Tallink Grupp 2025 Q4 financial review

Closes the year with a bang

Tallink Grupp’s Q4 2025 results confirm a recovery trend in the second half of the year, even though the full-year outcome still reflects a weak start to 2025.

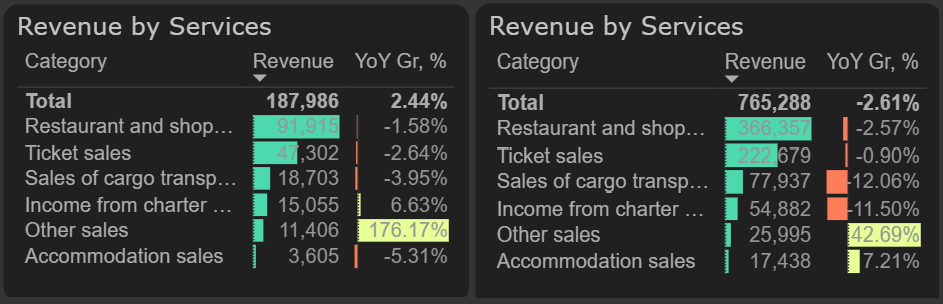

In 2025, the company’s revenue remained stable: annual revenue were only 2.6% lower than in 2024 due to the negative impact of the first quarter, while fourth quarter turnover was 2.4% higher than a year earlier. However, the stability in revenue was mainly supported not by the company’s core services, but by other, unspecified services.

Revenue by services, 2025 Q4 and 2025

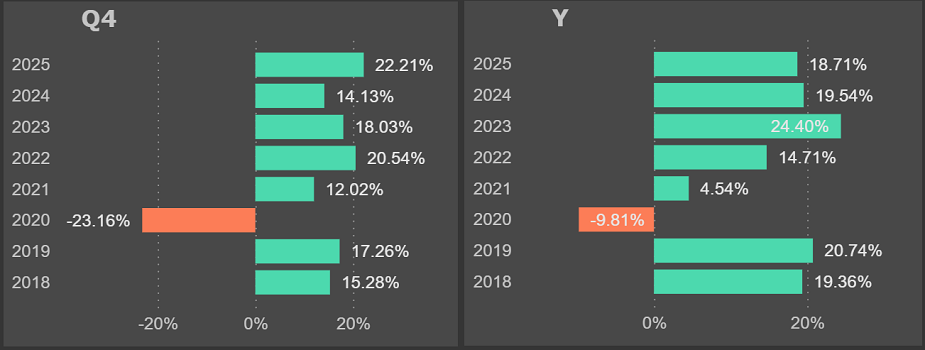

Although revenue increased in the fourth quarter of 2025, cost of sales declined, resulting in a significant jump in the gross margin compared to the same quarter in 2024. Accordingly, fourth quarter gross profit was 61% higher than a year earlier.

The annual gross margin was slightly lower than in 2024.

