Pieno Žvaigždės 2024 Q3 financial review

Comeback after a weaker first half

Q3 delivered a recovery, showcasing stronger results compared to the second quarter. In a significant achievement, Pieno Žvaigždės maintained last year's performance levels in Q3, overcoming the profit decline experienced in the first half of the year.

In the third quarter, exports rebounded to 2022 levels, driving revenue growth, though at a moderate pace. While export growth for the period was 9% YoY, lower than Vilvi Group’s impressive 34%, it’s worth noting that Vilvi Group’s surge comes after a significant loss of export positions in 2023, making their recovery appear exceptionally pronounced.

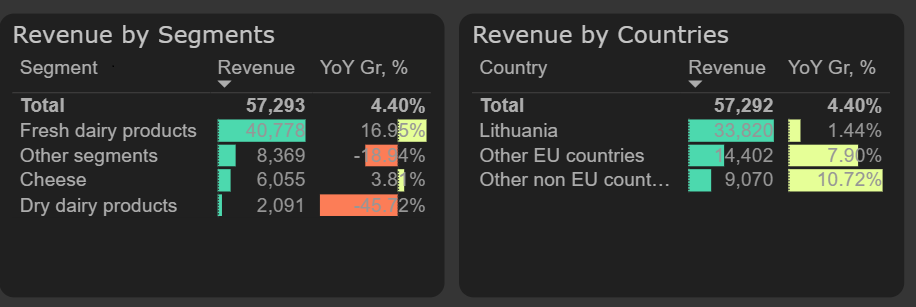

Revenue by segments and countries, 2024 Q3

Operating margin recovery

After weighing heavily on first-half results, the decline in operating margin stabilized in the third quarter, reaching 10% – close to last year’s levels. This recovery enabled the company to sustain its Q3 operating profit at nearly the same level as the previous year.

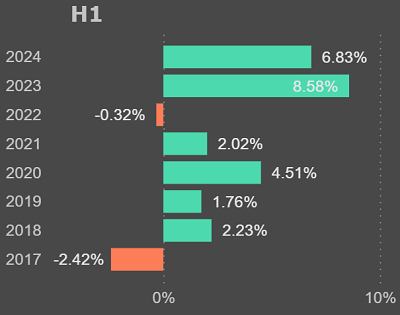

Operating margin, H1

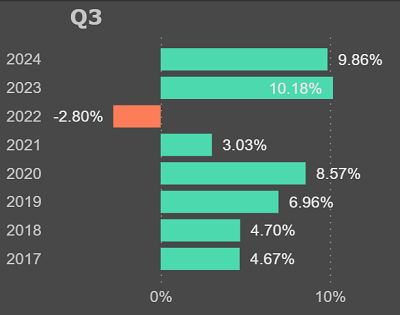

Operating margin, Q3

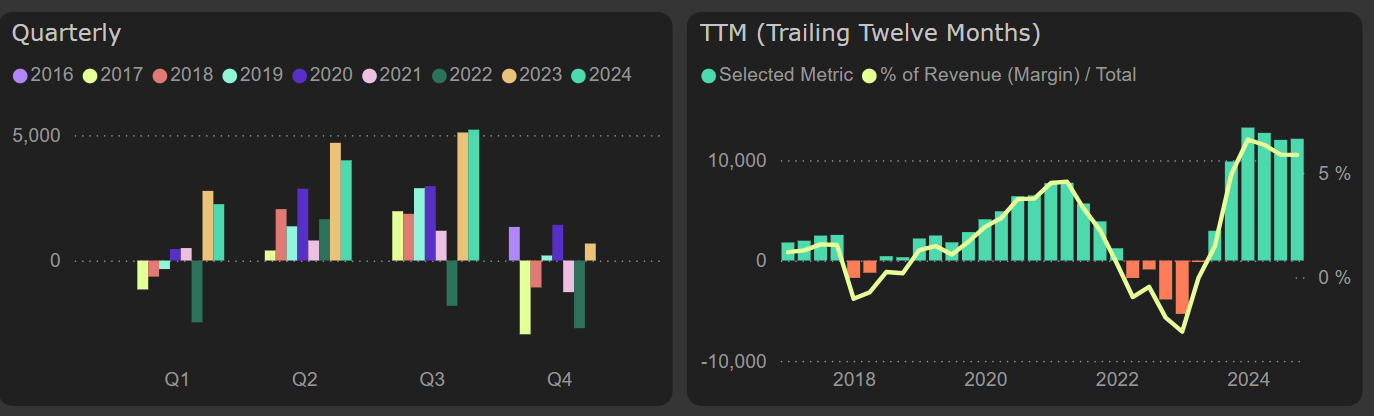

Net profit in the third quarter reached €5 million, keeping the annual figure steady at approximately €12 million. However, weaker performance in the first half of the year has left net profit for the nine-month period 9% below the same timeframe last year.

