Dovre Group (DOV1V)

Three businesses for the price of two

During last four quarters Dovre Group (DOV1V) generated 200M Eur of revenue, earned 9,4M Eur of EBITDA and achieved 9,4M Eur of free cash flow. For the company with only 40M Eur Enterprise value, negative net debt, 16% return on invested capital (ROIC) and non-cyclical profile it is truly noticeable if not remarkable achievement.

Core business areas

Just for the remainder (or quick review): Dovre group is a global provider of project management services with three business areas – Project personnel, Consulting and Renewable energy. The Project personnel business area is a global provider of project professionals for large investment projects. The Consulting business area provides project management expertise for the development and execution of large investment projects. The Renewable energy business area was added in 2021 Q2 after acquisition of 51% of Suvic Oy, a development company specializing in the construction of renewable energy solutions, such as wind farm projects, solar power parks and transforming traditional energy production plants to renewable biomass fuel operations.

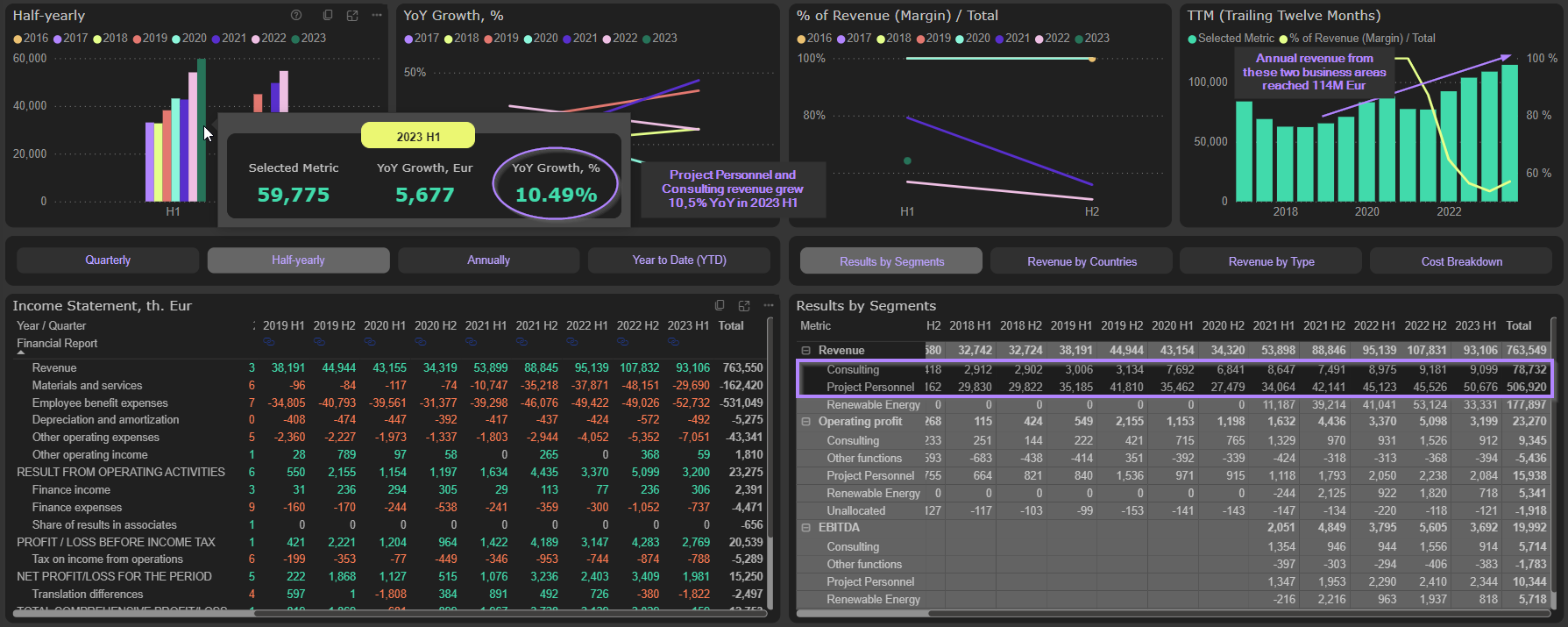

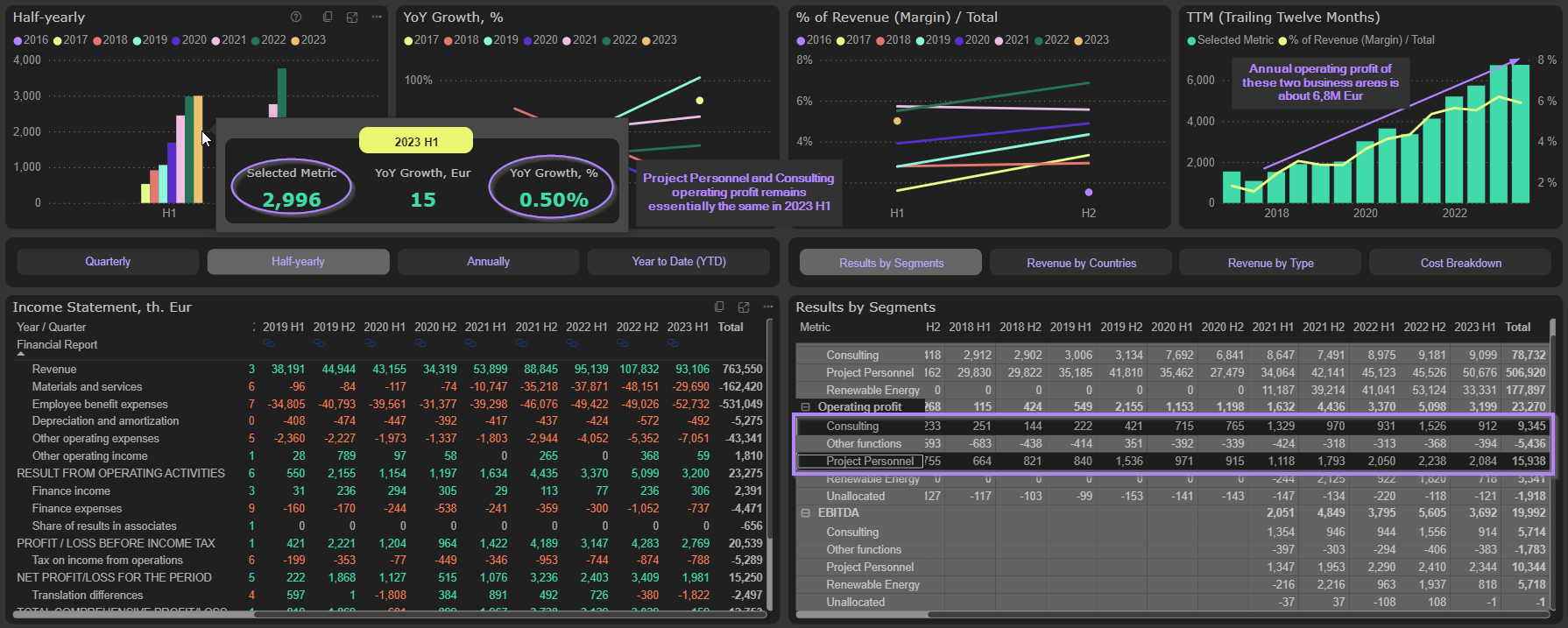

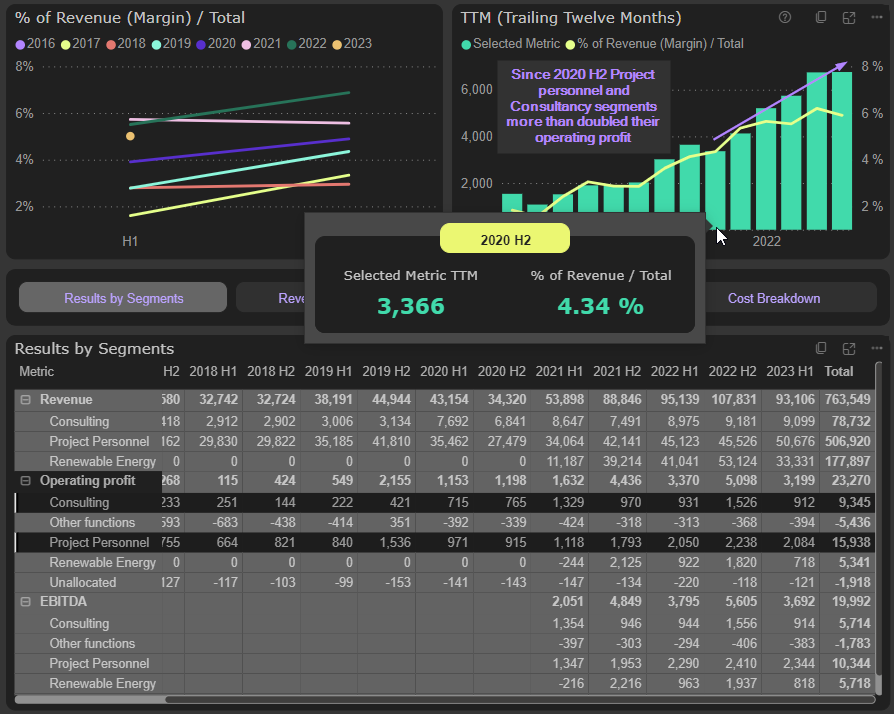

The Project personnel and Consulting segments, company’s traditional core business areas (57% of total revenue, 81% of total operating profit and 78% of total EBITDA), continue their strong performance: 2023 H1 revenue grew by 10% to 59,8M Eur, while operating profit and EBITDA remained essentially the same – 3M and 3,3M Eur respectively:

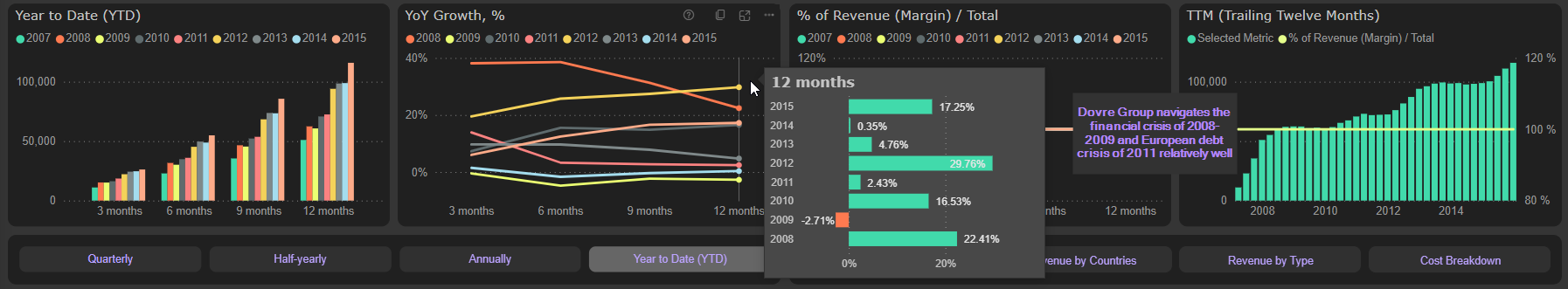

Company’s 2023FY outlook for these business areas is stable. It means about 6,8M Eur of annual operating profit and about 7,2M Eur of EBITDA. Moreover, revenue profile of these business areas exhibits rather non-cyclical patterns. E.g., below is revenue analytics of these two business areas for the period, that includes global financial crisis of 2008-2009 and European debt crisis of 2011:

Headaches with renewable energy

On June 26 Dovre Group released a negative profit warning. The company lowered its 2023 revenue guidance from above 203M Eur to 185-195M Eur and operating profit’s guidance from 8,5M Eur to above 7M Eur. The company cited challenges in the Finnish renewable energy market and weaker NOK/EUR exchange rate as the main reasons. This warning slashed over 15% from Dovre Group’s market cap. From then share price fell another 7%, bringing company’s market cap to 47M Eur. It seems that market reaction was slightly overdone.

First of all, negative profit warning was released when NOK/EUR exchange rate was near the bottom of the year, declining by 10% YTD. Today NOK/EUR is about 2% higher.

Next, since June 26 Dovre Group reported about Suvic Oy expansion into the Swedish market and its participation in the waste-heat-to-energy power plant construction contract with Fortum. These developments significantly softened the blow of “the reduced number and smaller size of new projects in the Finnish Renewable Market sector”.

