Tallink Grupp 2025 Q1 financial review

Waves of financial storm

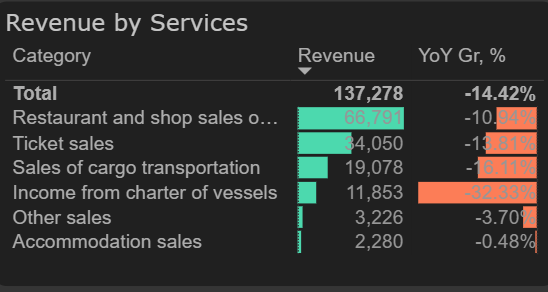

Tallink Grupp ended the first quarter of 2025 – traditionally a period of weaker financial performance – with a net loss of €33 million. The results were negatively affected by both declining sales and challenges in cost management. The company’s revenue has been steadily declining since peaking in the middle of 2023, a level that still fell short of pre-pandemic figures. In Q1 2025, revenue was 14% lower compared to the same period last year. Revenue contraction this quarter was recorded across all services. Particularly concerning is the continued decline in income from vessel chartering, which once again showed the steepest drop among all services – just like last year – even though it was the main source of growth back in 2023.

Revenue by services

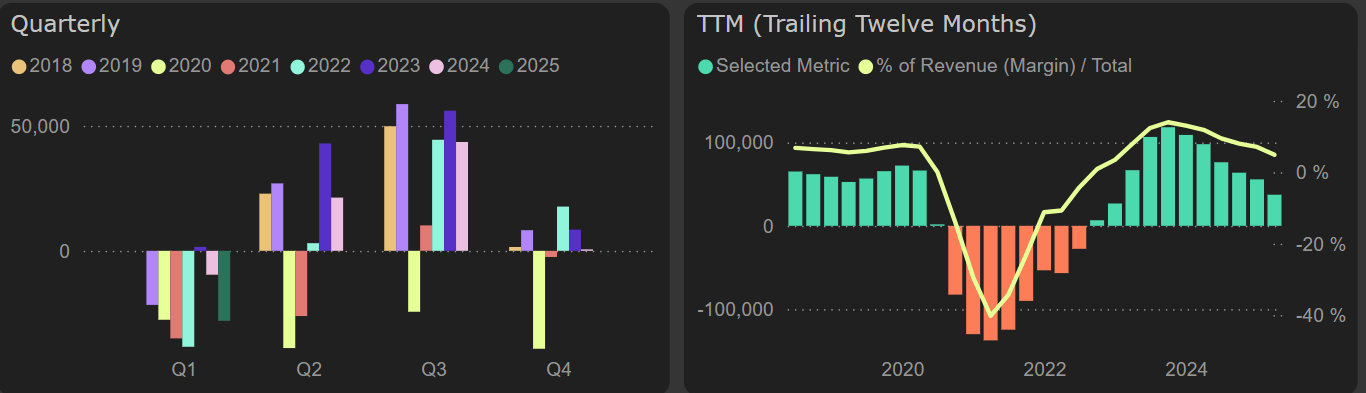

In the first quarter of 2025, the cost of sales declined significantly slower than revenue – only 3% YoY – meaning costs actually exceeded the generated revenue. Additional pressure came from a 3% YoY increase in sales and administrative expenses.

In the first quarter of last year, the results were strongly supported by a one-off gain from asset sales. However, even after excluding this one-time effect, Q1 2025 still appears weaker compared to Q1 2024.

Operating profit without other operating income

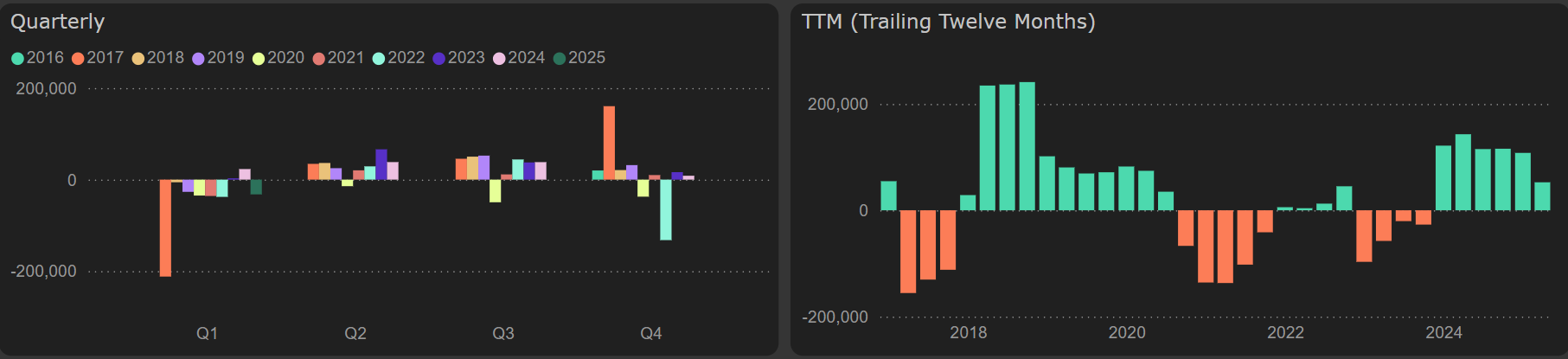

Due to the negative results in the first quarter of 2025, the annual funds from operations (FFO) decreased to €86 million. Over the past year, the company invested only €29 million in fixed assets, so despite weakening operating performance, annual free cash flow still stands at €53 million (an 11.6% yield).

However, the annual investment need to offset depreciation amounts to around €80 million (excluding leased assets), which essentially matches the current FFO. This means that free cash flow would be nearly wiped out just to maintain its asset base.

Free cash flow