Merko Ehitus 2024 Q4 financial review

Strong year-end finish with margins skyrocketing

The fourth quarter of 2024 was another successful period for Merko Ehitus, although the growth rate was slower compared to the third quarter. The financial result growth was driven by both increased profitability and revenue.

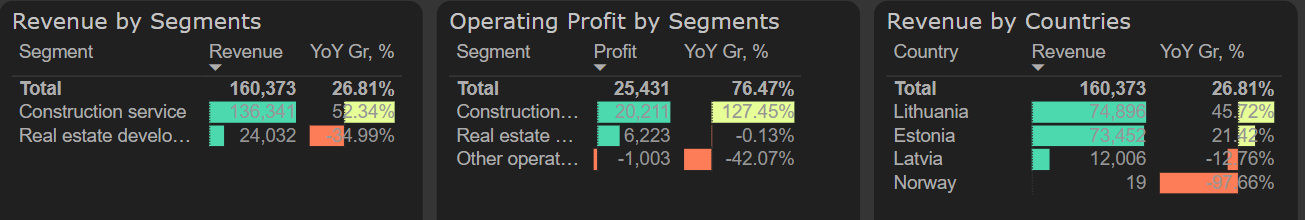

Revenue grew by 26.8% YoY in Q4, driven primarily by strong performance in the construction segment. Lithuania market stole the show, with revenue more than doubling – from €115.2 million in 2023 to €283.6 million in 2024. In Estonia, after three consecutive quarters of revenue decline, the fourth quarter saw a 21% YoY increase. However, it is important to note that the comparison period – the fourth quarter of 2023 – was relatively weak.

Results by segments and countries, 2024 Q4

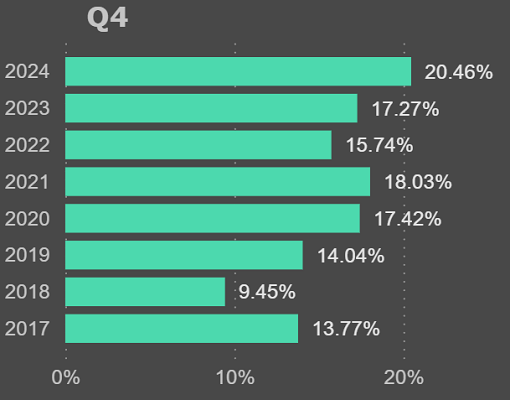

The gross margin in Q4 stood at 20.46%, which, although slightly lower than in the third quarter of 2024 (22.48%), still remained at a record level. Marketing and administrative expenses grew by 8% YoY, but their increase was significantly slower than revenue growth. The company’s net profit for 2024 grew by 40.7%, reaching €64.6 million.

Q4 gross margin

New contracts: the key challenge?

