Vilvi Group 2024 Q3 financial review

New heights with impressive results

Vilvi Group growth in the third quarter is exceptionally impressive – particularly in the significant surge in profits.

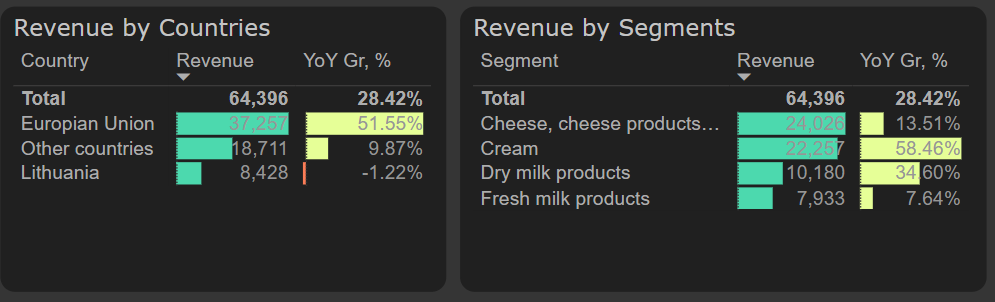

Cream and exports remain the key drivers behind robust revenue growth. Overall, revenue increased by 28% in the third quarter compared to last year. Notably, there is still visible QoQ growth – 6% increase compared to 2024 Q2.

Revenue by countries and segments, 2024 Q3

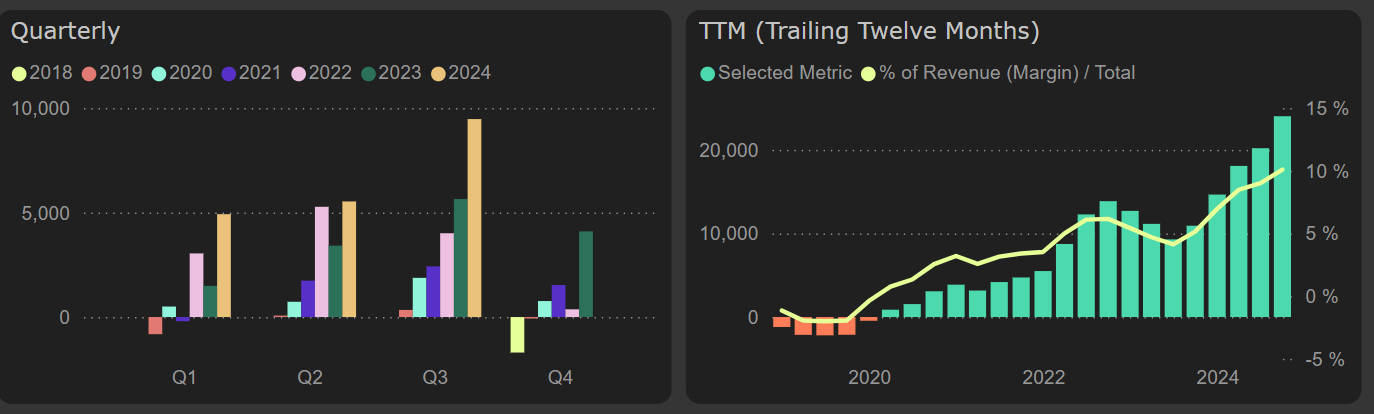

Gross margin – the star of the results

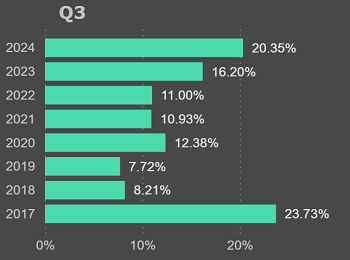

Gross margin reached a remarkable 20% in the third quarter, the highest level since 2017. This surge in profitability enabled the company’s gross profit to outpace revenue growth, climbing 61% YoY – more than twice the rate of revenue expansion. Gross profit for the third quarter soared to a record-breaking €13 million.

