Infortar 2025 Q3 financial review

Positive turnaround in key segments

The third quarter of this year was better for Infortar’s core segments – shipping (Tallink Grupp) and energy – than last year. Last year, in the third quarter, the energy segment earned only €580K in operating profit, whereas this year it grew to €17.9M. Although Tallink Grupp's operating results in the third quarter grew modestly by 4.3% compared to last year, it is positive that the negative trend from the first half of the year has stopped, and this, one of the most important quarters for the company, was stronger than last year.

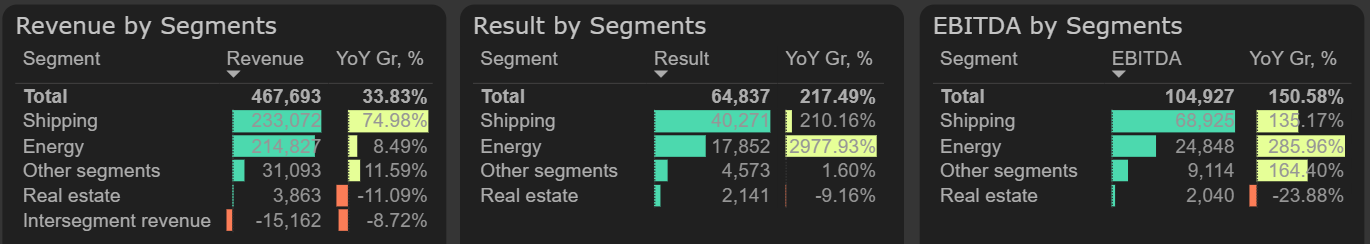

Results by segments, 2025 Q3

According to Infortar’s actual data, third quarter revenue increased by 34% compared to last year, while operating profit more than tripled. However, last year, not all of Tallink Grupp's results were consolidated in the third quarter. When adjusting for last year's data, Infortar’s third quarter operating profit grew by about 21%, from €51.4M last year (€44M from Tallink Grupp and €7.4M from other Infortar segments) to €64.9M this year.

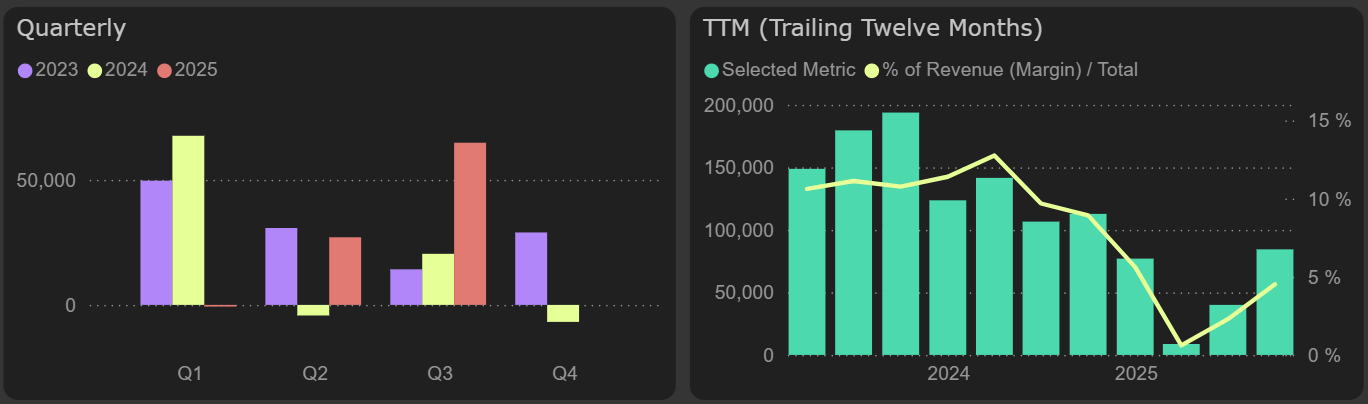

Operating profit

Another point worth noting is that this quarter, €41M of net profit out of Infortar's total net profit of €72M came from Tallink Grupp, so a significant portion – about €13M – belongs to the minority shareholders.

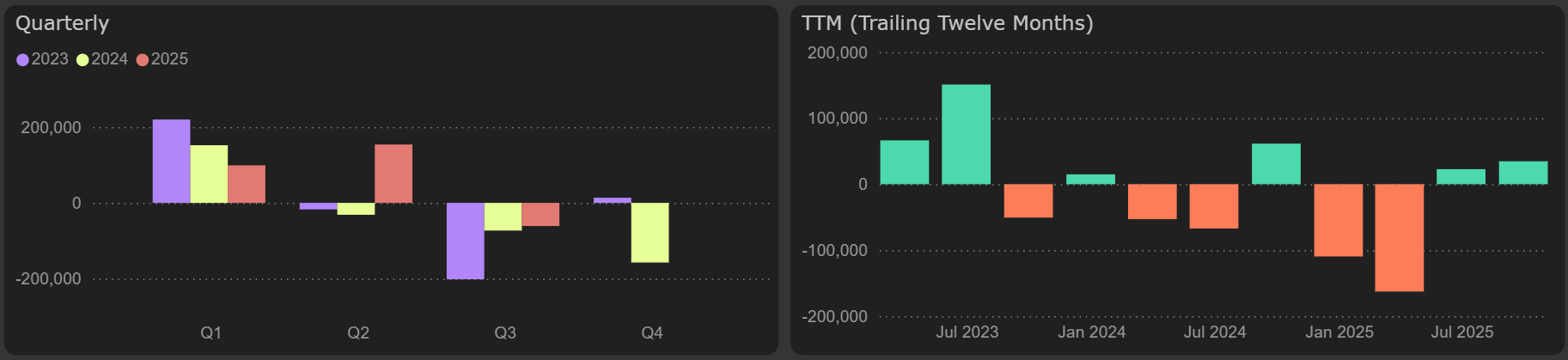

Infortar's annual free cash flow remained positive at €34.7M, driven by strong third quarter funds from operations, despite some pressure from reductions in payables.

Free cash flow