Grigeo (GRG1L)

Back on the track

Skyrocketing electricity and timber prices, plunging margins and halted production in Klaipeda plant. That was the reality, which Grigeo faced just twelve months ago. With average energy costs of 400-500 Eur per megawatt-hour it was cheaper to shut down the factory than to continue production. Today, with average energy prices below 100 Eur per megawatt-hour, timber prices 40% below their 2022 highs and still rising sanitary paper prices, Grigeo profitability is back on the track.

Who killed the margins?

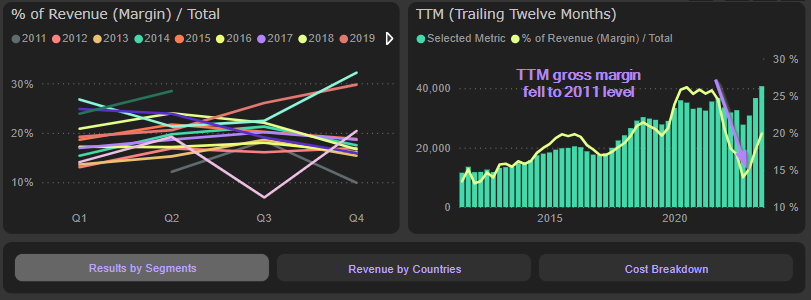

In 2022 Grigeo gross margin was really seriously hurt by energy shock and skyrocketing timber prices. In 20222 Q3 gross margin plunged to tiny 7%, while TTM gross margin reached the levels not seen from 2011:

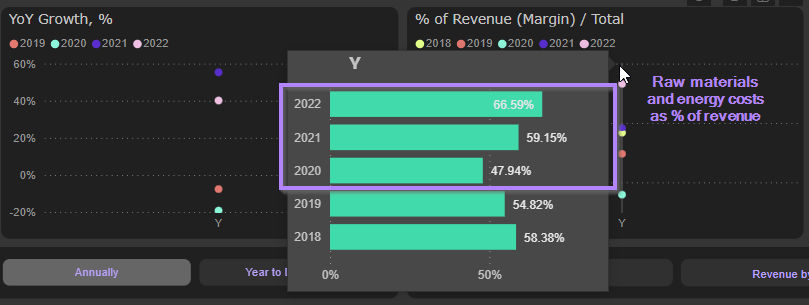

It’s not surprising, considering the levels of energy and timber prices in the middle of 2022 and the fact, that raw materials and energy accounted for 59% of sales in 2021 (and shot up to 67% in 2022):

From the beginning of 2023 the situation has reversed. Electricity prices plunged from 400-500 Eur per megawatt-hour to below 100 eur. Timber prices are 40% below their 2022 highs. While sanitary paper (main product category) prices keep rising. An impact on Grigeo margins is quite obvious. However, in our opinion, is still underappreciated.