Q3 gross margin

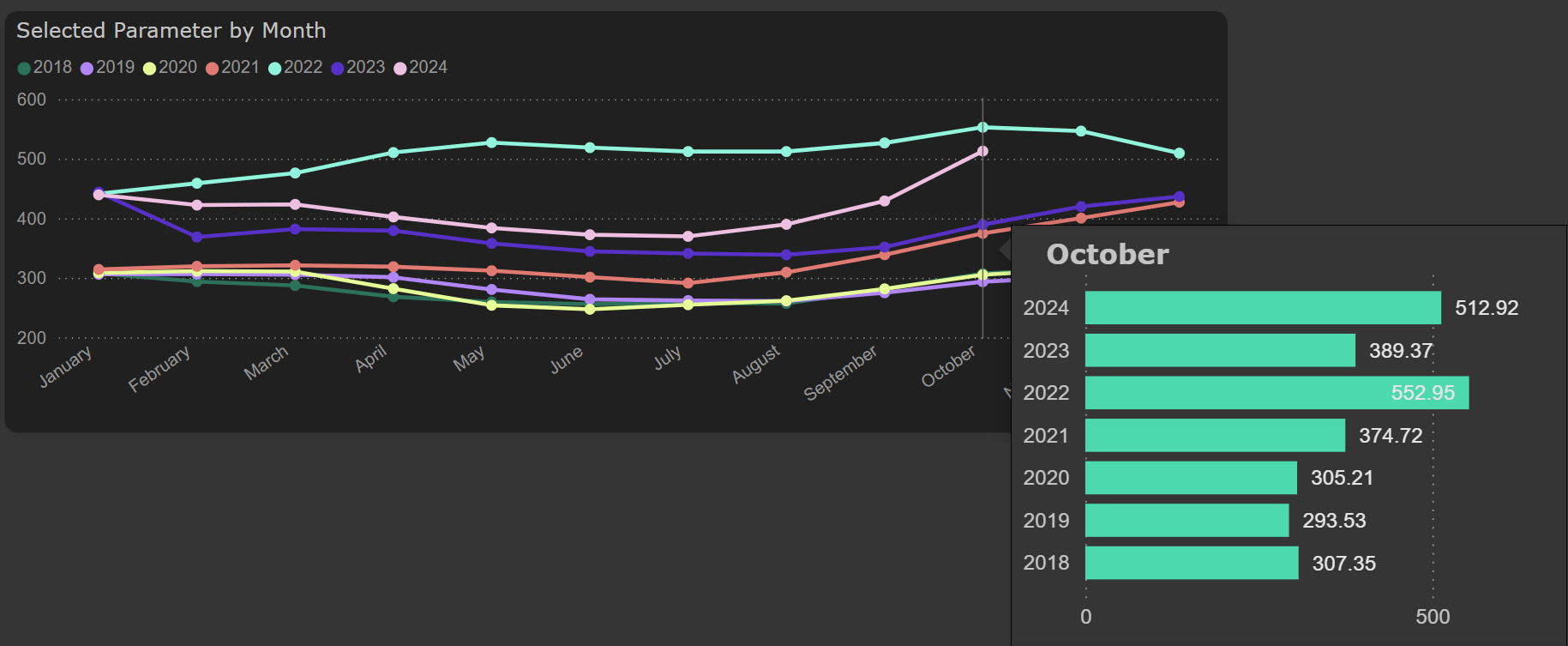

Vilvi Group gross margin over the past 12 months is 16%, and although there is a visible growth trend, but the continuation should be viewed with caution. Lithuanian statistics reveal that the average price of raw milk jumped particularly sharply in October. Therefore, if the price remains the same or even increases, it may negatively impact the gross margin in Q4 and slow profit growth.

