Šiaulių Bankas 2024 Q4 financial review

The discount is gone?

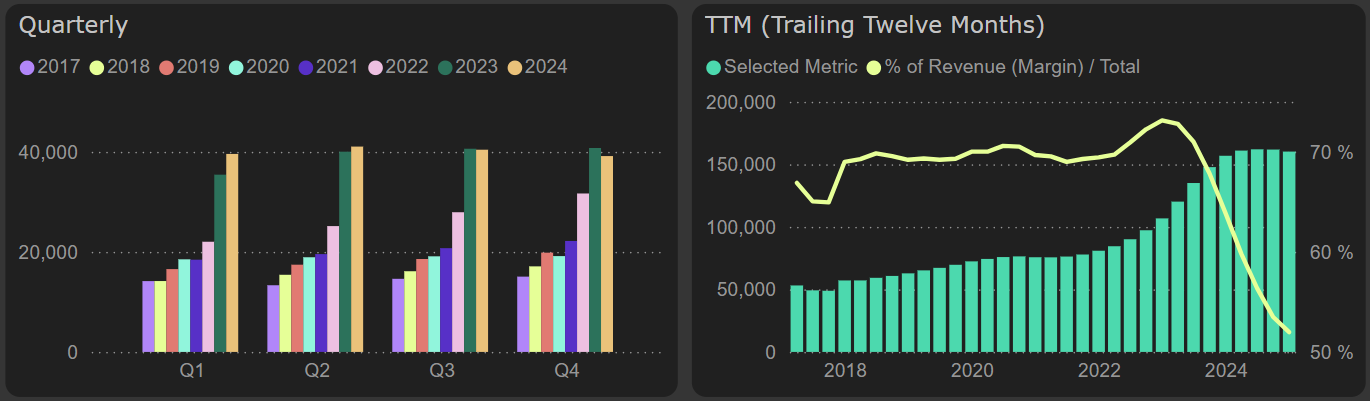

Šiaulių Bankas ended 2024 with relatively stable results. After the net interest income trajectory shifted in Q3, a further decline was recorded in Q4, though it remained moderate – down 4% compared to Q4 2023. While loan portfolio growth during this period was minimal, the net interest margin improved slightly compared to the third quarter (57.6% in Q3 2024 vs. 59% in Q4 2024).

Meanwhile, Estonian banks LHV Group and Coop Pank actively expanded their loan portfolios in Q4 but also experienced a decline in net interest income. For LHV Group, the decrease was milder at 1.7%, while Coop Pank saw a steeper drop of 7%.

Net interest income

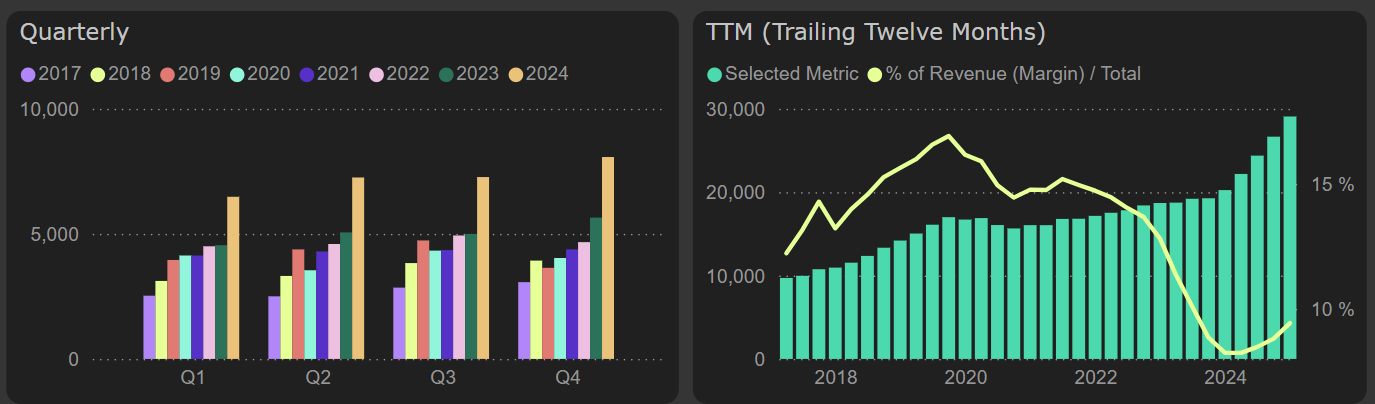

In 2024, Šiaulių Bankas earned €8.8 million more in net fee and commission income than in 2023. The primary driver of this growth was the acquisition of pension and investment fund management operations. However, this expansion also led to an increase in operating expenses. The biggest challenge for Šiaulių Bankas in 2024 was staff costs, which surged 37% (€13 million) compared to 2023.

