LHV Group 2024 Q4 financial review

Positive results despite cost pressure

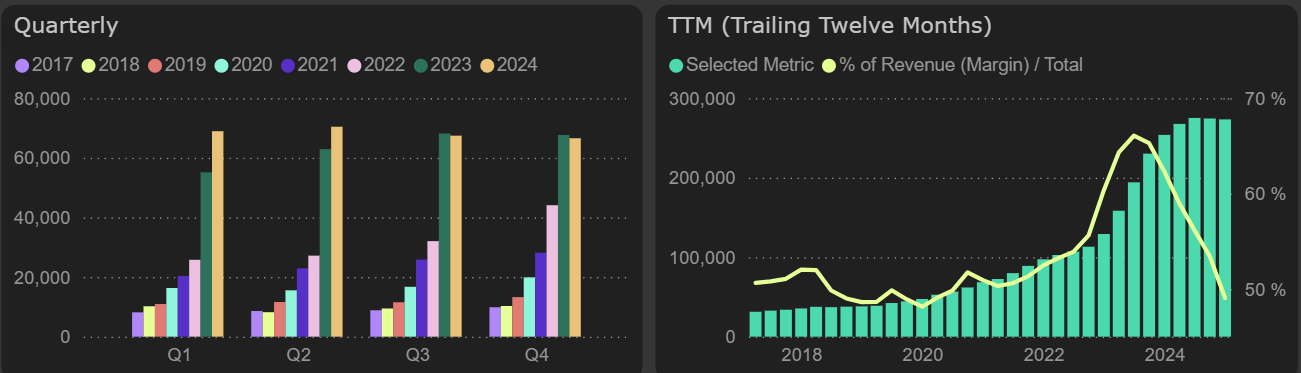

The end of 2024 looks fairly good for LHV Group, despite the negative impact of EURIBOR. In the fourth quarter, the loan portfolio grew by 10%, allowing the company to nearly maintain its net interest income at the previous year's level – with change of just -1.7% YoY, despite a significant margin decline. The net interest margin contracted noticeably not only compared to 2023 but also to previous quarters of 2024: in the fourth quarter, it stood at 41% compared to 50% in the third quarter, 53% in the second, and 54% in the first quarter.

Net interest income

Throughout 2024, LHV Group's loan portfolio grew by 28% – from €3.6 billion at the end of 2023 to €4.6 billion at the end of 2024.

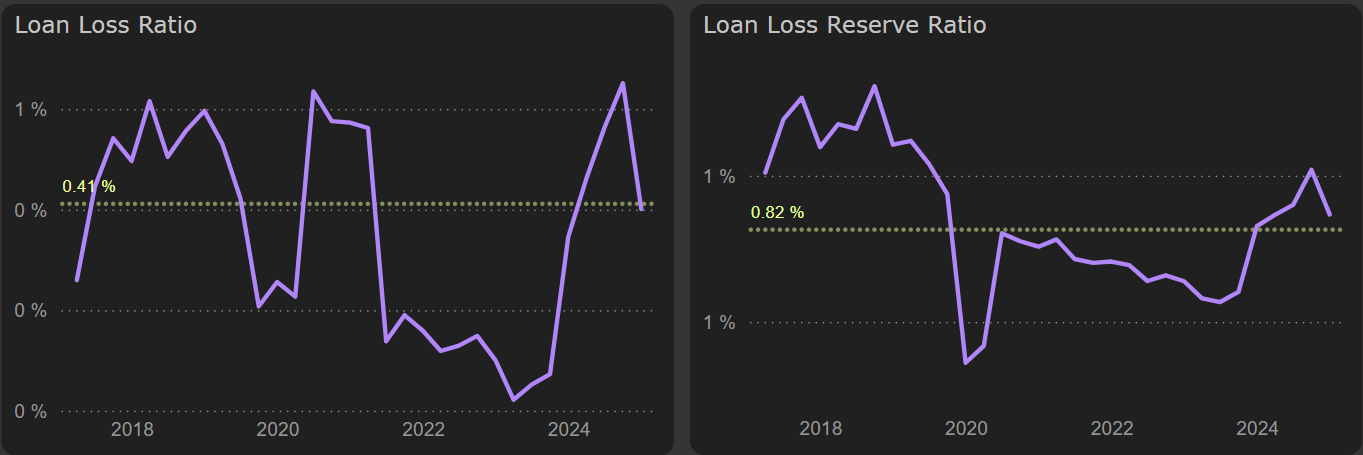

A positive change is also evident in credit quality. Until the third quarter, a significant deterioration in credit quality was observed, but in the fourth quarter, the trend reversed due to a sharp decrease in impairment expenses. As a result, the loan loss ratio decreased to 0.4%.