Finally, even with numbers provided in the profit warning release, which may appear to be really conservative, current valuation still looks compelling. Let’s start with the Project personnel and Consulting segments. The company expects the 2023 numbers of these business areas will be approximately the same as in 2022. That means about 6,8M Eur of operating profit and about 7,2M Eur of EBITDA. If we add to this operating result the costs of corporate functions and unallocated costs (about 1M Eur per year), we get approximately 5,8M Eur of operating profit before adding Renewable energy segment. That means, that Renewable energy segment should add only 1,2M Eur to the operating results to get the lower end of the company’s guidance.

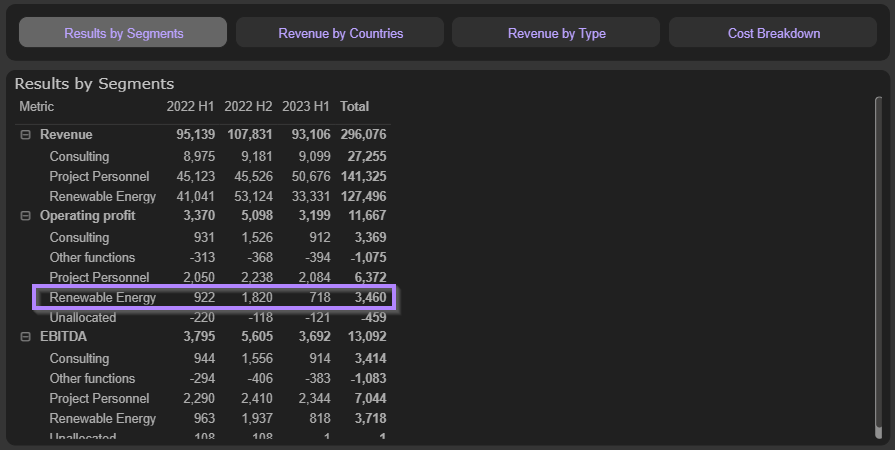

2023 H1 Renewable energy segment’s operating result was 0,72M Eur. To achieve 1,2M Eur annual result it should add only 0,5M Eur in 2023 H2. That is 70% less than in 2022 H2. That is, of course, possible, but not very likely, though:

Headwinds of wind industry are well known. E.g., see here and here. After euphoria of 2020-2021, stock prices of main industry’s players are in the depression now. Supply chain delays, design flaws, higher costs and write-downs are reflected in the stock prices. However, EU renewable energy targets remains unchanged (increase renewable energy share to at least 42,5% by 2030 from current 22%). That means adding 420 GW of wind energy by 2030. And during current turbulence in the wind market EU “pledges more support for wind industry”.

However, let’s assume this cautious Group’s 7M Eur 2023FY operating profit scenario. That gives us 8,1M Eur 2023FY EBITDA (TTM EBITDA is 9,4M Eur). With current Enterprise value of 40M Eur, we have about 5x 2023FY EV/EBITDA. That is far from expensive, or even fair, valuation.

Renewable energy for free?

On March 11, 2021, right after Dovre Group disclosed its conditional agreement to purchase 51% of Suvic Oy, its Enterprise value was about 37M Eur. Then it was Project personnel and Consulting company, with these two business areas generating about 3,4M of operating profit:

Today these two core business areas more than doubled their operating profits, new business area (Renewable energy) generate about 2,5M Eur of operating profit and Enterprise value remains essentially the same (about 40M Eur). Doesn’t it seem like Dovre Group has added its Renewable energy business area essentially for free, looking from the current Enterprise value perspective?

