SAF Tehnika 2024 Q4 financial review

Advance payments signal trouble for recovery

While Q1 showed some signs of growth, Q2 paints a different picture. In Q2 of the 2024/2025 financial year (2024 Q4), SAF Tehnika's EBITDA reached €447K – nearly equal to depreciation and amortization, leaving operating profit at just €33K.

During this period, the company's revenue declined by 21% across all regions compared to previous financial year. At the same time, rising operating expenses significantly reduced the EBITDA margin, which dropped to 6%.

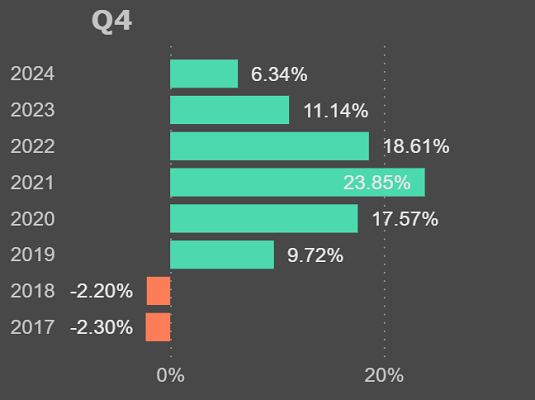

EBITDA margin

Although the direct costs of sold goods and services decreased at almost the same pace as revenue, employee costs, which are a crucial part of the overall cost structure, increased by 3% compared to the same quarter of the previous financial year.

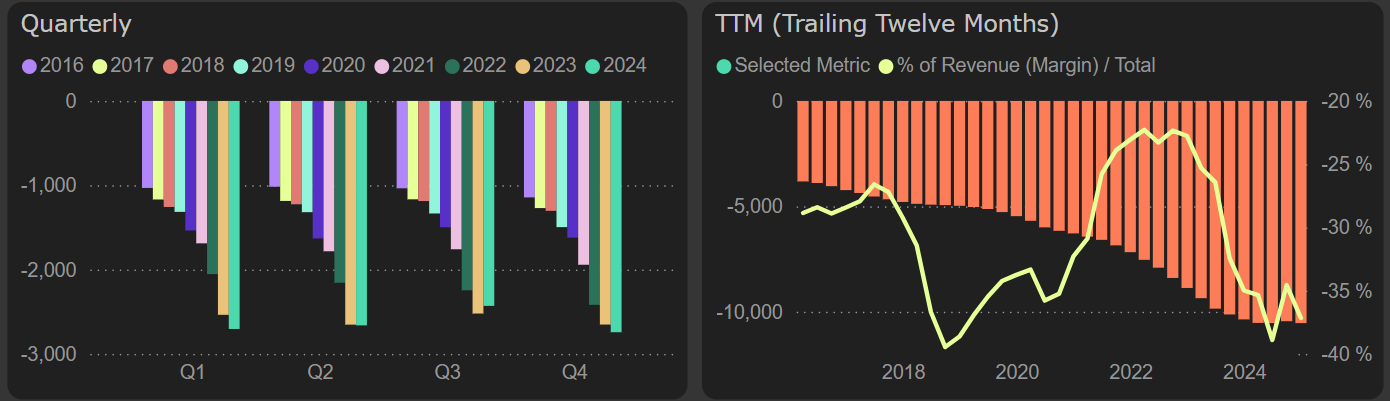

Salaries and social expenses

The net profit for Q2 of the 2024/2025 financial year was slightly higher than the operating profit due to the positive impact of foreign exchange gains.

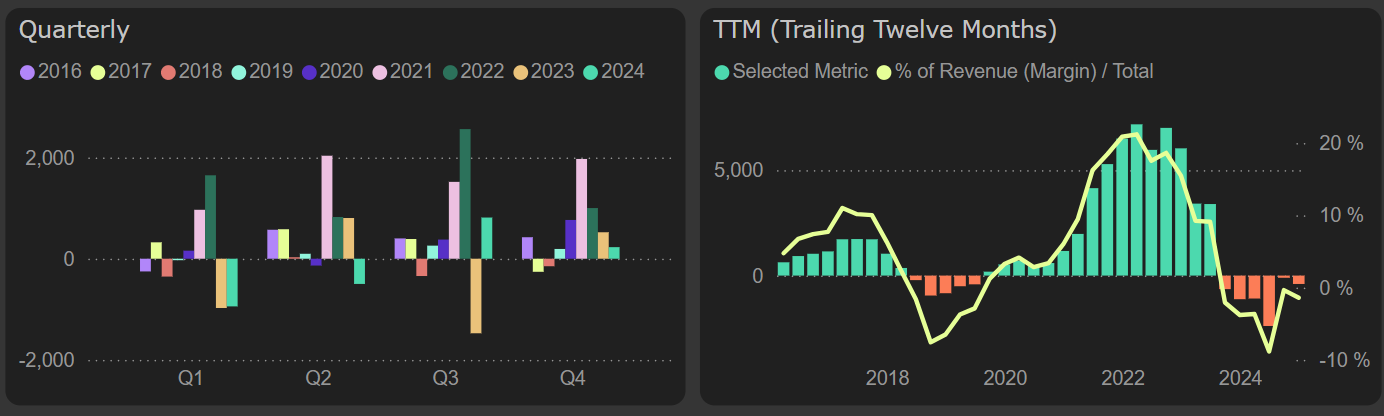

Net profit

In 2024, SAF Tehnika significantly reduced its investments in long-term assets. Moreover, a decrease in net working capital is showing a positive cash flow. These factors were the main drivers of the company's free cash flow growth, despite the fact that funds from operations did not support this increase.

