Vilvi Group 2025 Q1 financial review

Raw milk prices hit profitability

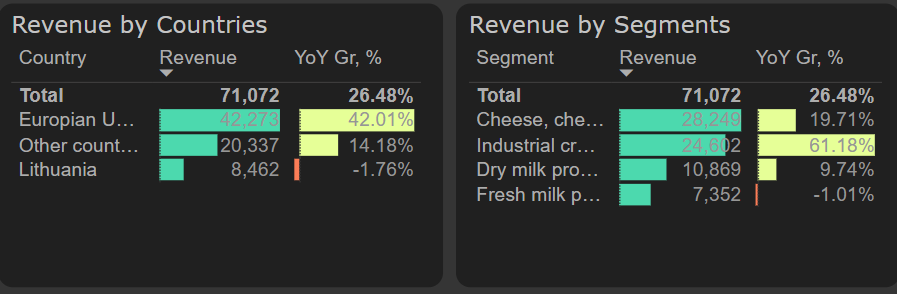

In the first quarter of 2025, Vilvi Group’s revenue grew rapidly – by 26% compared to Q1 2024 and 11% compared to Q4 2024. As in the previous year, the main driver of sales growth remains exports to European Union countries (+42%), with the industrial cream segment leading among product groups (+61%).

Revenue by countries and segments, Q1 2025

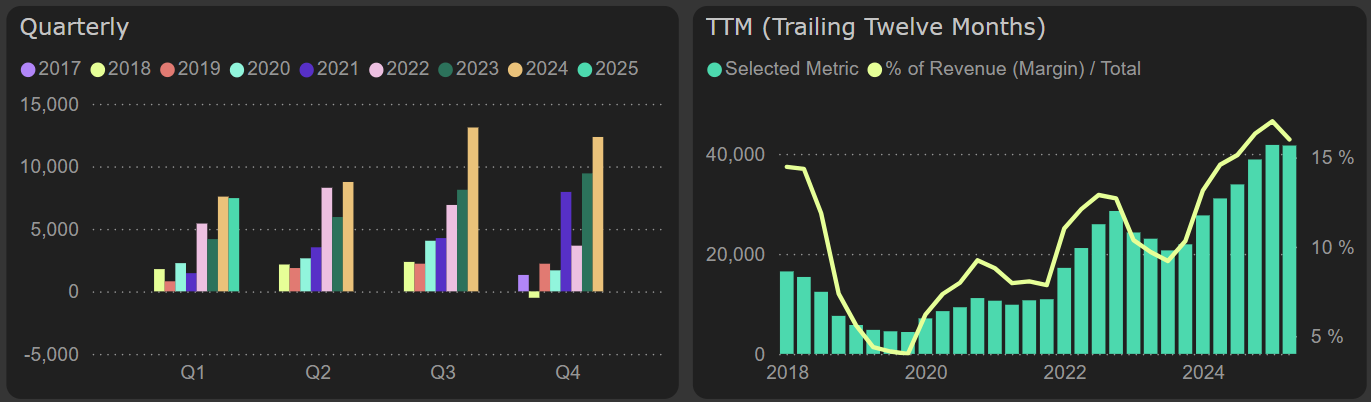

Despite higher revenue, the company’s profit declined. The main reason was a sharp increase in raw milk prices, which put pressure on the company’s gross margin. The gross margin contracted by 3 % – from 13.5% in Q1 2024 to 10.5% in Q1 2025. Meanwhile, operating expenses were fairly well controlled, increasing at a similar pace to revenue – 23%. Nevertheless, the company’s EBITDA decreased by 6% YoY, while net profit saw an even steeper drop of 18% YoY.