Credit quality metrics

The decrease in impairment expenses led to a 10.8% increase in net profit in the fourth quarter of 2024 compared to the same period in 2023, when a record-high impairment expenses amount was recorded. However, profit before impairment expenses declined by 7.7% YoY this quarter, primarily due to rising staff costs.

In 2024, staff costs increased by 23.8% compared to 2023, and by 28.7% based on corrected data. The growth in net interest, net fee and commission income during the first half of 2024 contributed to the overall annual performance, with net profit rising by 6.6% YoY to reach €150 million.

Net profit

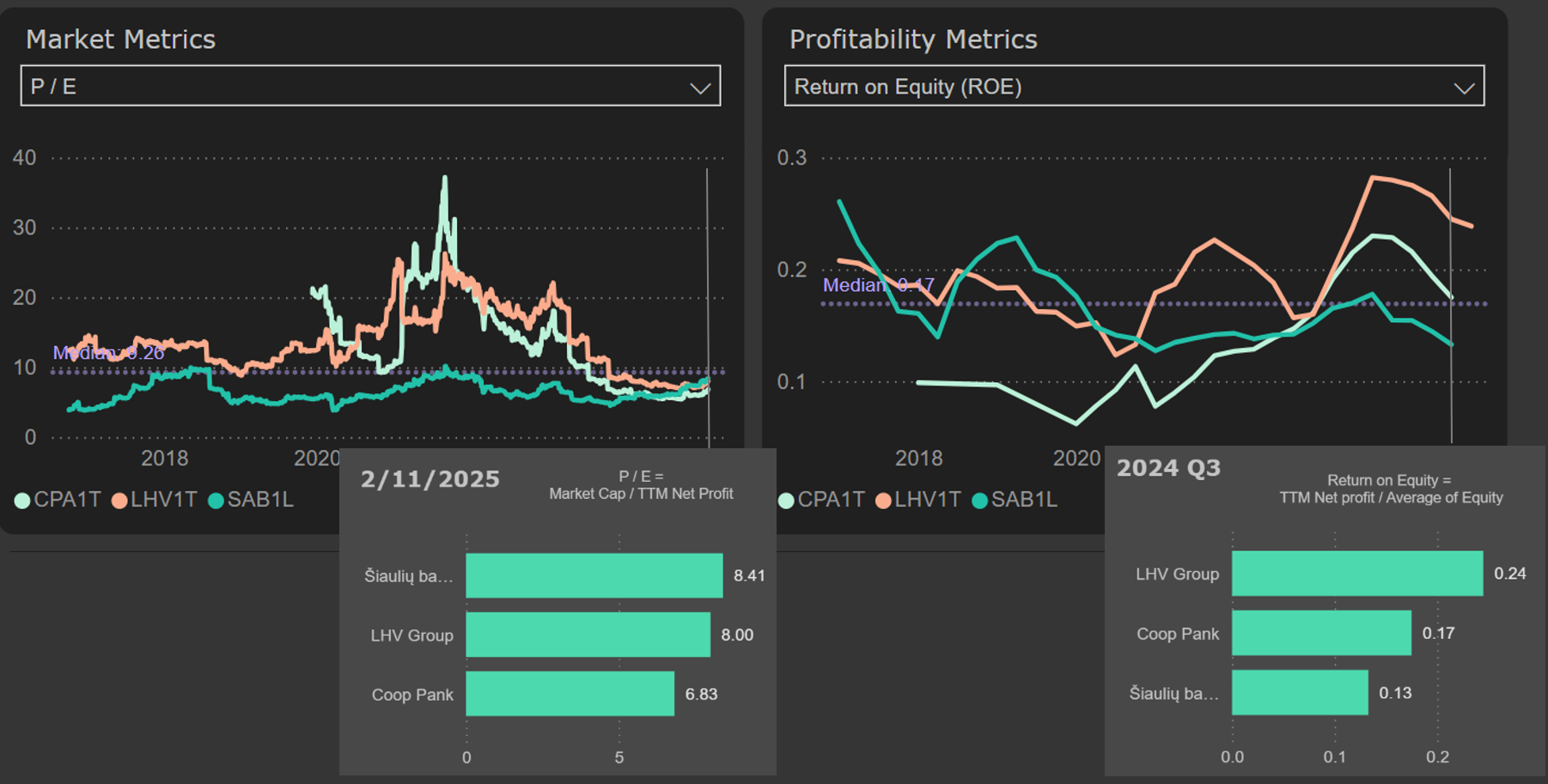

Valuation metrics within the company's context remain relatively low, but they are worse than those of Coop Pank. However, LHV Group's has a significantly higher ROE, which partially justifies this premium. The ROE contrast is especially notable with Šiaulių bankas, where the P/BV discount has decreased and P/E of Šiaulių bankas now exceeds that of LHV Group.

Comparison between banks: P/E vs. ROE