It‘s all about paper

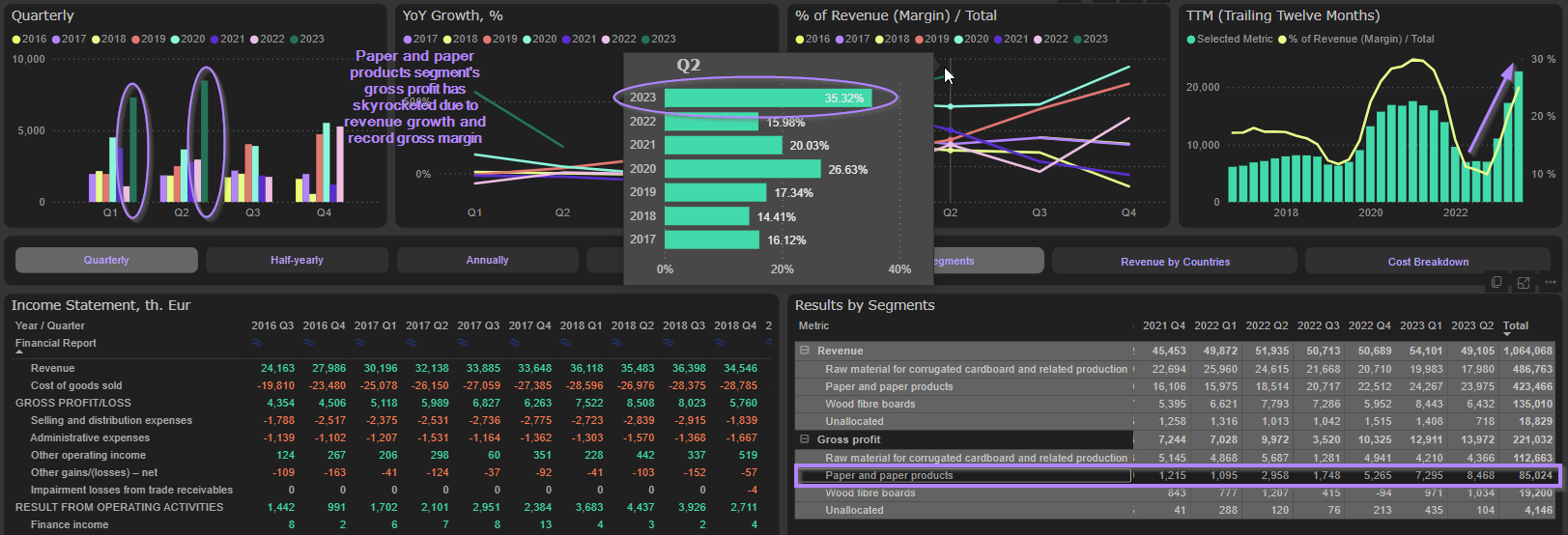

This radically improved environment is best reflected in the paper and paper products segment. Segments sales soared by 52% in 2023 Q1 and by 30% in 2023 Q2:

Segment’s gross profit, however, skyrocketed 566% YoY in 2023 Q1 and 186% YoY in 2023 Q2 due to record gross margins:

Considering low base effect, there is a lot of room for further segment’s improvement in 2023 Q3 and even in 2023 Q4.

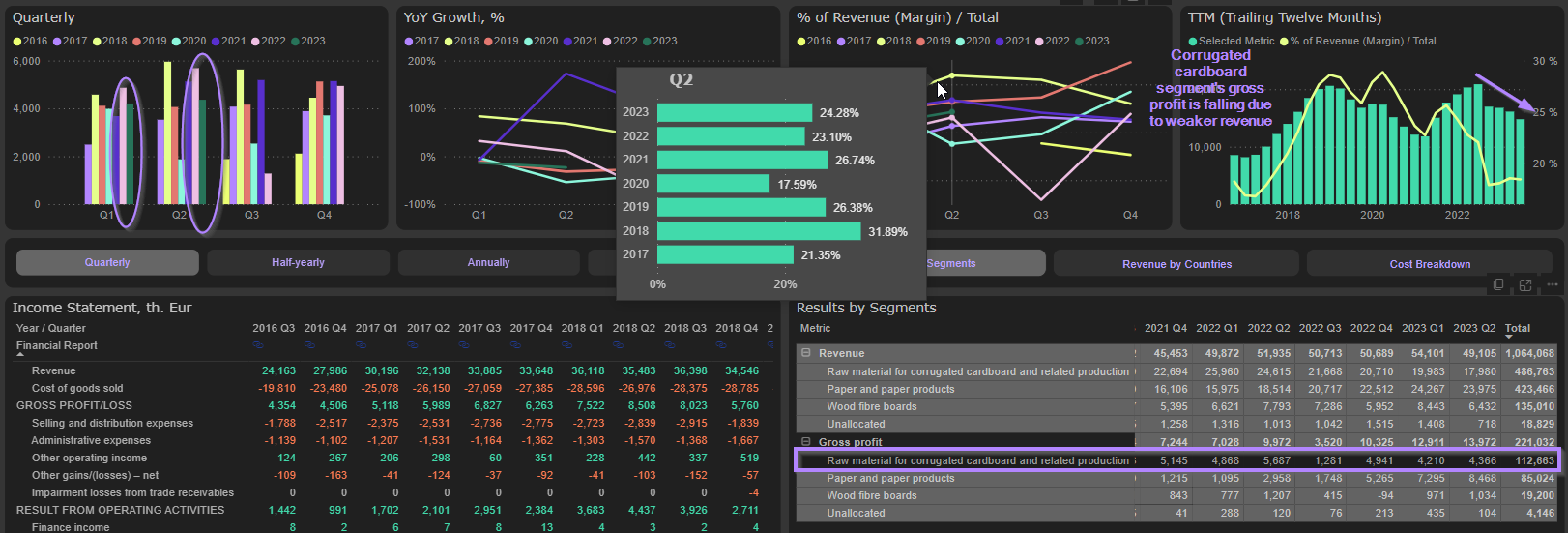

However, it’s not so perfect at all in other segments. Corrugated cardboard segment’s revenue are falling together with global corrugated cardboard prices. This segment’s gross margin remains essentially the same, so the gross profit is falling also:

Wood fibreboard segment started to face, probably, serious headwinds from furniture and construction industries: 2023 Q2 sales decreased 17% YoY.

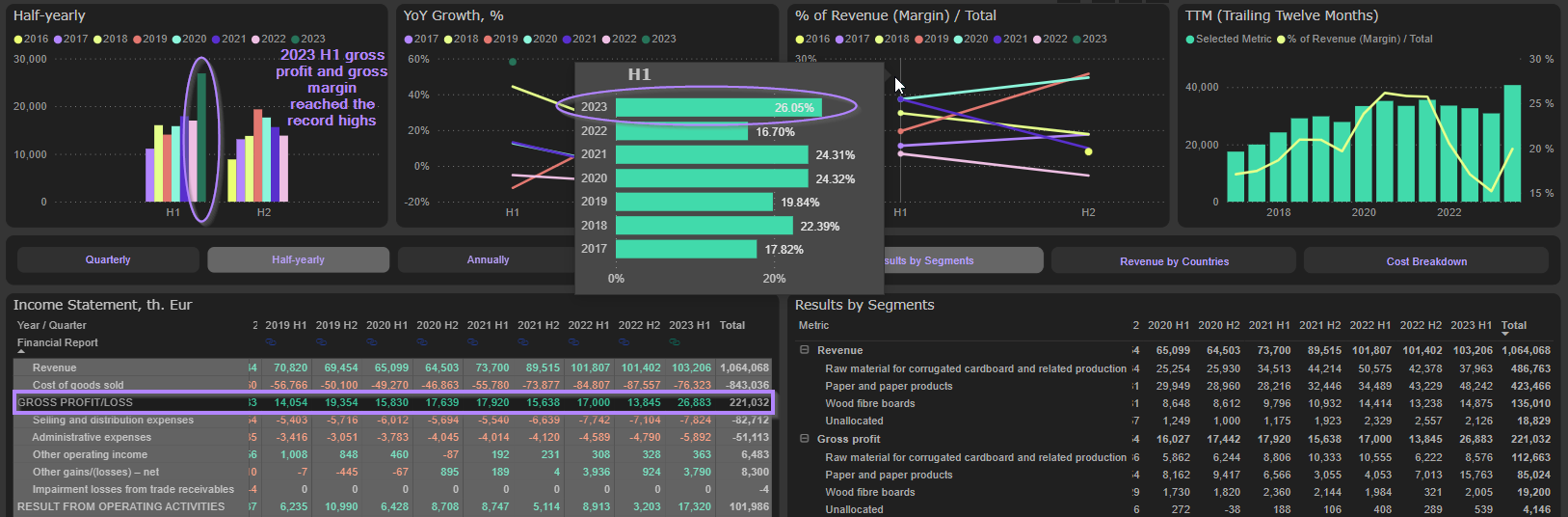

However, strong paper and paper products segment clearly saved the day: in 2023 Q2 as well as in 2023 H1 gross margin and gross profit reached the record highs:

Operating results

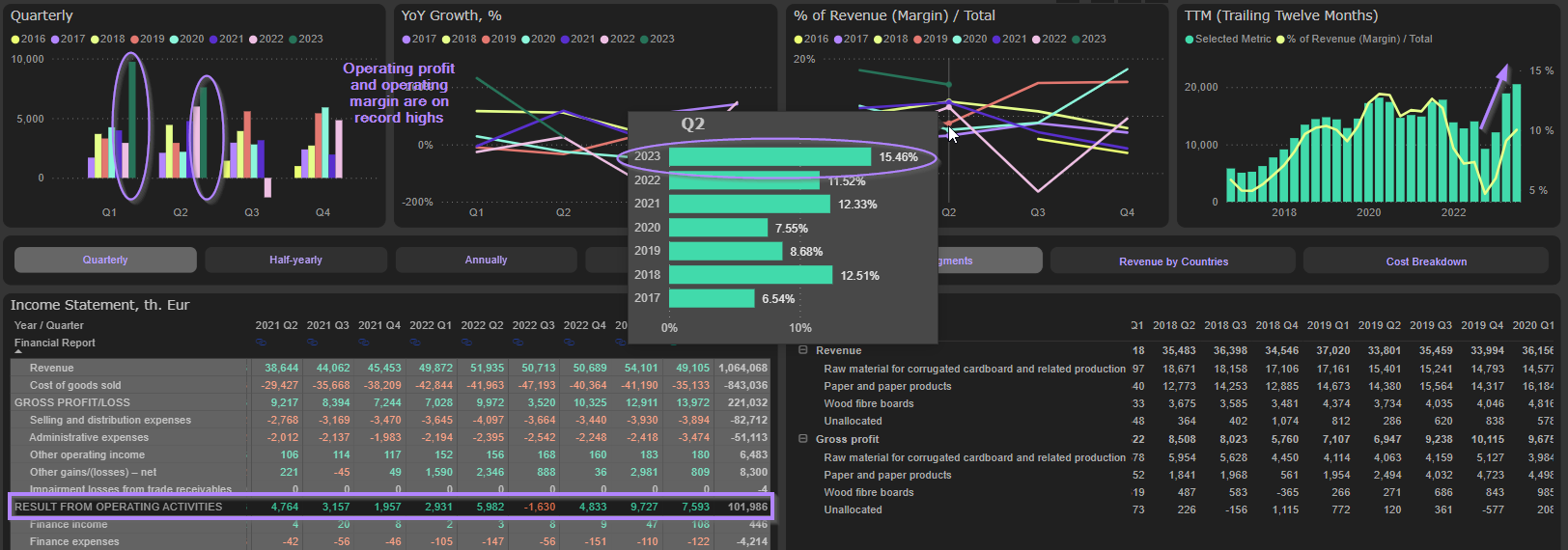

Operating expenses continue to grow at double digit rate and their ratio to revenue has slightly worsened (from 12,11% in 2022 H1 to 13,29% in 2023 H1). Despite of that operating profit and margin are still making new quarterly highs:

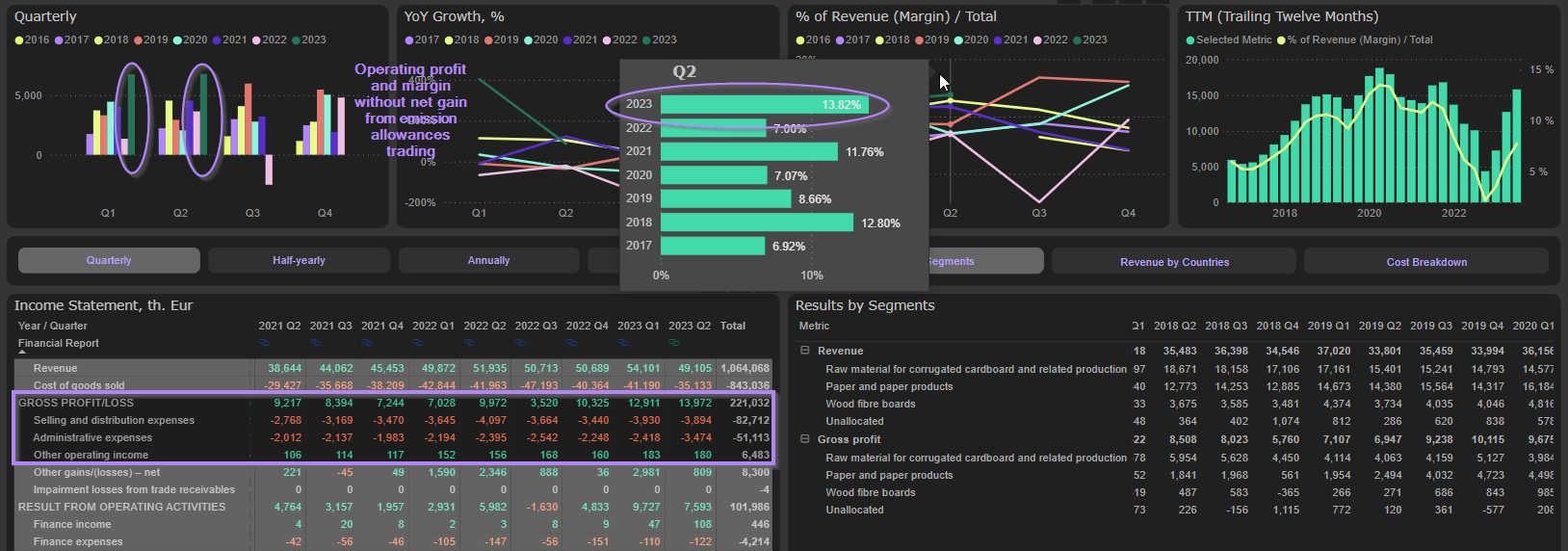

Even if we eliminate net gain from emission allowances trading (included in the Other gain/losses item), operating results are still impressive, with the probability of further positive surprises in 2023 Q3:

Improvements across the board

Last couple of quarters were marked not only by significant improvements in profitability (already remarkable achievement in itself). Grigeo managed to strengthen further its already bullet-proof balance sheet by lowering net debt (already strongly negative) and improving liquidity and debt ratios. Free cash flow reached new highs. Valuation multiples improved despite of strong stock price performance. All sub-scores of our scoring algorithm improved compared to beginning of this year:

Cash cow

As usual, our main focus is on the cash flows.

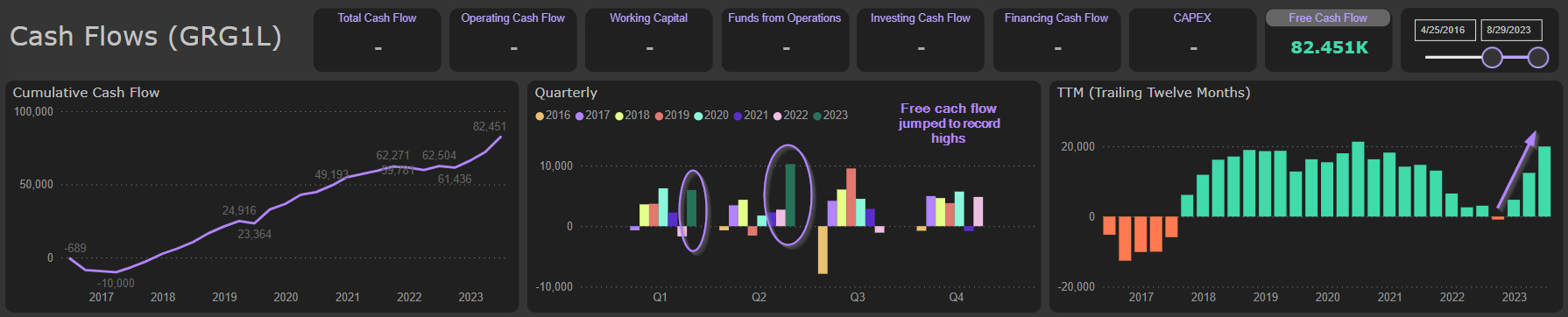

Cash flow from operations exploded to new highs in 2023 Q2 as well as in 2023 H1, confirming Grigeo cash generating machine status:

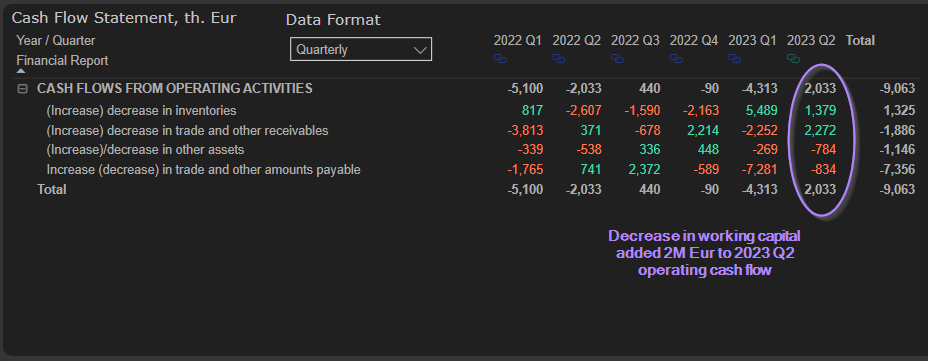

2021 Q2 cash flow from operations was supported strongly by finally reversed dynamic of working capital – decrease in working capital added 2M Eur to quarterly operating cash flow.

