Artea Bank 2025 Q3 financial review

Operating costs held back profits

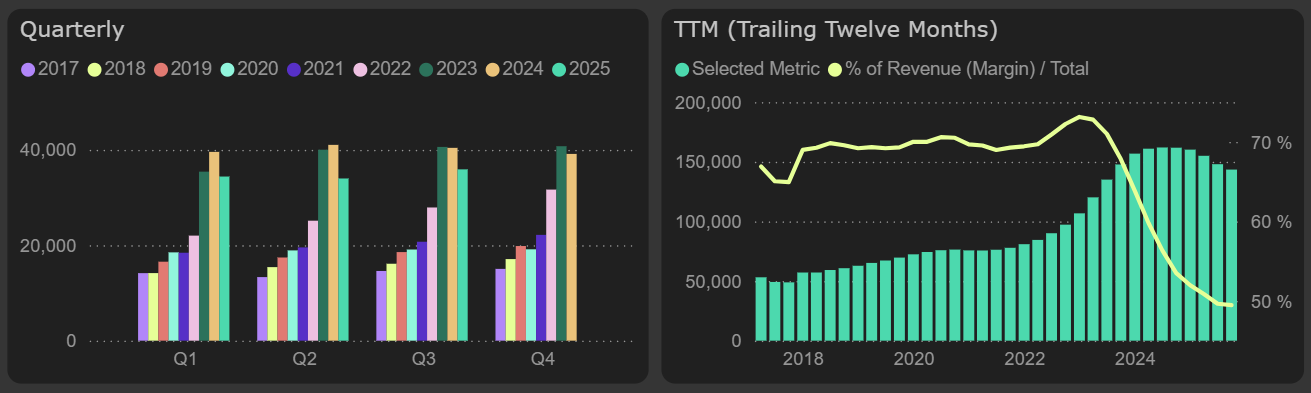

Artea Bank's Q3 results mark the final data for the Baltic banking sector, which continues to show signs of a downtrend. Artea's net interest income for Q3 was 11% lower than last year. Compared to Estonian banks, Coop Pank's interest result decreased by 9% YoY, while LHV Group saw a 18% YoY decline.

Despite this, Artea Bank's net interest income for Q3 was almost €2M (+5.6% QoQ) higher than in Q2 of this year. Meanwhile, LHV Group continued to report a declining interest result quarter after quarter, while Coop Pank maintained stability in this year.

Loan portfolios at LHV Group and Coop Pank grew more intensively in Q3, increasing by 4.7% and 4.1% respectively, while Artea Bank's portfolio grew by only 1.1%.

Net interest income

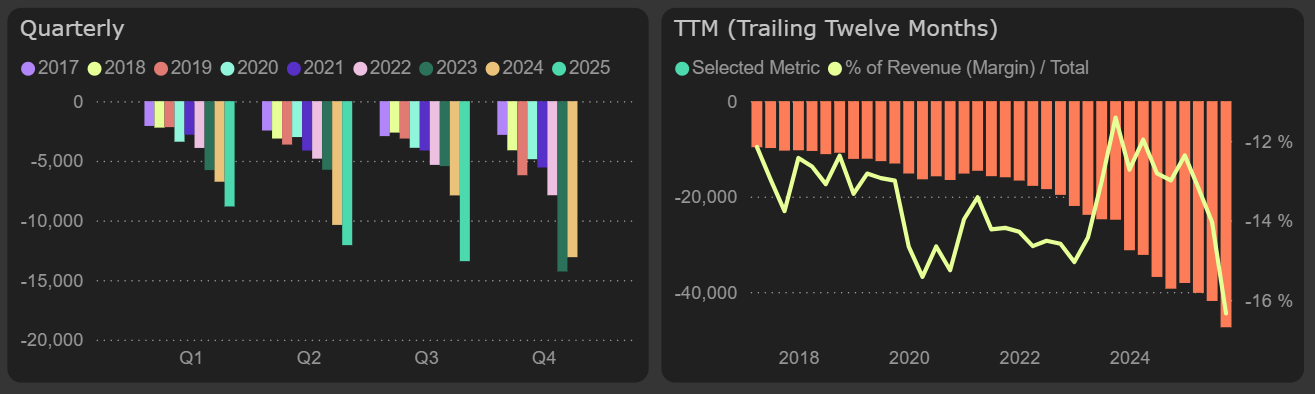

Artea Bank's profit before impairment fell significantly more than its interest result – by 30% compared to last year. The main reason for this was a €5.5M (+70% YoY) increase in other operating expenses compared to Q3 last year. Among these expenses, the largest increases were seen in IT and communication costs (+€2.9M) and expenses for service organizations (+€1.8M). Employee costs growth stabilized, with a 4% increase in Q3 compared to last year, and they were about €1M (7-9%) lower than in the first two quarters of this year.