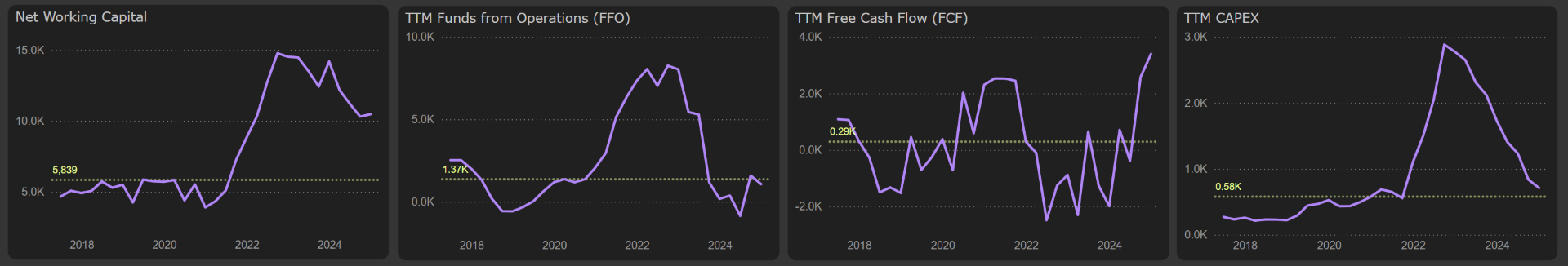

Net working capital and cash flows metrics

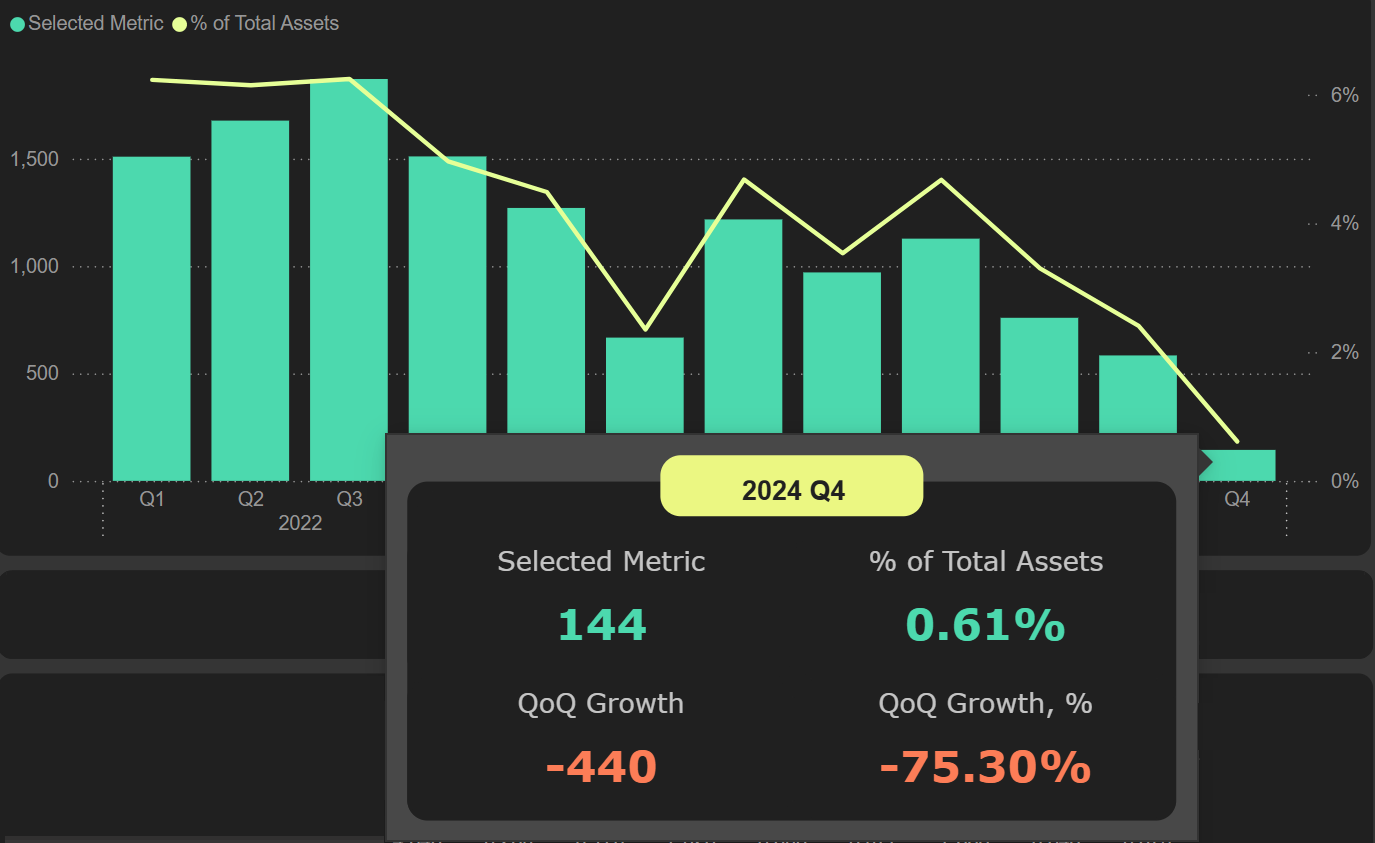

Future revenue growth projections, as indicated by advance payments, are pessimistic. Advances received from customers continue to decline and have reached the 2018 level, when the company's revenue was approximately half of its current amount.

Customer prepayments

At the moment, SAF Tehnika does not appear attractive from an investment perspective. Weaker Q2 2024/2025 financial results compared to Q1 have worsened the company's EV/EBITDA ratio to 12.6x. Additionally, advance payments indicate a potential revenue decline, which could significantly impact the company's profit, especially given the already reduced profit margins.