Gross margin, Q4 and yearly

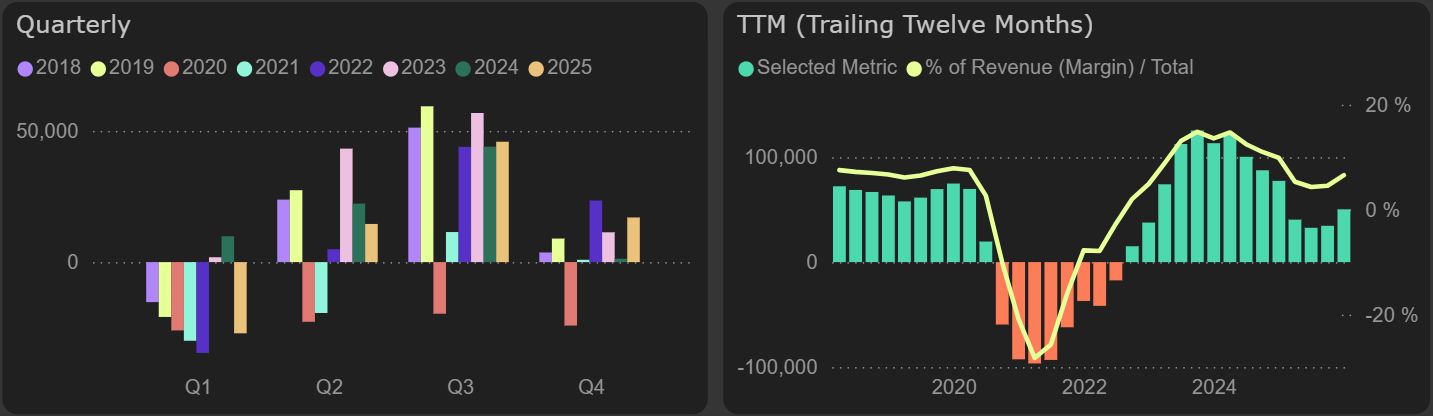

Despite operating expenses in the fourth quarter of 2025 being 7% higher than in 2024, mainly due to increased administrative costs, operating profit was significantly higher than in the same quarter of 2024. In addition, €1.7M more in other operating income was recognized this quarter compared to a year earlier. Operating profit in the fourth quarter of 2024 was just €1.3M, whereas in the same quarter of 2025 it was 13 times higher at €17M.

Overall, operating profit in 2025 was one-third lower than a year earlier, amounting to €50M, compared to €77M in 2024. Although the 2024 result was significantly boosted by asset sale, even after excluding the other operating income item, operating profit in 2025 was still around 20% lower than in 2024.

Operating profit

As financial liabilities decreased, the company’s financial expenses continued to decline and in 2025 were 25% (€7M) lower than a year earlier.

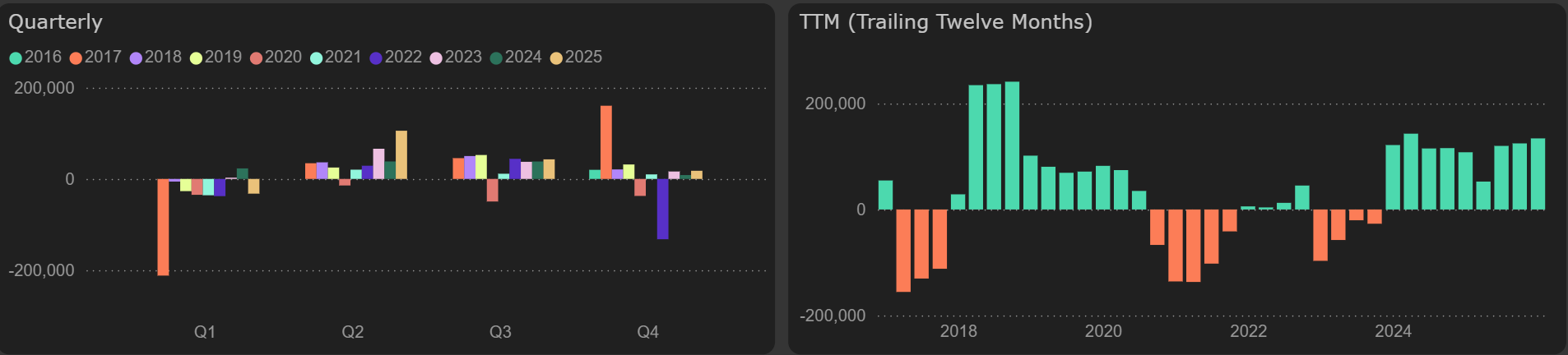

Free cash flow in 2025 amounted to €134M. However, more than half of this amount (€79M) was related not to the company’s core operations, but to assets sale. Funds from operations in 2025 was €82M, which is 22% lower than in 2024.

Free cash flow