Telia Lietuva 2025 Q1 financial review

Profit jump marks the quarter

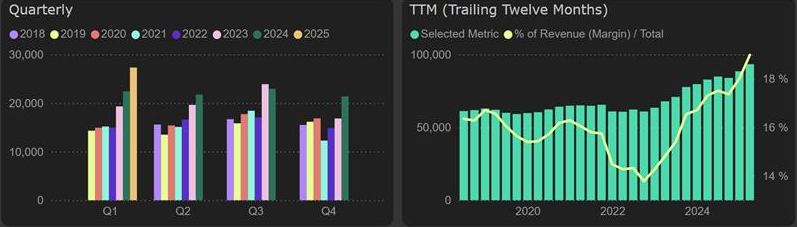

Telia Lietuva started 2025 successfully, demonstrating strong first-quarter results. The company’s revenue dynamics remained stable, with modest yet consistent growth. However, the standout feature of the quarter was a significant profit surge, driven by a noticeably improved profit margin. The operating margin increased from 18.8% in Q1 2024 to 22.8% in Q1 2025.

The main driver behind the improved profitability was a 6.8% YoY decrease in the cost of goods and services (–€3 million), amid stable revenues. Other operating expenses declined even more – by 7.7% YoY – but their absolute value impact was smaller (–€1.1 million) compared to the cost of goods and services.

Although employee expenses continued to rise slightly (1.5% YoY), the pressure was significantly lower than in the previous year due to a reduced headcount.

Operating profit

The company’s net profit for the first quarter grew by 24% compared to the same period last year. On an annual basis, net profit reached a record-high of €76 million. However, this result was also influenced by non-cash expenses – reduced depreciation – therefore, EBITDA grew at a slightly slower pace of 10% YoY.

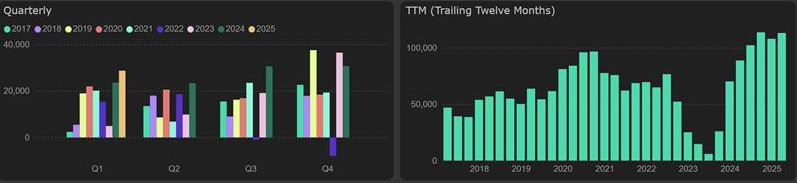

Free cash flow

Free cash flow also increased – the current annual level stands at €113 million, which corresponds to an 11% yield. However, working capital also had a positive impact on free cash flow – over the past year, Telia Lietuva unlocked around €17 million. Additionally, the current level of capital expenditures is slightly below depreciation, so from a more conservative perspective, the free cash flow yield could be estimated at around 9–10%, which still represents a very attractive level.