Akola Group 2025 Q4 financial review

A fading spark

The second quarter of the FY2025/2026 for Akola Group was weaker than the previous financial year, both in terms of restated and actual figures. The main pressure was caused by lower turnover and, at the same time, higher operating costs. The overall six-month picture remains more balanced due to a strong in the first quarter of 2025/2026.

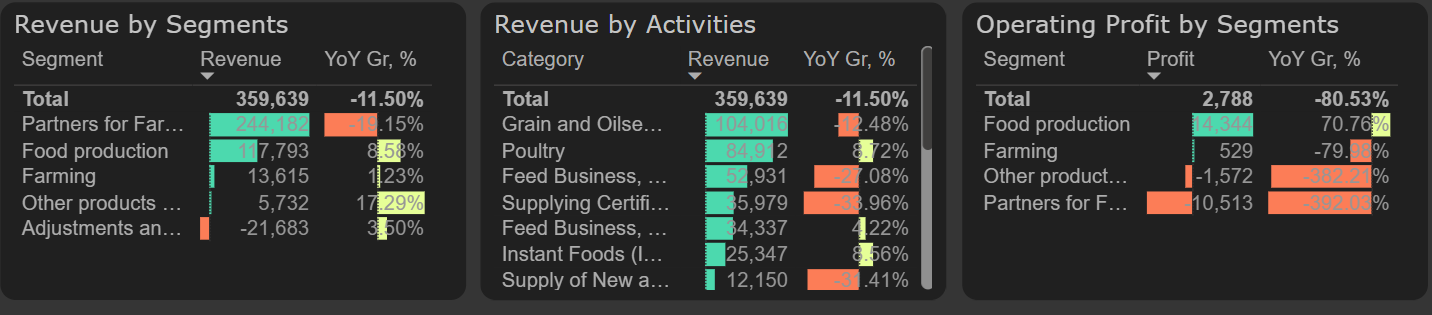

Revenue in the second quarter of the FY 2025/2026 were 12% lower than a year ago, and 6% lower on a restated basis. Adjustments were made in the seeds, plant care products and fertilizers business areas, where the turnover reported in 2024/2025 was reduced by €29M. However, even on an restated basis, the revenue decline was driven by the parters for farmers segment, while other company segments grew during this quarter.

Results by segments, 2025/2026 Q2 (2025 Q4) (actual data)

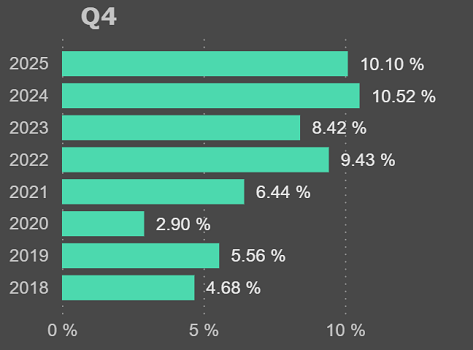

It is positive that in this quarter the cost of goods sold decreased at a similar pace as revenue, so the gross margin remained high in the company’s context, reaching 10%. Accordingly, gross profit declined roughly in line with revenue – down 15% YoY (6% YoY on a restated basis).

Gross margin, 2025/2026 Q2 (2025 Q4)

With lower turnover, a significant pressure on results in the second quarter of 2025/2026 came from a jump in operating expenses, which increased by 18% compared to the previous financial year. The rise in selling expenses was driven by higher personnel and marketing costs. General and administrative expenses increased mainly due to the receivables impairment and provisions.