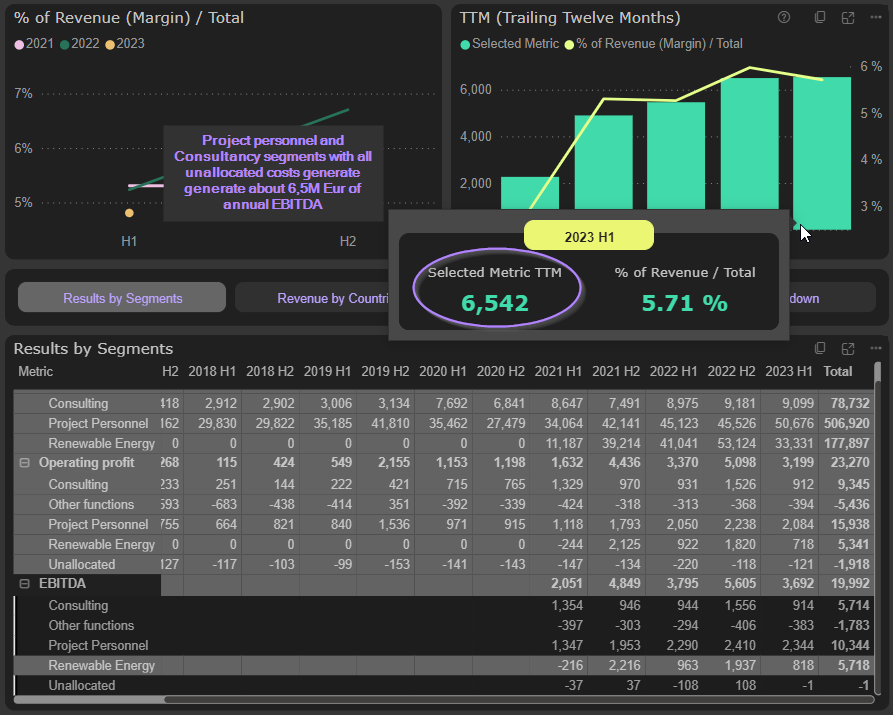

Let’s look on that from another angle. The Project personnel and Consulting segments’ EBITDA with all unallocated and corporate functions’ costs is about 6,5M Eur. With stable outlook, as we already know. With current Enterprise value (about 40M Eur) that gives us 6,1x EV/EBITDA. Which looks very reasonable. Again, Renewable energy business area is essentially for free:

Effective use of capital

Dovre Group is an example of quite effective capital use.

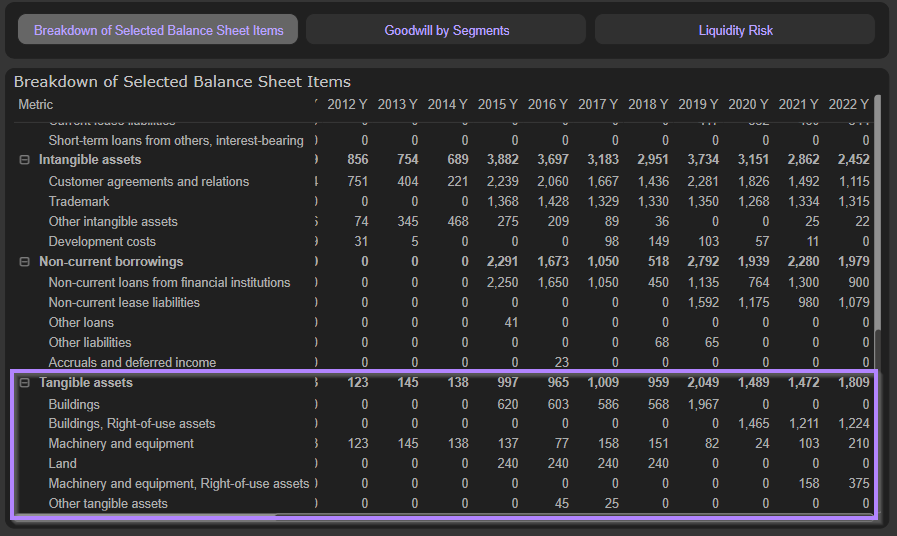

First of all, it has very low fixed asset base. Actually, excluding right-of-use assets, the company has virtually no fixed assets:

Accordingly, the requirements for replacement CapEx also are very low. Actual capital expenditures (excluding acquisition) are only about 0,2M Eur per year:

That means, that virtually total cash flow from operations could be returned to shareholders, creditors or used for acquisitions. In past ten years Dovre Group used successfully all tree ways to utilize generated cash.

Next, the company has quite high return on invested capital (ROIC) – about 16%. This level or ROIC confirms Dovre Group’s ability to utilize the capital effectively. That would justify also significantly higher valuation multiples than market is assigning currently to company’s shares.