Average purchase price of milk, Eur/t

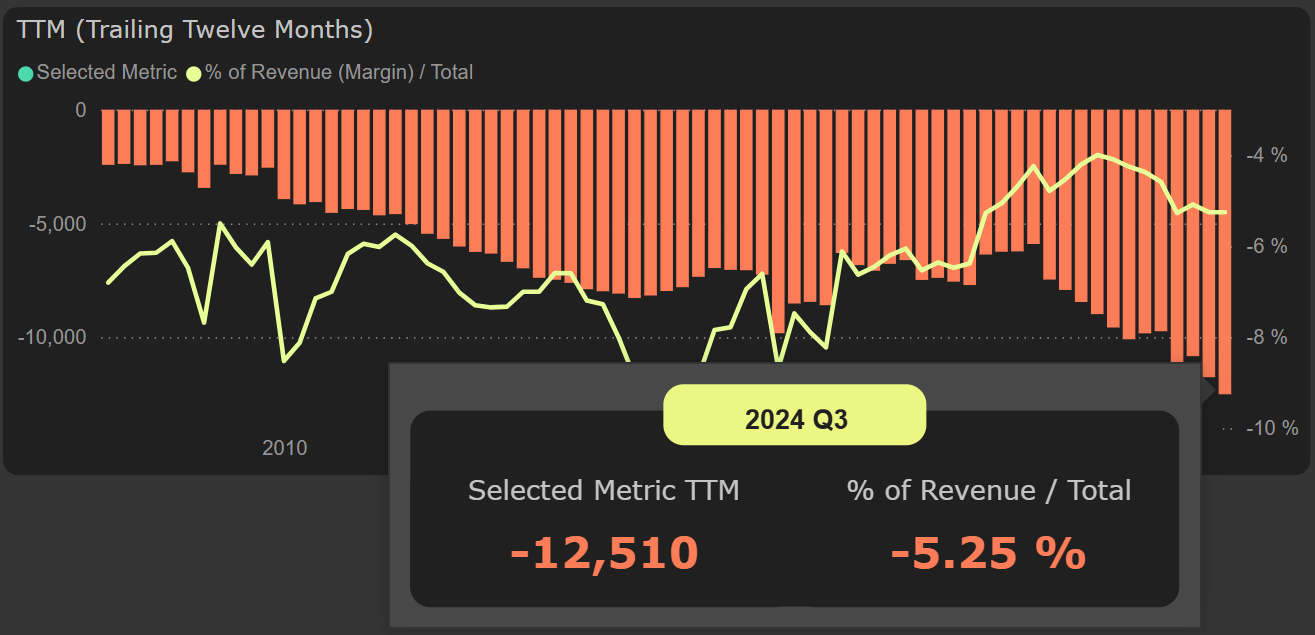

Other operating expenses – distribution and administrative expenses – were managed less efficiently than cost of goods sold. These expenses grew at a much faster pace than revenue, rising by 36% YoY. However, over the last 12 months, distribution and administrative expenses accounted for just 5% of revenue, which remains relatively low both historically and compared to competitors.