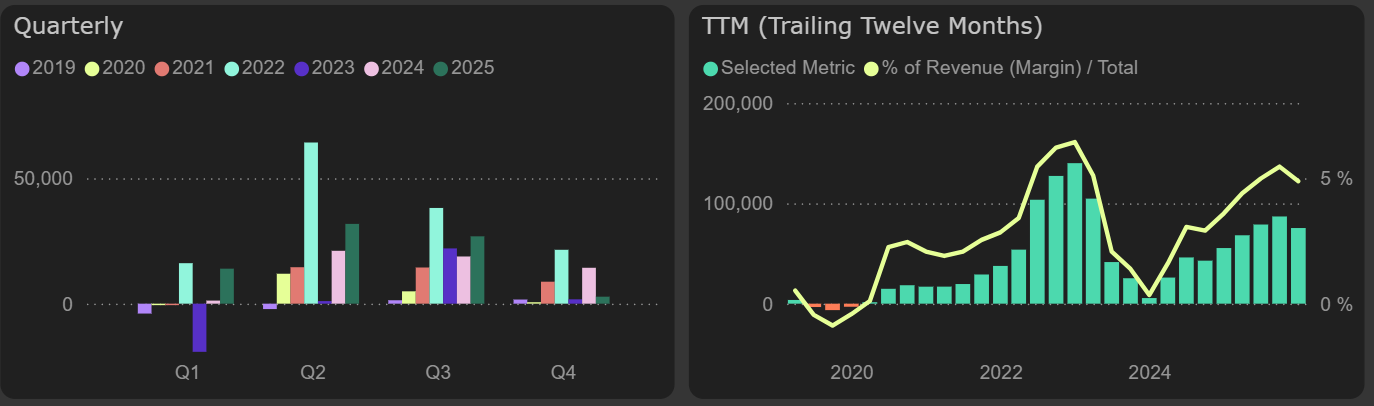

Operating profit in the second quarter of 2025/2026 amounted to only €2.8M, compared to €14.3M a year ago (€10.5M on a restated basis). This quarter was the weakest for the partners for farmers segment, which recorded an operating loss of €10.5M. In contrast, the food production segment showed growth not only in turnover but also in margin, resulting in operating profit for this segment in the second quarter of 2025/2026 being 71% higher than a year ago.

Operating profit

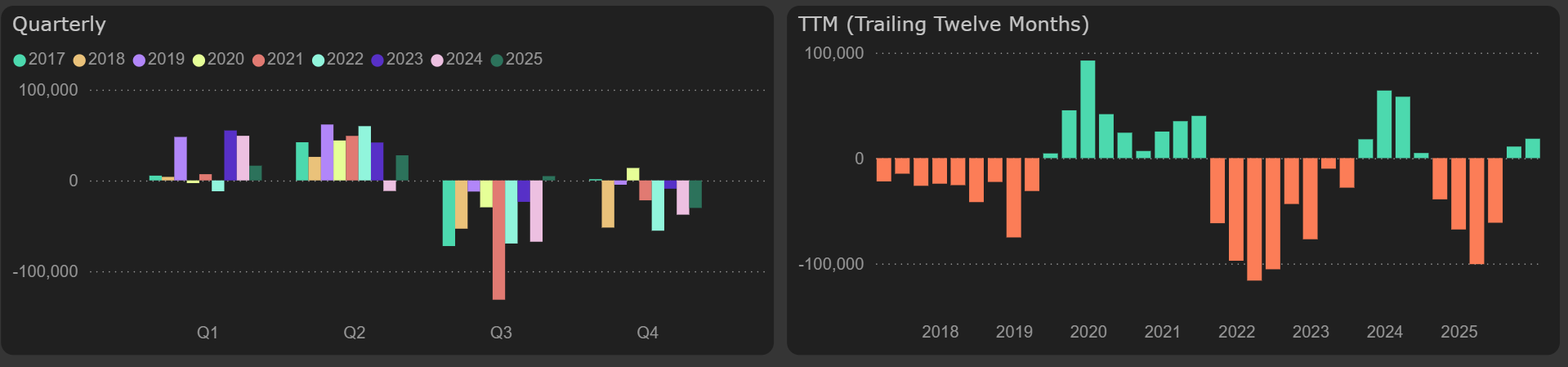

Despite a weaker quarter, free cash flow remained positive at €18M.

Free cash flow