Tallink Grupp 2024 Q4 financial review

Grey skies persist

As expected, Tallink Grupp's fourth quarter did not bring any positive surprises. The company's revenue continued to decline – overall, in 2024, it was 6% lower than in 2023. The largest impact was caused by a 39% decrease in chartering income. However, this downward trend stabilized towards the end of the year. Although in Q4, chartering income was 27% lower than during the same period in 2023, compared to Q3 2024, the decline was only 4%. Meanwhile, the decrease at the beginning of the year was more significant.

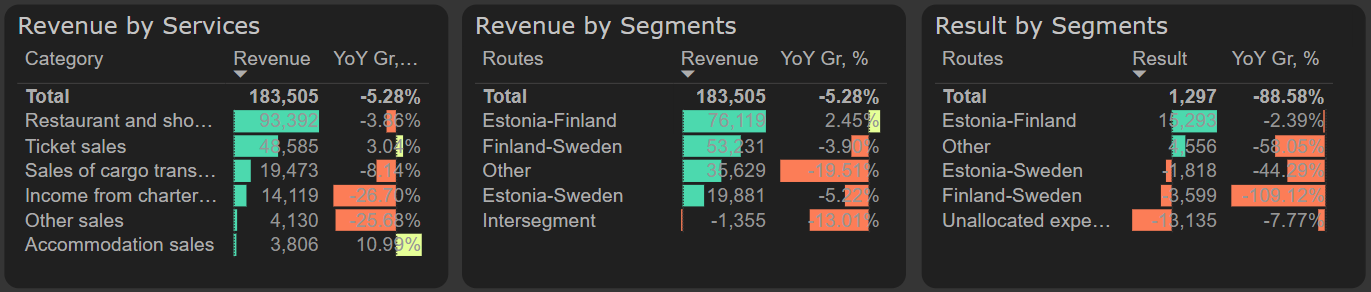

Results by segments, 2024 Q4

Despite the revenue decline in 2024 was relatively moderate, cost management challenges had a significantly stronger negative impact on the Tallink Grupp results. The cost of goods sold and other operating expenses remained almost at the same level as in 2023, meaning that, as revenue decreased, operating profit fell by 32%. Considering that other operating income increased due to asset sales, excluding this effect, the decline in operating profit compared to 2023 was 49%.

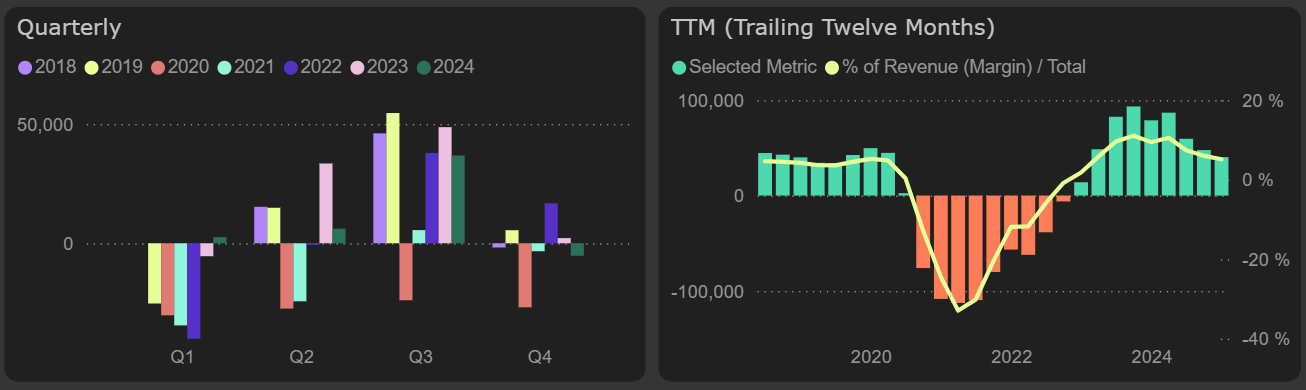

Main P&L parameters, 2024

The fourth quarter of 2024 was unprofitable for the company, with a net loss of €5.2 million. For the entire year of 2024, the company earned €40 million in net profit, but a significant portion of this amount came from the sale of assets in the first quarter. It is likely that the beginning of 2025 will also not be exceptional, as historically Q1 has been highly unprofitable for the company.

Net profit

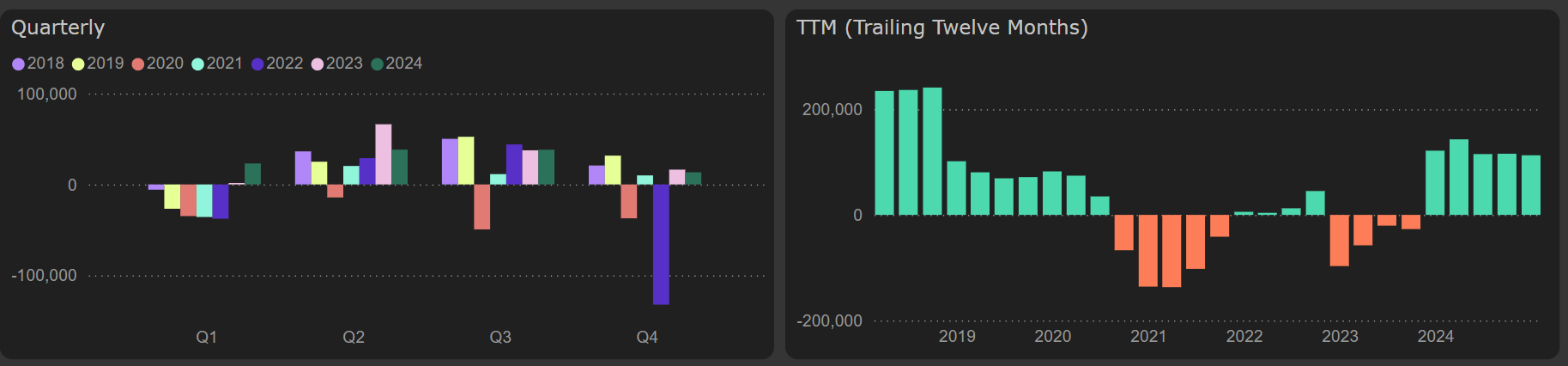

The cash flow situation looks more favorable: in Q4, operating cash flow decreased by 9% YoY, with the decline offset by positive cash flow from working capital. Free cash flow remained stable, with an annual level of €113 million, mainly due to significantly minimized investments. A large portion of these funds was directed towards debt reduction, which decreased by €93 million in 2024. However, if the company maintains dividend payments at the same level (€45 million), the debt level may rise again. While the dividend yield appears attractive (9%), in the future, as investments return to normal levels, challenges may arise in maintaining such payouts if the company’s performance does not improve.

Free cash flow