Gross profit

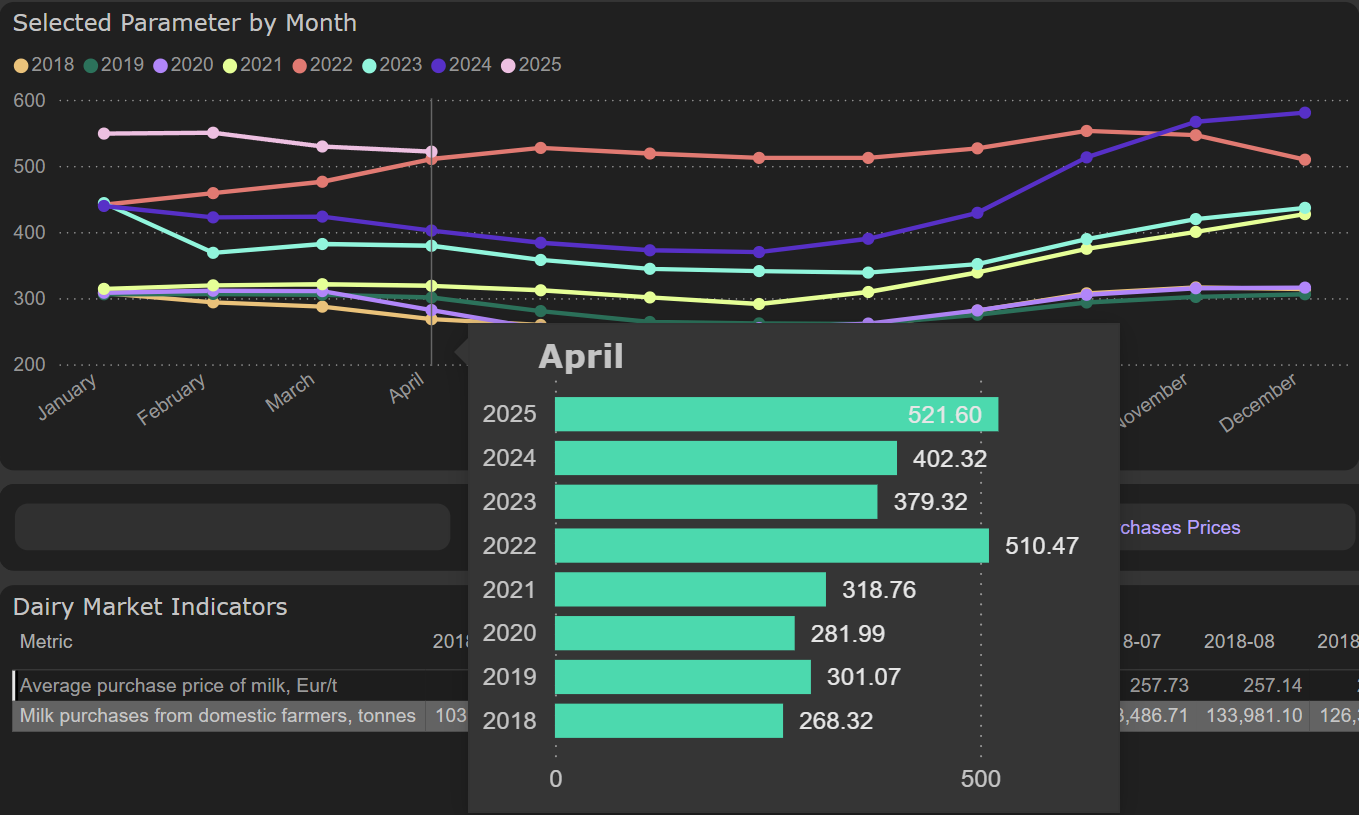

As is typical with the approach of summer, the raw milk price curve shows a slight decline compared to the beginning of the year. However, in April, raw milk prices remained 30% higher than during the same period in 2024, suggesting that the gross margin is also likely to remain weaker in the second quarter compared to the same period last year.

Average purchase price of milk, Eur/t

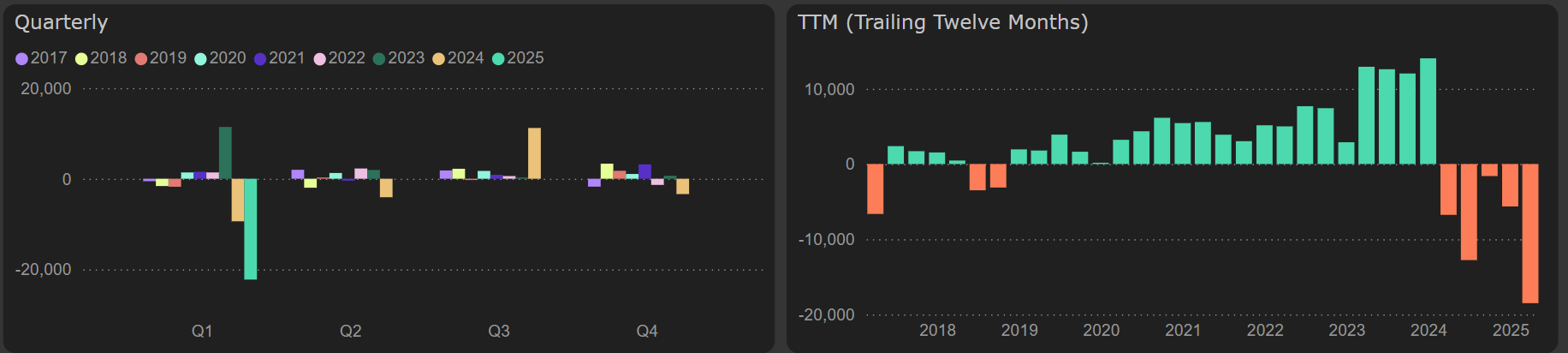

Cash flows were negatively affected by a €20M increase in trade and other receivables. Simultaneously, the company continued its active investments in fixed assets, keeping free cash flow in negative territory. As a result, financial debt increased, though the gearing ratio remains at a comfortable 50%.

Free cash flow

Recently, the company’s valuation multiples have risen slightly – P/E now stands at 5.5x, and EV/EBITDA at 5.4x. While these levels remain attractive, the projected pressure on gross margin may pose certain risks for next quarter’s results.