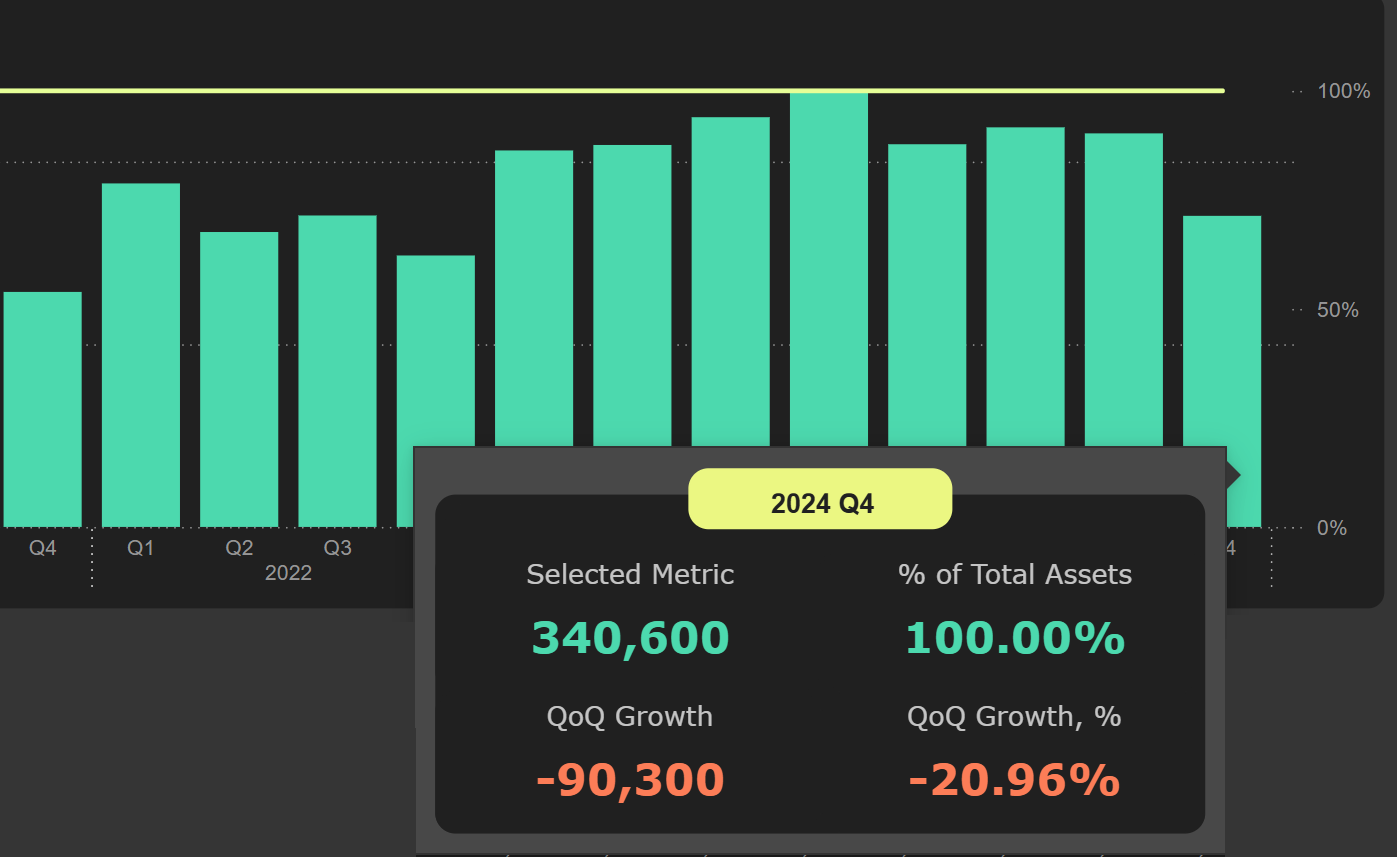

New orders remain the weakest part of the results – contracts signed in the fourth quarter amounted to €45.9 million, leading to a decrease in the order book to €340.6 million by year-end. Throughout 2024, the company signed new contracts worth €338 million, which is 32.5% less than in 2023, when the total value of signed orders reached €500.8 million.

Order book

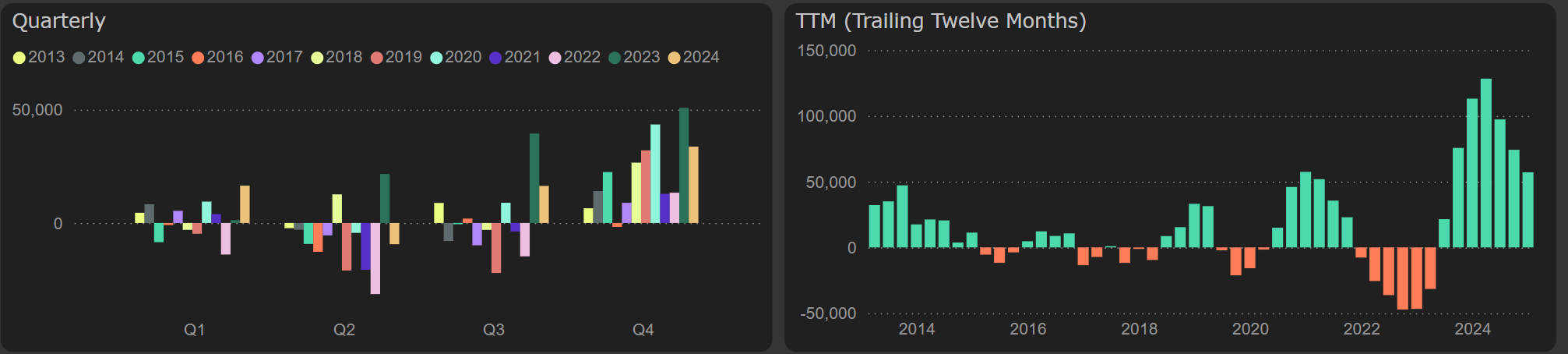

In 2024, the company generated €57 million in free cash flow. Although a declining trend is observed, it was primarily driven by the positive impact of working capital in the second half of 2023. Strong financial results create favorable conditions for maintaining or even increasing dividend payments, given the exceptionally comfortable debt level (gearing ratio of 13.14%) and a high cash level in balance sheet of €91.9 million.

Free cash flow

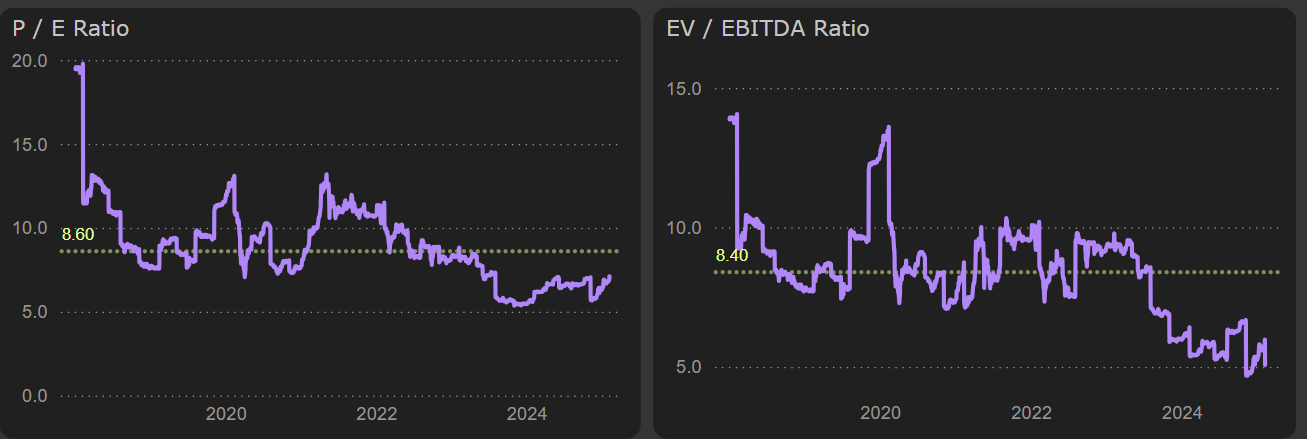

Valuation metrics remain at a relatively low level in the context of the company: EV/EBITDA at 5.03x and P/E at 6.96x.

Valuation metrics: P/E and EV/EBITDA