In 2025, fewer impairment costs were accrued, bringing the loan loss ratio to its best historical level — 0.17%.

Credit quality metrics