Distribution and administrative costs

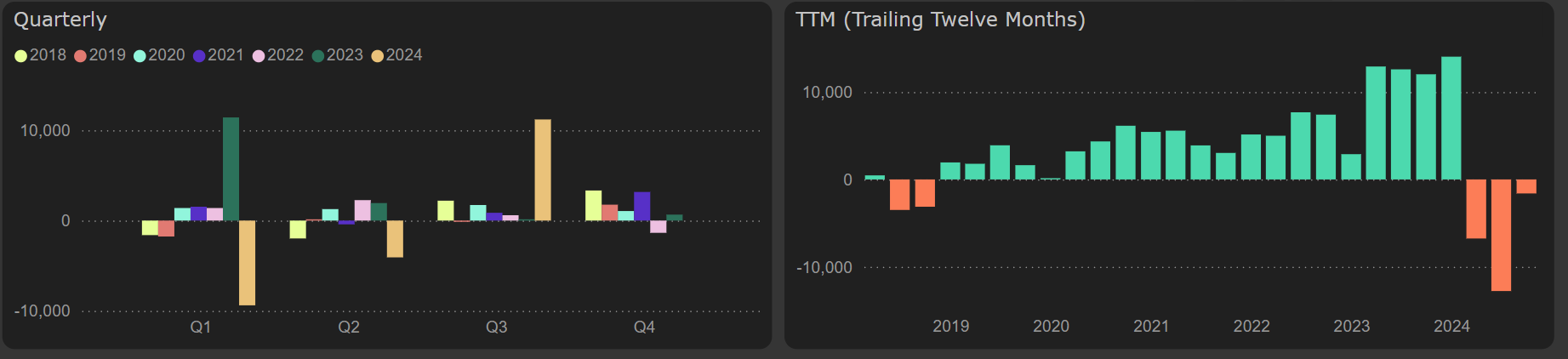

The third quarter delivered a net profit of €9 million, marking a 68% increase compared to last year. The growth over the first nine months is even more remarkable, with a 89% YoY rise. Over the past year, the company achieved a total net profit of €24 million.

Net profit

Free cash flow turning toward the green

Funds from operations are equally impressive, with Q3 growth reaching 74% YoY and a robust 12-month cash flow of €27.6 million. In the third quarter, as investments slowed, the company generated €11 million in free cash flow and is on track to enter positive 12-month territory.

Free cash flow

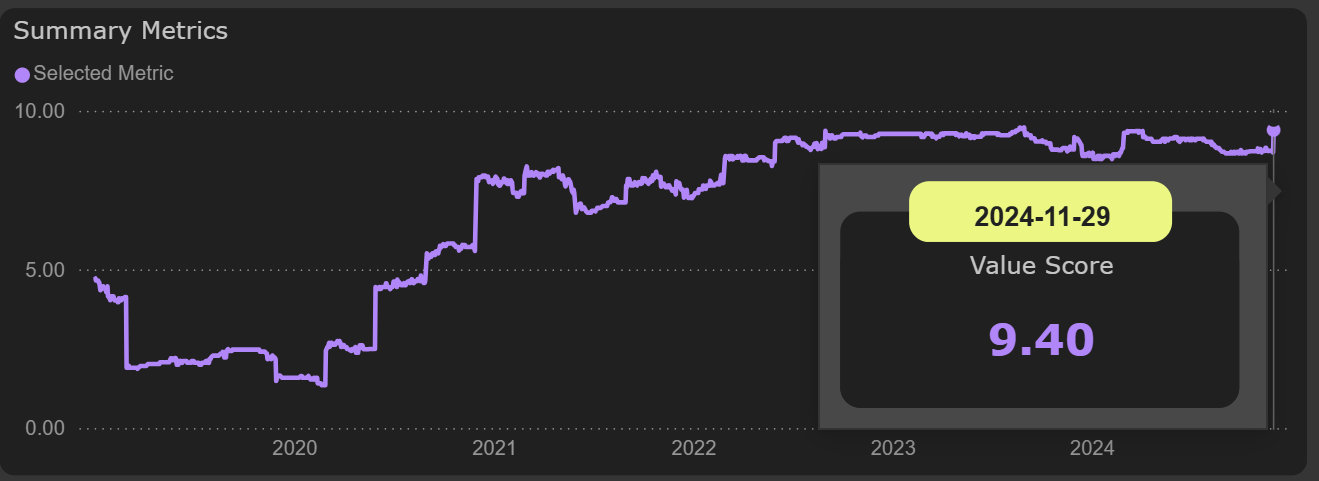

After delivering impressive financial results, the company’s valuation metrics appear highly attractive - P/E ~3.9x and EV/EBITDA ~3.5x.

PLY Value Score