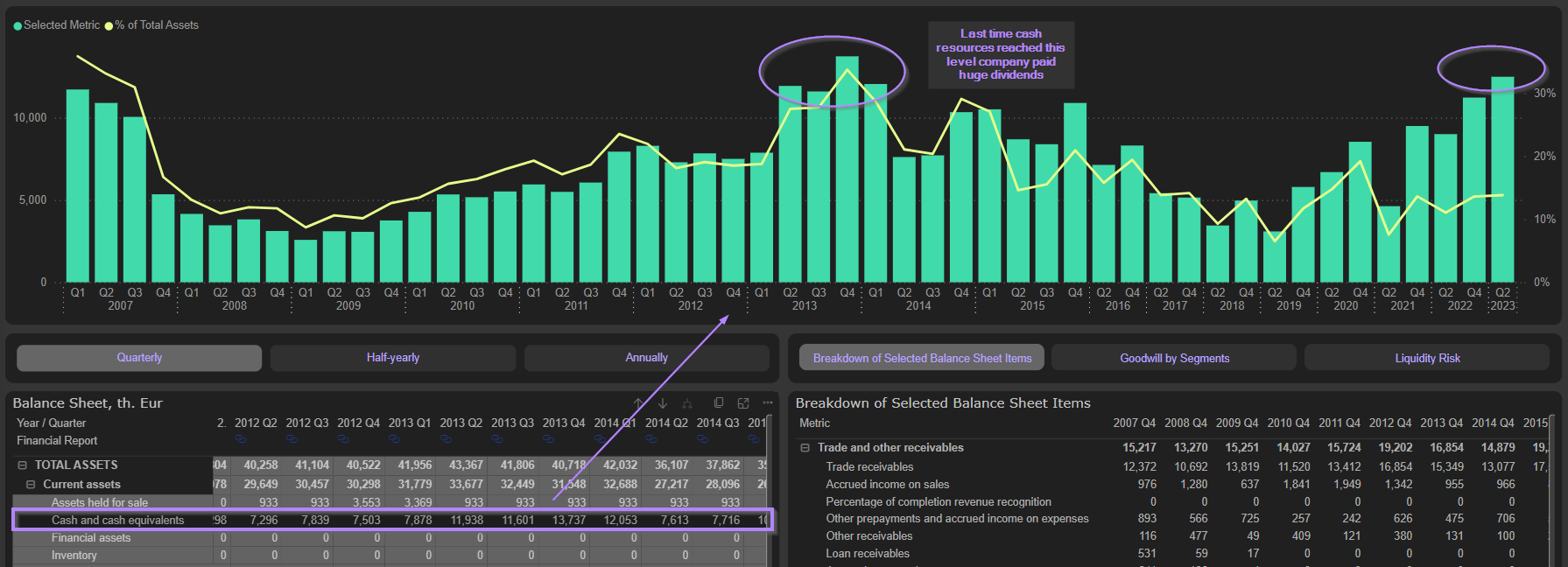

Finally, the company has accumulated 12,5M Eur of cash (btw, it is 27% of current market cap). Of course, natural questions are arising, how the company will use these resources. Because of quite low debt level (only 4M Eur, excluding lease liabilities), the answers to these questions also are quite obvious – dividends or acquisitions. Very likely, both options would be positive for share price. For example, last time the cash resources reached this level (that occurred in 2013),

company paid huge dividends – 4,4M Eur in 2014 and 5,1M Eur in 2015. The dividend yield shoots up then to almost 20% with very obvious implications for share price.

Free cash flow yield

At the lower end of the management’s guidance 2023 (7M Eur operating profit), company will be able to generate about 5,6M Eur operating cash flow, before changes in working capital (Funds from operations – FFO). Arithmetic is quite straightforward: take operating profit (7M Eur), add depreciation & amortization (1M Eur), and subtract financial expenses (1,2M Eur) and taxes (1,2M Eur) paid.

CapEx requirements, as it was mentioned, are relatively low – about 0,2M Eur annually. Working capital, given management’s revenue guidance, likely to be stable, or even declining. So, we have about 5,4M Eur of free cash flow (FCF).

