Grigeo Group 2025 Q3 financial review

Profit increased, but not from main operations

Grigeo Group showed a profit increase in Q3 2025 – the operating profit rose by 24% to €5.9M compared to the previous year. A large part of this growth was driven by €1.8M from the sale of emission allowances.

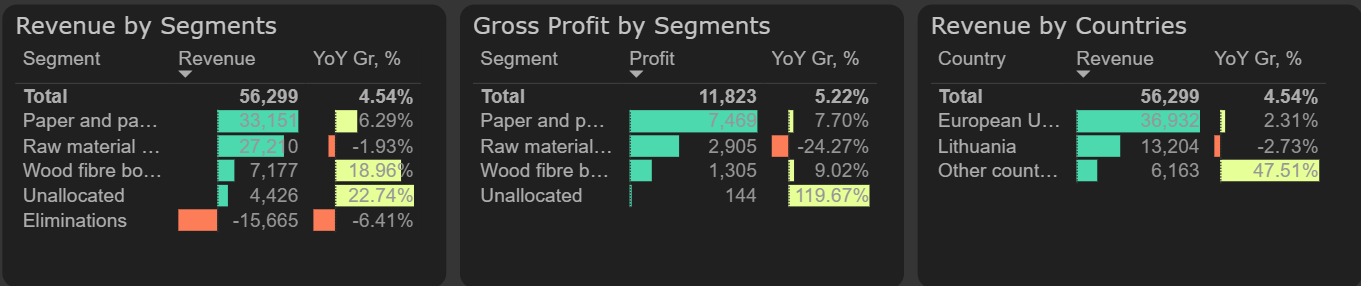

Revenue in Q3 was 4.5% higher than in the same quarter last year. The paper segment continued to grow, increasing by 6% compared to the previous year. Additionally, the wood fibre boards segment’s turnover was 19% higher this quarter compared to the same period last year.

Results by segments, 2025 Q3

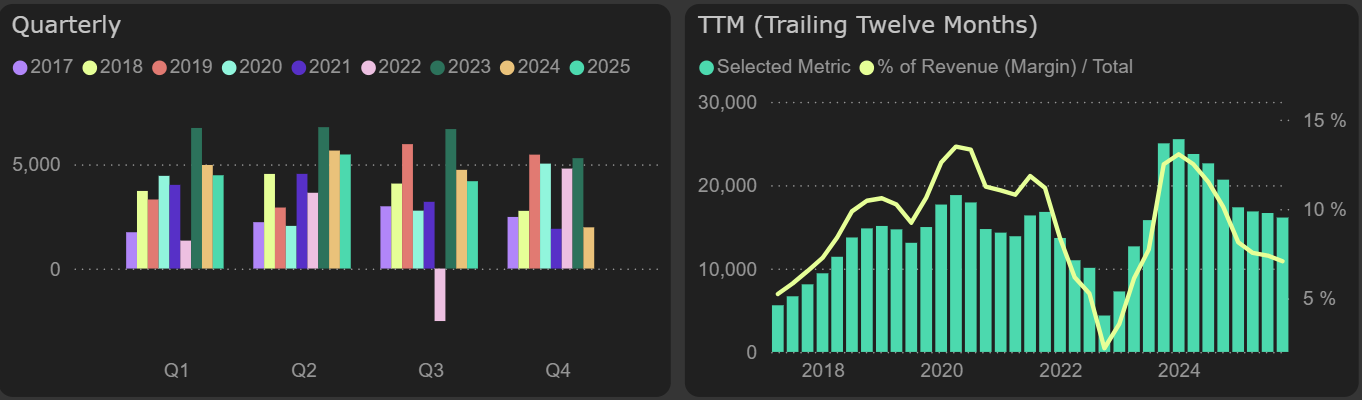

The gross margin remained similar to last year’s level, so the gross profit grew at a similar pace as revenue – 5.2%. However, operating costs rose at a much faster rate than revenue, increasing by 16% YoY. As a result, when calculating operating profit excluding the impact of emission allowances, eliminating other gains/(losses), the result was 11.5% lower than last year.