Other operating expenses

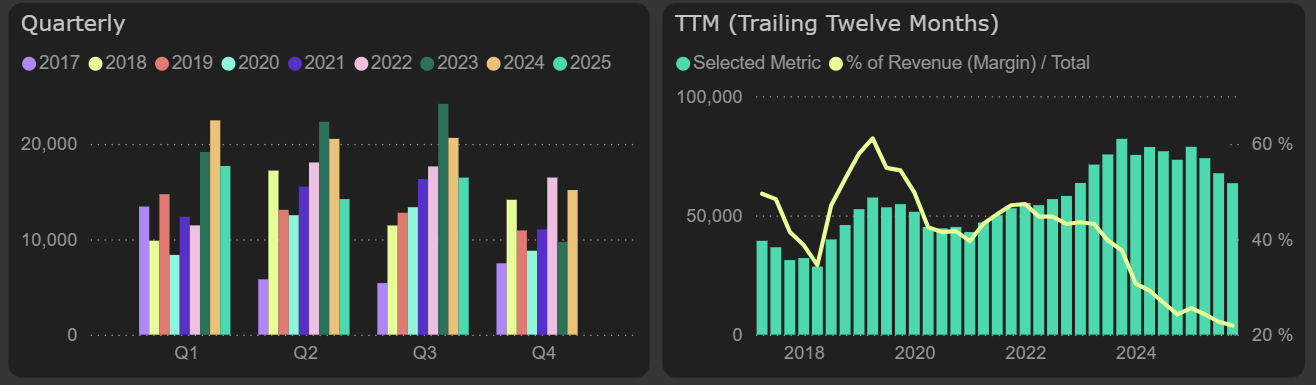

The decline in net profit was partially offset by lower loan impairment expenses, and the overall impairment result was positive in Q3. Compared to last year, net profit for Q3 decreased by €4M (-20% YoY), reaching €16.5M. The 9 month decline was slightly higher – 24% YoY.

Net profit

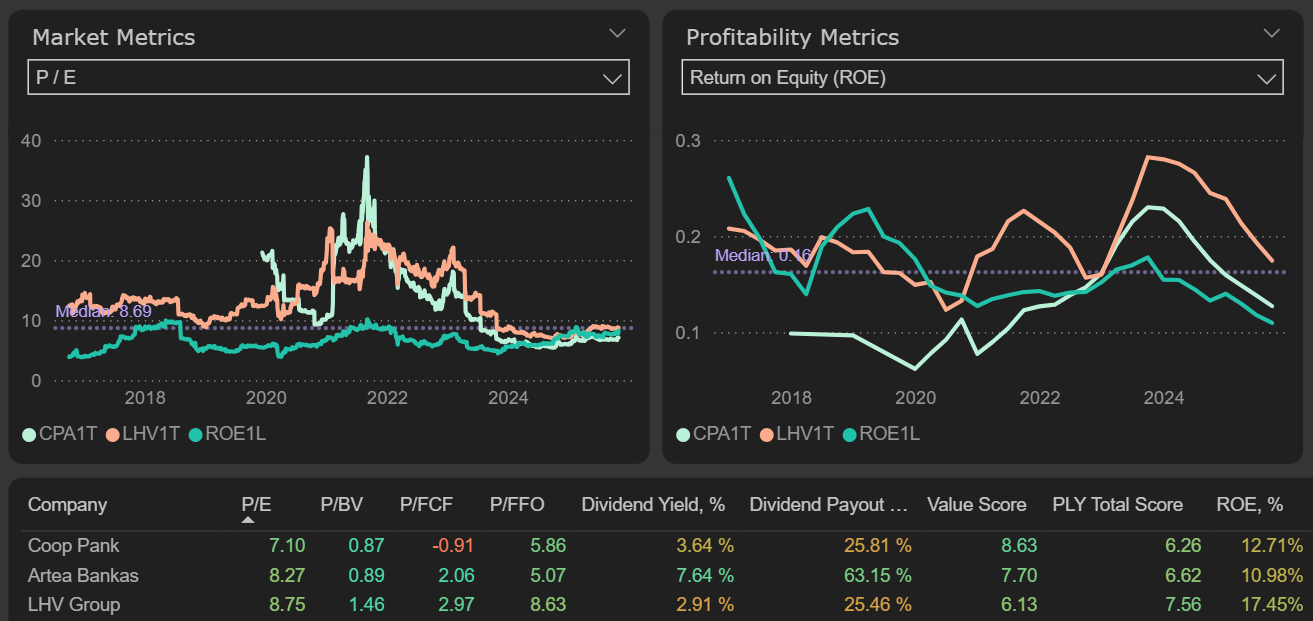

After the third quarter results, Coop Pank still holds the lowest valuation metrics (P/E, P/BV) and outperforms Artea in ROE. As before, LHV Group has the highest P/E and P/BV ratios, but this is balanced by a significantly higher ROE.

Comparison between banks