Net profit

Pressure on free cash flow

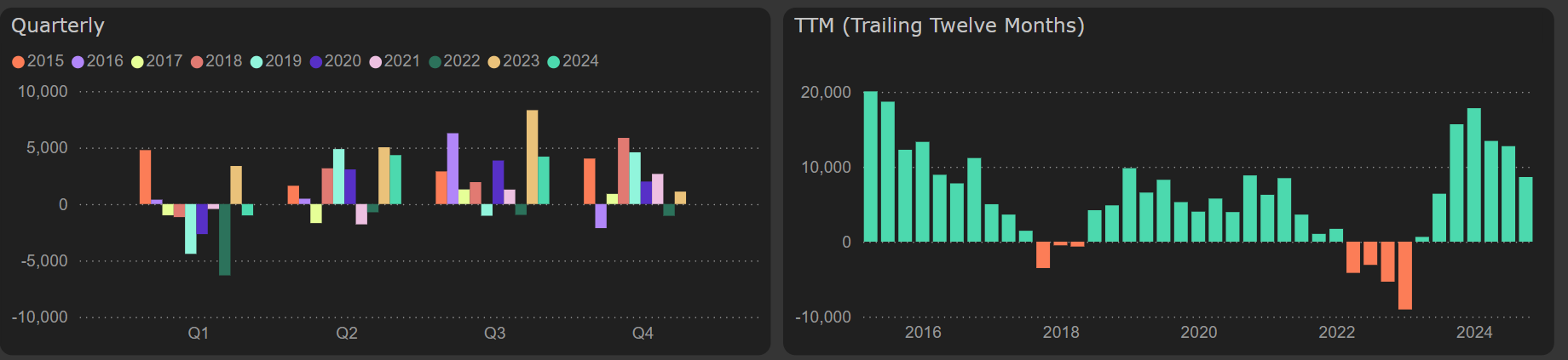

In the third quarter, the company generated €6 million in fund from operations, marking a 4% increase compared to last year. However, free cash flow decreased, primarily due to changes in working capital. In Q3 2023, €3.5 million was freed up from working capital, whereas Q3 2024 saw an additional €0.6 million required.

Change in working capital

After a dip between 2022 and the first half of 2023, fixed asset investments have returned to normal levels. As a result, the combined impact of these investments and changes in working capital led to a slight decrease in annual free cash flow, which stands at €8.6 million. However, given the low financial debt level, the company remains well-positioned to potentially maintain a dividend payout similar to last year, offering a dividend yield of 9%, though this will depend on future performance, which may be aggravated by rising raw milk prices.

Free cash flow

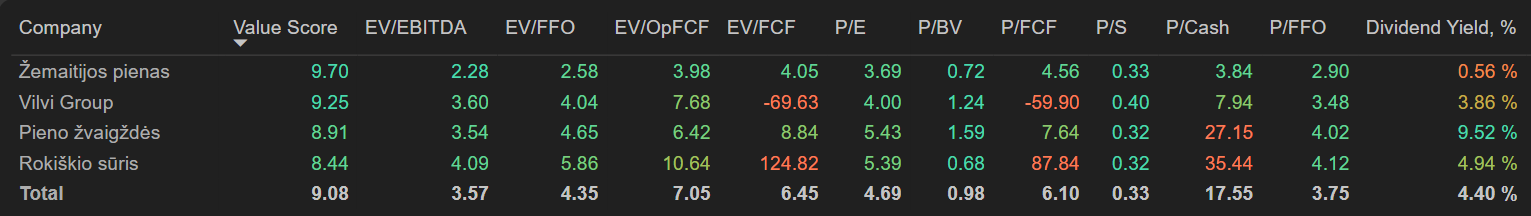

Pieno Žvaigždės valuation multiples remain solid, with a P/E ratio of ~5.4x and an EV/EBITDA of ~3.5x. Although it may not be the cheapest option compared to other dairy producers, but valuation metrics are among the lowest in the Baltic market.

Valuation metrics