Operating profit excluding other gains/(losses)

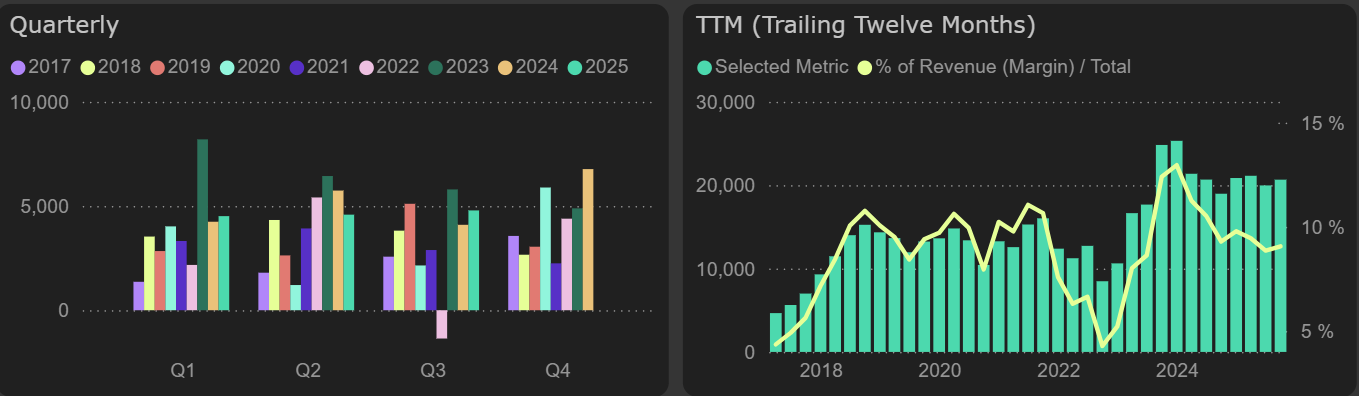

Net profit grew by 17% in Q3, bringing the nine-month total to €13.9M, nearly matching the previous year's result of €14.1M.

Net profit

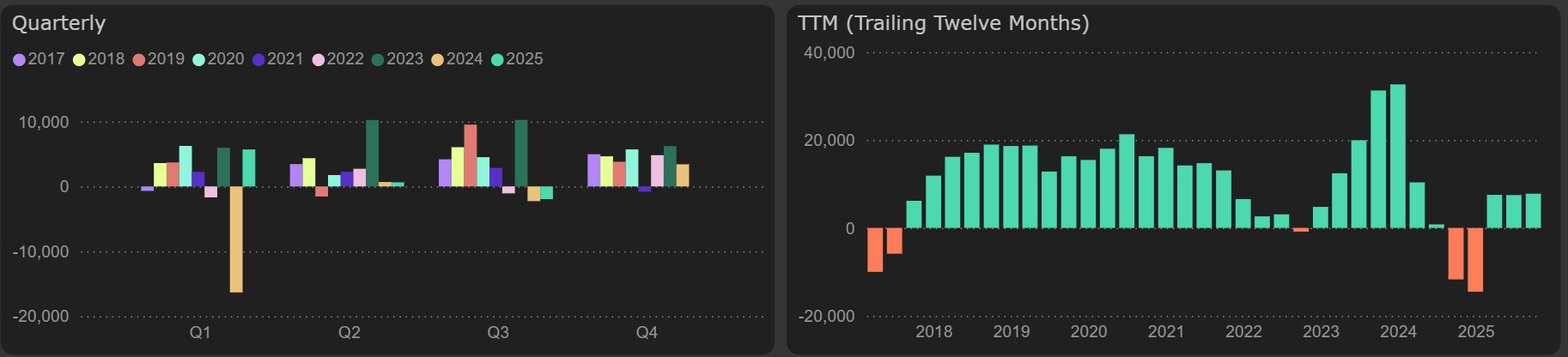

The annual free cash flow remained stable at €7.8M (5.8% yield). FFO in Q3 grew by 27% compared to last year, however, CapEx were nearly double, which resulted in the growth from operating activities cash flow not being reflected in the free cash flow.

Free cash flow