Net fee and commission income

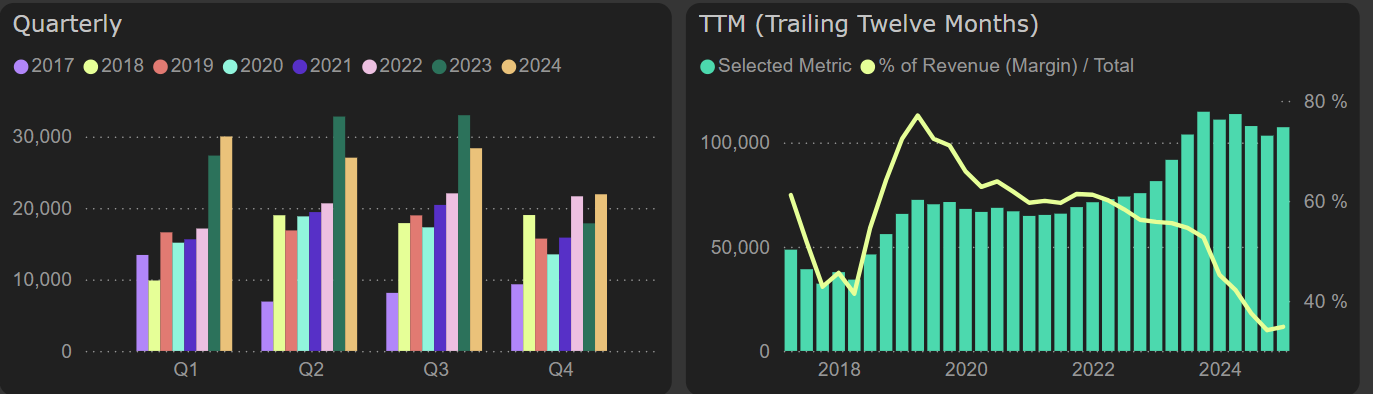

The Q4 profit before imapirment expenses was 23% higher than in the same period of 2023. However, the comparative quarter’s results were negatively impacted by one-off expenses, including a €2 million solidarity tax and significantly higher insurance-related costs.

Operating profit before impairment losses

Due to improved credit quality, impairment losses in 2024 was €4 million lower than in the previous year. The Loan Loss Ratio stood at 0.37% at the end of 2024, compared to 0.6% in 2023. This shift supported net profit growth, which increased by 4.5% year-over-year, reaching €78 million.

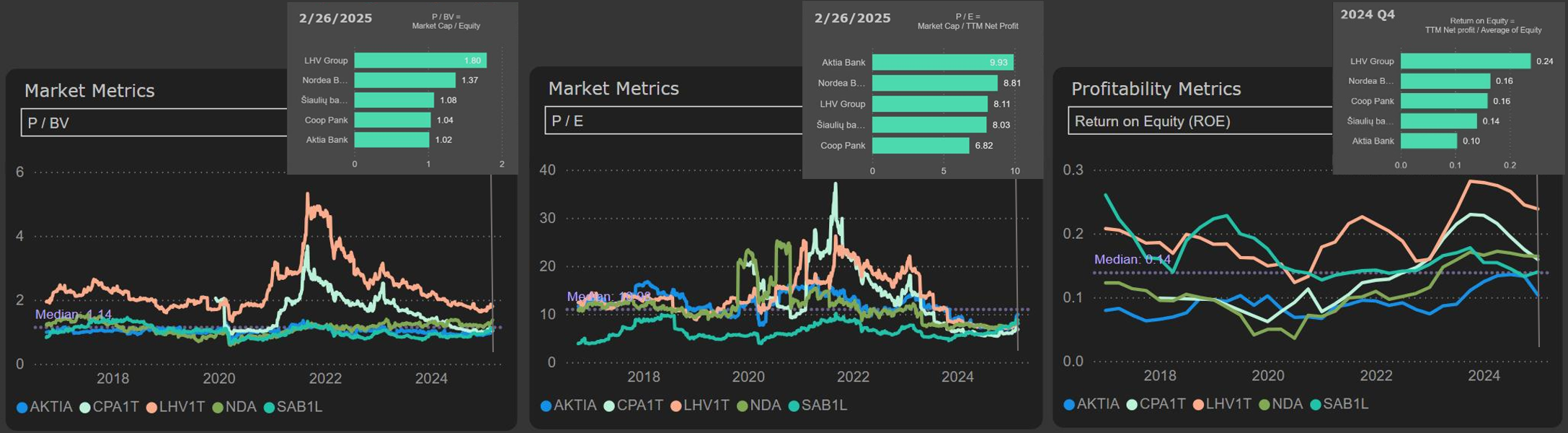

The market is catching up

With all banks having published their Q4 reports, a comparison of Expert Dashboard data suggests that Šiaulių Bankas is no longer the cheapest bank in the Baltic market.

Šiaulių Bankas ROE lags behind that of Estonian banks–Coop Pank and especially LHV Group.

At the same time, its P/E ratio remains very similar to LHV Group, but compared to Coop Pank, Šiaulių Bankas appears more expensive. Additionally, based on the P/BV ratio, Šiaulių Bankas is priced higher than Coop Pank. While Šiaulių Bankas P/BV ratio is still better than that of LHV Group, the gap that existed in 2021–2022 has narrowed significantly, and it can now be justified by the notable ROE difference.

Furthermore, Šiaulių Bankas historical valuation metrics indicate that its stock is no longer considered cheap, with these indicators having moved away from their previous lows.

Comparison between banks: P/BV, P/E, ROE