Coop Pank 2024 Q4 financial review

Performance sliding downhill

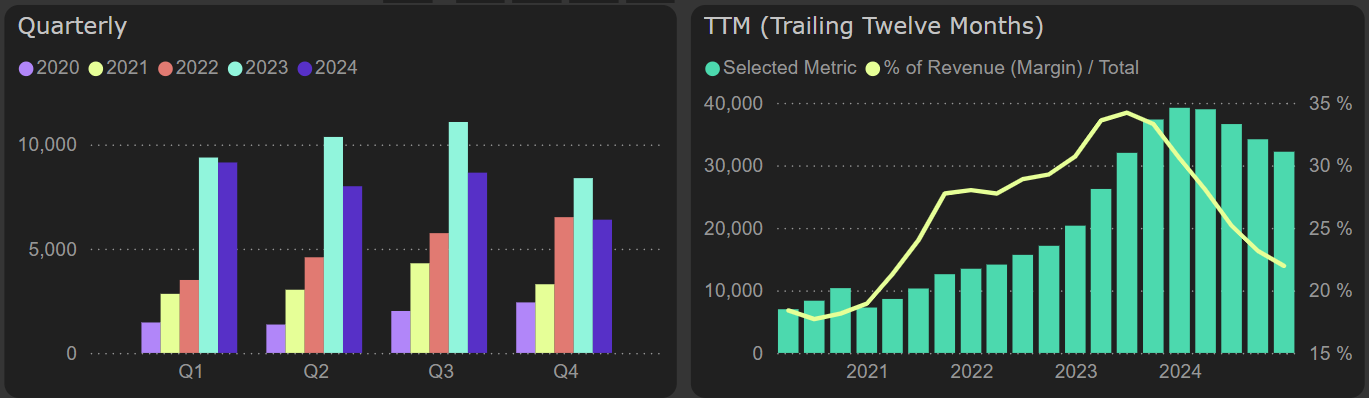

Coop Pank's financial performance continues to deteriorate. In the fourth quarter of 2024, the company's net profit decreased by 24% year-over-year, reaching €32 million for the full year – an 18% decline compared to 2023. This downturn was driven by falling net interest income, impacted by margin contraction, and rising operating expenses.

Net profit

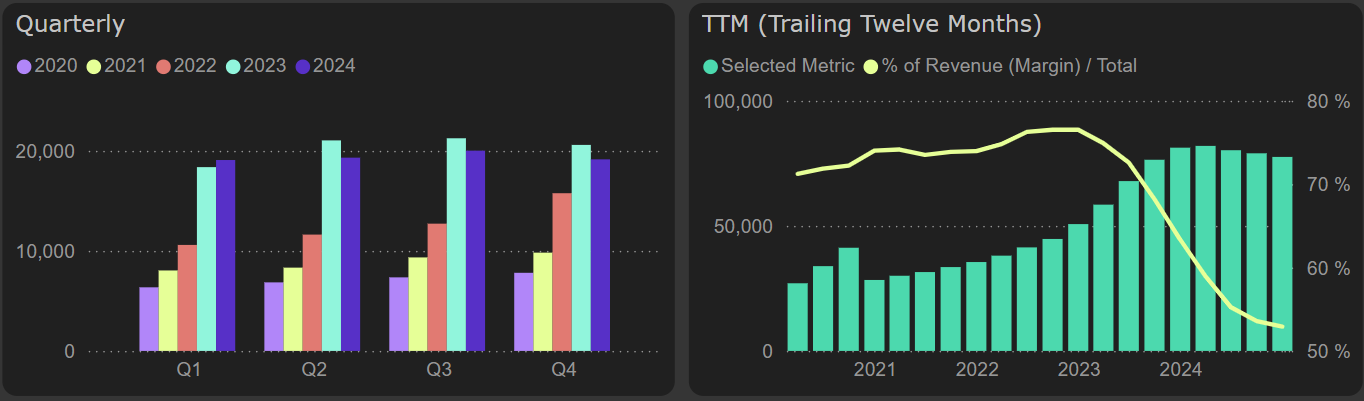

In 2024, Coop Pank's loan portfolio grew by 19%, with the strongest growth momentum, similar to LHV Group, recorded in the last quarter of the year. However, a turning point occurred in Q4, as the trajectory of interest income shifted, declining by 3% YoY. At the same time, interest expenses continued to rise slightly compared to Q4 2023, leading to a 7% decrease in net interest income in this quarter.

Net interest income

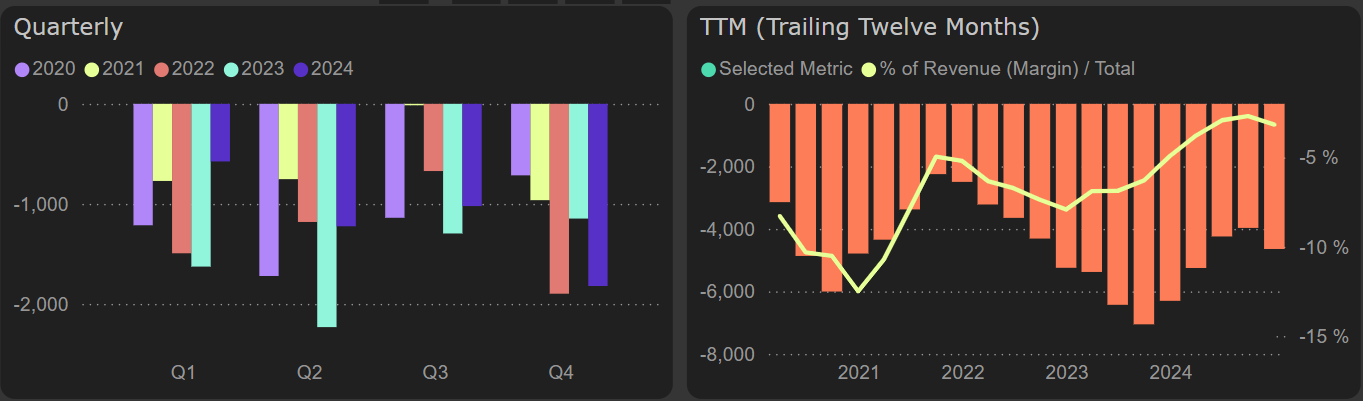

Additional pressure on the company's results in the fourth quarter came from rising operating expenses. The most significant increase was recorded in employee expenses, which grew by 9% in Q4 compared to Q4 2023. Over 2024, employee expenses rose by 16% compared to 2023.

Although credit quality indicators remain strong, a higher amount of impairment expenses was recorded in the fourth quarter. If the impairment expenses amount continues to rise, it could put additional pressure on the company's financial results.

Impairment expenses