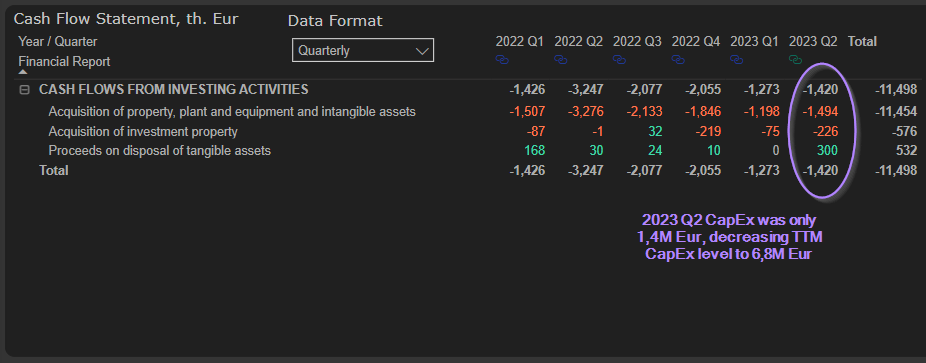

2023 Q2 CapEx was only 1,4M Eur, decreasing TTM CapEx level to 6,8M Eur (below replacement level of ~9M Eur):

Combination of very strong operating cash flow and modest CapEx sent 2023 Q2 as well as 2023 H1 free cash flow to new highs:

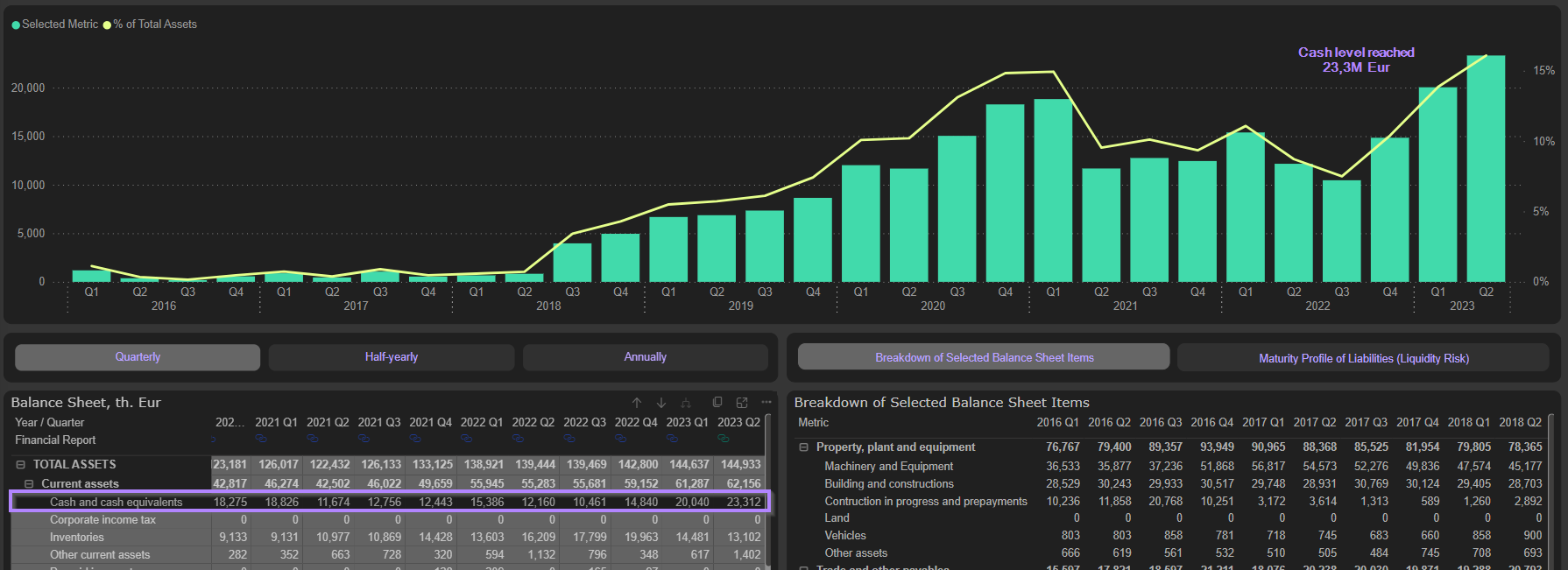

Cash level on the balance sheet reached new high of 23,3M Eur (18% of market cap), sending Net debt level to -17,7M Eur:

Extremely cheap

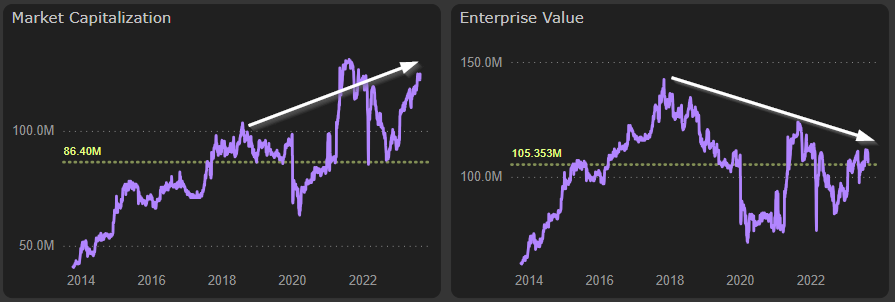

Of course, Grigeo share price didn’t sit quietly observing such spectacular improvements in fundamentals. From the beginning of the year share price rose 34%. However, it still looks extremely cheap.

Major valuation multiples are significantly below their long-term averages:

Of course, Grigeo financial performance is very sensitive to raw materials and energy price volatility. It seems, that actually we are on the positive side of the cycle. However, even our conservative estimations for 2023 EBITDA are 27M Eur and for 2023 FCF – 16M Eur (these estimations don’t include gains from emission allowances trading). Considering current market capitalization (125M Eur) and enterprise value (108M Eur) that gives us 4x EV/EBITDA and 14,8% FCF yield (we prefer EV for FCF yield calculation to reflect capital structure differences). That still looks very attractive.

Considering valuation multiples, it’s worth to pay attention to the difference in the growth rate of market capitalization and enterprise value. Since 2018 enterprise value actually fell by 20%, while market capitalization rose by 25%. It was caused by significant reduction of Net debt. That has important implications for Grigeo valuation.

We shouldn’t forget also about the excess cash. It should be utilized in some ways. Of course, one of the reasons for holding excess cash level is coverage of potential liabilities, caused by environmental damage claims (more on that in Risks part). From the perspective of shareholders, however, most natural choice would be extra dividends. If cash level would be reduced to 10M Eur (still significant amount, considering company’s operations), dividend yield would reach 10%. On the other hand, strong FCF could support even significantly larger dividend payout.

Risks

As always, any investment case isn’t complete without risks elements. Let’s mention just few of them.

Raw materials and energy prices. Less than year ago we saw, what energy shocks and skyrocketing raw materials prices could do to Grigeo margins. Sensitivity is really very high. Considering current developments in commodity markets, these risks are significantly subdued. However, they shouldn’t be ignored.

Claims for environmental damage. Long story short: in 2021 Environmental Protection Department (EPD) filed the claim for environmental damage. The amount of claim is quite impressive – 48M Eur. Grigeo assessed the damage much more modestly – about 2,2M Eur and offered a settlement, which includes also installation of wastewater treatment facilities. Settlement was rejected by EPD and the process of court hearings continues. We currently only have the first instance and Grigeo already submitted a request to the court to initiate an appeal to the EU Court of Justice and EU and Constitutional Court. It seems that there is a very long way to go.

Headwinds in corrugated cardboard and wood fibre boards segments. These two segments already feel significant pain coming from furniture, construction and packaging industries. While strategic future for corrugated cardboard in packaging industry is really bright (switching from plastic to paper and wood), current macro signs are not very encouraging. Developments in furniture and construction industries are also significant source of worry.