With current market cap (47M Eur) that gives us very solid 11,5% FCF yield. However, we prefer to calculate FCF yield based on enterprise value (EV) level, to reflect companies’ differences in capital structure. With current EV (40M Eur), Dovre group’s projected FCF yield is about 13,5%. Or, calculating in reverse, 2023FY EV/OpFCF ratio is about 7,4x. That places Dovre Group in the top percentiles of all Finnish (and not only Finnish) companies.

Management’s shareholdings

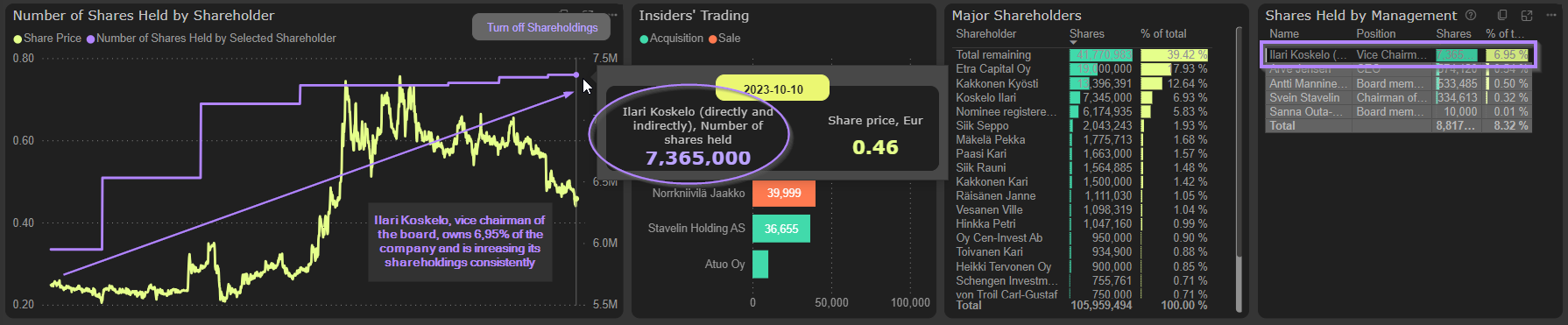

Dovre Group’s management owns 8,82M of company’s shares (8,32% of total shares outstanding). Ilari Koskelo, vice chairman of the board and also one of the largest shareholders, owns 6,95% of the company and is increasing its shareholdings consistently:

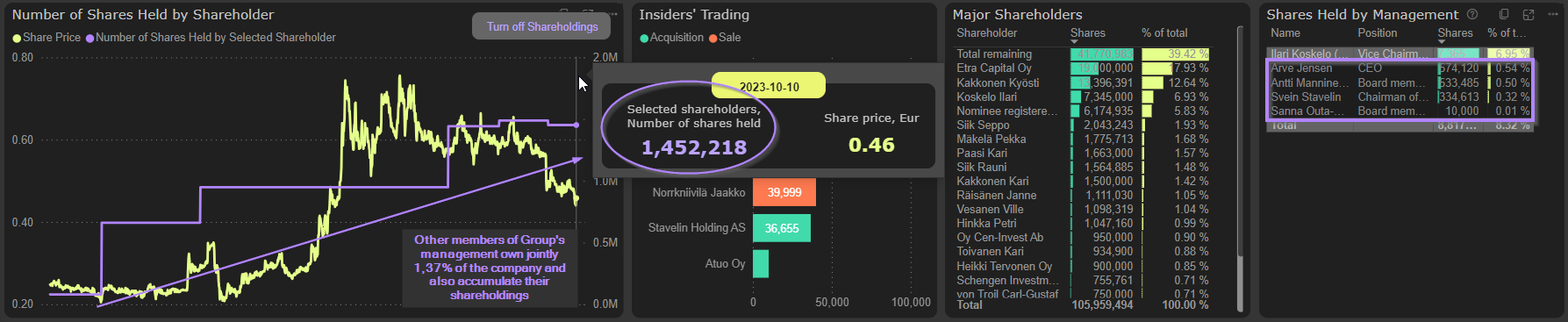

Other members of Group’s management own jointly 1,37% of the company and also accumulate their shareholdings:

Management’s ownership and especially its dynamic indicates good alignment between management’s and shareholders’ interests. That means lower risk of agency problem.