LHV Group 2025 Q1 financial review

Growing costs weigh on the bottom line

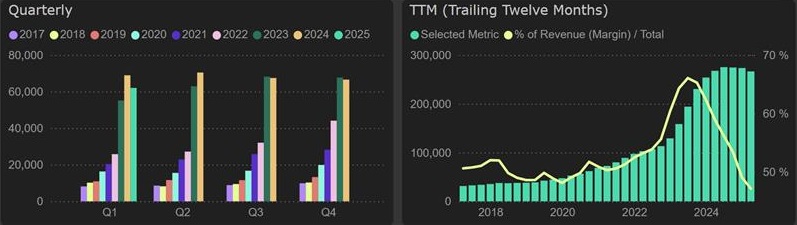

In the first quarter of 2025, LHV Group reported a more significant decline in net interest income – by 10% compared to the same period last year. The loan portfolio continued to grow, but the growth rate was more moderate than in the last three quarters of the previous year. Despite the 4% increase in the loan portfolio during the first quarter of 2025, the interest income trajectory changed – although only slightly (–1.2%), this income was lower than in the same period last year. At the same time, interest expenses continued to rise – by 15% YoY, and this had a negative impact on the net interest result.

Net interest income

Staff costs continued to be one of the main contributors to overall cost growth, increasing by 12% YoY in Q1 2025 (or 16% based on adjusted comparative figures). An additional €2.8 million in impairment was also recorded this quarter, though it only slightly worsened the loan loss ratio.

Staff costs

In the context of stagnating interest income, rising costs (interest, staff, impairment) led to a significant contraction in net profit – down from €40.7 million in Q1 2024 to €29 million in Q1 2025 (–28% YoY), although the decline was slightly offset by a €2.2 million higher result from financial assets.

Net profit

LHV Group’s position in terms of P/E and P/BV context remains essentially the same – although it is trading at a premium compared to Šiaulių Bankas and Coop Pank, the gap is very modest and completely justifiable by higher ROE.